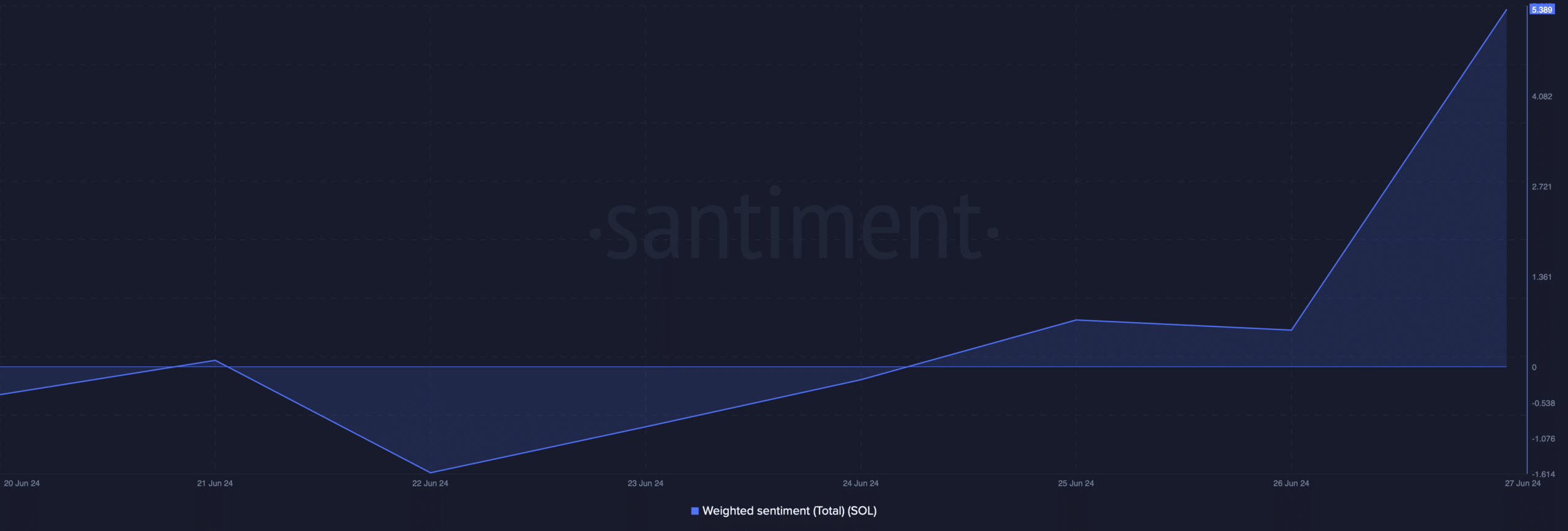

- FOMO around Solana has increased substantially in the last few days.

- Fear and greed index hinted at a price correction

As an experienced financial analyst, I have seen numerous market trends come and go. The recent surge in Solana’s price has been impressive, but as the data suggests, investors must remain cautious.

Investors in Solana (SOL) experienced relief after several days of price declines as the token’s weekly and daily graphs switched from red to green. Nevertheless, it is essential for investors to exercise caution, as excessive excitement around SOL could potentially halt the current uptrend.

Solana investors enjoy profits

According to data from CoinMarketCap, Solana’s price experienced a significant leap of more than 9% in just the past week. Intraday, its value even rose by approximately 4%, pushing the token back up to reach a value of around $145 once more.

At the moment of publication, the price of SOL underwent a minor adjustment and was being bought and sold for around $144.8. Its market value surpassed $67 billion.

Due to the latest increase in price, there has been a shift in investor attitude towards the coin, becoming more optimistic, as indicated by the significant surge in positive sentiment.

As a crypto investor, I’ve been keeping a close eye on the positive signals coming from Solana’s latest data. However, a recent tweet from Santiment has piqued my concern. They mentioned a potential development that could negatively impact Solana. So, while I’m still hopeful about its future, I’ll be sure to keep an eye on this new information.

According to the tweet, as SOL‘s price surged, there was growing fear of missing out (FOMO) among investors. Typically, heightened FOMO during a price uptrend can signal the end of the bull market.

It was interesting to know that Avalanche [AVAX] also showcased a bullish rally along with SOL. The good news for AVAX was that FOMO around it didn’t rise much.

Will SOL’s bull rally last?

To gain insight into the potential conclusion of SOL‘s bull market, AMBCrypto analyzed its on-chain data for a clearer understanding.

As a researcher studying market trends, I discovered through our examination of Coinglass’s data that the long/short ratio for Solana (SOL) had grown. Typically, an uptick in this particular metric is perceived as a favorable indication, suggesting that there is robust bullish sentiment towards the asset.

As a crypto investor, I’ve noticed that Solana’s fear and greed index stands at 63% currently, signaling a “greed” phase in the market. Historically, when this indicator hits such levels, it suggests that a price correction could be on the horizon.

