-

Those who own about 0.1% of DOGE’s circulating supply are selling the cryptocurrency.

Datasets indicated accumulation, something which could stop the price from plunging.

As an experienced analyst, I believe that the recent sell-off from large Dogecoin (DOGE) holders is a cause for concern. The fact that this group owns about 0.1% of DOGE’s circulating supply and have been selling in large quantities could put downward pressure on the price. At present, DOGE trades at $0.12, a 23.74% decrease over the past 30 days.

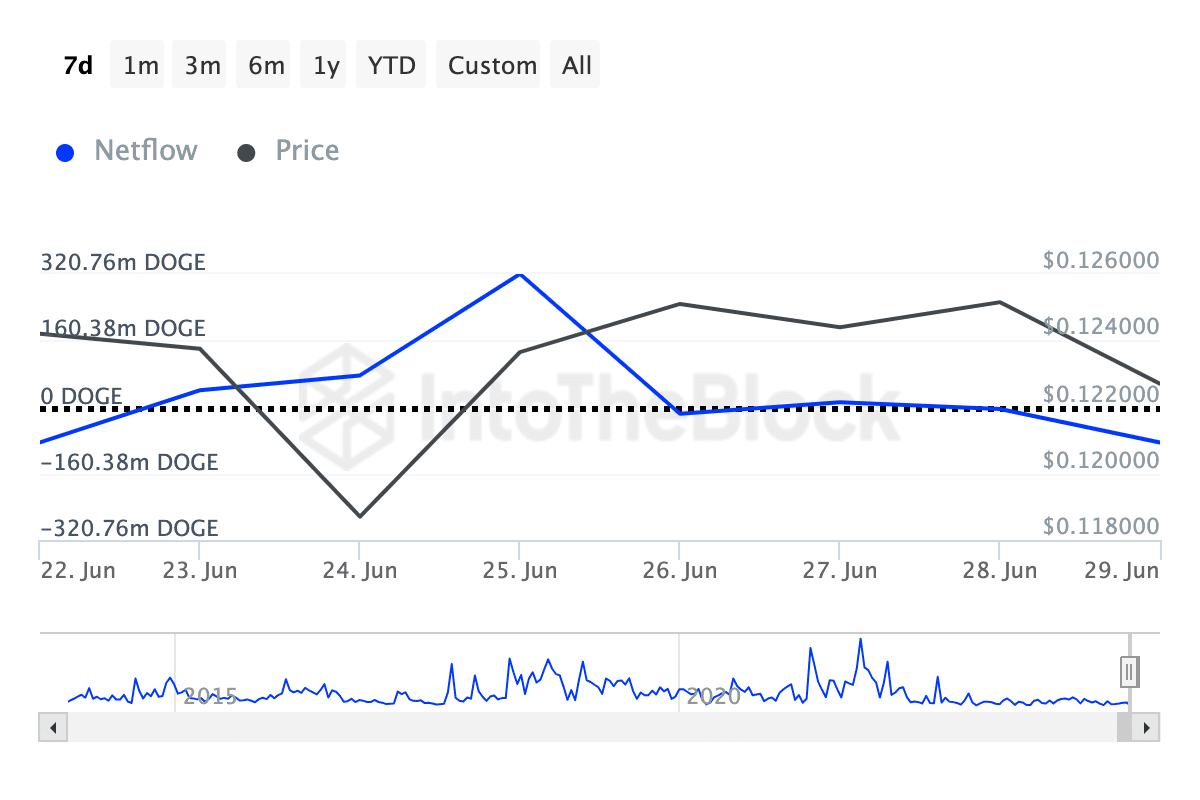

As an analyst, I’ve observed a significant decline of 311% in the outflow of Dogecoin [DOGE] held by large investors over the past week. This trend may suggest increased selling pressure and potentially impact the price negatively.

For context, large holders are addresses holding about 0.1% of the total circulating supply.

Due to the sizeable financial resources controlled by this particular group, they have a considerable influence on pricing. Sharp rises in the relevant indicator suggest that major investors are amassing the coin, leading to an anticipated rise in its value.

DOGE large holders choose a different side

Large players in the market have recently disposed of their DOGE coins, which may suggest further price declines for the cryptocurrency if this trend persists.

At the moment of publication, the value of Dogecoin was exchanged at $0.12. Over the past 30 days, this represented a drop of 23.74%. Given this price trend, it’s plausible to anticipate further decline towards $0.10.

