- Bitcoin fell below $60K as ETF outflows and Options expiry sparked market-wide liquidations

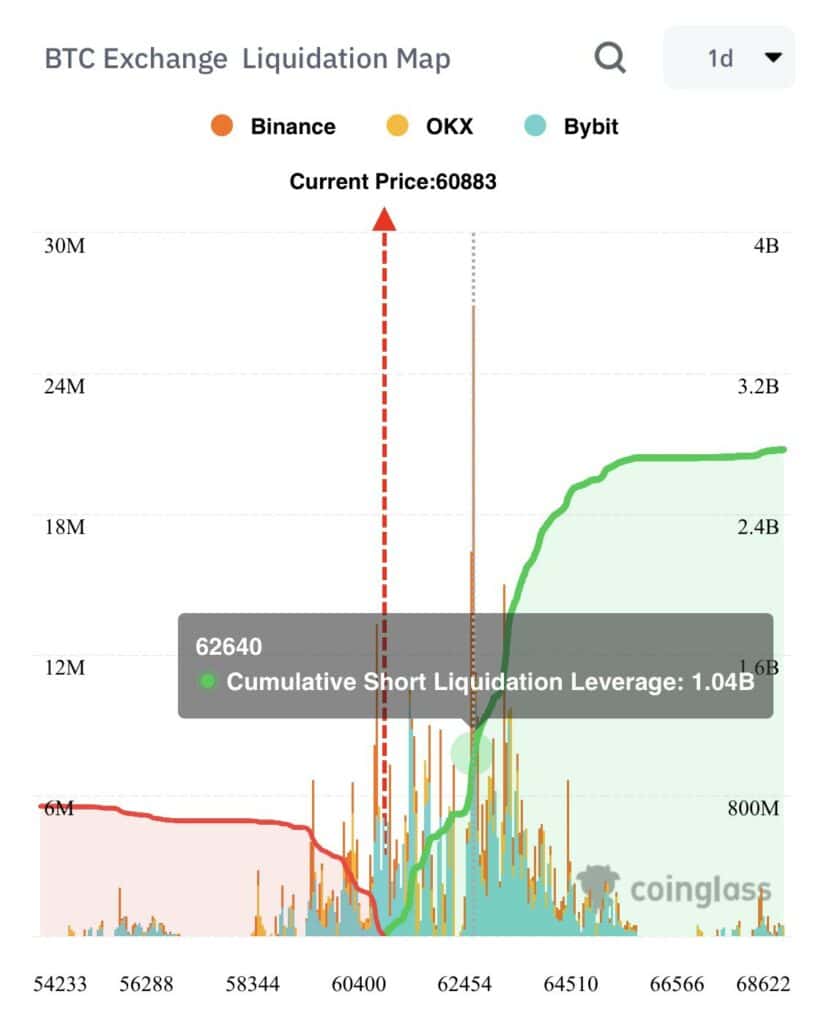

- Analyst Ali Martinez warned against a potential liquidation of $1 billion if Bitcoin rebounded to $62,600

As a crypto investor with some experience in the market, I’m keeping a close eye on the recent developments affecting Bitcoin (BTC) and the broader cryptocurrency market. The sudden drop below $60,000 for BTC and the overall market decline of over 4% within 24 hours is concerning, especially given the potential impact of significant events like Mt. Gox creditor repayments and upcoming ETF launches.

