-

The project’s development activity reading dropped; however, participants remain bullish on DOT.

Indicators showed that DOT’s price risked falling below $6.

As a seasoned crypto investor with a keen interest in Polkadot (DOT), I’ve witnessed the project’s development activity drop over the past week. While it’s disheartening to see this metric decrease, I remain optimistic about DOT’s potential due to several reasons.

As a researcher studying the development of Polkadot (DOT), I have consistently observed that this blockchain platform has prioritized active development as a primary driver of its growth. Numerous reports from AMBCrypto attest to this leadership in innovation within the blockchain industry.

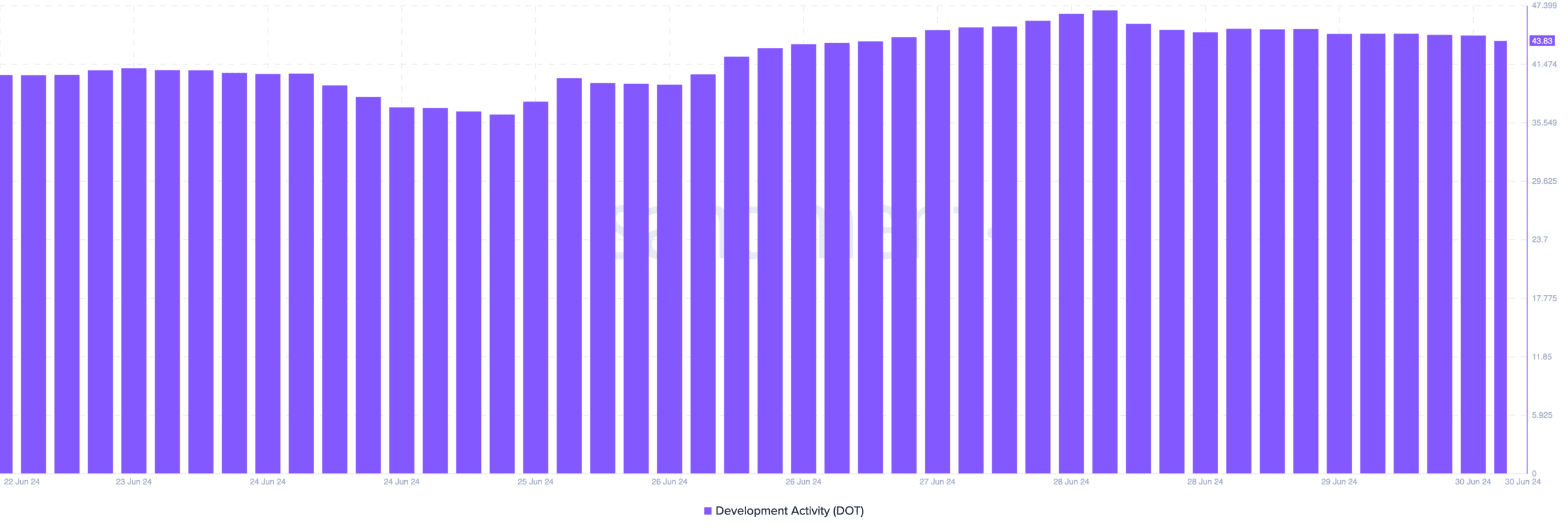

Last week, our development activity metric reached a value of 46.93, which was comparable to an earlier occasion. However, starting from the 28th of June, we noticed a decline in this metric. An uptick in development activity usually signifies that a project is releasing new features onto its network.

During the recent week, Polkadot saw a reduction in its commitment to refining the network. At the current moment, this was evident. Nevertheless, it’s important to note that the protocol still managed to make substantial progress during that timeframe.

Shipping stalls amid optimism

For instance, Snowbridge, a decentralized cross-chain initiative, debuted on the platform with significant advancements. Additionally, there were other progressions worth mentioning. Some centered around Non-Fungible Tokens (NFTs), while another aspect focused on enhancing asset security.

If the current trend persists into next week, I believe the development activity for this project will pick up again. As for the price of DOT, it was last traded at $6.11.

It’s quite remarkable that this particular project ranked among the highest percentage gainers from the pool of the top 20 market projects. Additionally, there has been a consensus among industry analysts that the value of this cryptocurrency is underestimated.

Michael van de Poppe is one of the individuals expressing this viewpoint. Based on van de Poppe’s analysis, DOT may take a path similar to Ethereum (ETH). He elaborated on his rationale during X, pointing out that:

As an analyst, I believe that Polkadot’s growth trajectory is similar to Ethereum’s, indicating that its current valuation is undervalued. I am optimistic about the potential of the Polkadot ecosystem, with the upcoming new segments set to bring significant value.

