-

Lido outperformed Ethereum in terms of fees earned in the last few days.

Despite interest in staking growing, the price of ETH declined.

As a crypto investor with experience in staking and observing the market trends, I find Lido’s recent fee generation performance quite impressive. The fact that it outperformed Ethereum itself in terms of fees earned is a significant achievement. With its dominance in the staked ETH market and continued growth in TVL, Lido seems poised to continue its upward trajectory.

Lido [LDO] has managed to outperform Ethereum [ETH] in the last few days in terms of fees earned.

Lido showed growth

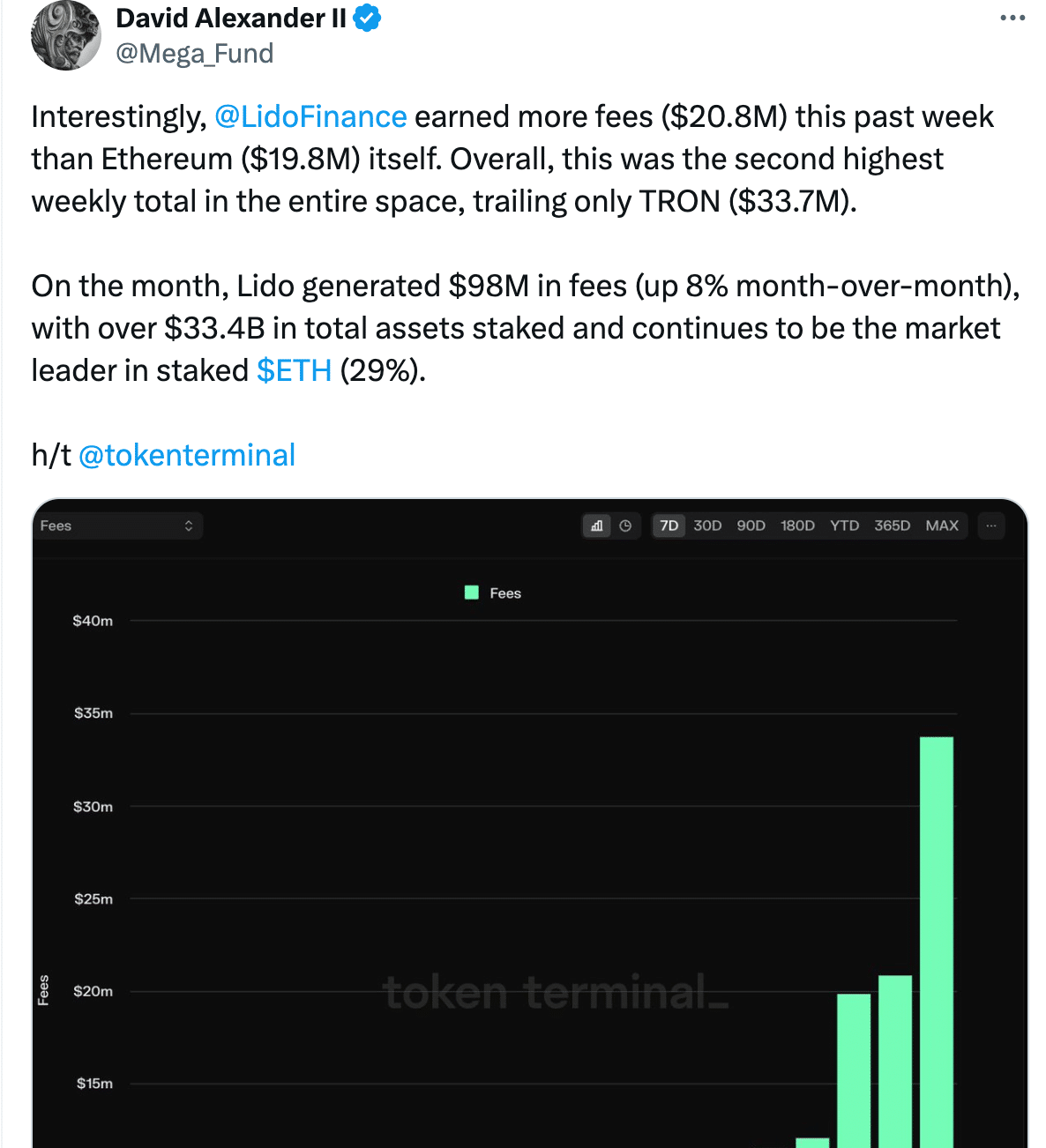

As an analyst, I’ve noticed some intriguing data regarding fee collections for both Lido Finance and Ethereum over the past month. In a single week, Lido Finance managed to amass a substantial total of $20.8 million in fees. Remarkably, this figure surpassed the fees Ethereum itself collected during that same timeframe – a sum of $19.8 million.

During that particular week, Lido Finance ranked as the second biggest fee earner in the cryptocurrency sector, trailing only behind Tron [TRX] with its impressive earnings of $33.7 million.

As a crypto investor, I’ve noticed that Lido Finance has been consistently gaining traction throughout the month. In total, this decentralized finance (DeFi) platform generated approximately $98 million in fees during this period, marking an impressive 8% growth compared to the previous month.

