-

Arbitrum and Optimism saw more transactions in the new year.

ARB and OP were in a bear trend at press time.

As a crypto investor with some experience under my belt, I’ve closely monitored the trends of Arbitrum (ARB) and Optimism (OP), two promising Layer 2 scaling solutions for Ethereum. The data shows an intriguing pattern: both networks have seen a remarkable increase in transaction activity this year.

Two notable Ethereum [ETH] scalability solutions, Arbitrum [ARB] and Optimism [OP], have seen a surge in transaction usage as evidenced by current data.

Although there’s been an uptick in transaction activity on both networks, their Total Value Locked (TVL) and the value of their native tokens have experienced a downturn over the past few days.

Arbitrum and Optimism see increased transactions

Based on a recent study conducted by IntoTheBlock, the transaction volume for top Ethereum Layer 2 platforms like Arbitrum and Optimism has witnessed a fourfold increase within the last twelve months.

The second quarter saw a notable increase in activity, with this trend becoming more evident after the implementation of Ethereum Improvement Proposal (EIP) 4844.

EIP-4844 aims to improve Ethereum’s scalability by introducing a novel transaction type for handling data more effectively. This results in reduced fees and increased network capacity.

As a growth analyst, I have conducted a thorough examination of the data from Growthepie and found that Arbitrum has seen significantly greater expansion than its counterpart since the beginning of the year.

Before this period of rapid growth, ARB transactions were under 1 million.

As a researcher studying transaction data on ARB, I’ve noticed a remarkable surge in activity starting from post-March. The number of transactions per day skyrocketed, exceeding one million and peaking at an astounding 2.6 million on the 26th of June.

Oppositely, there was a significant increase in transactions for OP around early April, reaching over 800,000. However, since then, there has been a noticeable decline.

From my investigation up to the present moment, ARB has consistently seen a large volume of activity, recording over 1.5 million transactions. In contrast, Optimism’s transaction count has dropped significantly, now standing at approximately 409,000.

TVL on Arbitrum and Optimism declines

As a researcher studying the adoption and usage of Layer 2 solutions like Arbitrum and Optimism within the Decentralized Finance (DeFi) ecosystem, I’ve noticed an intriguing trend in the Total Value Locked (TVL) data reported by DeFiLlama. Initially, there were significant increases in TVL as more users migrated to these platforms in search of faster and cheaper transactions and improved scalability. However, following these initial surges, I’ve observed that TVL tends to experience subsequent declines. This could be attributed to various factors such as market volatility, user behavior, or network upgrades. Further investigation is required to fully understand the reasons behind this pattern.

The growth of this trend is clearly apparent in Arbitrum’s case, as its Total Value Locked surpassed $3.1 billion in March. This substantial expansion signifies a notable surge in usage and financial commitment towards the platform.

Since then, TVL has seen a significant drop. The most recent data indicates that it currently stands at approximately $2.7 billion.

Just as optimistically, the total value locked (TVL) in Optimism surged past the $1 billion threshold in March. However, similar to ARB, its TVL has since decreased and now hovers around $665 million.

As a crypto investor, I’ve noticed that the Total Value Locked (TVL) in both Arbitrum and Optimism has been decreasing recently. There could be several reasons behind this trend. Firstly, investor sentiment might have shifted, leading some to withdraw their funds from these Layer 2 networks. Additionally, broader market conditions may be affecting the entire crypto ecosystem, causing a ripple effect on projects like Arbitrum and Optimism. Lastly, there could have been specific events within each network that have negatively impacted investor confidence, further contributing to the decline in TVL.

