- Analyst identifies a Bull-Flag pattern suggesting Bitcoin could soon reverse its June downtrend.

- MVRV ratio and exchange stablecoin ratio provide key insights into Bitcoin’s market conditions.

As a long-term crypto investor who has witnessed numerous market cycles and price swings, I’m cautiously optimistic about the recent developments in Bitcoin’s price action. The emergence of the Bull-Flag pattern and the insights from technical indicators like MVRV ratio and exchange stablecoin ratio provide promising signs that a reversal might be on the horizon.

Bitcoin (BTC), the pioneering digital currency, is exhibiting indications of possibly turning around from its recent slump, generating buzz amongst financial analysts and investors.

As a researcher studying the cryptocurrency market, I’ve observed a tough month for Bitcoin with prices reaching a low of $58,000 only a few days ago. However, there has been some positive movement since then, and currently, Bitcoin is trading at approximately $61,516.

As an analyst, I’ve noticed today’s price action included a momentary spike above $62,000 – a level significant to some market observers, implying the potential for a larger upward trend.

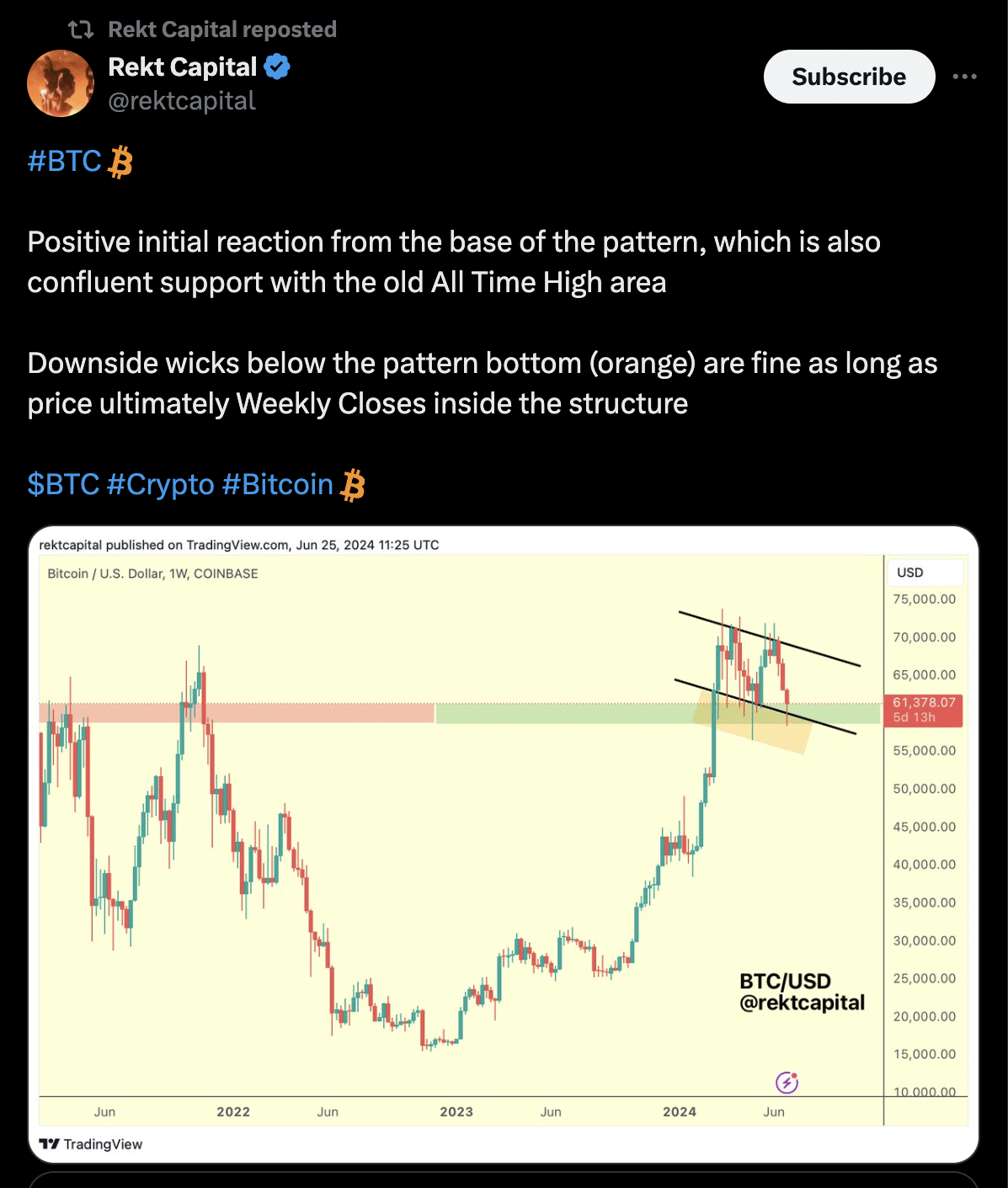

As a dedicated market researcher, I’ve been closely monitoring Bitcoin’s price movements, and I’m intrigued by Rekt Capital’s perspective on the potential ending of the recent downtrend. This assessment is based on discernible trends unfolding in Bitcoin’s daily trading data.

