-

Bitwise CIO predicts $15 billion inflow into Ethereum ETFs within 18 months.

Ethereum ETFs expected to attract significant institutional investment, bolstering ETH’s market position.

As an experienced financial analyst with a background in cryptocurrency markets, I’ve closely followed the developments surrounding Ethereum [ETH] ETFs and their potential impact on the world’s second-largest cryptocurrency. Based on my analysis of recent industry news and trends, I share Matt Hougan’s optimistic outlook for institutional investment in Ethereum upon the launch of official ETFs.

The eagerness for the introduction of Ethereum [ETH] ETFs is at an all-time high, with numerous industry insiders debating possible launch timelines. Analysts are growing optimistic, predicting that these ETFs might become available as early as mid-July.

Based on current trends, it appears that several candidates are expected to file revised S-1 forms with the SEC by July 8th, according to Bloomberg’s reports.

As a researcher, I’ve come across information from Nate Geraci, the president of The ETF Store. He mentioned that the final approvals could be granted as early as July 12th. If everything goes according to plan, this timeline might lead to a product launch during the week of July 15th.

Ethereum ETFs to see $15 billion inflows?

The Chief Investment Officer of Bitwise, Matt Hougan, is optimistic about Ethereum’s potential to attract institutional investors, a belief that hasn’t been widely held before.

In a recent video featuring analyst Scott Melker, it was disclosed that the significant investment in Ethereum in European and Canadian markets has strengthened the CIO’s belief in its potential to thrive in the United States market as well.

As a crypto investor, I value Hougan’s insights that go beyond mere speculation. He engages in deep, strategic discussions with leaders at renowned financial institutions, providing me with valuable perspectives on the future of cryptocurrency markets.

A conversation with a large, $100+ billion advisory firm disclosed their intent to expand into Ethereum once an approved ETF becomes available, indicating the increasing acceptance of cryptocurrencies as a valid investment asset class within the financial community.

Additionally, Hougan contests the widely-held belief that cryptocurrencies closely mirror the movements of conventional financial markets.

From my perspective as a crypto investor, I believe that cryptocurrencies tend to follow their own unique market trends rather than being directly tied to traditional financial markets. Occasionally, there are brief moments of correlation due to extraordinary economic events, but for the most part, the cryptocurrency market behaves independently.

This independence is crucial for investors seeking diversification and risk-adjusted returns.

Ethereum’s struggle: Market downturn and surging liquidations

In the context of the overall market slump, Ethereum’s value has followed a similar trend as Bitcoin, experiencing a decrease of around 6.2% within the past 24 hours, resulting in its current trade price of $3,139.

This significant decrease has led to considerable losses for many traders.

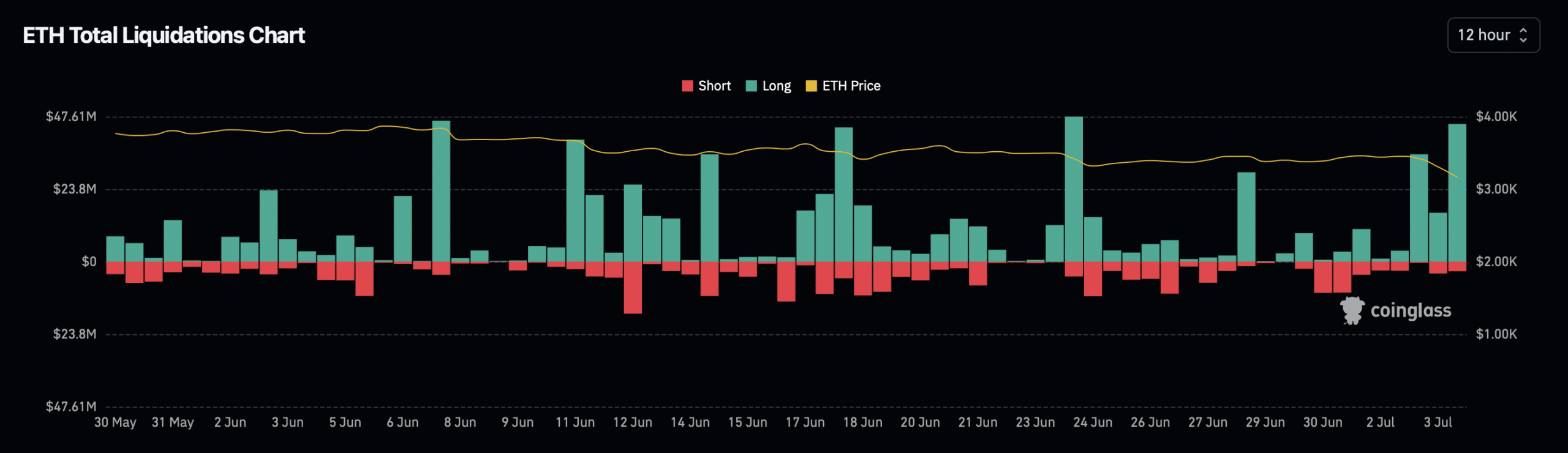

According to Coinglass’s latest data, approximately 113 thousand traders faced liquidation within the last 24 hours, leading to a grand total of $317.34 million in liquidated positions.

