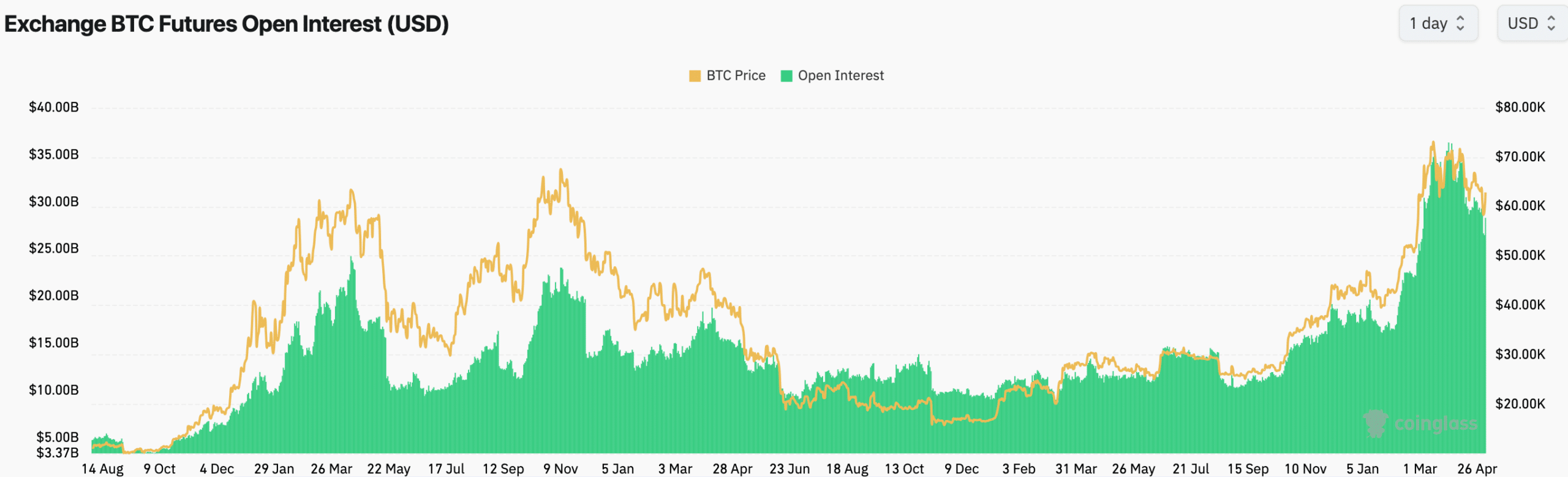

- A hike in Open Interest is a positive for the cryptocurrency’s price

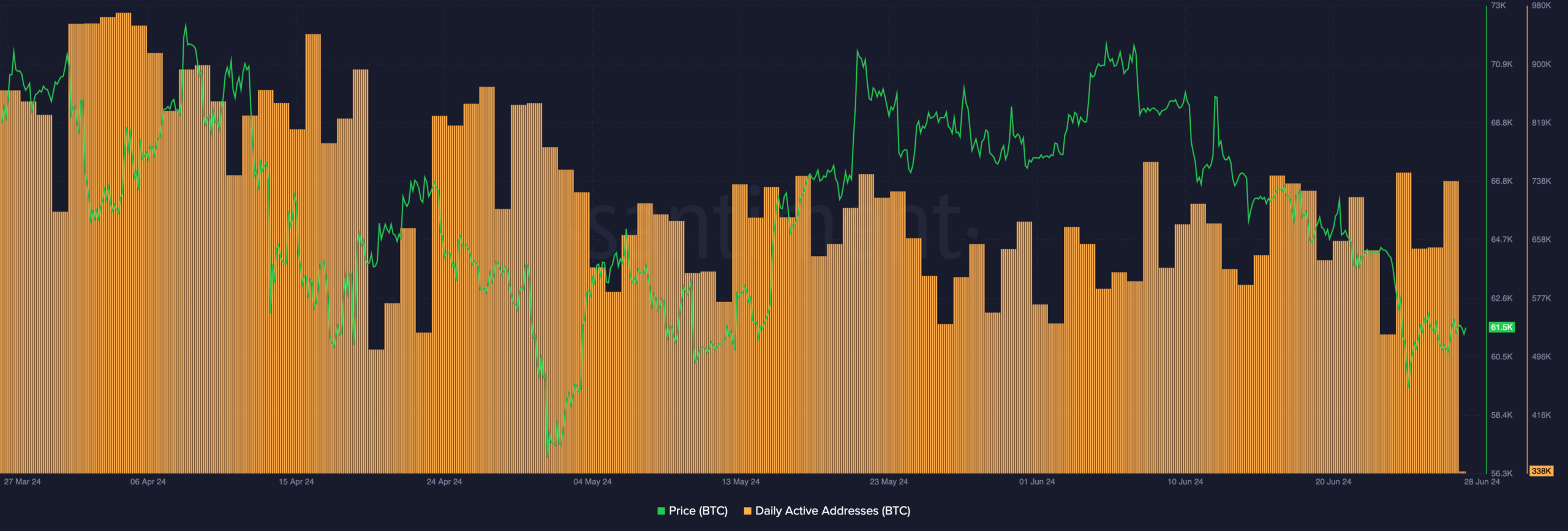

- Activity on the Bitcoin network fell materially over the last few days though

As a researcher with experience in the cryptocurrency market, I believe that an increase in Open Interest for Bitcoin is generally positive for its price. This surge in interest suggests that traders are anticipating significant price fluctuations in the future and could lead to increased institutional investment, resulting in higher liquidity in the Futures market. However, it’s important to note that this trend also comes with risks. For instance, if there’s a significant drop in Bitcoin’s price, short sellers may be forced to buy back their positions, leading to further price drops in a self-fulfilling prophecy. On the other hand, if the price unexpectedly rises, short sellers could face mounting losses and be pressured to buy back Bitcoin, triggering a dramatic reversal.

The drop in Bitcoin’s [BTC] value recently caused many other cryptocurrency tokens to follow suit with a correction. Consequently, this price downturn triggered a shift in investor sentiment, leading to a pessimistic outlook throughout the crypto market.

As a crypto investor, I’ve noticed an intriguing development: although the price of Bitcoin has been decreasing, the Open Interest in this cryptocurrency has remarkably increased. This trend indicates that more and more traders are becoming drawn to Bitcoin. One potential explanation is that these traders believe that significant price swings lie ahead, making it an opportune moment to enter the market.

Open Interest on the rise

One advantage of the Open Interest in Bitcoin is that it signifies increased institutional participation in Bitcoin trading. Consequently, this could lead to improved liquidity within the Bitcoin Futures market.

According to Coinglass’s data, there has been a noticeable increase in short positions for Bitcoin, surpassing long positions. In the event of a substantial price decrease, this imbalance could lead to a chain reaction known as a short squeeze. During a short squeeze, short sellers are compelled to purchase Bitcoin to settle their debts, which can exacerbate the downward trend in an escalating cycle.

Should the price of Bitcoin suddenly surge, short sellers could find themselves in a bind. With numerous short positions, they would be confronted with increasing losses, leading them to purchase Bitcoin to mitigate their losses. This mass buying could intensify the price rise, resulting in a remarkable turnaround.

