- Bitcoin’s recent price recovery is technical, not fundamental, per analyst Willy Woo.

- Despite a temporary price increase, underlying market weaknesses and speculative pressures persist.

As a seasoned crypto investor who has witnessed numerous market fluctuations, I share Willy Woo’s perspective on Bitcoin’s recent price increase. While it’s true that we have seen some temporary recovery in BTC‘s price, the underlying weaknesses and speculative pressures persist.

Recently, Bitcoin (BTC) experienced a significant surge, briefly touching the $62,000 threshold. However, this upward trend was short-lived as the cryptocurrency continued to face downward pressure from bears.

As a Bitcoin market analyst, I’ve observed its remarkable rise to surpass the $73,000 mark in March. However, since then, we’ve witnessed a significant drop of almost 20%. Currently, the cryptocurrency trades below the $61,000 threshold with recent price swings reaching as low as $60,606 at this moment.

As a researcher observing the market trends, I’ve noticed a noteworthy reversal in this specific area, which occurs against the backdrop of broader market instability. This decline suggests a substantial pullback from previous advancements, implying potential vulnerabilities in the underlying market fundamentals.

Assessing Bitcoin’s recent price increase

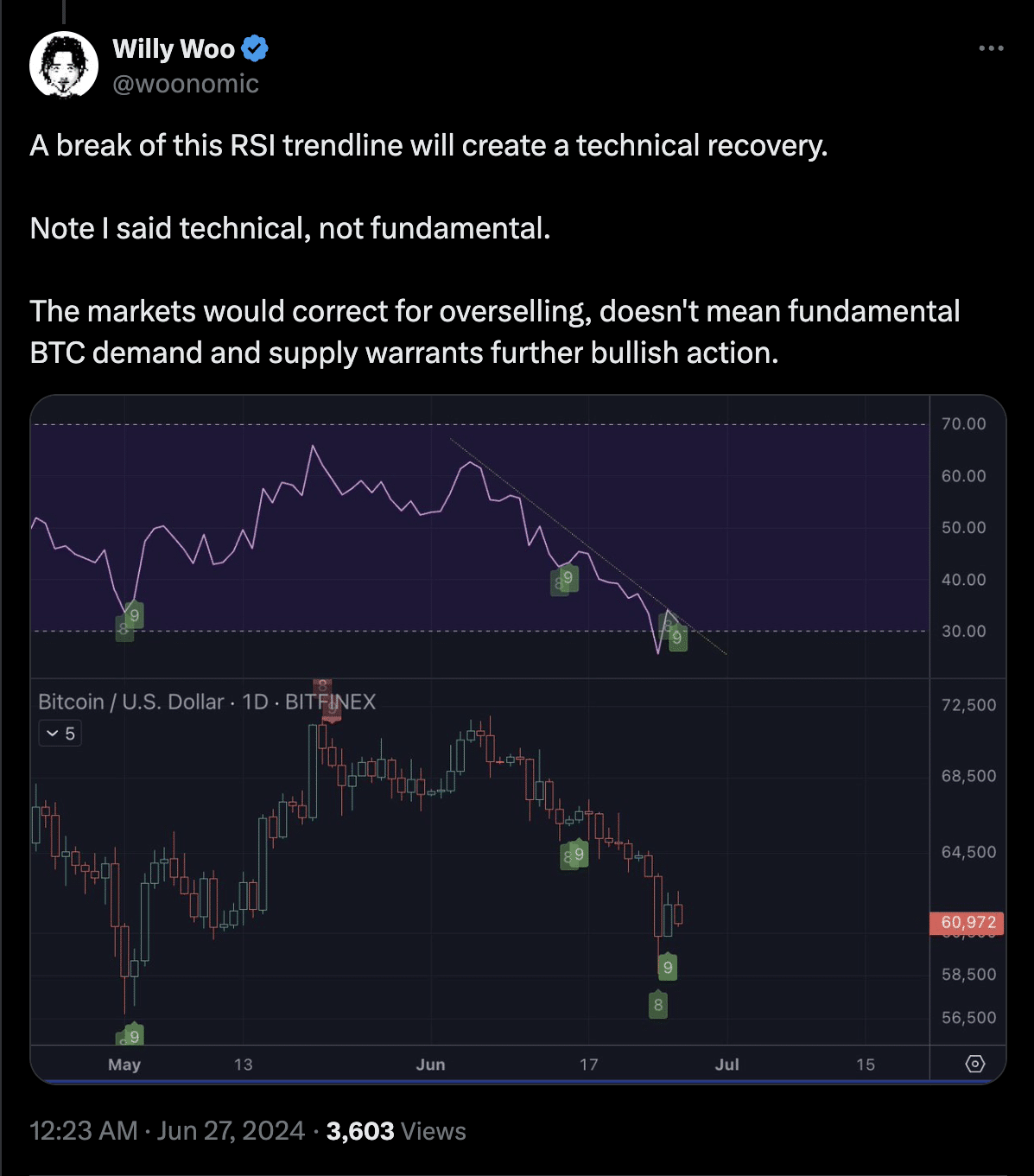

Crypto expert Willy Woo has provided new perspectives on Bitcoin’s price instability. He explains that the recent market corrections have helped reduce excessive leverage, but a complete bounce back is still not around the corner.

As a researcher examining the current market situation based on Woo’s analysis, I believe there is still excessive speculation present that requires attention in order to bring stability to prices.