Approximately $76.51 million of the total involves Ethereum liquidations. A significant portion of this sum, around $70.16 million, is linked to long positions, while a smaller amount, approximately $6.35 million, pertains to short positions.

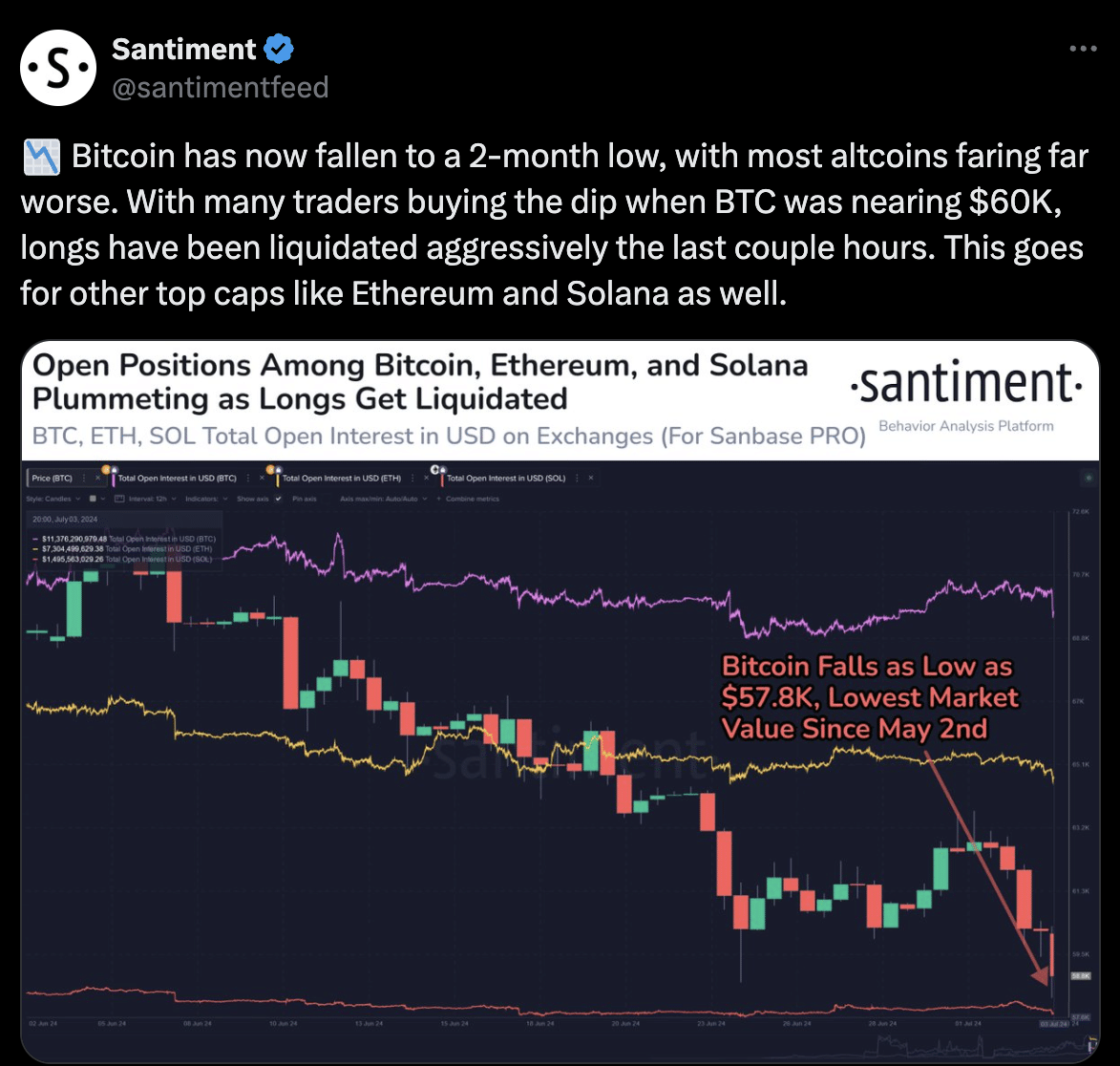

As a researcher studying the cryptocurrency market, I’ve come across concerning news from market intelligence platform Santiment. They report that Ethereum’s open interest is experiencing a decline.

