- Binance Coin was unable to defend the gains it made earlier this month.

- It is likely that prices would move toward $500 next before recovery can begin.

As a seasoned crypto investor with a few battle scars to show for it, I’ve learned to read between the lines of market data and technical indicators. Binance Coin’s [BNB] inability to defend its gains earlier this month was a sobering reminder that the markets can be unforgiving at times.

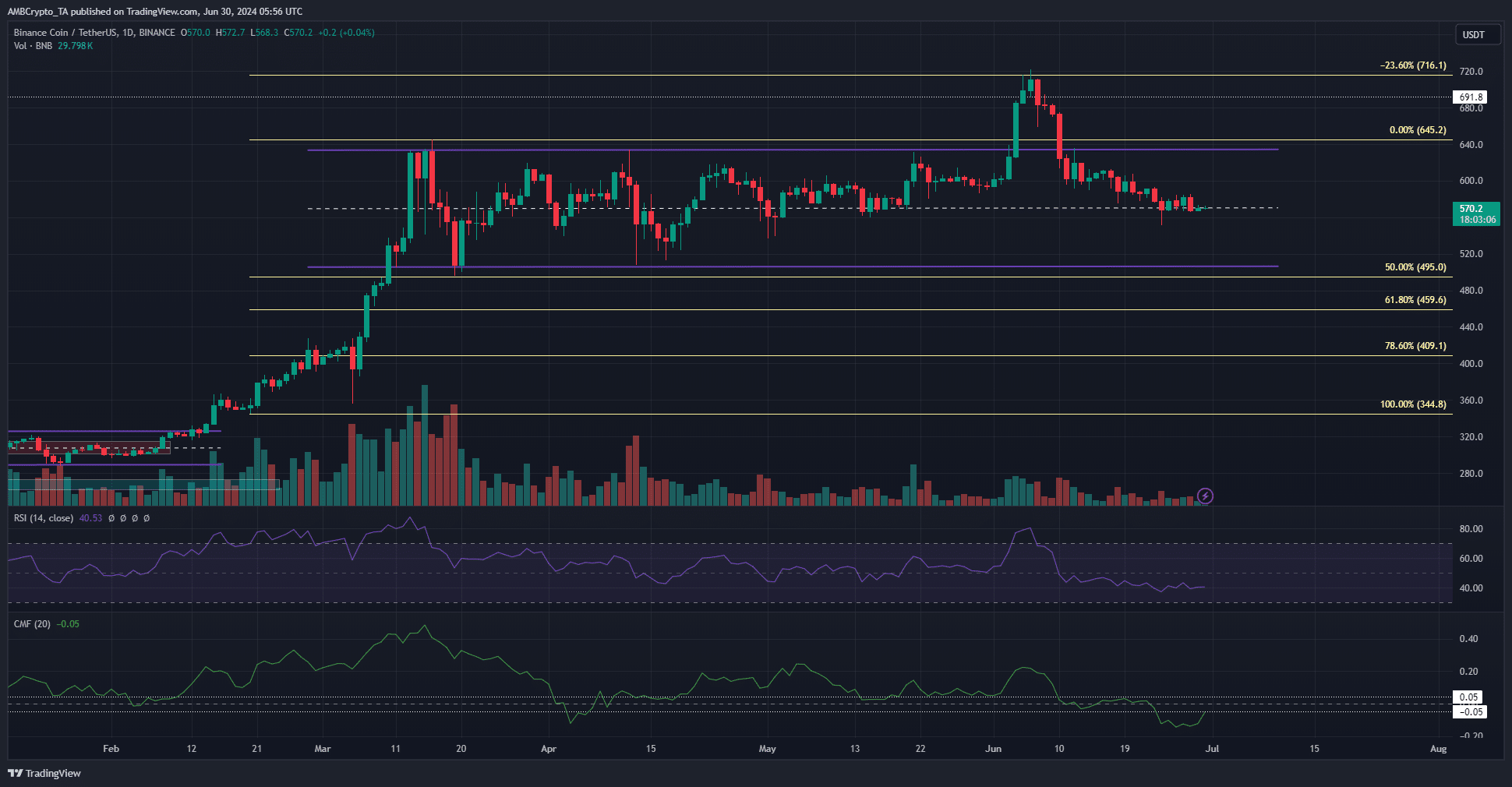

BNB’s bulls failed to protect the surge above the $635 resistance level. At present, the coin has retreated to the $570 support area. Based on current technical analysis, the trends suggest a bearish outlook.