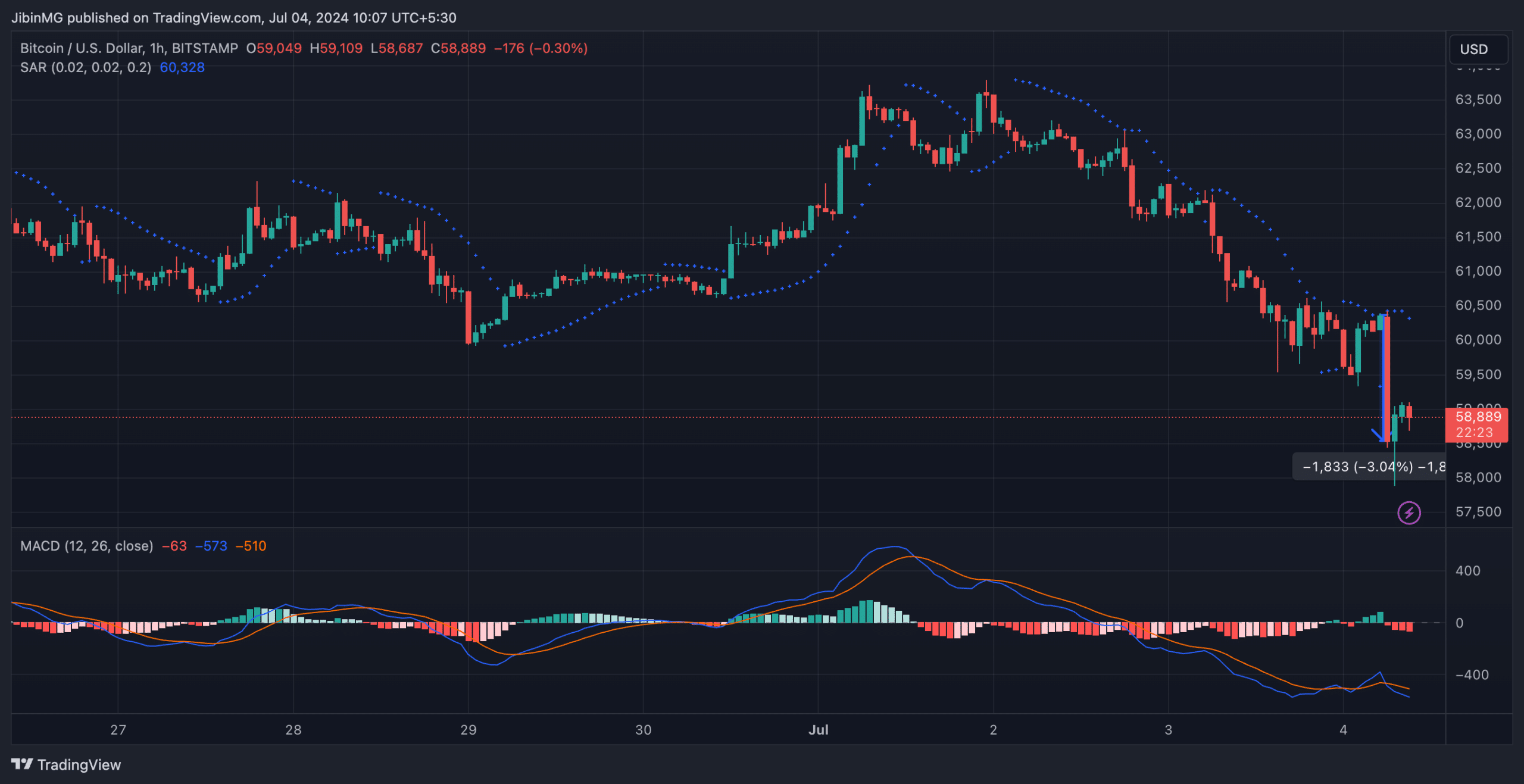

Bitcoin (BTC) has experienced another dip, dropping beneath the $60,000 mark on price graphs. This decline signified a 4% decrease within the last 24 hours. Notably, Bitcoin was the hardest hit crypto during a wider market slump.

The downturn occurred concurrently with the crypto market’s drop of more than 4% in the past 24 hours, influencing significant cryptocurrencies such as Bitcoin, Ethereum, Dogecoin, Binance Coin, and Chainlink.

At present, the Fear & Greed Index stands at 48, signifying a neutral mood amongst investors. In simpler terms, investors aren’t unduly fearful or excessively greedy at this moment, yet there’s still a significant amount of uncertainty in the market.