According to Woo’s assessment, the Bitcoin price surge to $62k shouldn’t be mistaken for a genuine market recovery. Instead, it appears to be a technical bounce-back, implying that underlying concerns persist in the Bitcoin market.

I, as an analyst, would interpret Willy Woo’s description of Bitcoin’s recent price surge as a technical rebound. He believes that this upward trend is not driven by genuine increased buyer demand but rather by automated responses within trading algorithms.

I noticed some distinct trends, like the TD9 reversal and concealed bullish divergence, implying a brief rebound, yet they don’t guarantee an enduring revival in the long term.

Woo stated,

“So far this technical reversal is playing out.”

However, Woo emphasized that this rebound does not reflect an underlying fundamental strength.

In simpler terms, Bitcoin’s price is currently adjusting to its earlier overbought status, not due to a shift in underlying market demand or supply.

To experience a significant shift in coin fundamentals and signify a bullish reversal, we require a noticeable surge in individuals buying coins directly from exchanges without relying on previous purchases (i.e., spot buyers). Currently, this trend is not prominent enough.

Woo also noted that,

“The hash rate hasn’t rebounded yet, indicating that miners may have halted selling their Bitcoin to finance new mining equipment.”

He concluded,

“Brace yourselves for tedious price movements in the coming weeks. This isn’t the time for thrilling gains. Rather, it’s when cautious investors might consider selling off their positions or growing tired and closing them, providing an opportunity for us to progress. A prudent strategy here would be to accumulate more Bitcoin and wait for the less patient speculators to exhaust themselves.”

