- Bearish sentiment across the crypto sector was on the rise.

- Bitcoin and Ethereum witnessed a decline in profitable and short-term holders.

As a researcher, I find the current state of the crypto market to be quite bearish based on recent trends and data analysis. The decline in bullish sentiment across various online forums and social media platforms is a clear indicator of this. Additionally, the significant drop in profitable holders and short-term holders for both Bitcoin [BTC] and Ethereum [ETH] adds to my bearish outlook.

According to AMBCrypto’s interpretation of Santiment’s findings, there was a growing negative attitude towards cryptocurrencies in general.

Bears leap forward

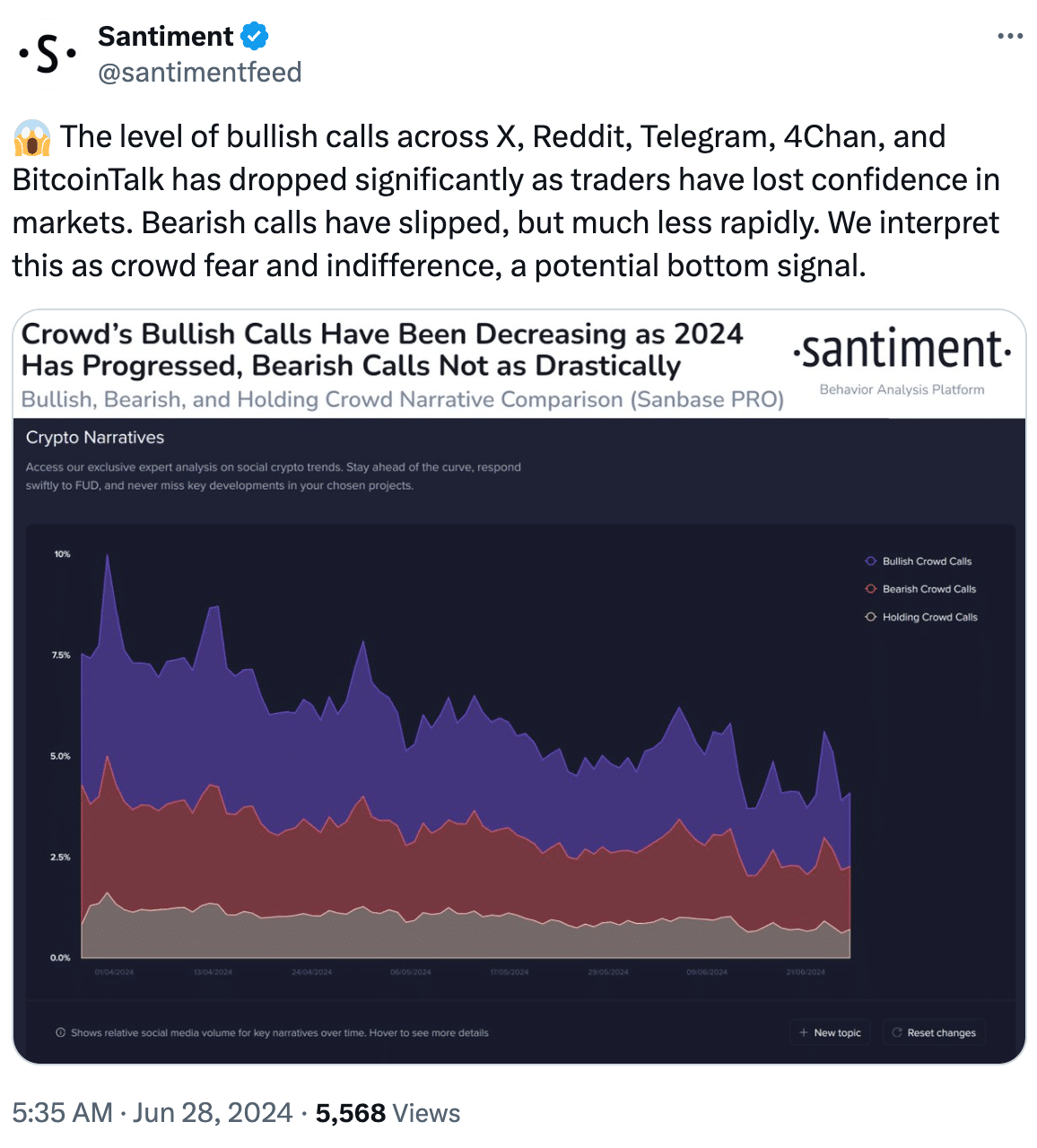

Based on my analysis of the data from various online platforms such as X, Reddit, Telegram, 4Chan, and BitcoinTalk, there has been a significant decrease in bullish sentiment expressed by users.