As a researcher studying the cryptocurrency market, I can tell you that Mt. Gox’s plan to begin repaying its creditors this month adds significant weight to the situation. Over 127,000 individuals are owed bitcoins valued at more than $9 billion. Given the potential for substantial profits in the digital currency market, many of these creditors may choose to sell their BTC holdings, leading to increased selling pressure.

Bitcoin ETF outflows and investor concerns

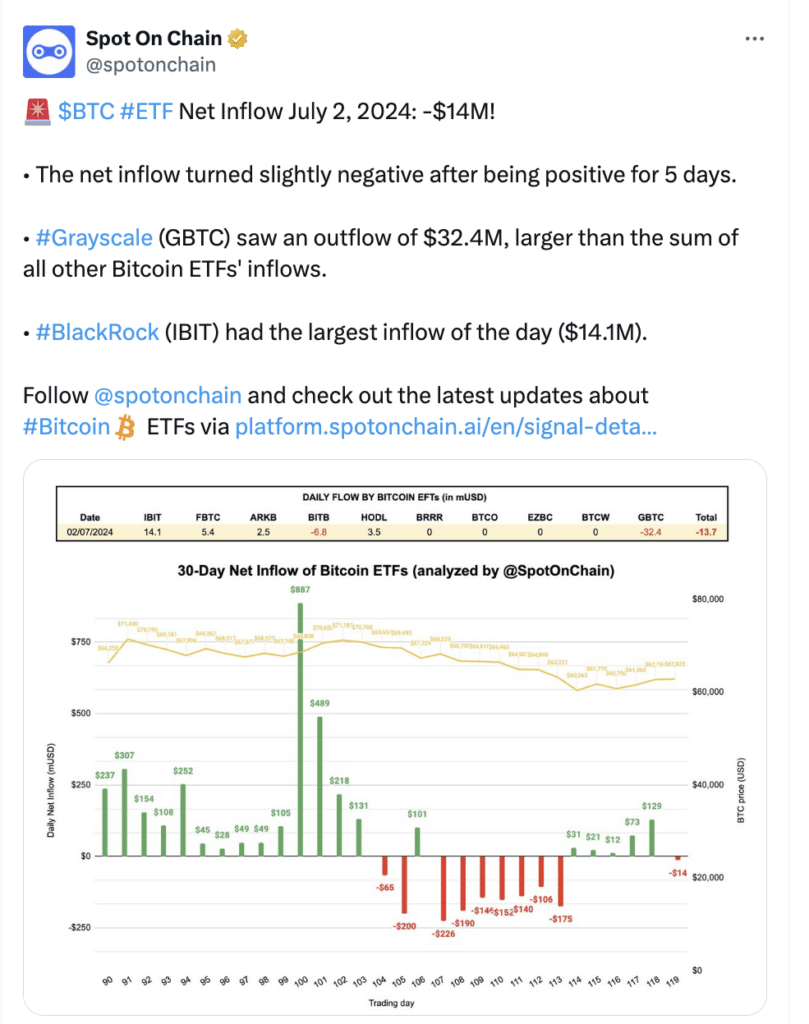

The large-scale withdrawals from U.S Spot Bitcoin ETFs have played a considerable role in shaping the current market scenario. After five consecutive days of inflows totaling $129.5 million up until July 1, the pattern changed with a net withdrawal of $13.7 million on July 2.

As a crypto investor, I’ve noticed some interesting flows in and out of various Bitcoin ETFs recently. Specifically, there were inflows of $14.1 million from BlackRock IBIT and $5.4 million from Fidelity’s FBTC. However, these gains were overshadowed by a significant outflow of $32.4 million from Grayscale. These shifts in ETF movements have raised some concerns among investors like myself regarding the current trend of Bitcoin’s price.