ARB and OP get strong resistance

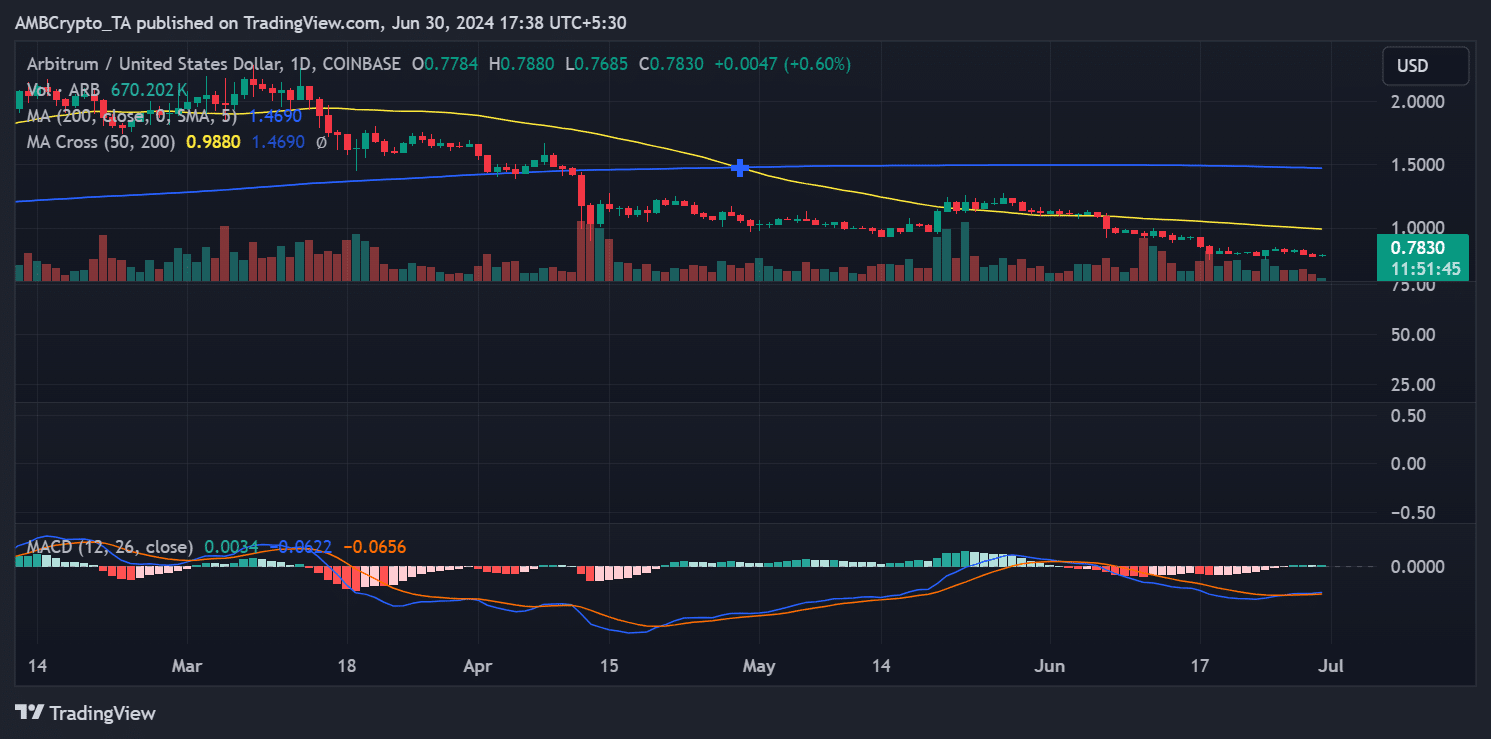

As a crypto investor, I’ve noticed that the price trends for Autobahn (ARB) and Oasis (OP) have been heading south based on AMBCrypto’s recent analysis.

In the past several weeks, the price of OP has been drifting further away from its recent moving average, hovering around the $2.2 mark.

The distance to this level suggests that $2.2 serves as a significant resistance, making it progressively harder for prices to surmount this price barrier.

As of this writing, OP was trading at around $1.7, showing a modest increase of less than 1%.

ARB has continued to distance itself from its previous short-term moving average, strengthening the resistance level approximately at $1. Currently, ARB is priced around $0.7 on the market, experiencing a minimal uptick of under 1%.

The increasing gap between the resistance levels for both tokens implies a heightened bearish attitude among investors, suggesting they are less hopeful about imminent price increases.

Read More

- Masters Toronto 2025: Everything You Need to Know

- We Loved Both of These Classic Sci-Fi Films (But They’re Pretty Much the Same Movie)

- ‘The budget card to beat right now’ — Radeon RX 9060 XT reviews are in, and it looks like a win for AMD

- Forza Horizon 5 Update Available Now, Includes Several PS5-Specific Fixes

- Street Fighter 6 Game-Key Card on Switch 2 is Considered to be a Digital Copy by Capcom

- Gold Rate Forecast

- Valorant Champions 2025: Paris Set to Host Esports’ Premier Event Across Two Iconic Venues

- The Lowdown on Labubu: What to Know About the Viral Toy

- Karate Kid: Legends Hits Important Global Box Office Milestone, Showing Promise Despite 59% RT Score

- Mario Kart World Sold More Than 780,000 Physical Copies in Japan in First Three Days

2024-07-01 07:04