- The higher timeframe market structure was bearish, but the momentum has begun to shift.

- The lack of demand was a concern and reinforced the bearish bias.

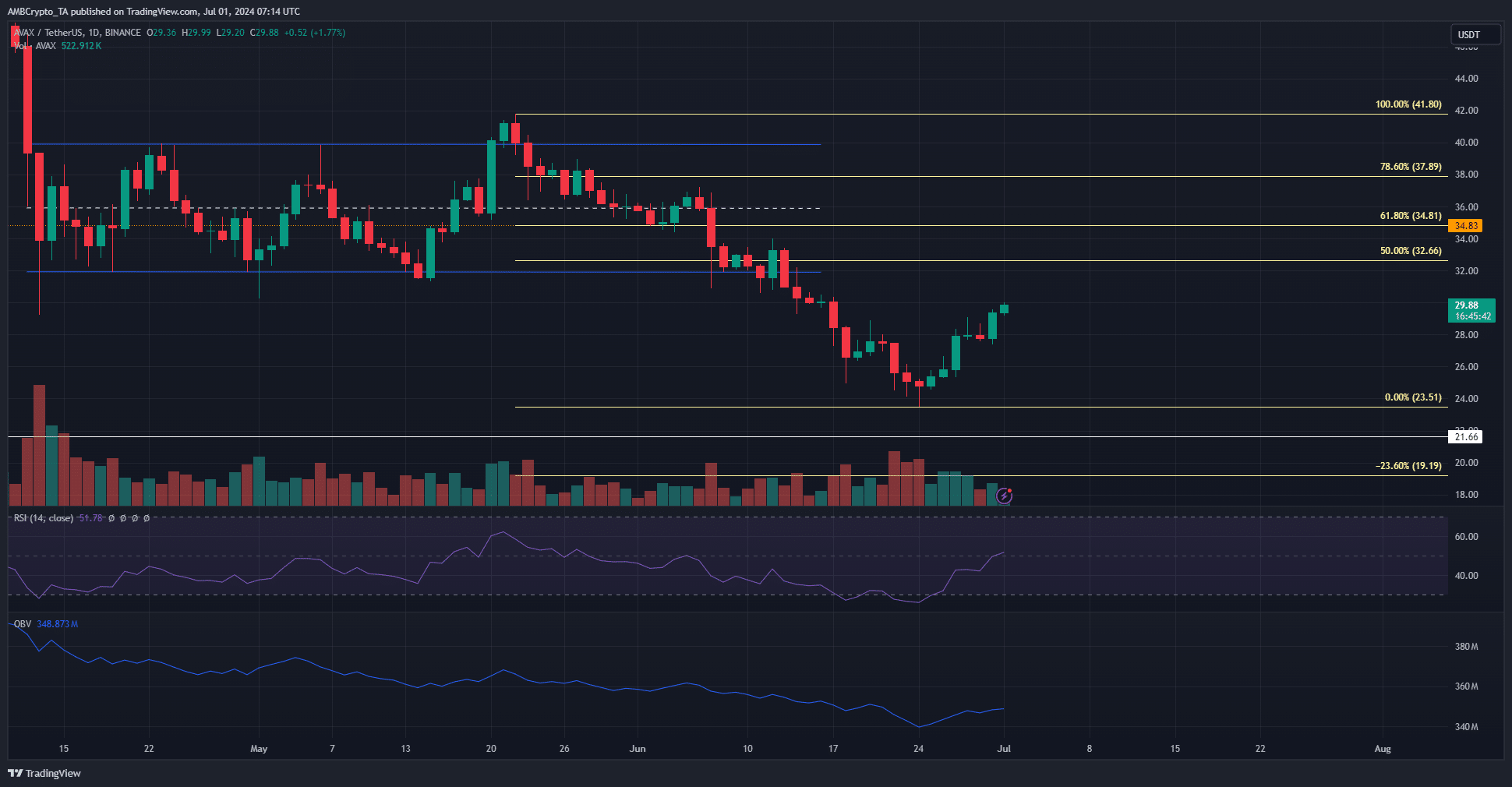

As an experienced market analyst, I have seen countless trends shift direction, sometimes unexpectedly. Based on my analysis of Avalanche’s (AVAX) recent price action and market structure, I believe that while the higher timeframe trend remains bearish, there are signs that momentum may be shifting.

Avalanche [AVAX] can get an ETF if Solana’s [SOL] current application is approved.

According to a latest article by AMBCrypto, regulatory authorities have become more receptive towards launching spot Exchange-Traded Funds (ETFs) based on cryptocurrencies that comply with specific conditions.

Over the last week, AVAX‘s price behavior showed signs of optimism, signaling a potential bullish shift in the short term. However, it’s important to note that the broader trend for AVAX still indicated bearishness. As traders formulate strategies for AVAX trading, they should consider the significant resistance levels ahead.

The momentum has tipped in the bulls’ favor

“The Relative Strength Index (RSI) on the daily chart indicated that momentum was shifting, as it rose above the neutral 50 threshold. This might be an initial sign of a reversal, but the overall trend continued to point downwards towards the nearby significant support level at $34.”

As a crypto investor, I’m keeping an eye on the current price level. If we manage to break above this point, it could mark the beginning of a bullish trend change. However, for such a price surge to be sustainable, On-Balance Volume (OBV) needs to follow suit and start trending upwards as well. Unfortunately, at the moment, OBV is still showing a downtrend.

