-

A Swiss government-owned bank, PostFinance, has added ADA. AVAX, SOL, XRP and DOT to its trading and custody options.

The move came amidst heightened speculation for AVAX and XRP ETFs.

As a seasoned crypto investor with a keen interest in the latest developments within the industry, I’m thrilled to see traditional financial institutions like PostFinance embracing digital currencies. The addition of ADA, AVAX, SOL, XRP, and DOT for trading and custody marks a significant milestone in expanding crypto use within the traditional financial markets.

As a financial analyst, I’ve noticed an increasing trend of traditional financial institutions embracing cryptocurrencies. In line with this development, PostFinance, being a Swiss government-owned bank, has broadened its crypto offerings to cater to the growing demand.

Based on recent updates, Postfinance now supports custodial services for various altcoins such as Cardano (ADA), Ripple (XRP), Avalanche (AVAX), Solana (SOL), and Polkadot (DOT).

Through their official X (formerly Twitter) page, PostFinance shared the news, stating that,

“Starting today, in addition to other cryptocurrencies, we support trading and safekeeping of Avalanche, Cardano, Polkadot, Ripple, and Solana.”

PostFinance’s latest action represents a significant advancement, broadening the reach of cryptocurrencies within conventional financial systems.

Last year, Sygnum kicked off an initiative involving Bitcoin (BTC) and Ethereum (ETH). Now, they’re broadening their scope to include other lesser-known cryptocurrencies.

Via Sygnum collaborations, traders are enabled to incorporate Bitcoin and Ethereum into their dealings; the expansion of this range now includes more altcoins, following the growing trend of utilizing these digital currencies.

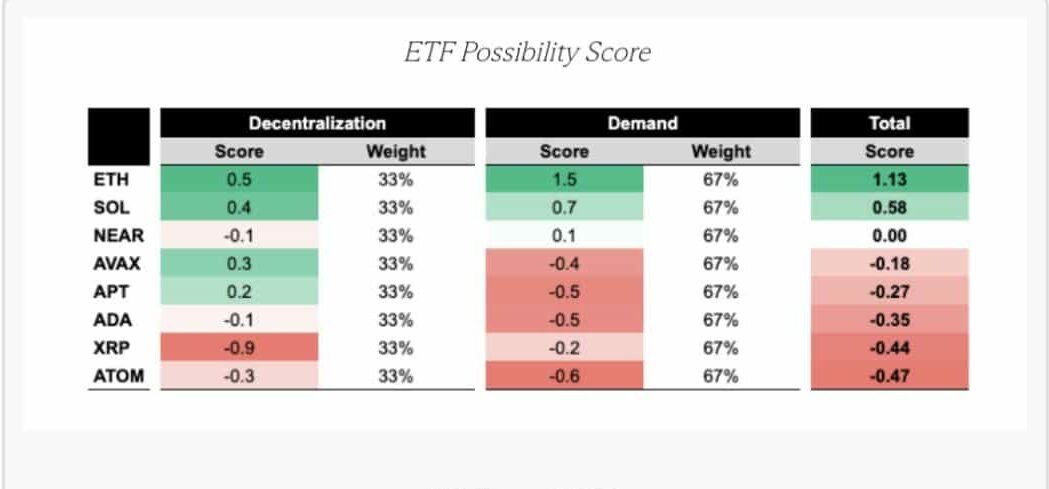

Institutions like banks and the conventional finance sector are placing wagers on potential ETF approvals for cryptocurrencies such as AVAX and XRP.

With an ETF, traditional finance will have access to institutional investments in these altcoins.

XRP, AVAX ETF rumors

After the recent green light given to Bitcoin and Ethereum ETFs, numerous crypto enthusiasts have voiced their intentions to pursue similar exchange-traded funds (ETFs) for other alternative coins.

As a crypto investor, I’ve witnessed the approval of Bitcoin lead to remarkable price surges, reaching new all-time highs. Despite the inherent volatility in the cryptocurrency market, I firmly believe that Bitcoin holds a strong position and has the potential to reach $100k by year’s end.

As a researcher studying the cryptocurrency market, I’ve noticed that the success of Bitcoin-related Exchange Traded Funds (ETFs) has sparked interest in the approval of ETFs for other altcoins. Ethereum (ETH) was recently given the green light last month, and Solana (SOL) is currently under review.

As a crypto investor, I’ve consistently heard whispers about potential Exchange-Traded Funds (ETFs) for XRP. Recently, during an interview with Altcoin Daily, the President of Ripple weighed in on this topic, sharing his insights.

“it would make a lot of sense.”

Similarly, there has been much excitement and discussion about the potential approval of an AVAX ETF, as analysts express their views on the potential advantages this could bring.

According to Jan Kimbo, AVAX would get 100x if an ETF is approved. He shared that,

“$AVAX will do 100-500x, but you won’t believe me until we are there and say.”

Read Cardano’s [ADA] Price Prediction 2024-2025

As an analyst, I can suggest that the approval of an ETF by PostFinance would be beneficial for investors, positioning the financial institution at the forefront of crypto adoption.

As a crypto investor, I appreciate when financial institutions like Postfinance cater to our needs by integrating altcoins with substantial GitHub activity, such as AVAX, XRP, DOT, SOL, and ADA. By doing so, Postfinance solidifies its position at the forefront of cryptocurrency adoption.

Read More

- Gold Rate Forecast

- PI PREDICTION. PI cryptocurrency

- Rick and Morty Season 8: Release Date SHOCK!

- We Loved Both of These Classic Sci-Fi Films (But They’re Pretty Much the Same Movie)

- Discover Ryan Gosling & Emma Stone’s Hidden Movie Trilogy You Never Knew About!

- SteelSeries reveals new Arctis Nova 3 Wireless headset series for Xbox, PlayStation, Nintendo Switch, and PC

- Masters Toronto 2025: Everything You Need to Know

- Mission: Impossible 8 Reveals Shocking Truth But Leaves Fans with Unanswered Questions!

- Discover the New Psion Subclasses in D&D’s Latest Unearthed Arcana!

- Linkin Park Albums in Order: Full Tracklists and Secrets Revealed

2024-07-03 17:12