-

German MP Joana Cotar urged her government to reconsider selling its seized BTC holdings.

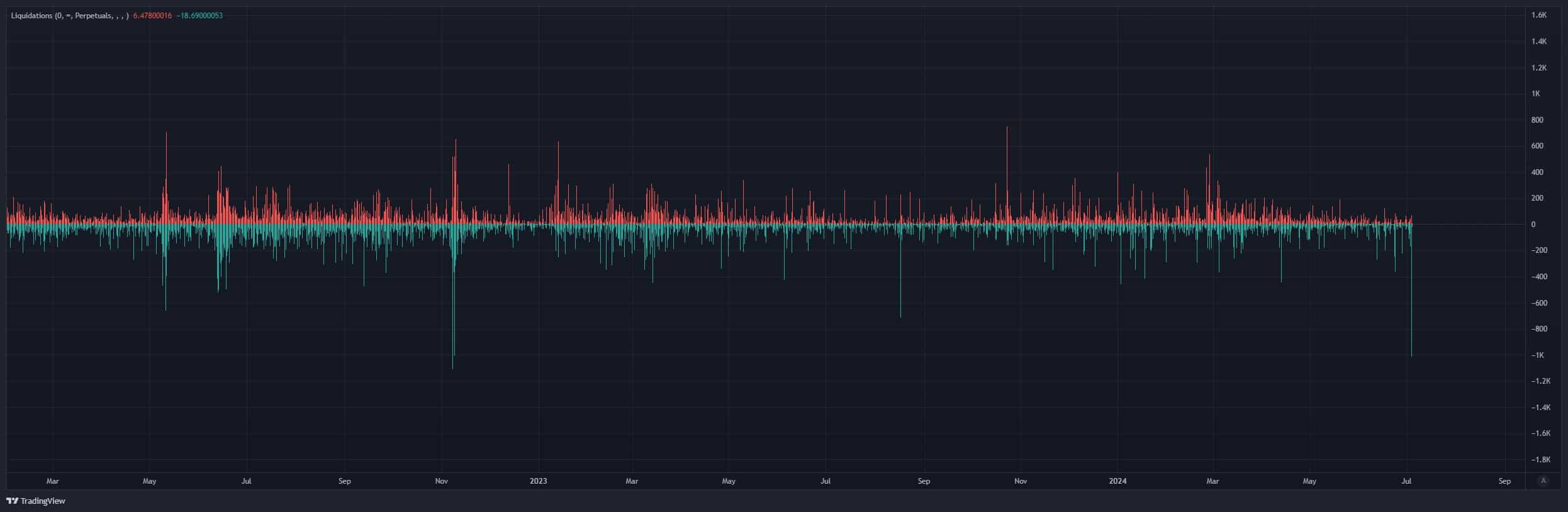

The ongoing BTC dump has triggered the largest liquidation post-FTX crisis.

As a researcher with a background in finance and economics, I find the ongoing Bitcoin sell-off by the German government to be a concerning development for the crypto market. The recent dump has triggered the largest liquidation event since the FTX crisis, causing massive losses for investors and further exacerbating the market downturn.

