- Bitcoin’s price around $61k is a victim of market cooling, summer slowdowns

- Mt. Gox unlocks and government sales raise some supply concerns too

As an experienced analyst, I believe that Bitcoin’s current price around $61k is primarily a result of market cooling and summer slowdowns. The positive news about potential ETH ETFs led to initial optimism in the market, but subsequent adjustments have contributed to the ongoing downturn. Furthermore, historical trends and reduced trading activity during the summer months are also impacting the market’s performance.

Recently, the crypto market hasn’t been performing well. At the moment of publication, the industry’s combined value was at $2.26 trillion. Notably, Bitcoin, the biggest cryptocurrency, experienced a nearly 1% decrease in value.

Bitcoin and the market’s top altcoins weren’t the only ones affected though.

The memecoin market experienced a decline, with its market value dropping by 1.33% to reach $47.89 billion. Additionally, the trading activity decreased substantially by 19.31%.

There are several reasons behind the recent downturn in the market, a combination of market-related incidents and larger economic trends. It’s important to examine these influencing factors in detail.

Market cooling after positive ETH ETF news

The anticipation of Ether (ETH) exchange-traded funds (ETFs) becoming available has brought a sense of relief to the crypto market following a period of heightened volatility. Reports indicate that the United States Securities and Exchange Commission (SEC) is nearing its decision to approve these ETFs, potentially as early as July 4th.

At first, the expectation fueled market excitement, but later market corrections have prolonged the slump.

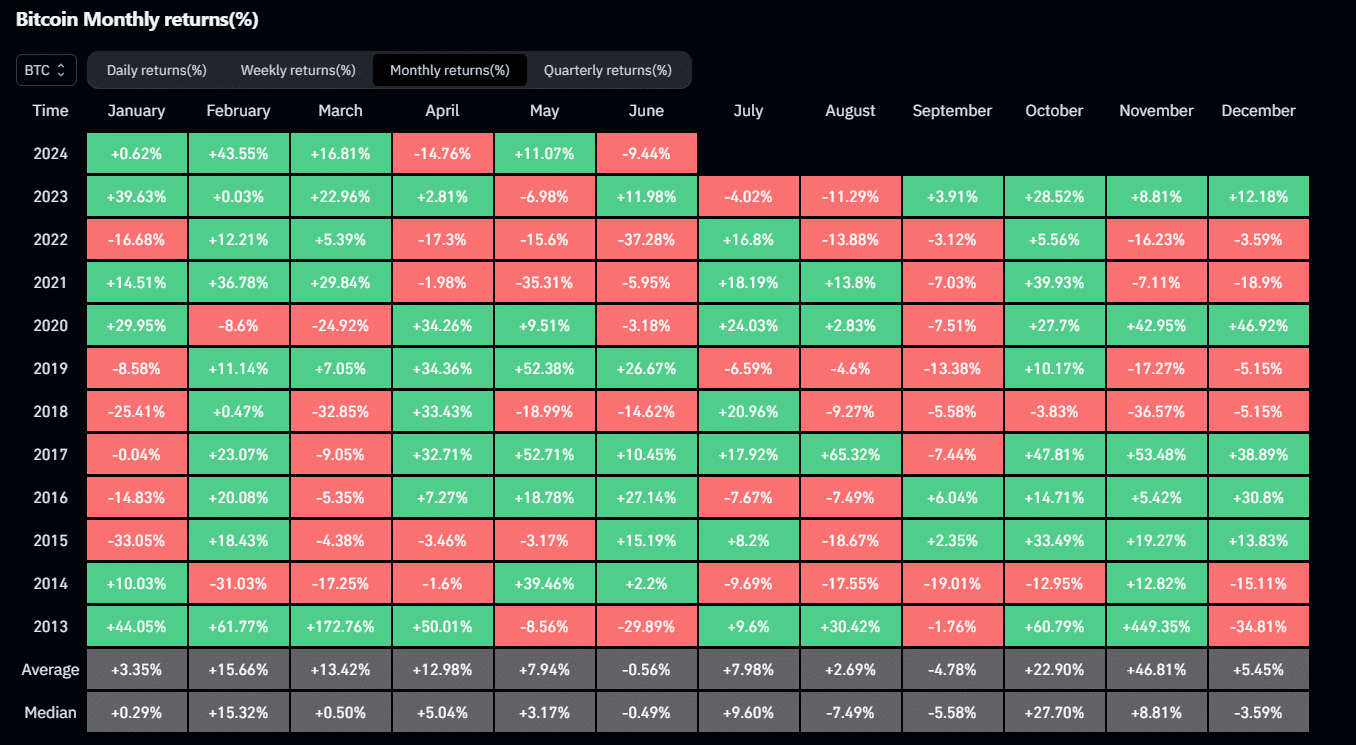

As a crypto investor, I’ve noticed that the market can be influenced by seasonal trends and decreased trading activity during the summer months. Specifically, Bitcoin’s performance in June hasn’t been great historically, with an average return of -0.56%. In simpler terms, this month has often brought weak returns for Bitcoin.

The same was recently highlighted by popular market analyst Dan Crypto Trades.

As a researcher studying market trends, I’ve observed that the decrease in trading volumes during the summer break results in reduced market activity and heightened price fluctuations.

Concerns over Mt. Gox and government selling

There are also worries in the market about the effects of Mt. Gox’s upcoming unlocks and potential sales actions by regulatory authorities. This issue was brought up in QCP’s recent market update.

As a crypto investor, I’ve heard some voices downplaying the severity of the ongoing supply concerns in the Bitcoin market. However, the possibility of a significant increase in supply from various sources remains, fueling unease and adding to the bearish outlook for prices.

Support levels and future projections

As a crypto investor, I’ve noticed that despite the bearish news circulating, Bitcoin has managed to hold its ground around the $60,000 mark. However, if this support level gives way, we could see BTC taking a downturn and potentially testing lower levels around $50,000.

In fact, QCP analysts went on to say, ,

As a crypto investor, I believe we might see a dip in prices approaching the $50,000 mark. However, this level is likely to act as a robust support due to the growing interest from Traditional Financial Institutions (TradFi). With regulatory environments becoming more accommodating worldwide, their entry into the crypto market could provide significant price stability.

If the upcoming introduction of spot Exchange-Traded Funds (ETFs) for significant cryptocurrencies such as Solana (SOL) materializes, it may rekindle investor enthusiasm and contribute to market stability.

Given the current market situation, experts propose tactics for coping with the slump. For Bitcoin investors, producing returns during a flat trend is recommended, while considering making bold moves in the last quarter.

For Ether, taking a short-term bullish position ahead of the ETF launch might be advantageous.

Read More

2024-06-30 00:08