-

A supply overhang from Mt. Gox and government entities worsened the market sentiment.

Tron’s founder offered to buy the German government’s BTC holdings to reduce negative market impact.

As a crypto investor with some experience in the market, I’m deeply concerned about the recent events that unfolded on July 4th. The supply overhang from Mt. Gox and the German government worsened the already fragile market sentiment.

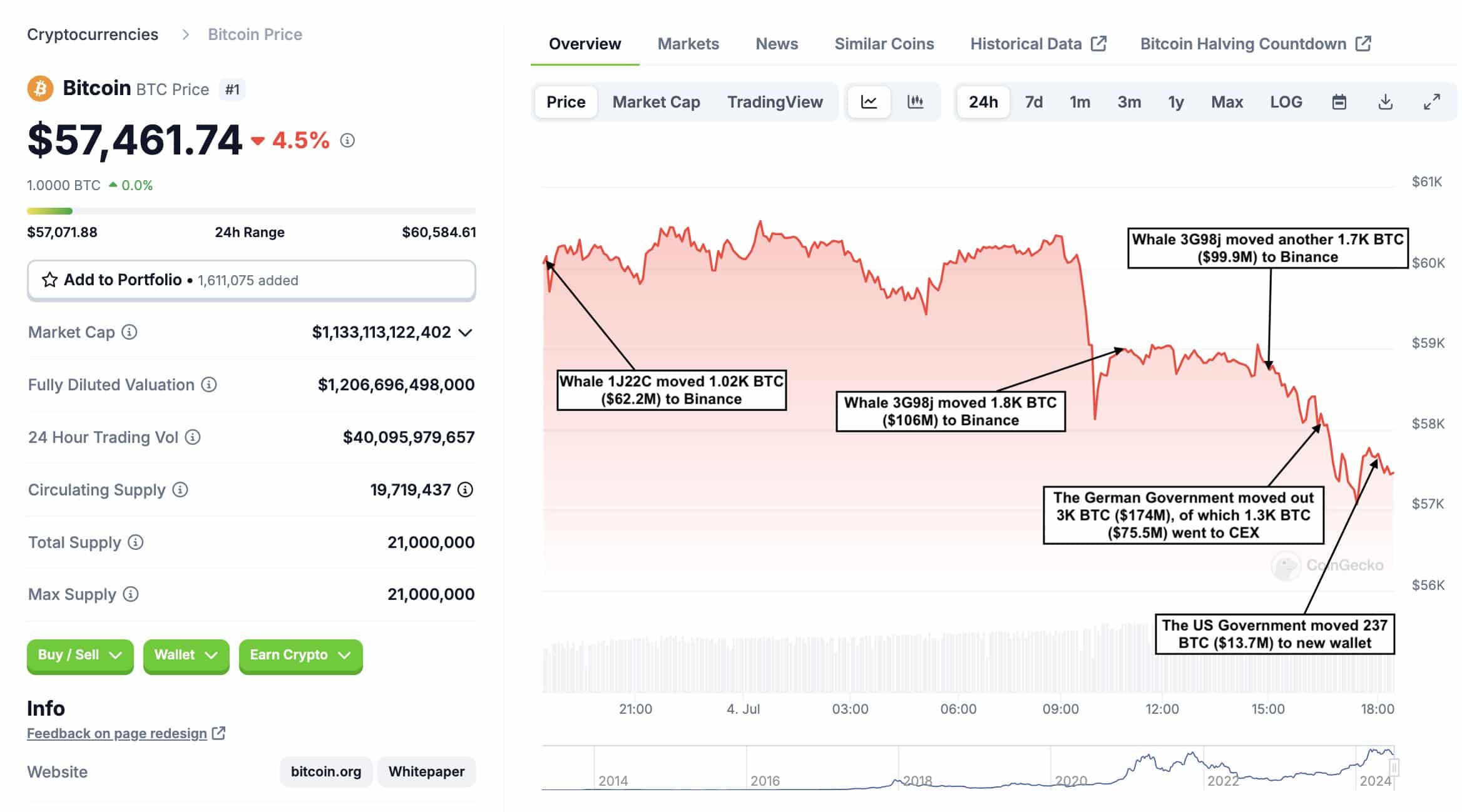

On the Fourth of July, the turbulence in the cryptocurrency market deepened as Mt. Gox prepared for and conducted trial runs and tests in readiness to disburse approximately $8 billion worth of Bitcoin [BTC].

In spite of the shadow cast by the ongoing Mt. Gox issue, the German authorities persisted in disposing of their Bitcoins.

