-

SHIB resistance has held firm over the past few weeks.

The current position could present buying opportunities.

As a seasoned crypto investor with a keen eye for market trends, I’ve seen my fair share of ups and downs in the world of digital currencies. And right now, I believe Shiba Inu (SHIB) presents an intriguing opportunity for potential buyers.

Over the past several weeks, the cost trajectory of Shiba Inu (SHIB) has been underwhelming, as its value has moved progressively farther from the earlier established price floors.

As an analyst, I have observed that this decline has significantly influenced investor attitudes. This is evident in the shrinking difference between the number of investors reaping profits from their investments and those suffering losses.

Shiba Inu oversold

As an analyst, I’ve noticed that Shiba Inu has been on a downward trend since the start of the month based on my analysis of the daily time frame chart from AMBCrypto.

As an analyst, I’ve noticed that the long-term moving average, previously acting as a reliable support line, has shifted roles and is now functioning as a resistance level in light of the current market downturn.

As an analyst, I’ve observed that the short-term moving average (represented by the yellow line) has been rather volatile in its function, at times acting as support and other times as resistance. Lately, though, it has taken a firm stance as resistance and has maintained this position for several weeks.

From my perspective as a crypto investor, SHIB was currently priced at approximately $0.000017 during this update. There was a small uptick in its trading value. However, I noticed that the coin experienced a significant drop of around 3% in the previous trading session’s close.

Shiba Inu’s price trend over the past few days has featured significant drops followed by small gains.

Buying opportunity?

The RSI, or Relative Strength Index, which is used to identify the momentum or speed of price changes in a financial instrument, signaled that Shiba Inu was experiencing a significant downward trend.

The RSI is slightly below 30, suggesting that the asset is in an oversold state.

As an analyst, I would interpret being in such a state as a potential buying sign for traders. This condition typically comes before a potential reversal or a brief halt in the market’s downward trend.

Shiba in/out of the money tightens

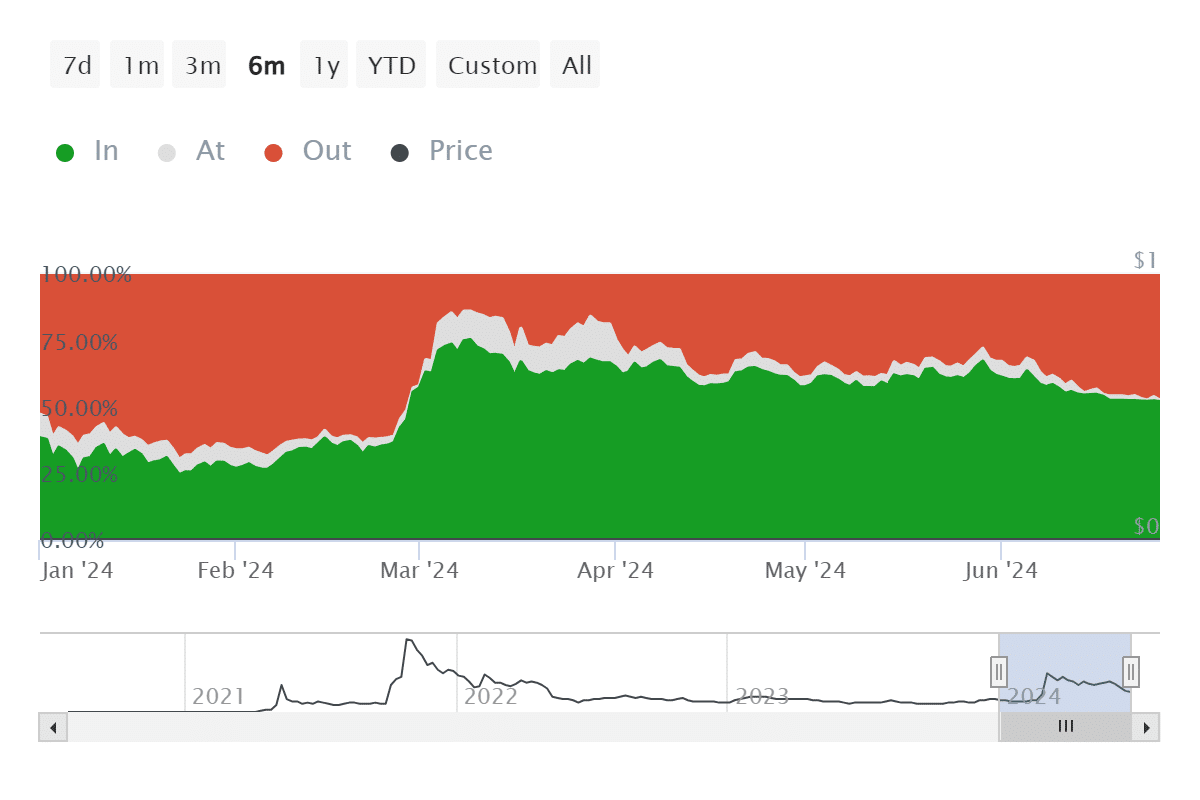

Based on an examination of IntoTheBlock’s In/Out of the Money data for Shiba Inu, it appears that the gap between the number of profitable and non-profit holding addresses is shrinking.

Approximately 52% of Shibaswap token address holders, totaling over 696,000 addresses, now hold tokens that were bought at prices below their current market value.

Approximately 638,000 addresses, representing over 47% of the total, currently find themselves in a loss position due to having purchased Shibaswap (SHIB) at higher prices than its current trading price.

Additionally, about 7,000 addresses, representing less than 1% of the total, have broken even.

An in-depth examination revealed that approximately 425 trillion SHIB tokens were traded at prices between $0.000018 and $0.000019, representing the largest volume of tokens that are now underwater (or out of money).

Among the price ranges from $0.000025 to $0.000030, this interval had the greatest number of addresses – more than 147,000 – that were underwater (or “out of the money”).

Read More

- Solo Leveling Season 3: What You NEED to Know!

- Rachel Zegler Claps Back at Critics While Ignoring Snow White Controversies!

- OM PREDICTION. OM cryptocurrency

- Captain America: Brave New World’s Shocking Leader Design Change Explained!

- Oshi no Ko Season 3: Release Date, Cast, and What to Expect!

- Oblivion Remastered: The Ultimate Race Guide & Tier List

- Gold Rate Forecast

- Meta launches ‘most capable openly available LLM to date’ rivalling GPT and Claude

- Fantastic Four: First Steps Cast’s Surprising Best Roles and Streaming Guides!

- How to Get to Frostcrag Spire in Oblivion Remastered

2024-06-28 02:15