ETF rumors appear, but DOT does not care

“Another possible explanation for the buzz surrounding Polkadot is that it’s being considered for an Exchange-Traded Fund (ETF). In simple terms, an ETF is a type of investment fund. If Polkadot makes it to an ETF, traditional financial institutions would gain access to DOT, mirroring the route taken by Bitcoin [BTC] and Ethereum.”

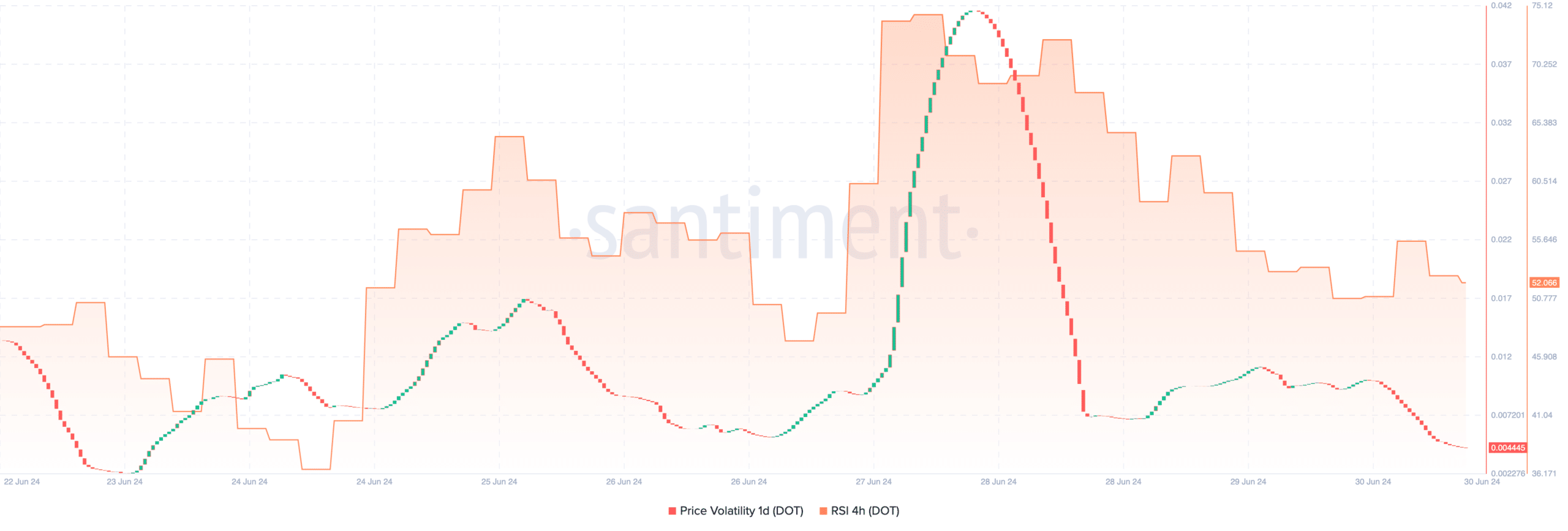

Based on our analysis at AMBCrypto, the enthusiasm surrounding the token appeared to be fading despite initial optimism. This observation became clear upon examining the Relative Strength Index (RSI) indicators on the 4-hour chart.

The Relative Strength Index (RSI) reflects the momentum of a security’s price movement. An uptick in the RSI indicates bullish momentum, while a decline signifies bearish momentum.

As of the current moment, the marker showed a decline to 52.06, signaling that sellers were cashing in on their previous earnings. Additionally, there was a decrease in price fluctuations over the past day.

Read Polkadot’s [DOT] Price Prediction 2024-2025

As a researcher examining the market trends, I’ve observed a decrease in volatility for DOT. This means that the price may not undergo significant swings or fluctuations in the near future. However, if selling pressure intensifies, I caution that the DOT price could potentially dip below the $6 mark.

As a researcher studying market trends, I can share that should bulls enter the scene, the price may persist at a level above $6 or even aim for $7.

Read More

- Masters Toronto 2025: Everything You Need to Know

- We Loved Both of These Classic Sci-Fi Films (But They’re Pretty Much the Same Movie)

- ‘The budget card to beat right now’ — Radeon RX 9060 XT reviews are in, and it looks like a win for AMD

- Forza Horizon 5 Update Available Now, Includes Several PS5-Specific Fixes

- Street Fighter 6 Game-Key Card on Switch 2 is Considered to be a Digital Copy by Capcom

- Valorant Champions 2025: Paris Set to Host Esports’ Premier Event Across Two Iconic Venues

- Gold Rate Forecast

- The Lowdown on Labubu: What to Know About the Viral Toy

- Karate Kid: Legends Hits Important Global Box Office Milestone, Showing Promise Despite 59% RT Score

- Mario Kart World Sold More Than 780,000 Physical Copies in Japan in First Three Days

2024-07-01 08:07