- Bitcoin fell below $60,000 on the 4th of July.

- Following Bitcoin’s massive breakdown, altcoins were significantly impacted.

As a seasoned crypto investor with several years of experience in the market, I’ve seen my fair share of price fluctuations and market downturns. The recent breakdown of Bitcoin (BTC) below the crucial $60,000 level on July 4th was a stark reminder of the volatile nature of this asset class.

Fourth of July saw Bitcoin (BTC), the largest cryptocurrency in the world, experience a decline of over 3.4 percent and dip below the significant price mark of $60,000.

After the significant setback in Bitcoin’s price movement, seasoned trader and analyst Peter Brandt identified a bearish signal in the form of an inverted flag and pole pattern on its chart.

In his recent post, Peter emphasized a pessimistic outlook towards Bitcoin, presenting a graph showing the digital currency dropping below a significant support line and exiting a bearish flag formation.

Why is Bitcoin falling?

Yet, the significant drop in BTC‘s price might be attributable to a more current observation made by Bloomberg ETF specialist James Seyffart.

Fourth of July saw James share on platform X his belief that the approval of a spot Ethereum ETF by the SEC, as anticipated, is uncertain with a relatively low probability.

James stated that,

“I’m not overly certain about the accuracy of those predicted launch dates at the moment. There isn’t a set deadline for this process, and I understand why SEC’s Corp Fin is taking their time. However, the changes involved were relatively minor, so I find it puzzling that the ETFs wouldn’t be ready within a couple weeks.”

Impact of BTC on altcoins

As a researcher studying the cryptocurrency market, I’ve observed that Bitcoin’s dramatic decline had a ripple effect on the prices of top altcoins. Specifically, Ethereum, Solana, Binance Coin, Ripple, and Dogecoin experienced noteworthy price decreases following Bitcoin’s breakdown.

Based on information from CoinMarketCap, the prices of Ethereum, Solana, Binance Coin, Ripple, and Dogecoin have declined by approximately 4.8%, 10%, 6%, 5.5%, and 6.5% respectively over the past 24 hours.

As a market analyst, I’ve observed a significant price decrease in Bitcoin, which has triggered apprehension among investors. This fear is reflected in the decline of Bitcoin’s open interest (OI) by approximately 3.5%, as reported by the on-chain analytic firm, CoinGlass.

Bitcoin technical and price-performance analysis

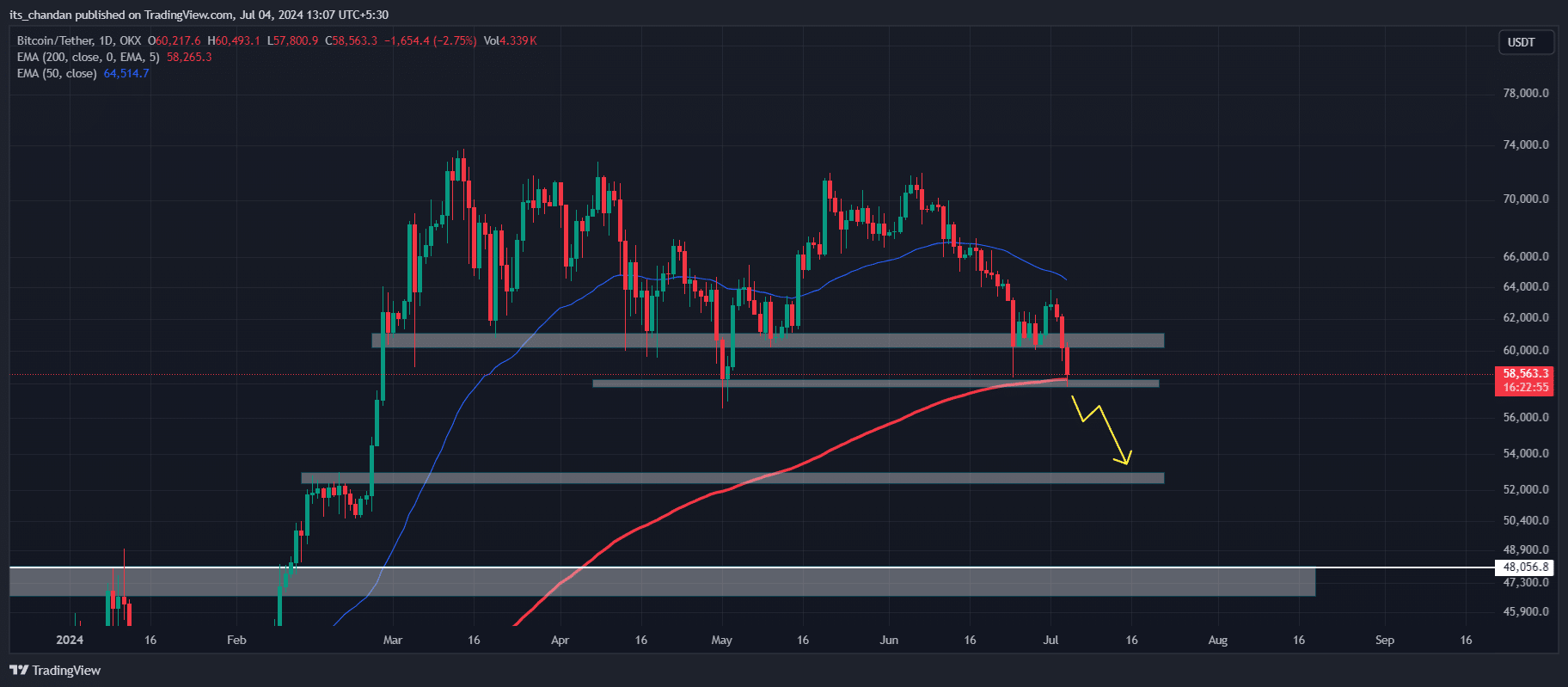

Based on the technical assessment of experts, Bitcoin’s trend appears to be downward and its current value hovers around the 200-day Exponential Moving Average.