The purchasing amount fell short of a significant threshold, leading to a persisting bearish inclination on the daily chart. According to Fibonacci retracement analysis (pale yellow lines), potential bearish reversals may occur around $34.8 and $37.9.

The short-term AVAX sentiment was bullish

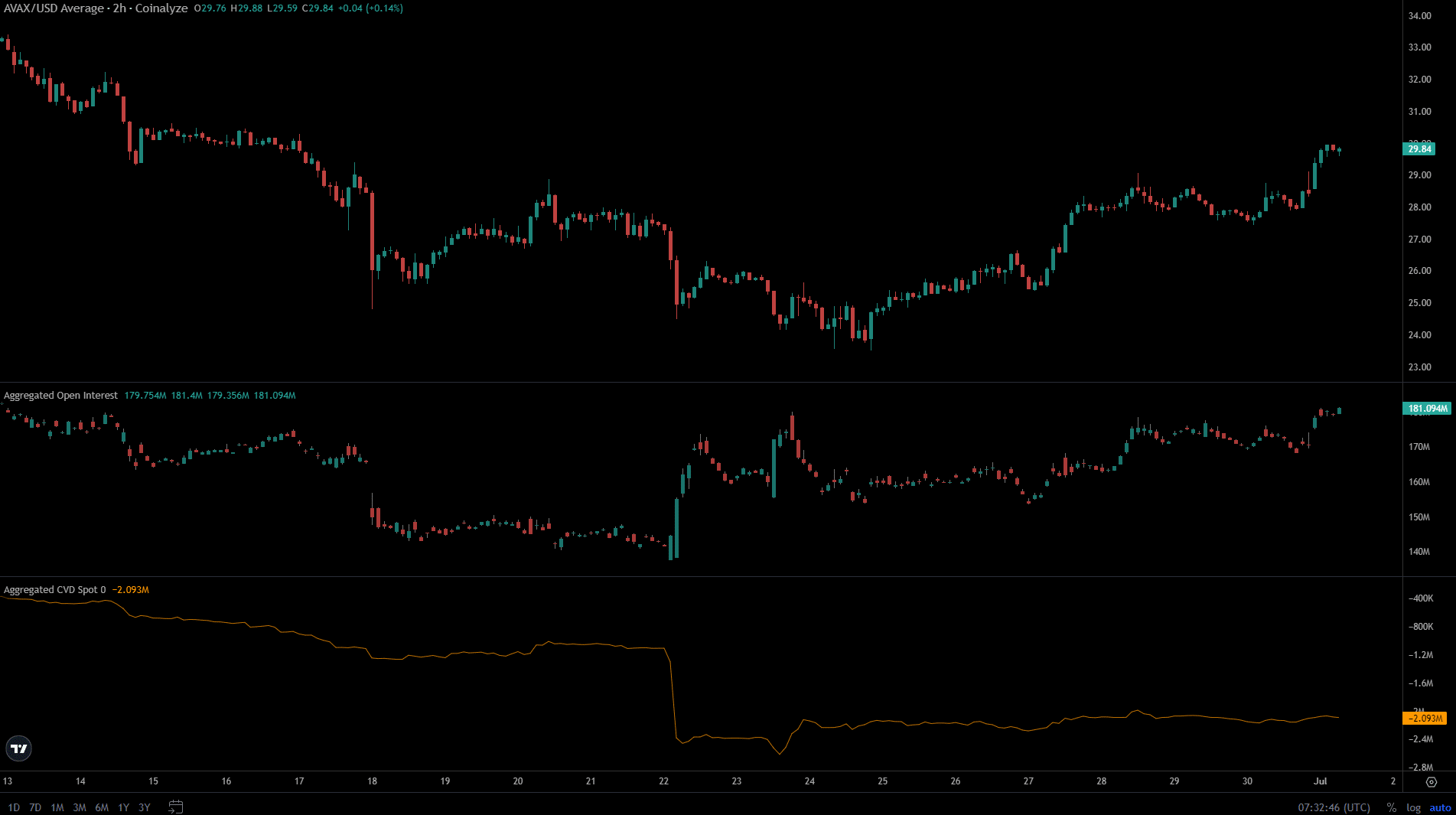

Despite a downtrend on the larger time frame, smaller time frame traders successfully capitalized on the recent price surge. Open interest increased significantly from $140.2 million to $181.1 million as of the current report.

Read Avalanche’s [AVAX] Price Prediction 2024-25

Alternatively, the CVD’s price action showed signs of hesitation, implying both cautious buying and insufficient fundamental support. This scenario increased the likelihood that the long-term bearish trend remained dominant.

Above the $30 mark, bears may take over the market. However, if the price rises beyond $34 or $37.8, the bearish outlook could be called into question.

Read More

- Best Race Tier List In Elder Scrolls Oblivion

- Elder Scrolls Oblivion: Best Pilgrim Build

- Elder Scrolls Oblivion: Best Thief Build

- Days Gone Remastered Announced, Launches on April 25th for PS5

- Gold Rate Forecast

- Ludicrous

- Elder Scrolls Oblivion: Best Sorcerer Build

- Where Teen Mom’s Catelynn Stands With Daughter’s Adoptive Parents Revealed

- Justin Baldoni Opens Up About Turmoil Before Blake Lively’s Shocking Legal Claims

- Yvette Nicole Brown Confirms She’s Returning For the Community Movie

2024-07-01 20:07