Bitcoin bull-flag emergence

Based on the analysis by Rekt Capital, it seems Bitcoin’s daily price charts are showing signs of an emerging Bull-Flag pattern. If this pattern develops completely, it may suggest that Bitcoin is preparing for a significant surge, aiming to surpass and possibly shatter its current downtrend.

Traders keep a keen eye on these complex price patterns as they may signal impending significant price increases.

Rekt Capital noted,

“We can check if the ongoing price movement on the Daily chart is shaping up as a tiny, initial Bull Flag formation.”

Rekt Capital has revealed that Bitcoin’s recent price drop may be nearing the typical 22% correction observed in past market trends. This correction initially triggers optimistic reactions, aligning with previous support levels at record highs.

According to Rekt Capital’s analysis, it is crucial for Bitcoin’s weekly closing price to surpass the lower limit of the pattern in order to maintain this significant support level. While momentary drops beneath this threshold can be permissible.

Are there signs of a bullish breakout?

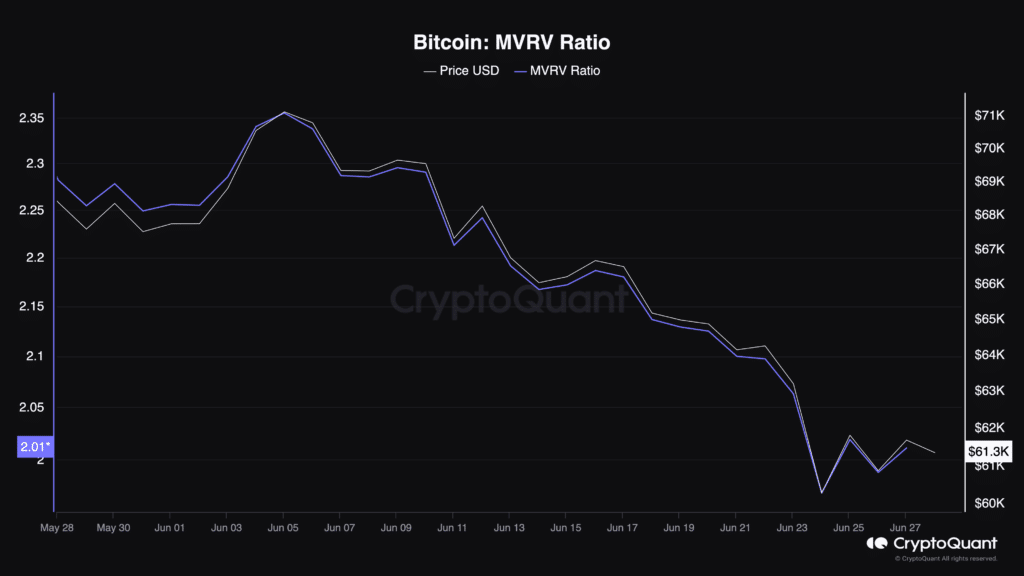

Although Rekt Capital’s technical analysis is hopeful regarding Bitcoin’s potential for a bullish surge, it’s essential to examine key market indicators to validate this prediction. One of these indicators is the MVRV (Market Value to Realized Value) ratio, which is now at 2.01. This figure suggests that on average, Bitcoin investors are earning a 101% profit from their purchase prices. Therefore, analyzing the MVRV ratio provides valuable insights into whether Bitcoin’s price increase is indeed sustainable and likely to continue.

The MVRV ratio for Bitcoin, which is calculated by dividing its total market capitalization by its realized capitalization, sheds light on whether the cryptocurrency is currently underpriced or overpriced when compared to its past value trends.

With a ratio greater than 2.0, Bitcoin often enters a region where sellers may become more active, enticed by potential profits to offload some of their assets.

