- The price of Bitcoin has gone up close to 5% since the recent weekend.

- There was a buy signal from on-chain metrics but also concerns over “artificial demand”.

As a researcher with a background in analyzing cryptocurrency markets, I’ve seen my fair share of volatility in Bitcoin’s [BTC] price action. The recent 4.5% surge since the weekend of June 29th was an interesting development that brought both opportunities and concerns.

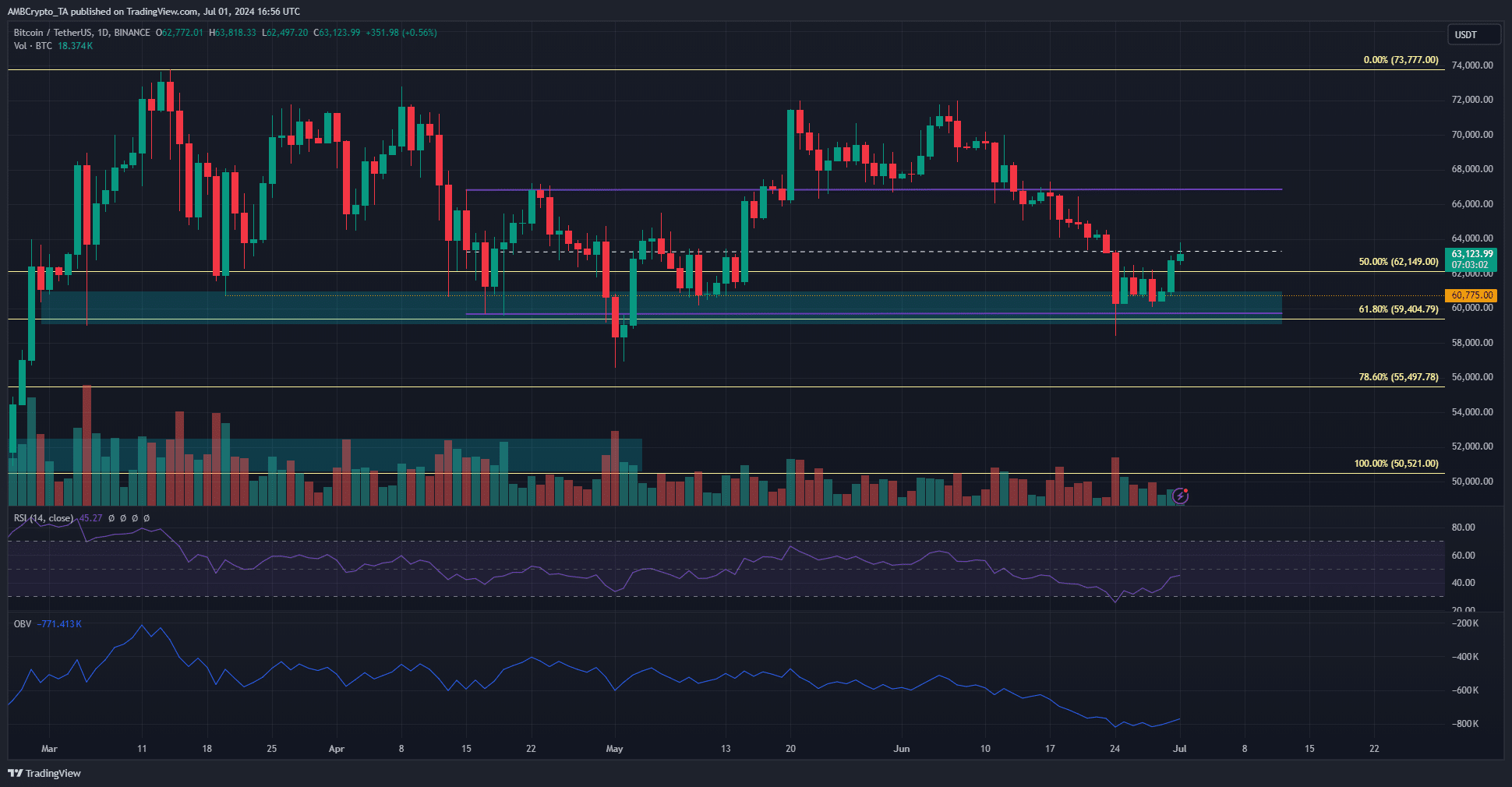

Bitcoin’s price has risen by 4.5% since June 29th. During this increase, key support levels from early March were successfully held, and the bottom ranges of the previous three-month price fluctuations were preserved.

As of when this article was published, the price level of $63,300 acted as a barrier for the mid-range market. According to technical analysis, a bullish turnaround on larger charts had not emerged yet.

In the shorter time frames, the pessimistic market outlook from last week and the disproportionate futures market could potentially attract sellers to target higher price levels for liquidation.