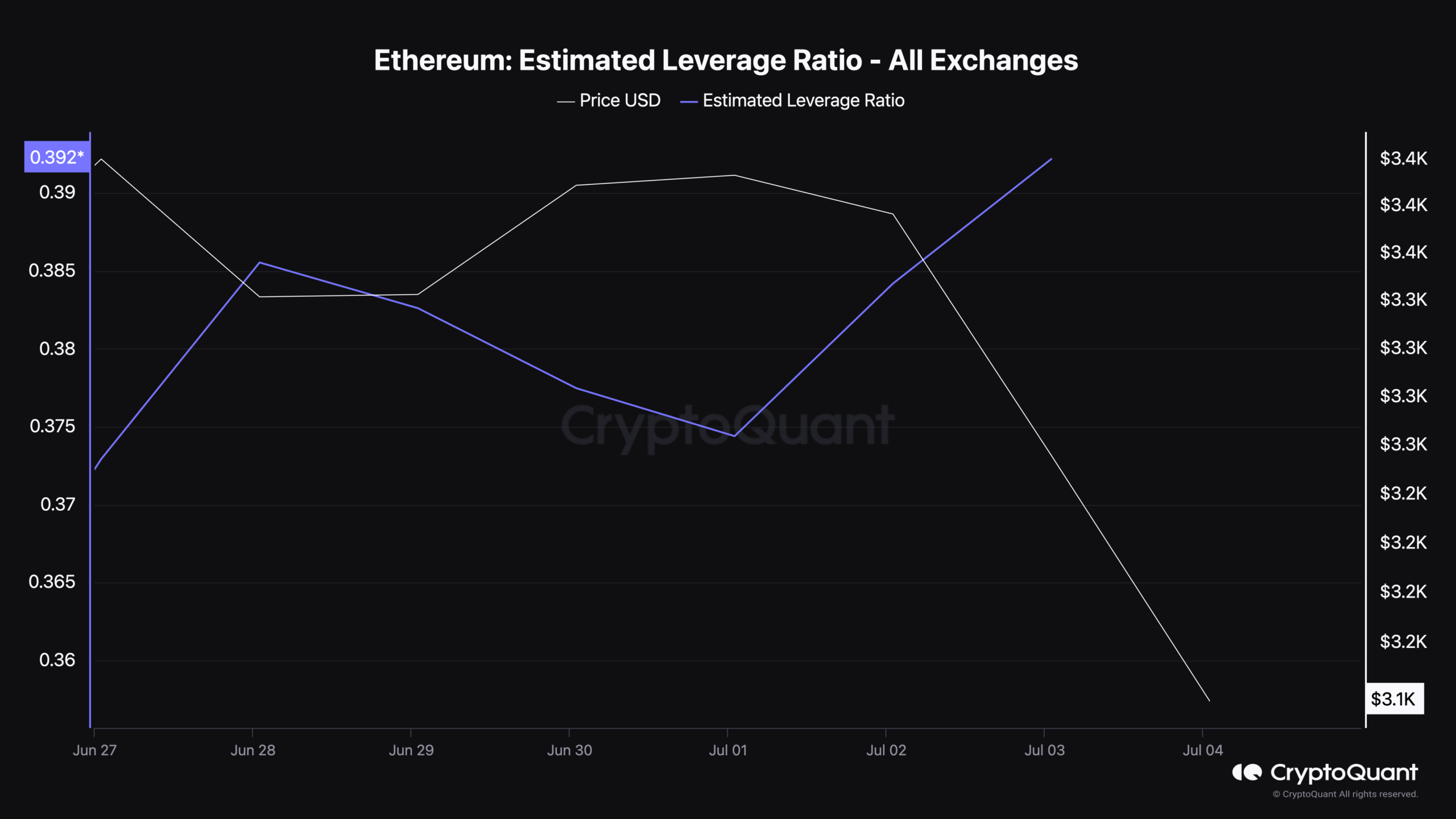

As a researcher examining the cryptocurrency market, I’ve come across some intriguing data from CryptoQuant. The estimated leverage ratio for Ethereum on all exchanges has reached a significant level of 0.392. This figure signifies an uptick in leveraged positions compared to the asset’s total market capitalization. Such a trend might be indicative of heightened volatility, potentially leading to more liquidations in the Ethereum market.

Read Ethereum’s [ETH] Price Prediction 2024-25

Despite these challenges, not all indicators for Ethereum are bearish.

As a researcher studying the Ethereum blockchain, I’ve noticed an intriguing development: the volume of transactions on its decentralized applications (dApps) has recently surged, indicating vibrant activity in specific sectors of Ethereum’s ecosystem.

Read More

- Discover Liam Neeson’s Top 3 Action Films That Will Blow Your Mind!

- Kanye West Praises Wife Bianca’s Daring Naked Dress Amid Grammys Backlash

- Gold Rate Forecast

- OM PREDICTION. OM cryptocurrency

- Nintendo Switch 2 Price & Release Date Leaked: Is $449 Too Steep?

- Netflix’s New Harlan Coben Series Features Star-Studded Cast You Won’t Believe!

- EUR PKR PREDICTION

- Top 5 Hilarious Modern Comedies Streaming on Prime Video Now!

- Attack on Titan Stars Bryce Papenbrook & Trina Nishimura Reveal Secrets of the Saga’s End

- Matty Healy’s Cryptic Response Fuels Taylor Swift Album Speculation!

2024-07-05 06:15