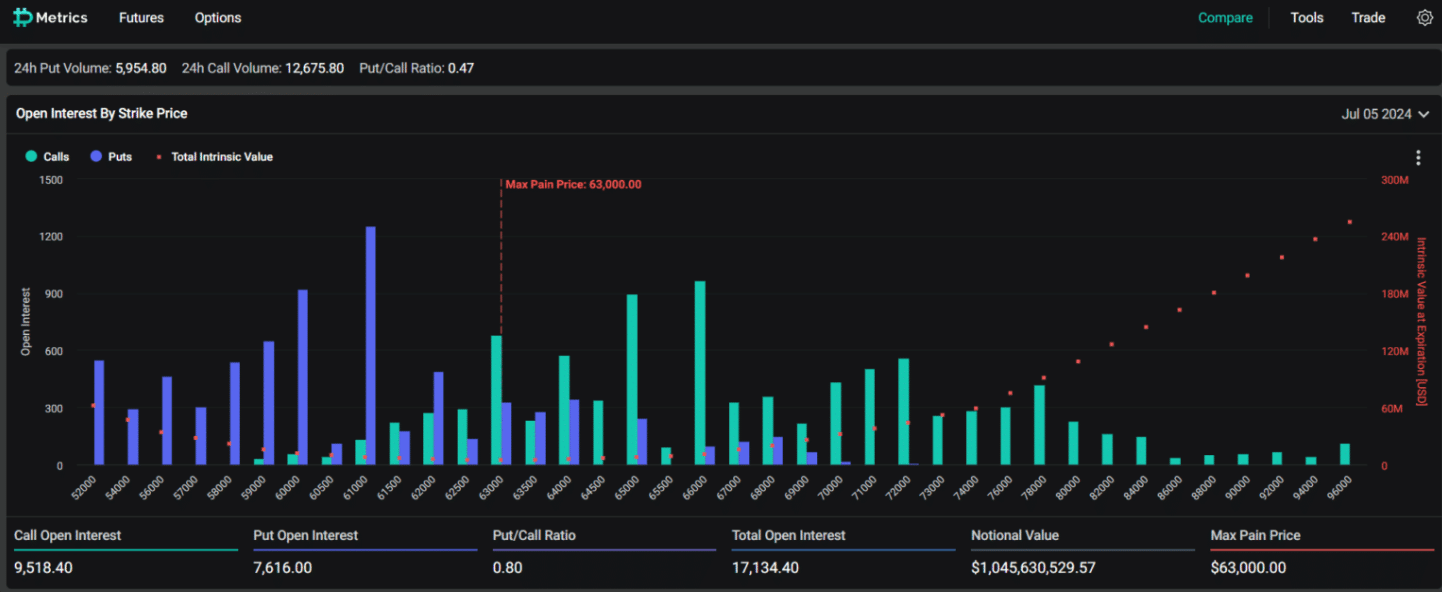

At the same time, the approaching expiration of significant Bitcoin (BTC) and Ethereum (ETH) options is adding to market turbulence. Notably, Deribit’s data indicates that options worth more than $1.04 billion for BTC, with a put-call ratio of 0.80, are due to expire on July 5, 2023.

The price ceiling for the most painful investment choices is set at $63,000. This significant figure could impact investor decisions and market trends, causing careful trading and heightened doubt among market players in the lead-up to expiration.

