-

MSTR did better in terms of price performance compared to BTC year to date.

BTC’s price movement remained stagnant and did not see much growth.

As an experienced financial analyst, I have closely followed the performance of Microstrategy (MSTR) and Bitcoin (BTC) over the past year. While Bitcoin has seen some growth with a price increase of around 40% year-to-date, MSTR’s stock price has significantly outperformed, surging more than 115%.

Michael Saylor’s company, Microstrategy (MSTR), is well-known for taking a bold and optimistic approach towards Bitcoin (BTC).

Lately, MicroStrategy’s stock has become a popular discussion among investors because it has surpassed Bitcoin’s performance in terms of growth.

While Bitcoin has risen around 40% year-to-date, MicroStrategy’s stock has surged over 115%.

MicroStrategy beats all odds

As a crypto investor, I’m excited about MicroStrategy right now. The reason for this optimism could be the growing market sentiment towards companies that hold substantial amounts of Bitcoin as part of their balance sheets.

Maxim Group began analyzing MicroStrategy’s stock with a recommendation to buy and set a sizable price goal of $1,835. This figure signified a significant increase of over 20% compared to the previous closing price of $1,495.

Maxim’s optimistic outlook is driven by MicroStrategy’s bold Bitcoin strategy and its shift towards advanced artificial intelligence cloud services for the future.

As a researcher, I’ve observed that MicroStrategy’s connection to Bitcoin is significant and long-standing. Currently, the company owns a substantial collection of approximately 226,331 Bitcoins.

This daring decision has paid off handsomely, as it’s been calculated that Bitcoin holdings account for approximately half of MicroStrategy’s total stock worth, marking a significant change in the corporation’s financial makeup.

What’s behind MSTR’s growth?

As an analyst, I would describe MicroStrategy’s approach as follows: MicroStrategy employs a strategy that resembles a leveraged fund, utilizing both debt and equity to procure Bitcoin. The presence of this leverage is considered a significant factor contributing to the stock’s superior performance.

“This approach might gain popularity among businesses, charities, and governments alike, should tax laws become more advantageous.”

As a researcher studying the stock market, I’ve observed an intriguing development with MicroStrategy. Following Maxim Group’s initiation of coverage on the company, MicroStrategy’s stock price experienced a significant jump of approximately 5%. This surge in value can be attributed to two key factors that have sparked investor optimism: firstly, the company’s substantial Bitcoin holdings, and secondly, their ambitious plans for AI integration.

In the financial report of the company for the year 2023, there was an impressive turnaround, noticeably in their cloud sector. The income from subscription services witnessed a significant jump of 33.6% compared to the previous year, amounting to $81 million.

In contrast to the decrease in product licensing and support income, the cloud segment’s gross profit margin exhibited a substantial increase. It went up from 59.2% in the year 2022 to 60.9% in the year 2023.

Read Bitcoin’s [BTC] Price Prediction 2024-25

Based on the evidence, MicroStrategy’s business model seems to be transitioning effectively, which could be one reason why it has surpassed Bitcoin’s performance in recent times.

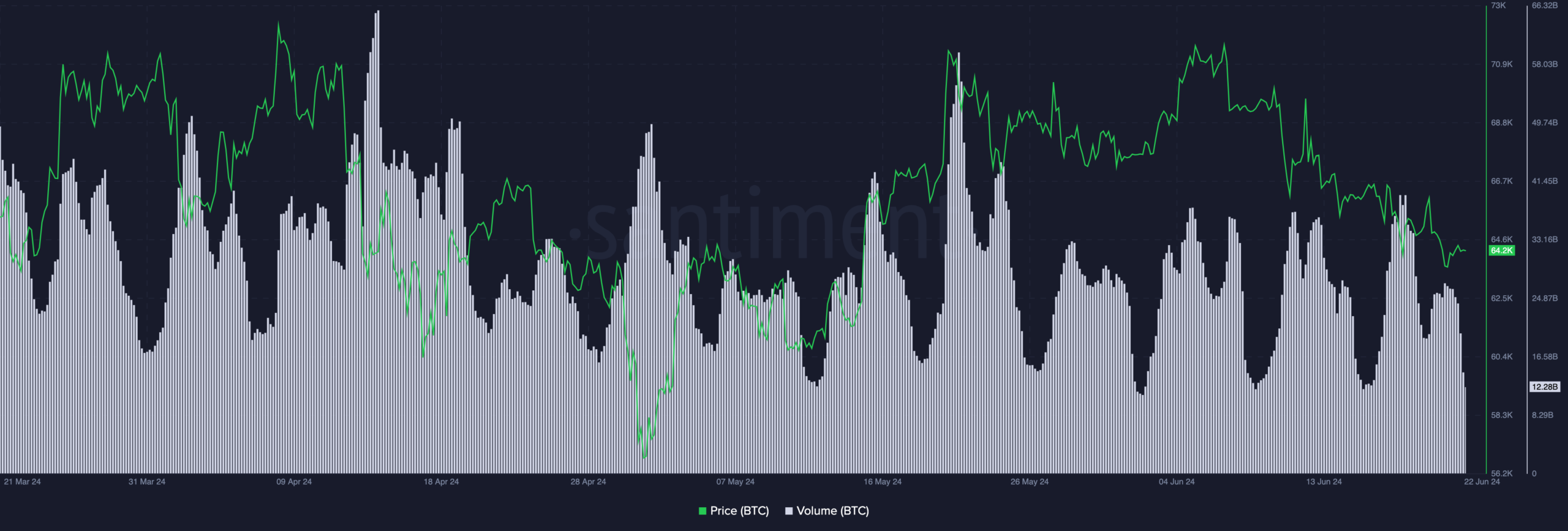

Currently, Bitcoin is priced at $61,152.44 during this composition’s creation. In the past 24 hours, there has been a decrease of 0.35% in its value.

Read More

- OM PREDICTION. OM cryptocurrency

- Oblivion Remastered: The Ultimate Race Guide & Tier List

- Oblivion Remastered – Ring of Namira Quest Guide

- The Elder Scrolls IV: Oblivion Remastered – How to Complete Canvas the Castle Quest

- Poppy Playtime Chapter 4: Release date, launch time and what to expect

- Serena Williams’ Husband’s Jaw-Dropping Reaction to Her Halftime Show!

- Solo Leveling Arise Amamiya Mirei Guide

- Ian McDiarmid Reveals How He Almost Went Too Far in Palpatine’s Iconic ‘Unlimited Power’ Moment

- Ryan Reynolds Calls Justin Baldoni a ‘Predator’ in Explosive Legal Feud!

- Why Tina Fey’s Netflix Show The Four Seasons Is a Must-Watch Remake of a Classic Romcom

2024-06-28 08:07