As a crypto investor, I can tell you that Lido’s significant fee generation can be attributed to its leading position in the staked Ethereum (ETH) market. At this moment, Lido manages over $33.4 billion worth of staked ETH assets, making up approximately 29% of the total staked ETH market share.

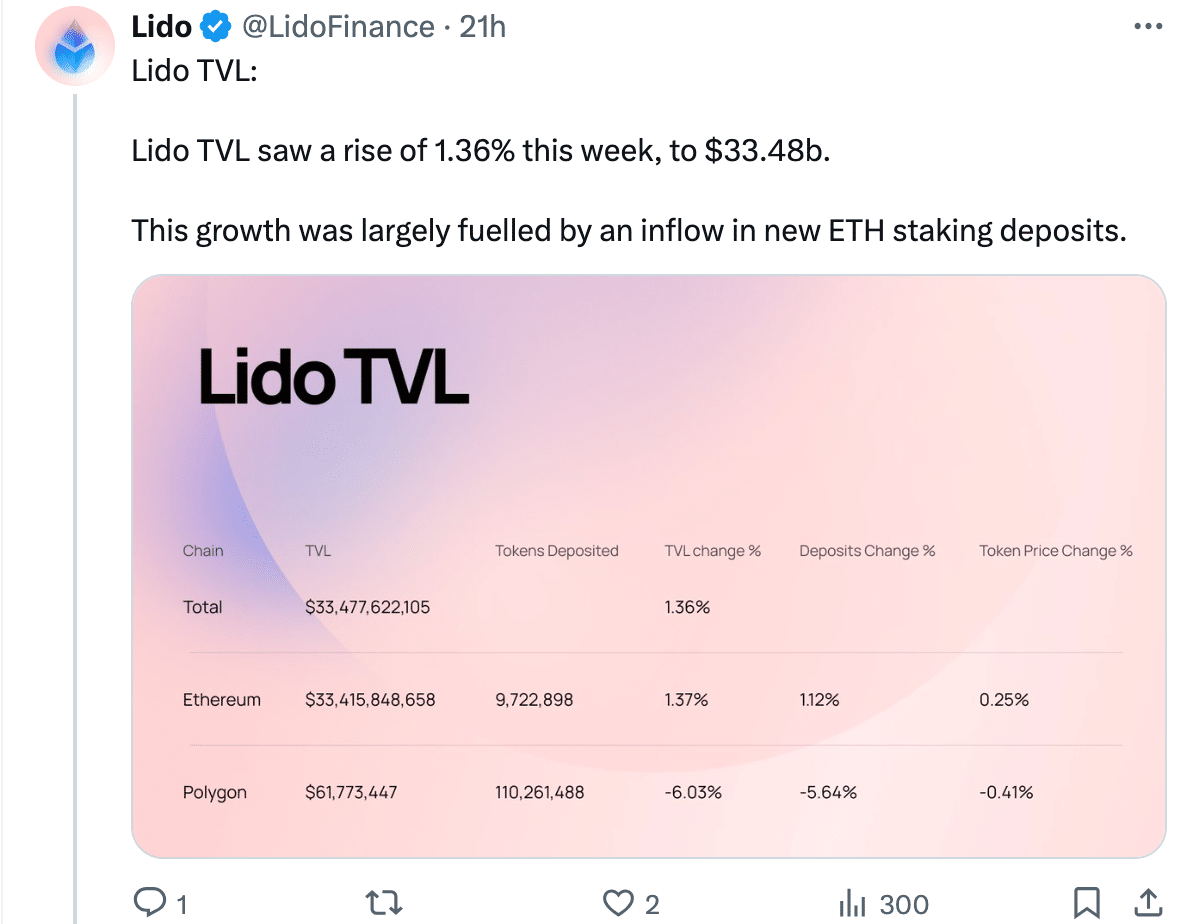

This week, the total value locked in Lido experienced a notable increase of 1.36%, amounting to $33.48 billion. This growth can be attributed to a significant influx of new Ethereum (ETH) staking deposits. Over the past seven days, approximately 95,616 more ETH were staked through Lido.

While the 7-day stETH APR dipped slightly by 0.04% to 2.96%, there were positive signs elsewhere.

The quantity of wrapped stETH (wstETH) transferred to Layer 2 networks experienced a notable increase of 7.19%. As a result, the current total now stands at 141,586 wstETH.

As a researcher studying the Ethereum Layer 2 scaling solutions market, I’ve observed that Arbitrum currently holds the largest share with approximately 65,290 wrapped staked Ether tokens (wstETH). Optimism comes in second place with around 27,879 wstETH. Over the past week, both networks have experienced slight decreases.