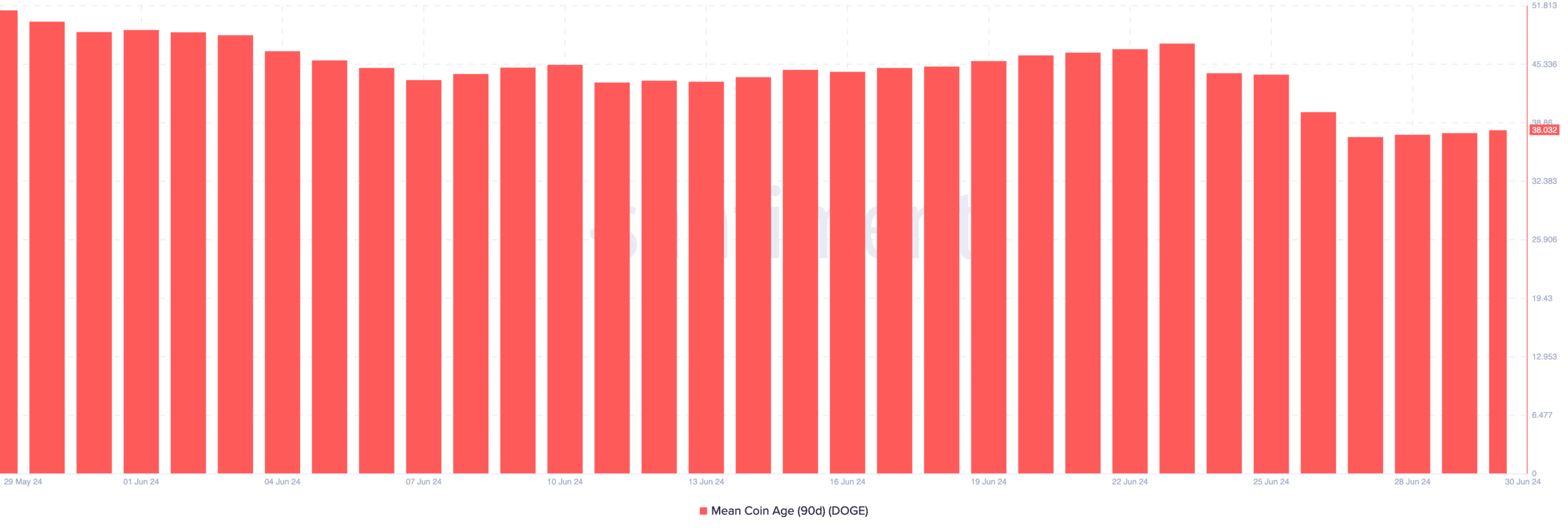

To determine if the downward trend for cryptocurrencies will persist, AMBCrypto analyzed the Mean Coin Age (MCA) metric. The term “Mean Coin Age” refers to the average age of all coins, with the calculation taking into account the purchase price as a weighting factor.

As an analyst, I’d like to point out that the Monetary Control Act (MCA) sets a specific condition for identifying old coins. These are coins that have been in possession of an individual for over six months, or 155 days, prior to being declared as “old” coins according to this legislation.

When the MCA spikes, it means that the trading activity among old coins is increasing.

Typically, this action results in transactions, implying they’re being offered for sale. For Dogecoin specifically, its 90-day moving average decline started on the 25th of June.

This decrease signifies that the old coins are no longer putting their holdings up for sale in self-custody, instead choosing to keep them for themselves.

It’s plausible that recent sell-offs of large amounts of DOGE were instigated by investors who have acquired the cryptocurrency within the past several months.

Traders are waiting to buy at a discount

Examining the two metrics, and taking into account their influence on Dogecoin’s value, it becomes clear that the cryptocurrency may hold steady in the near term. Based on particular benchmarks, the Dogecoin price could fluctuate between $0.11 and $0.13 over the next few days.