Partially explained in that source is the reason behind Bitcoin’s price rise, yet additional influences are also impacting its growth. Will these positive forces continue to propel prices upward?

The metrics indicate a network-wide accumulation but also hint at trouble

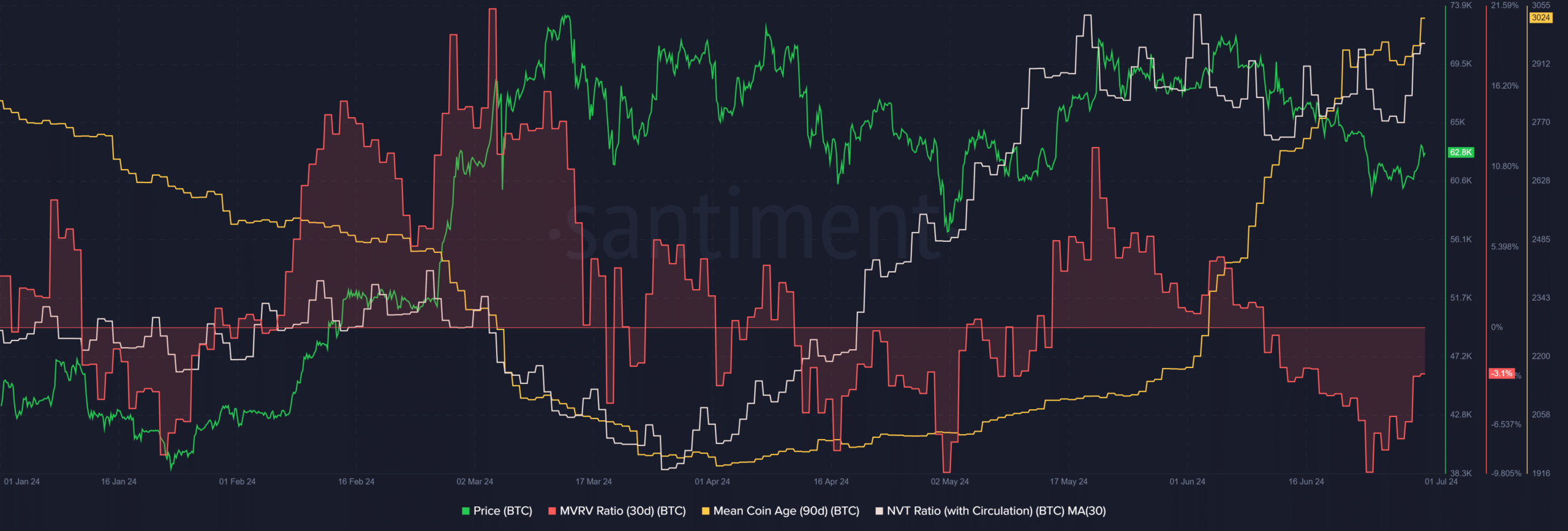

Short-term investors had lost money over the past month, as indicated by a negative 30-day MVRV ratio. Yet, during the previous six weeks, the average age of coins in circulation had been steadily increasing. This development presented a promising sign.

The signal suggested that there was accumulation among holders, implying undervaluation of the asset. Collectively, this presents a promising short-term buying opportunity. Such conditions may trigger a bullish trend for the leading cryptocurrency.

Based on my analysis of the data, I found that the Network Value to Transactions Ratio for Bitcoin, which is determined by dividing the network value by the number of daily on-chain transactions, indicated that Bitcoin was overvalued at that given moment in time. This means that the total value of all Bitcoins in circulation was higher than the amount being transacted daily on the blockchain.

This could hinder the bulls but is overshadowed by the MVRV and mean coin age combination.