As a researcher studying the Bitcoin market, I’ve observed that the 200-day moving average (EMA) of around 200 may act as a potential support level. However, the prevailing market sentiment and investors’ current appetite suggest a bearish trend for Bitcoin.

Read Bitcoin’s [BTC] Price Prediction 2024-25

Should Bitcoin’s daily closing price fall below the 200 Exponential Moving Average (EMA) and the support level at $57,700 on the chart, it could potentially lead to a significant decline in price of around 8%, bringing the cryptocurrency down to approximately $53,000 in the upcoming days.

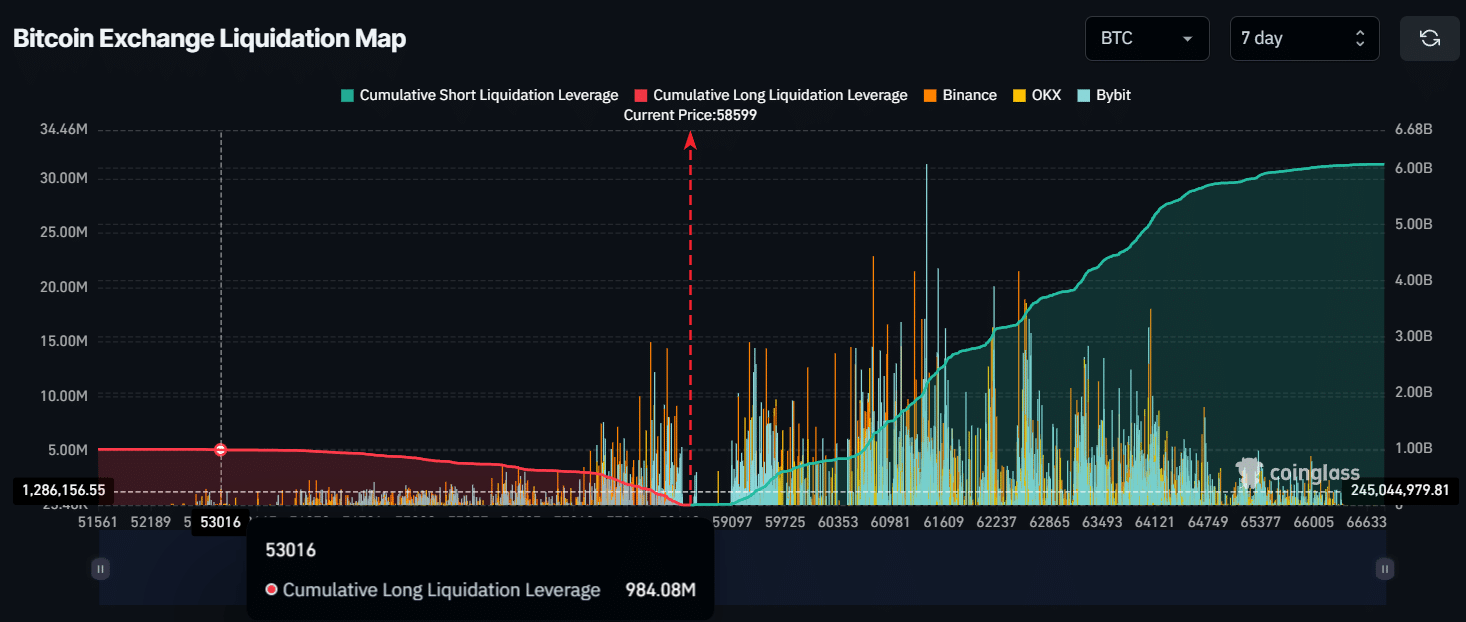

As a crypto investor, if the market takes a turn for the worse and the price of a particular coin drops significantly, my long positions could be at risk. In fact, Coinglass data indicates that around $1 billion worth of such positions might get liquidated in this scenario.

Read More

- Gold Rate Forecast

- Rick and Morty Season 8: Release Date SHOCK!

- SteelSeries reveals new Arctis Nova 3 Wireless headset series for Xbox, PlayStation, Nintendo Switch, and PC

- Discover the New Psion Subclasses in D&D’s Latest Unearthed Arcana!

- PI PREDICTION. PI cryptocurrency

- Mission: Impossible 8 Reveals Shocking Truth But Leaves Fans with Unanswered Questions!

- Eddie Murphy Reveals the Role That Defines His Hollywood Career

- Masters Toronto 2025: Everything You Need to Know

- We Loved Both of These Classic Sci-Fi Films (But They’re Pretty Much the Same Movie)

- Discover Ryan Gosling & Emma Stone’s Hidden Movie Trilogy You Never Knew About!

2024-07-04 20:08