- Pepe has a bearish market structure and is likely to retest recent lows once more.

- The eagerness in the futures market suggested a recovery, which once initiated, could be rapid.

As an experienced analyst, I’ve closely monitored PEPE‘s price action and market developments. Based on the current trend, PEpe has a bearish structure and is likely to retest recent lows once more. This is despite the brief 20% bounce earlier this weekend that has since reversed.

Pepe (PEPE), currently trading within a short-term price range, experienced a sell-off following a price peak. A significant development regarding the memecoin involved the deposit of approximately $7.8 million worth of PEPE tokens into Binance exchange, indicating increased selling activity.

An earlier AMBCrypto analysis indicated a bearish trend, suggesting that any price increase might prompt investors to sell, hoping to recoup their losses. This prediction proved accurate.

The 20% bounce earlier this weekend has begun to see a reversal

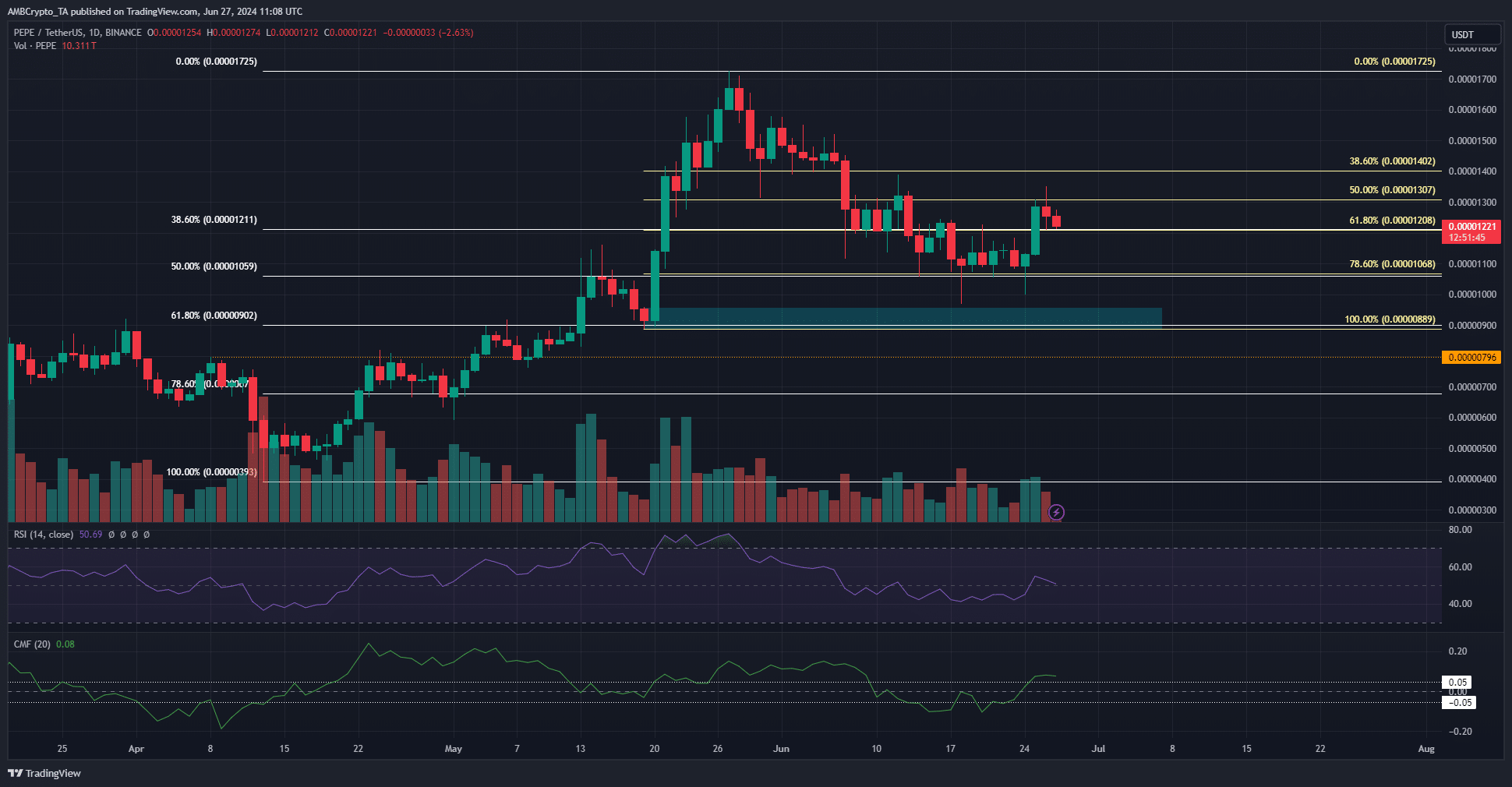

As a crypto investor, I analyzed the price movements in April and May using the Fibonacci retracement tool to identify potential support and resistance levels. Specifically, I plotted two sets of these levels based on the significant upswings that occurred during those months.

In the latter part of May, a less significant price shift occurred. The prior low at the 78.6% retracement level (pale yellow) was defended as a support, but the $0.000013 mark, representing a 50% pullback, functioned as resistance and thwarted bullish advances.

The significant shift in the market was signaled by the white-labeled levels. These markers indicated that the $0.0000089, identified as a bullish order block, represented a 61.8% retracement point. As such, it’s expected that the price will rebound from this area.

If the downward trend does not continue, a prolonged bear market may not yet have taken hold. The support level situated at $0.0000068, which is 78.6% below the current price, could potentially bring about a reversal of the significant correction. However, this development would suggest bearish control in the near term.

As a crypto investor, I observed some encouraging signs in the daily indicators following the significant 20% price surge we experienced earlier this week. The Relative Strength Index (RSI) was hovering around the 50 mark, which is considered neutral territory. My hope is that the bulls would manage to flip this level from resistance to support, thereby establishing a new uptrend.

In a comparable manner, the Capital Market Factor (CMF) stood at a noteworthy level of 0.08, signaling substantial capital injections. For PEPE investors to spark a bullish comeback, this inflow trend must persist.