Insights from market data

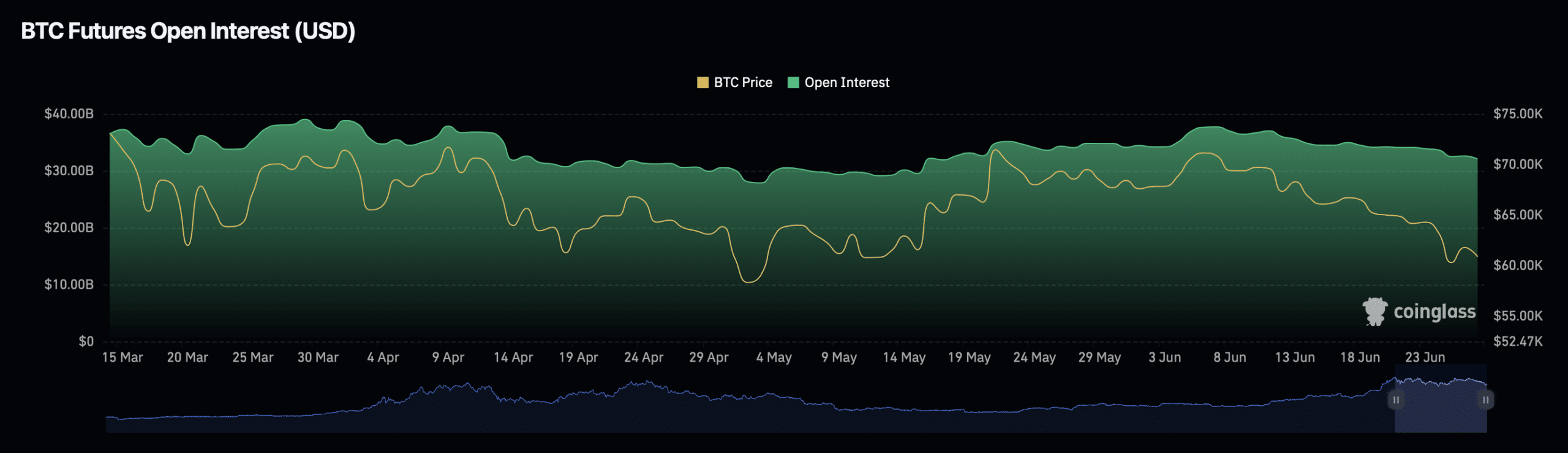

The pessimistic viewpoint was strengthened by the latest figures on Bitcoin’s Open Interest and trading activity.

An examination of the data from Coinglass, as presented by AMBCrypto, revealed a notable 2.16% reduction in open positions and a substantial 25% decrease in daily open position volume over the past day. This finding suggests lessened trading activity and potentially diminished levels of speculative interest.

As a researcher studying the Bitcoin market, I would interpret such declines as indicators of reduced eagerness among traders to open new positions, potentially due to expectations that the cryptocurrency’s price may continue to decrease.