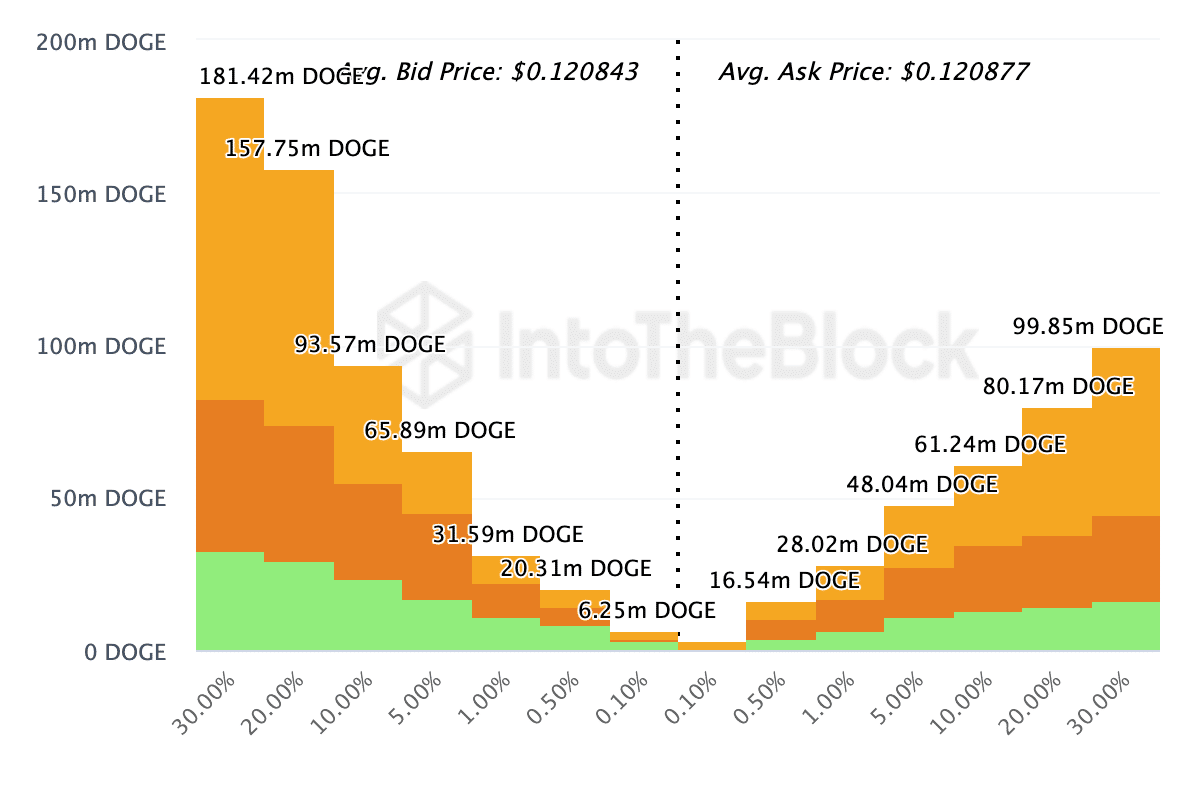

Instead of “But what are other market participants doing?”, you could consider saying “What is the trading activity like among other market players?” or “How does the current demand and supply situation look among other traders in the market?” In the context of AMBCrypto’s analysis, you might paraphrase as “AMBCrypto examined the Exchange On-Chain Market Depth to understand the current buying and selling intentions of other traders.”

Traders on the top 10 exchanges are divided into two groups: those intending to buy a coin (referred to as bids), and those planning to sell (referred to as asks). If the quantity of offers to sell exceeds the number of bids, then a potential price decrease could transpire within days or weeks.

In simpler terms, there are more Dogecoin bids (offers to buy) than there are asks (offers to sell), based on data from IntoTheBlock. This situation favors the buyers as it can potentially drive up the price.

As a researcher observing the DOGE market, if the number of participants waiting for a lower price to buy (or “snipe”) continues to grow, it could be a sign that a rally is on the horizon. If this trend persists, DOGE’s price may surge towards $0.15 within a few weeks.

However, the forecast will be invalidated if the value of traders bidding decrease.

Read More

- PI PREDICTION. PI cryptocurrency

- Gold Rate Forecast

- Rick and Morty Season 8: Release Date SHOCK!

- Discover Ryan Gosling & Emma Stone’s Hidden Movie Trilogy You Never Knew About!

- Mission: Impossible 8 Reveals Shocking Truth But Leaves Fans with Unanswered Questions!

- SteelSeries reveals new Arctis Nova 3 Wireless headset series for Xbox, PlayStation, Nintendo Switch, and PC

- Discover the New Psion Subclasses in D&D’s Latest Unearthed Arcana!

- Linkin Park Albums in Order: Full Tracklists and Secrets Revealed

- Masters Toronto 2025: Everything You Need to Know

- We Loved Both of These Classic Sci-Fi Films (But They’re Pretty Much the Same Movie)

2024-06-30 14:15