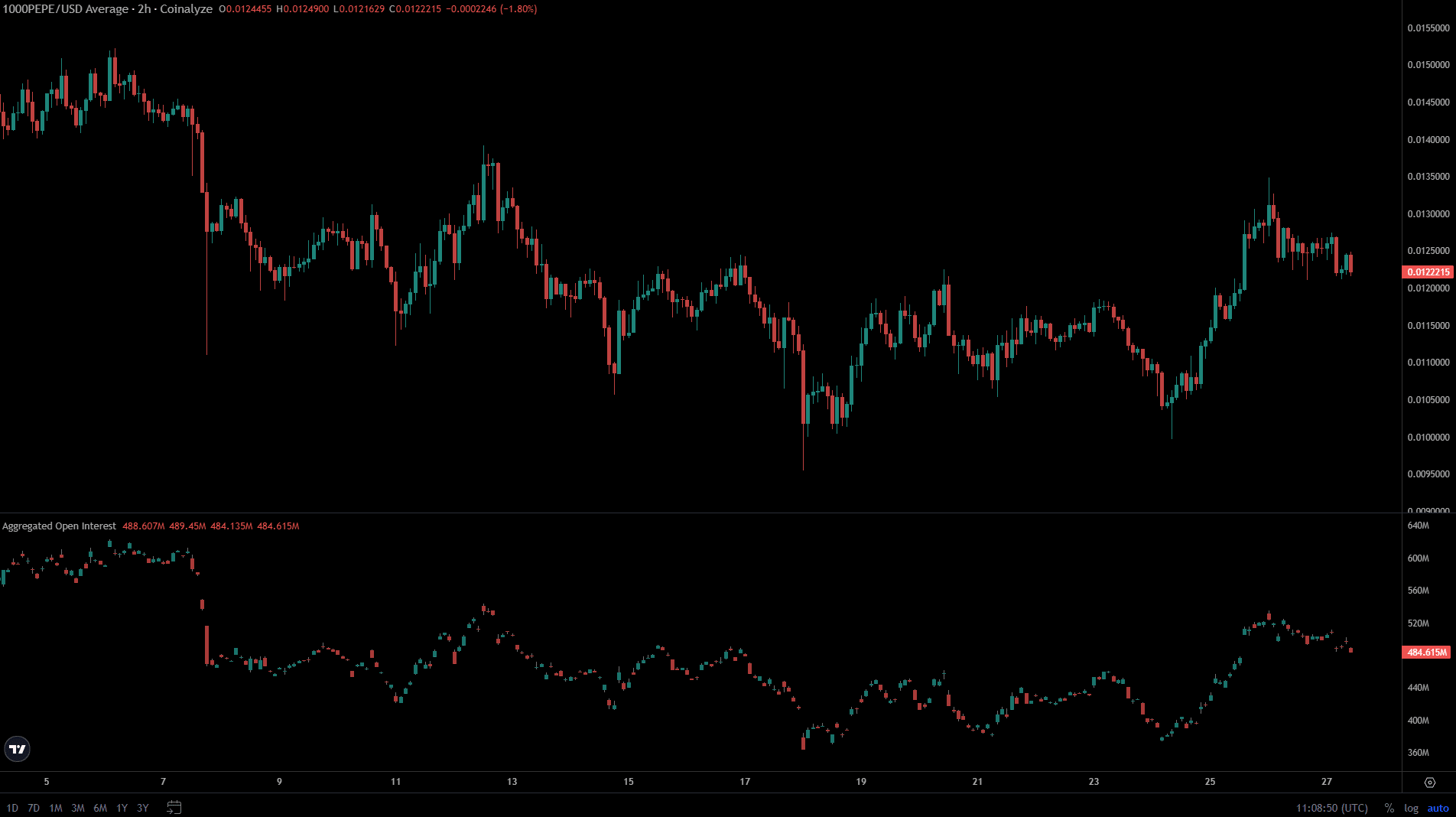

The Open Interest highlighted the ebbs and flows in market sentiment

Although PEPE‘s price has decreased significantly since late May, investors in the futures market remained optimistic and bought PEPE contracts during brief uptrends. This was evident on the 25th when a sudden 15% price increase caused the open interest to jump from $400 million to $520 million.

Read Pepe’s [PEPE] Price Prediction 2024-25

Over the last 36 hours, the Open Interest (OI) on my crypto investment platform has retreated to a level of approximately $484 million. This decrease suggests a dip in bullish sentiment among traders. However, this week’s events have hinted at an eagerness among PEPE investors for a trend reversal.

Should Bitcoin (BTC) initiate a rebound, Pepe could emerge as one of the top-performing larger alternative cryptocurrencies.

Read More

- Gold Rate Forecast

- Rick and Morty Season 8: Release Date SHOCK!

- SteelSeries reveals new Arctis Nova 3 Wireless headset series for Xbox, PlayStation, Nintendo Switch, and PC

- Discover the New Psion Subclasses in D&D’s Latest Unearthed Arcana!

- PI PREDICTION. PI cryptocurrency

- Mission: Impossible 8 Reveals Shocking Truth But Leaves Fans with Unanswered Questions!

- Eddie Murphy Reveals the Role That Defines His Hollywood Career

- Masters Toronto 2025: Everything You Need to Know

- We Loved Both of These Classic Sci-Fi Films (But They’re Pretty Much the Same Movie)

- Discover Ryan Gosling & Emma Stone’s Hidden Movie Trilogy You Never Knew About!

2024-06-28 00:07