It appears that traders’ confidence in the markets has waned noticeably, as the number of bullish predictions has substantially declined. Surprisingly, the decrease in bearish predictions has been more gradual.

Anxious investors who had previously expressed optimism may now be more inclined to offload their Bitcoin [BTC] and Ethereum [ETH], causing a potential drop in prices for these cryptocurrencies in the near future. This action could initiate a chain reaction, prompting others to sell in panic, thereby intensifying the downward trend.

As an analyst, I would interpret the substantial decrease in bullish predictions as a potential sign of capitulation. This means that investors may have run out of optimism and are being compelled to liquidate their holdings.

The demand to sell Bitcoins and Ethereums may lessen at some point, resulting in a phase of stability and possibly marking the beginning of a price floor for both cryptocurrencies.

A tale of two holders

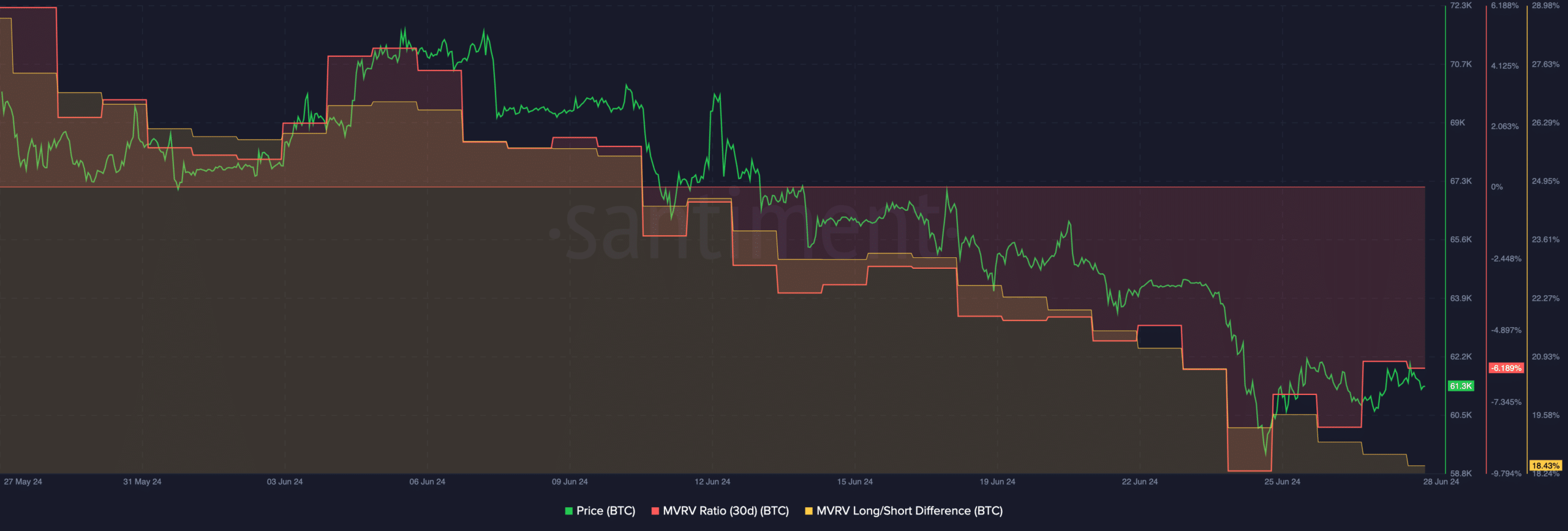

As of the current moment, Bitcoin was priced at $61,361.69 on the markets, representing a 0.67% decrease from its price over the past 24-hour period.

As a researcher studying Bitcoin (BTC) trends, I’ve observed a noticeable decrease in the MVRV (Moving Average Realized Value to Market Price Ratio) during this timeframe. This decline indicates that not only has the price dropped, but the profitability for most BTC holders has also suffered as a result.

As a crypto investor, I’ve noticed that the difference between long and short positions on Bitcoin (BTC) has shrunk. This decrease in the Long/Short ratio suggests that there are fewer long-term holders compared to the influx of short-term traders in the market.