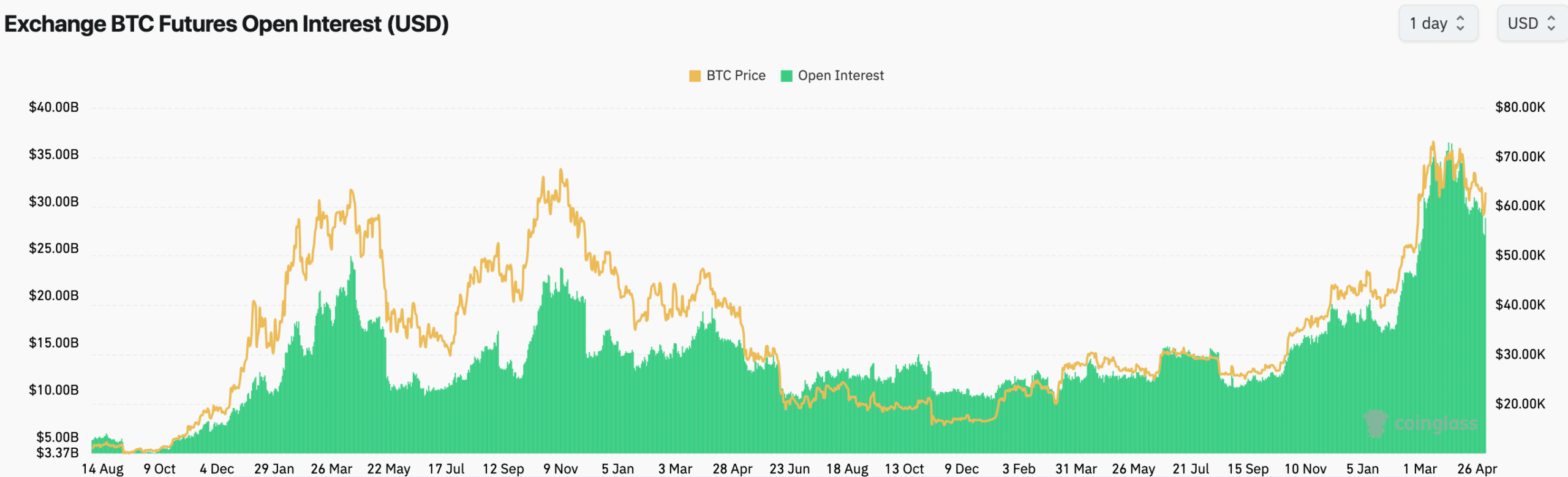

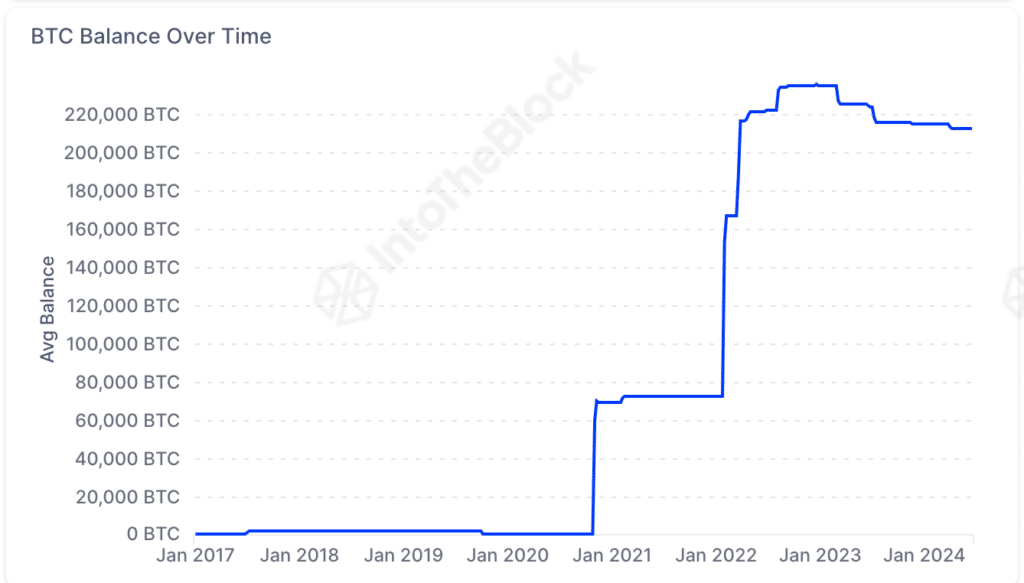

The selling of Bitcoin holdings by the U.S. government has historically led to a decrease in Bitcoin’s price on the charts.

Currently, the U.S government holds 213,039 BTCs – Roughly $13.10 billion.

The prospect of a government selling off assets can instill apprehension amongst investors, given historical precedents where such sales have been followed by price declines. This anxiety may result in a mass selling spree, exacerbating the downward pressure on prices.

Activity on the network

Based on current network conditions, there has been a substantial increase in the number of daily active Bitcoin addresses observed over the last few days. This trend suggests a notable decrease in engagement with the Bitcoin ecosystem.

This waning interest in the Bitcoin network may affect the price negatively too.

Read Bitcoin’s [BTC] Price Prediction 2024-25

Read More

- Gold Rate Forecast

- SteelSeries reveals new Arctis Nova 3 Wireless headset series for Xbox, PlayStation, Nintendo Switch, and PC

- Discover the New Psion Subclasses in D&D’s Latest Unearthed Arcana!

- Masters Toronto 2025: Everything You Need to Know

- Eddie Murphy Reveals the Role That Defines His Hollywood Career

- We Loved Both of These Classic Sci-Fi Films (But They’re Pretty Much the Same Movie)

- Forza Horizon 5 Update Available Now, Includes Several PS5-Specific Fixes

- ‘The budget card to beat right now’ — Radeon RX 9060 XT reviews are in, and it looks like a win for AMD

- Rick and Morty Season 8: Release Date SHOCK!

- Mission: Impossible 8 Reveals Shocking Truth But Leaves Fans with Unanswered Questions!

2024-06-29 05:11