As a researcher studying Bitcoin transactions on the 4th of July, I discovered that approximately 3,000 Bitcoins were moved. However, a significant portion of this amount, around 1,300 Bitcoins worth over $78 million, was sold and dumped onto the markets of Bitstamp, Coinbase, and Kraken. This unexpected large-scale selling event contributed to the ongoing market instability.

As a crypto investor in the midst of a turbulent market, I’ve kept a close eye on the developments surrounding Bitcoin and the German government. Amidst the chaos, an intriguing proposition emerged from Tron’s founder, Justin Sun: he expressed his intent to purchase all of the German government’s Bitcoin holdings directly from the market. This potential move aims to lessen the impact of the market downturn.

“I’m open to working out a private deal with the German government for buying up all their Bitcoin, aiming to limit the market disruption.”

German Bitcoin holdings and market reactions

As an analyst examining the information from Arkham Intelligence, I’ve discovered that the German government holds approximately 40,300 Bitcoins, valued at around $2.3 billion. Yet, the authenticity of Sun’s proposition remains uncertain – it could be a genuine proposal or simply another prank.

As a crypto investor, I acknowledge that Sun’s proposal might help in some way if it gets implemented. However, I have my doubts that it would be sufficient to halt the current market downturn. The recent sell-off on July 4th was not just instigated by the German government but also by three other significant Bitcoin whales. Consequently, the price plummeted to around $57K.

According to recent findings from the Spot On Chain data, it was disclosed that the U.S. authorities transferred $13.67 million in Bitcoin, while they continued to possess approximately $12.3 billion worth.

Two unlabeled whale wallets transferred approximately 4,500 Bitcoin, valued at around $270 million, adding to the downward market trend.

Crypto market analyst Samson Mow expressed criticism towards both the German and U.S. administrations for selling bitcoin directly to exchanges rather than following established procedures.

Picture this scenario: You’re tasked with marketing an incredibly hard-to-sell currency, one that boasts a significant historical value. Lastly, visualize yourself attempting to sell it through digital exchanges using market orders, inadvertently causing the price to plummet further and fetching even less than anticipated.

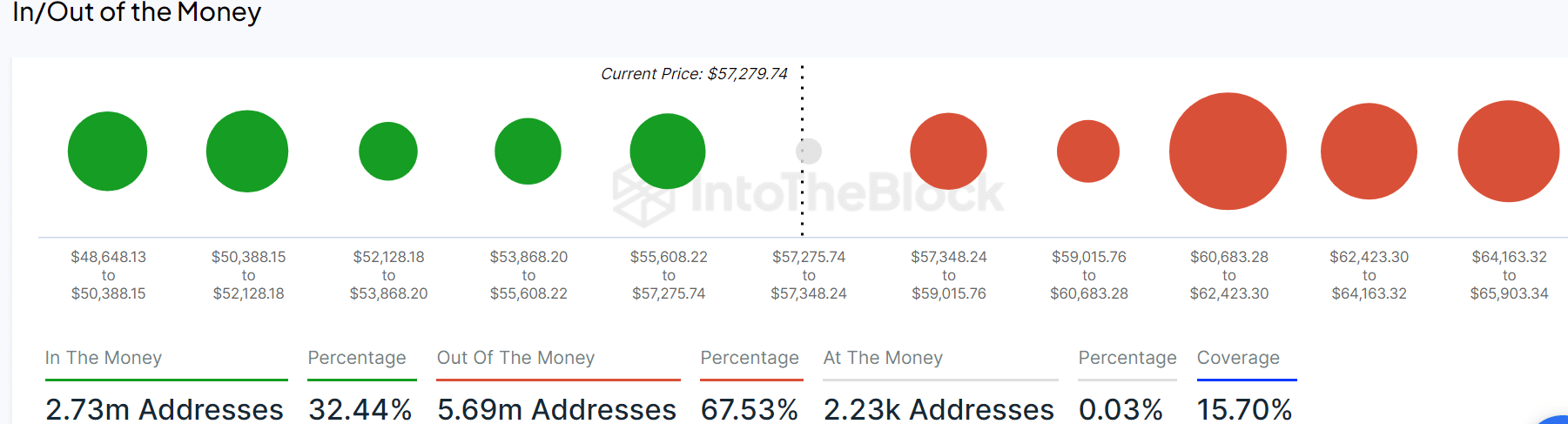

Approximately two-thirds of Bitcoin address holders experienced a loss when the price dipped to around $57,000. This was particularly true for individuals who had purchased their coins between $48,600 and $65,900.

In the last 24 hours, an extra large sell-off of Bitcoin liquidated positions amounting to approximately $113 million, with around $100 million worth of long positions being liquidated and resulting in significant losses for traders.

Read More

2024-07-05 04:07