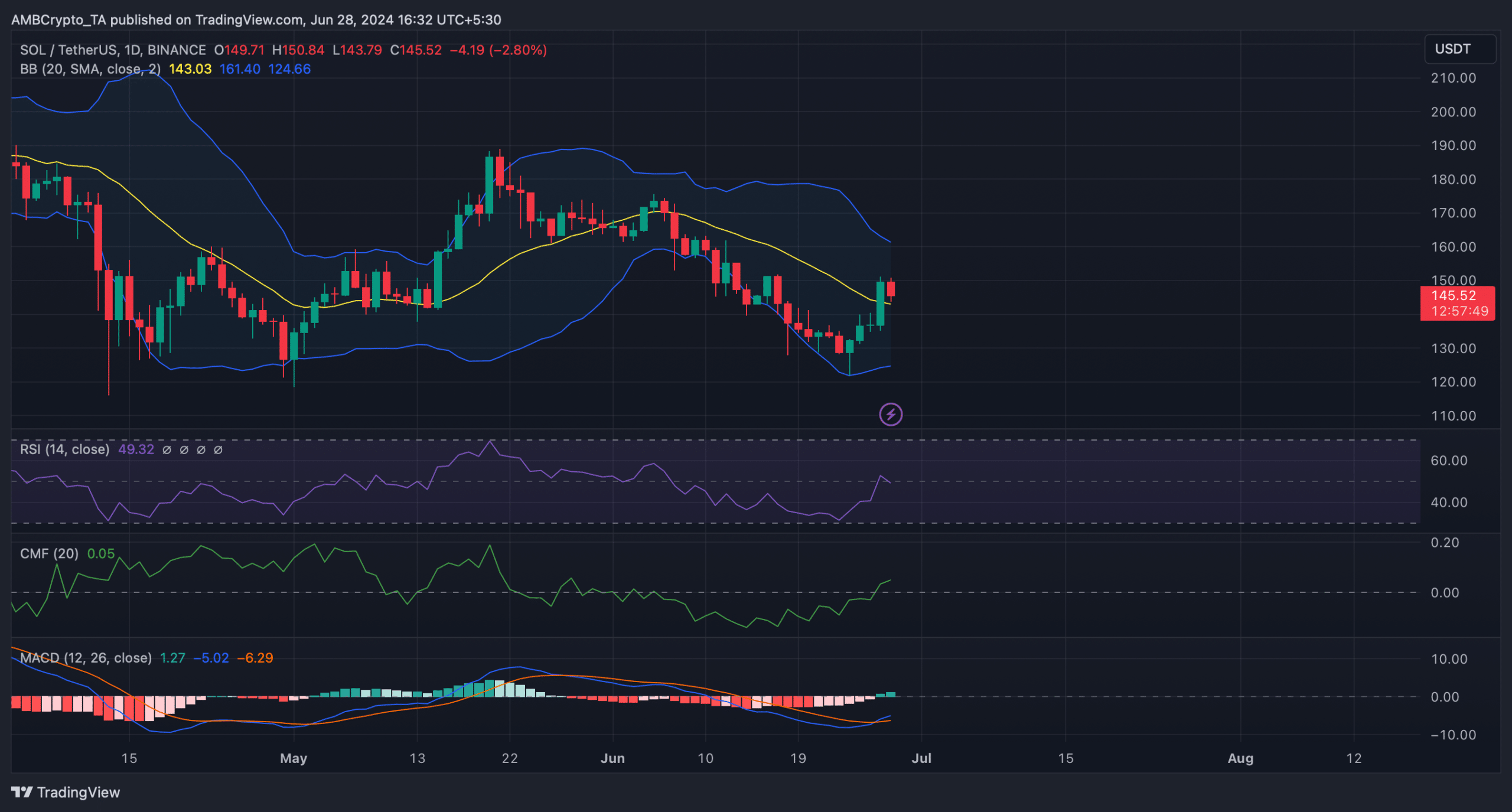

Based on my expertise, the Bollinger Bands signaled that Solana’s price was moving into a less turbulent range. Furthermore, the Relative Strength Index (RSI), following a significant surge, showed a decrease, suggesting that a potential price decrease for Solana might be imminent.

As an analyst, I’ve noticed that the Chaikin Money Flow (CMF) has been heading upward. Additionally, the Moving Average Convergence Divergence (MACD) indicator has shown a clear bullish crossover, suggesting that the price is likely to keep rising.

Based on our examination of Hyblock Capital’s figures, it’s not unlikely that Solana (SOL) will surpass $150 if the current bull market persists in the near future.

However, a correction might result in a drop to $141.

Read More

- Gold Rate Forecast

- Masters Toronto 2025: Everything You Need to Know

- We Loved Both of These Classic Sci-Fi Films (But They’re Pretty Much the Same Movie)

- SteelSeries reveals new Arctis Nova 3 Wireless headset series for Xbox, PlayStation, Nintendo Switch, and PC

- Rick and Morty Season 8: Release Date SHOCK!

- Discover the New Psion Subclasses in D&D’s Latest Unearthed Arcana!

- Mission: Impossible 8 Reveals Shocking Truth But Leaves Fans with Unanswered Questions!

- Eddie Murphy Reveals the Role That Defines His Hollywood Career

- PI PREDICTION. PI cryptocurrency

- ‘The budget card to beat right now’ — Radeon RX 9060 XT reviews are in, and it looks like a win for AMD

2024-06-29 04:07