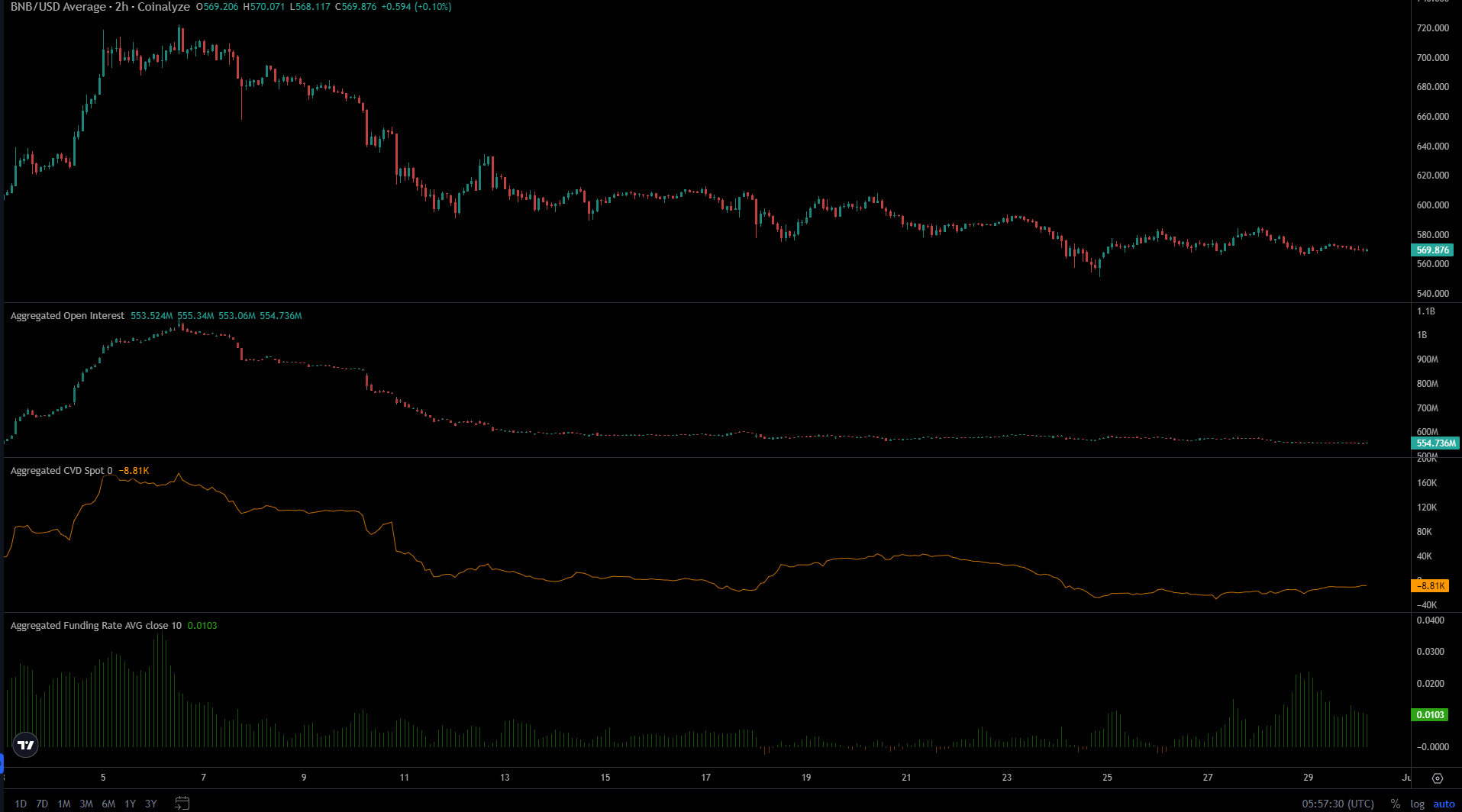

The mood in the futures market took a turn for the worse, as indicated by the data. However, there was a surprising change in attitude on the 29th, with optimism emerging. Yet, this shift didn’t come hand in hand with an increase in Open Interest.

As a crypto investor, I’m constantly keeping an eye on market trends and trying to anticipate the next big move. This week, with speculators eagerly awaiting the establishment of the next trend, I would advise traders to stay informed and prepared for potential volatility. Keep a close watch on market news and developments, and consider diversifying your portfolio to mitigate risk. Additionally, be ready to make strategic moves based on the current market conditions and your own investment strategy.

The retracement to the mid-range mark was uninspiring

During the initial week of June, Binance Coin experienced significant price surges, peaking at $717 – a new record high. According to Fibonacci retracement analysis, this represented a 23.6% extension from previous gains and approached a significant technical resistance level. Subsequently, prices took a downturn.

I anticipated that the previous peak at $635 would put a stop to the downtrend, but it failed to do so. Instead, the price dipped down to the middle range level of $570, where it has found some buying interest over the past week and held steady.

Based on the technical analysis, the daily Relative Strength Index (RSI) stood at 40, suggesting a bearish trend, while the Chaikin Money Flow (CMF) was negative at -0.05, reflecting significant selling pressure in the BNB markets, indicating that further declines could occur.

The liquidity at the $550 and $520 regions is likely to attract prices before a bullish recovery.

The slow rise in spot demand was a hopeful sign

Starting on June 6th, Open Interest has been on a decline. It plummeted significantly from a peak of $1.068 billion on that day to $618.2 billion by the 12th of June. This trend has continued, and the current Open Interest stands at approximately $554 billion as we speak.

Read Binance Coin’s [BNB] Price Prediction 2024-25

As an analyst, I observed that the CVD market exhibited a pattern akin to what we had seen previously between the 19th and 22nd of June. However, its recovery was hindered by insufficient and inconsistent demand.

Over the last two days, the CVD spread in the spot market has been creeping up gradually. Meanwhile, the funding rate has surged, signaling a potential shift in sentiment among speculators, who may now be growing more optimistic.

Read More

- PI PREDICTION. PI cryptocurrency

- Gold Rate Forecast

- Rick and Morty Season 8: Release Date SHOCK!

- Discover Ryan Gosling & Emma Stone’s Hidden Movie Trilogy You Never Knew About!

- We Loved Both of These Classic Sci-Fi Films (But They’re Pretty Much the Same Movie)

- Mission: Impossible 8 Reveals Shocking Truth But Leaves Fans with Unanswered Questions!

- SteelSeries reveals new Arctis Nova 3 Wireless headset series for Xbox, PlayStation, Nintendo Switch, and PC

- Discover the New Psion Subclasses in D&D’s Latest Unearthed Arcana!

- Linkin Park Albums in Order: Full Tracklists and Secrets Revealed

- Masters Toronto 2025: Everything You Need to Know

2024-06-30 16:07