Liquidations intensify market sell-offs

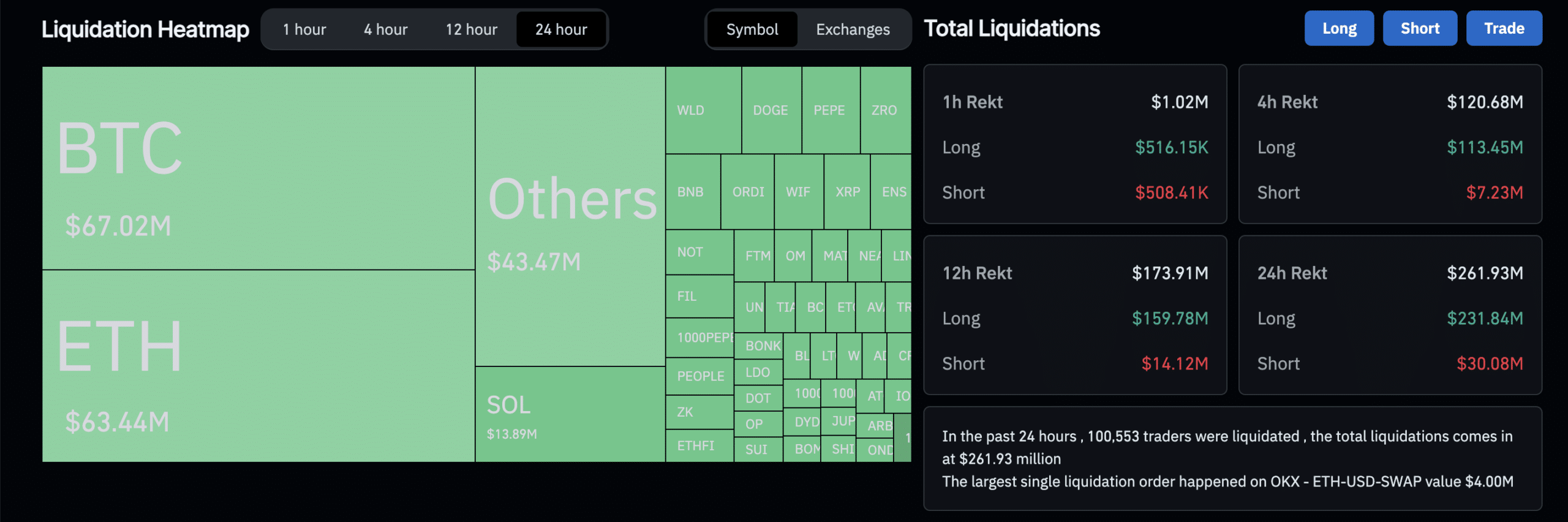

As a crypto investor, I’ve noticed that CoinGlass reported some significant market movements recently. In just 24 hours, sell-offs led to over $260 million in liquidations. Around 100,000 traders were affected by these liquidations, and the largest single one involved an ETH-USDT-SWAP on OKX.

Bitcoin faced liquidations totaling $67 million, while Ethereum saw $63 million in liquidations.

As a crypto investor, I’ve experienced my fair share of market volatility, and it’s easy to feel discouraged during a downturn. However, I try to keep an open mind and consider the perspectives of optimistic analysts. They believe that upcoming regulatory decisions could bring significant gains to the market. So even in these challenging times, I hold onto hope for potential profits down the line.

Analyst Ali Martinez cautions that there is a risk of additional sell-offs if Bitcoin reaches a price of $62,600 once more. This warning implies that over $1 billion in positions may be closed as a result.

Ethereum ETF launch delay

As a researcher studying the Ethereum ETF market, I’ve observed that the ongoing postponement of Spot Ethereum ETF launches has added to the prevailing market sentiment of pessimism. The SEC has recently announced a new deadline for form submissions, which is on 8 July. This fresh delay in the approval process unfortunately prolongs the uncertainty surrounding these much-anticipated funds.

The reception within the community has been less than ideal so far, with Nate Geraci, president of ETF Store, voicing his disappointment over the lengthy approval process. There is growing optimism that the prices of Bitcoin and other cryptocurrencies will surge once these much-anticipated ETFs become available.

Read More

- Gold Rate Forecast

- Discover Liam Neeson’s Top 3 Action Films That Will Blow Your Mind!

- OM PREDICTION. OM cryptocurrency

- Kanye West Praises Wife Bianca’s Daring Naked Dress Amid Grammys Backlash

- Nintendo Switch 2 Price & Release Date Leaked: Is $449 Too Steep?

- Netflix’s New Harlan Coben Series Features Star-Studded Cast You Won’t Believe!

- Meet the Stars of The Wheel of Time!

- Why Gabriel Macht Says Life Abroad Saved His Relationship With Family

- Where Teen Mom’s Catelynn Stands With Daughter’s Adoptive Parents Revealed

- EUR PKR PREDICTION

2024-07-04 12:08