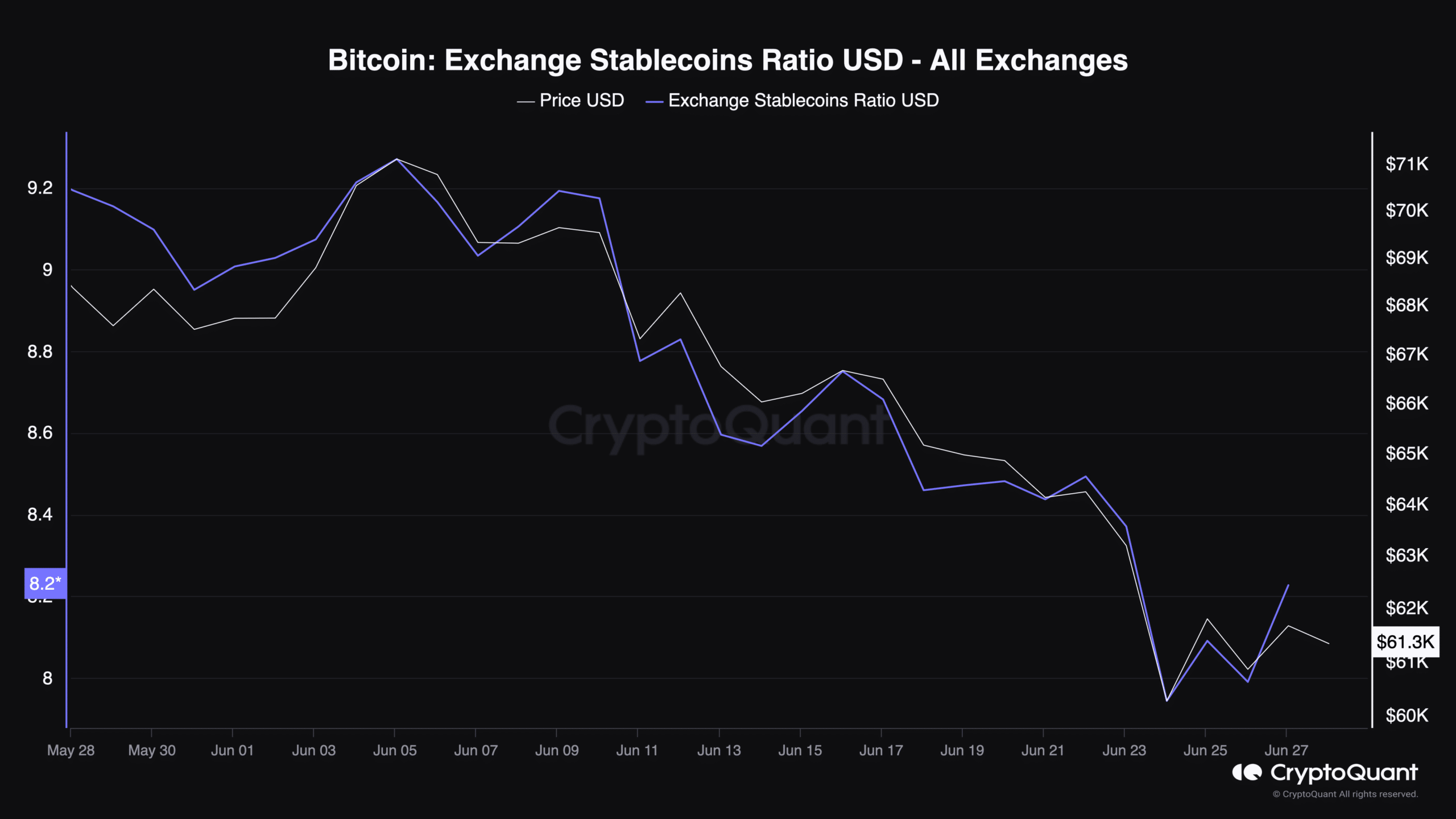

As a researcher studying market trends, I’ve noticed an intriguing development: the exchange stablecoin ratio has experienced a noteworthy increase of 2.33%, now standing at 8.22%. This ratio, which represents the relationship between the total amount of stablecoins stored in exchanges and the Bitcoin reserves, sheds light on potential buying power that could influence price movements in a positive direction.

Read Bitcoin’s [BTC] Price Prediction 2024-25

As a crypto investor, I believe a larger proportion of stablecoin holdings could indicate that traders are preparing to swap their stablecoins for Bitcoin. This action could possibly lead to an increase in Bitcoin’s price.

Despite the optimistic outlook from some analysts, Bitcoin’s crypto market is still showing signs of division. Notably, Willy Woo has expressed caution, emphasizing that Bitcoin’s bears are currently in charge, according to AMBCrypto’s latest report.

Read More

- Gold Rate Forecast

- PI PREDICTION. PI cryptocurrency

- Rick and Morty Season 8: Release Date SHOCK!

- Masters Toronto 2025: Everything You Need to Know

- We Loved Both of These Classic Sci-Fi Films (But They’re Pretty Much the Same Movie)

- Mission: Impossible 8 Reveals Shocking Truth But Leaves Fans with Unanswered Questions!

- SteelSeries reveals new Arctis Nova 3 Wireless headset series for Xbox, PlayStation, Nintendo Switch, and PC

- Eddie Murphy Reveals the Role That Defines His Hollywood Career

- LPT PREDICTION. LPT cryptocurrency

- Elden Ring Nightreign Recluse guide and abilities explained

2024-06-28 16:08