Short-term investors holding Bitcoin can be unpredictable and may be easily influenced by market swings. Prolonged volatility in the market might lead to further decreases for Bitcoin over an extended period.

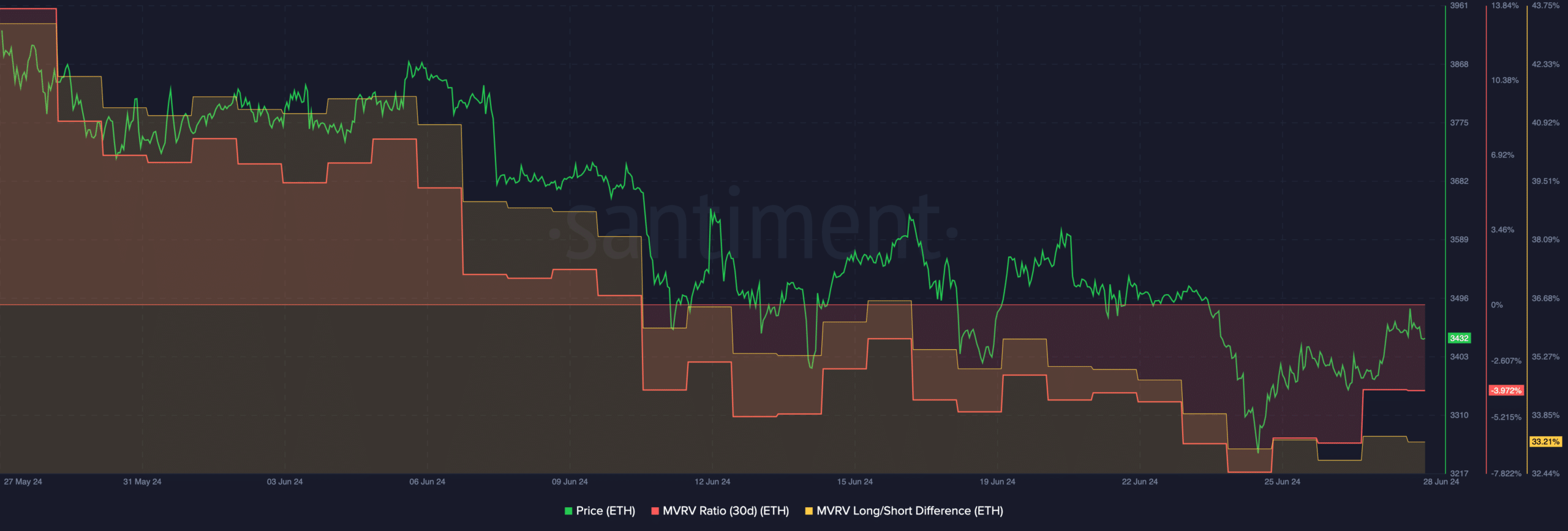

When considered together with Bitcoin, Ethereum might experience considerable selling pressure due to their strong correlation. According to IntotheBlock’s analysis, the relationship between these two cryptocurrencies was quite high at a correlation coefficient of 0.86.

Read Ethereum (ETH) Price Prediction 2024-25

In terms of price, ETH was trading at $3,432.61 and over the last 24 hours, it had grown by 1.37%.

The MVRV ratio (Market Value to Realized Value) and the difference between the number of Ethereum addresses with profits (long positions) and those with losses (short positions) have both decreased. This indicates a potential decrease in the number of profitable investors and an increase in short-term holders.

Source; Santiment

Read More

- Gold Rate Forecast

- SteelSeries reveals new Arctis Nova 3 Wireless headset series for Xbox, PlayStation, Nintendo Switch, and PC

- Discover the New Psion Subclasses in D&D’s Latest Unearthed Arcana!

- PI PREDICTION. PI cryptocurrency

- Eddie Murphy Reveals the Role That Defines His Hollywood Career

- Mission: Impossible 8 Reveals Shocking Truth But Leaves Fans with Unanswered Questions!

- Rick and Morty Season 8: Release Date SHOCK!

- Discover Ryan Gosling & Emma Stone’s Hidden Movie Trilogy You Never Knew About!

- Masters Toronto 2025: Everything You Need to Know

- We Loved Both of These Classic Sci-Fi Films (But They’re Pretty Much the Same Movie)

2024-06-29 00:07