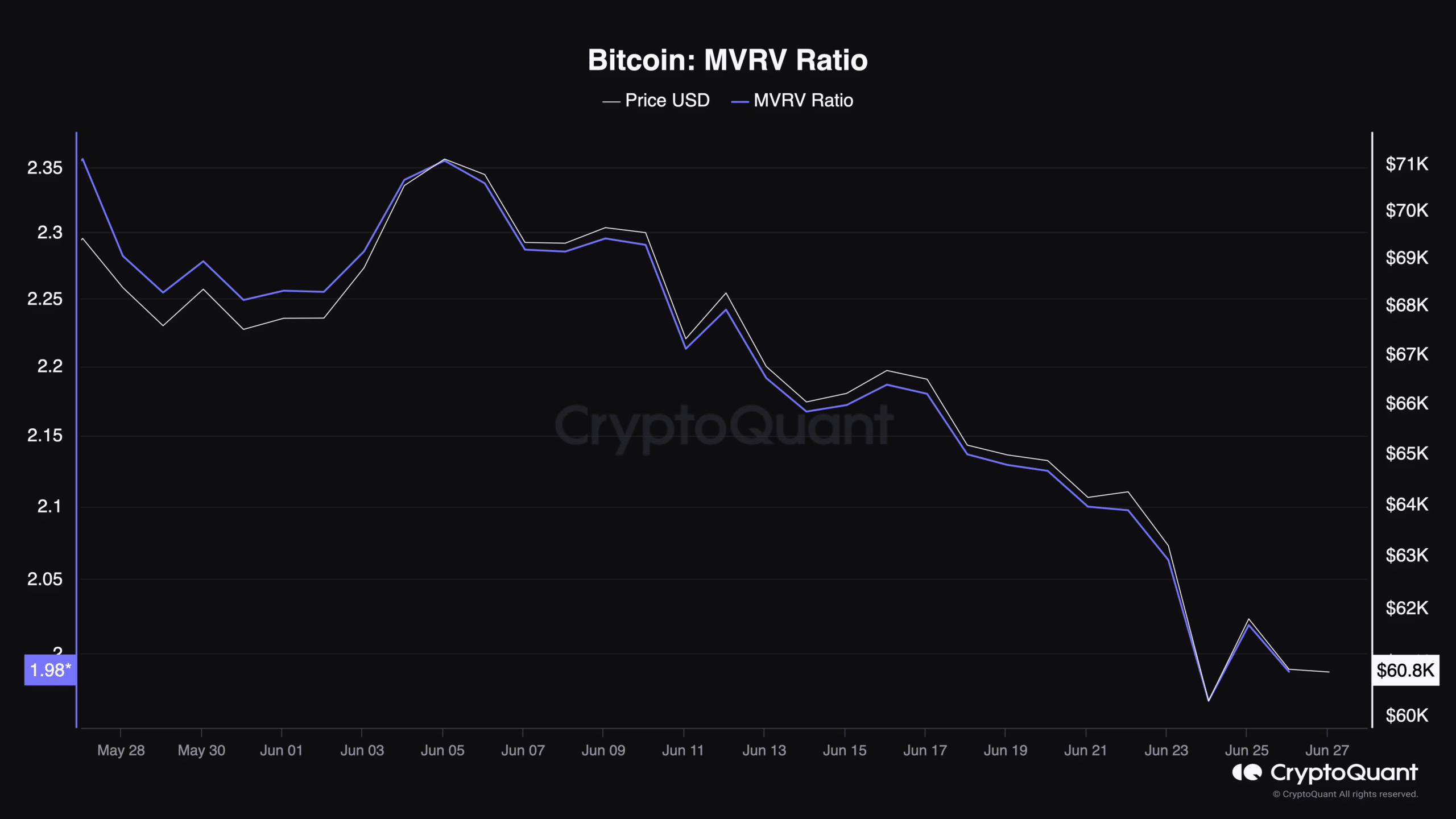

Additionally, the Market Value to Realized Value (MVRV) ratio for Bitcoin, which calculates the relationship between its current market value and the value of its previous transactions, stood at 1.98 as reported. This ratio serves as a useful indicator, signaling whether Bitcoin is underpriced or overpriced relative to its past average pricing trends.

A low Multiple of Realized Value Ratio (MVRR) of below 2 may indicate that Bitcoin is currently underpriced based on past transactions. This could potentially mean that the price may rise if investors’ sentiment shifts positively.

Read Bitcoin’s [BTC] Price Prediction 2024-25

Considering the present market instability and economic uncertainty, any anticipated growth should be approached with prudence.

As an analyst, I’ve observed bearish trends in the cryptocurrency market lately. However, it’s essential not to overlook some optimistic forecasts that continue to emerge. For instance, AMBCrypto’s reports suggest a potential surge in Bitcoin’s price up to $250,000 based on the rainbow chart analysis.

Read More

- Solo Leveling Season 3: What You NEED to Know!

- Oblivion Remastered: The Ultimate Race Guide & Tier List

- Rachel Zegler Claps Back at Critics While Ignoring Snow White Controversies!

- OM PREDICTION. OM cryptocurrency

- How to Get to Frostcrag Spire in Oblivion Remastered

- Bobby’s Shocking Demise

- Oshi no Ko Season 3: Release Date, Cast, and What to Expect!

- Captain America: Brave New World’s Shocking Leader Design Change Explained!

- Fantastic Four: First Steps Cast’s Surprising Best Roles and Streaming Guides!

- Gold Rate Forecast

2024-06-27 22:16