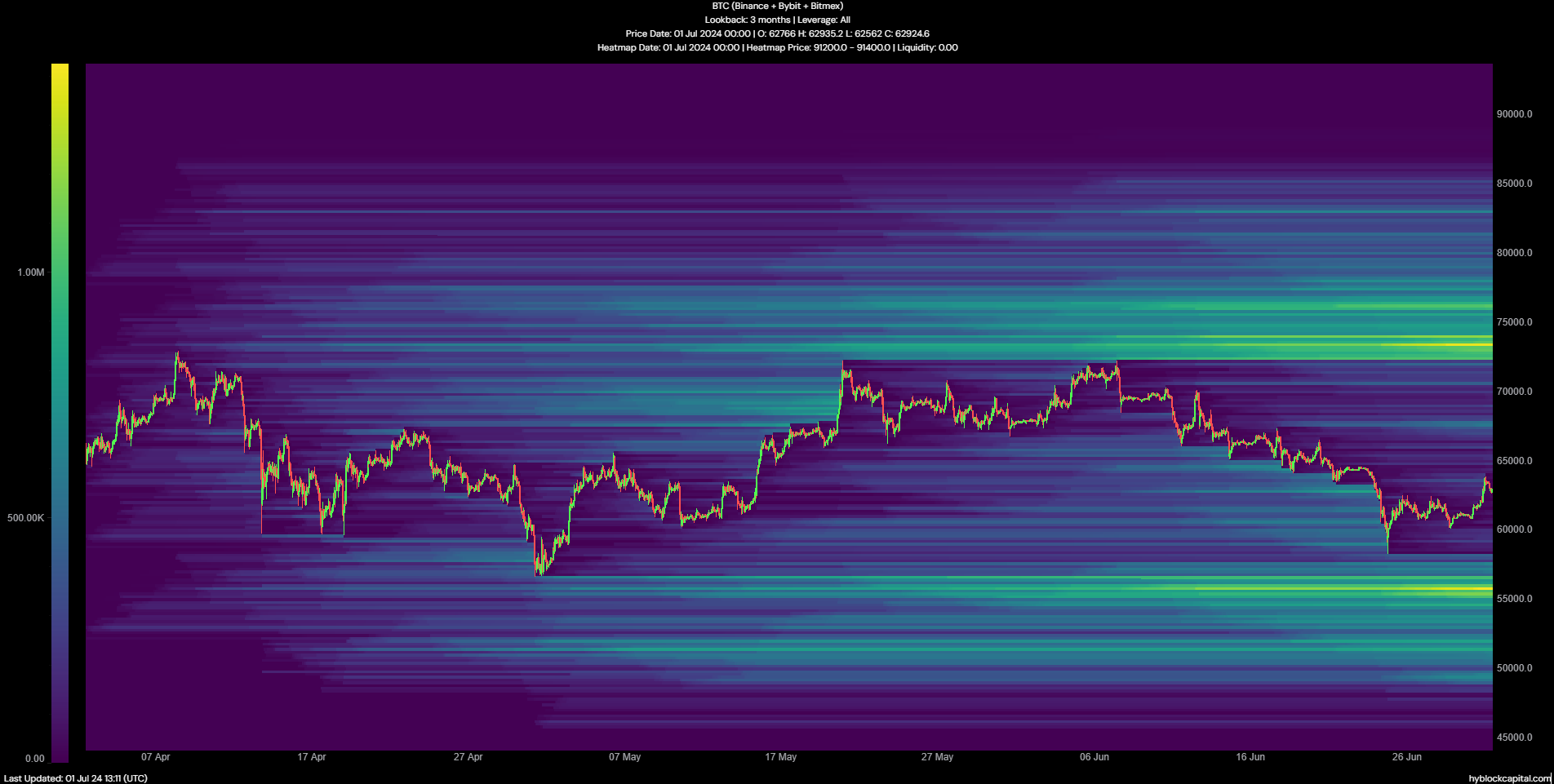

The liquidity cluster beckons BTC upward

As an analyst, I observed that the $55,000 area, with its significant liquidity pool, didn’t undergo testing when the bulls managed to prevent the price from dipping below the crucial psychological support at $60,000. It’s essential to note that not every high-liquidity zone necessitates a test. Should the market continue its upward trend, traders will likely focus their attention on the next area of interest at $73,000.

The road ahead is complex for Bitcoin bulls. According to a recent tweet from CryptoQuant’s Head of Research, Julio Moreno, signs point to miner capitulation, suggesting that Bitcoin’s price may have reached a local minimum.

Read Bitcoin’s [BTC] Price Prediction 2024-25

As a researcher studying the cryptocurrency market, I’ve noticed an intriguing observation made by my colleague Axel Adler. Contrary to popular belief, it was not the broader market that has been purchasing the recently sold Bitcoin in large quantities. Instead, crypto exchanges have been the primary buyers.

The analyst had a concern, as they perceived that other groups of investors were offloading their assets. They suspected that this artificial buying pressure could potentially have unfavorable consequences in the future.

Read More

- Gold Rate Forecast

- Rick and Morty Season 8: Release Date SHOCK!

- SteelSeries reveals new Arctis Nova 3 Wireless headset series for Xbox, PlayStation, Nintendo Switch, and PC

- Discover the New Psion Subclasses in D&D’s Latest Unearthed Arcana!

- PI PREDICTION. PI cryptocurrency

- Mission: Impossible 8 Reveals Shocking Truth But Leaves Fans with Unanswered Questions!

- Eddie Murphy Reveals the Role That Defines His Hollywood Career

- Masters Toronto 2025: Everything You Need to Know

- Discover Ryan Gosling & Emma Stone’s Hidden Movie Trilogy You Never Knew About!

- We Loved Both of These Classic Sci-Fi Films (But They’re Pretty Much the Same Movie)

2024-07-02 09:11