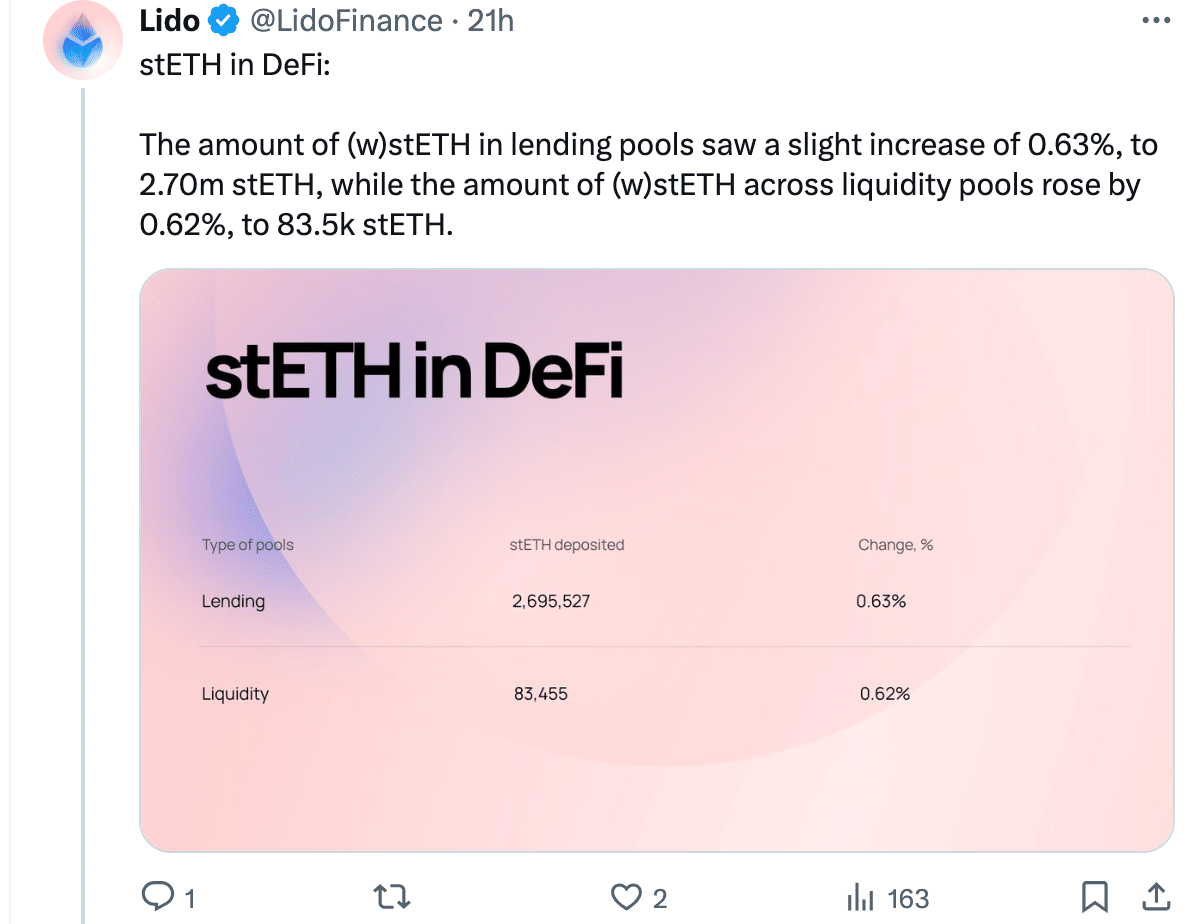

An uptick of approximately 2.7 million stETH and 83,500 stETH were added to lending and liquidity pools respectively, marking a slight growth in deposits.

The transfer of wstETH from the Ethereum network to the Cosmos networks experienced a modest increase, with a total of 1,788 wstETH representing a 2.12% rise over the past week.

I noticed that the trading volume for wstETH saw a decrease of 7.25% over the past week, amounting to approximately $1.23 billion in total.

As an analyst, I observed a substantial rise of 86.26% in the wstETH token on the Scroll network. In contrast, other platforms including Base, Polygon, Linea, and zkSync Era experienced relatively smaller decreases.

What happens next for ETH?

As a crypto investor, I’ve noticed an intriguing development in the cryptosphere – the escalating recognition and appeal of the Lido protocol. This trend suggests that more and more individuals are becoming drawn to the idea of staking Ethereum (ETH).

Realistic or not, here’s LDO’s market cap in BTC’s terms

Despite ETH‘s price remaining unchanged at present, an uptick in staking activity suggests that current holders are confident in Ethereum’s future value.

As of now, ETH is priced at $3,336.23 on the markets. In the past 24 hours, there has been a 3.15% decrease in its value.

Read More

- Gold Rate Forecast

- Rick and Morty Season 8: Release Date SHOCK!

- SteelSeries reveals new Arctis Nova 3 Wireless headset series for Xbox, PlayStation, Nintendo Switch, and PC

- Discover the New Psion Subclasses in D&D’s Latest Unearthed Arcana!

- Mission: Impossible 8 Reveals Shocking Truth But Leaves Fans with Unanswered Questions!

- PI PREDICTION. PI cryptocurrency

- Eddie Murphy Reveals the Role That Defines His Hollywood Career

- Masters Toronto 2025: Everything You Need to Know

- Discover Ryan Gosling & Emma Stone’s Hidden Movie Trilogy You Never Knew About!

- We Loved Both of These Classic Sci-Fi Films (But They’re Pretty Much the Same Movie)

2024-07-03 20:07