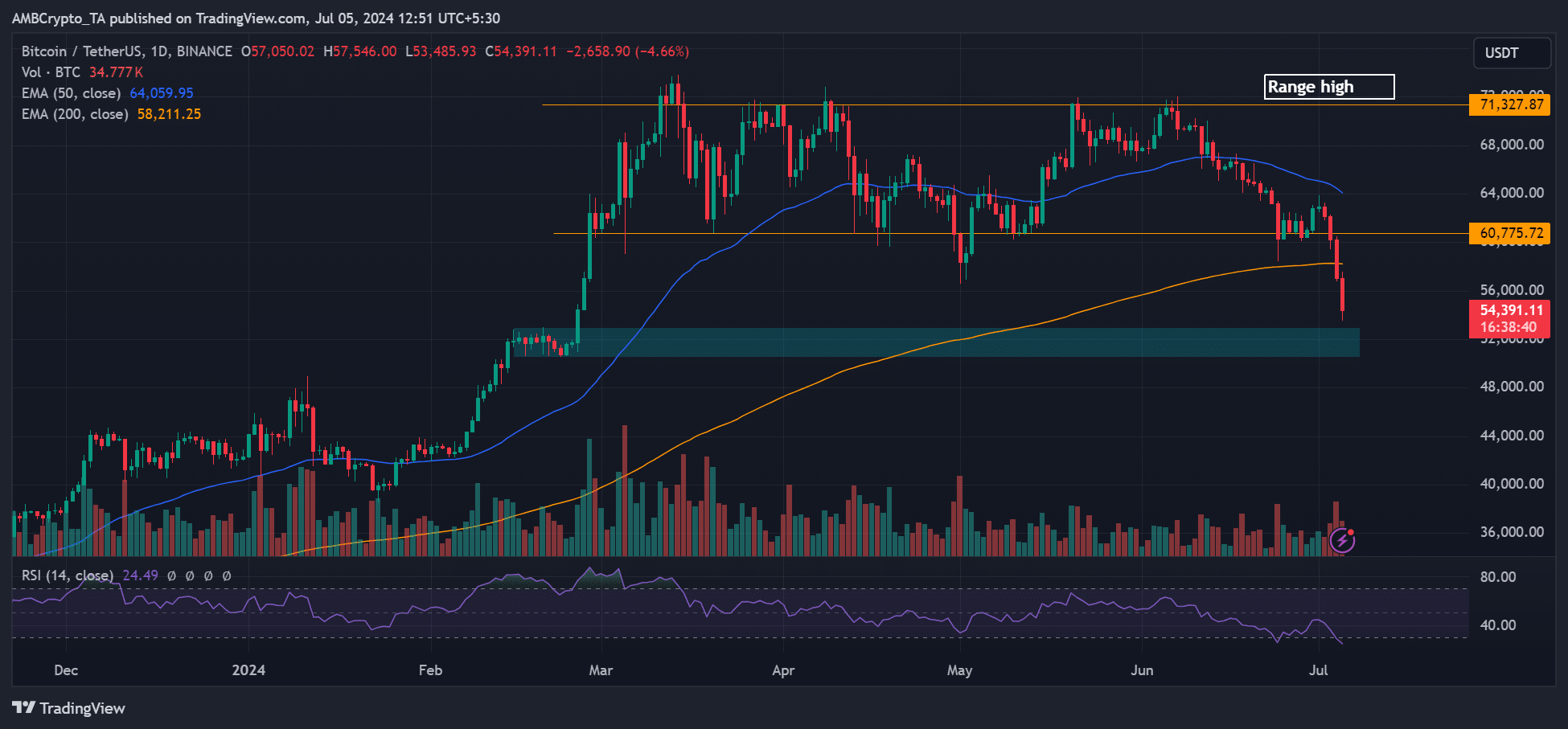

This week, the cryptocurrency market experienced a significant downturn with Bitcoin‘s [BTC] price dipping to $53K – its lowest point since early February 2024.

As a researcher examining market trends, I’ve noticed a deterioration in investor sentiment due to intense selling pressure instigated by influential entities such as the German government.

As a cryptocurrency analyst, I’ve been monitoring the recent developments regarding the seized Bitcoins from the illegal streaming site Movie2k.to by German authorities. Based on data from Arkham Intelligence, approximately 50,000 BTC have been moved so far. On the Fourth of July, around 3,000 BTC were transferred. In the last 12 hours, an additional 1,950 BTC have been on the move.

German Bitcoin selling sparks criticism

As a researcher investigating the cryptocurrency market, I uncovered evidence suggesting that large-scale Bitcoin (BTC) sell-offs, commonly referred to as “whale dumps,” were responsible for significant price declines and triggered a widespread market downturn. This unfolded to such an extent that it drew criticism from German Member of Parliament Joana Cotar, who expressed her displeasure publicly.

I strongly advocated for a reevaluation of my government’s previous decisions to sell off certain assets. On my professional platform X (previously known as Twitter), I publicly expressed this viewpoint.

Rather than considering Bitcoin as a reserve currency for strategic purposes, as some are discussing in the United States, our administration is actively disposing of it in substantial amounts.

In addition, Cotar sent a letter along with evidence to back up the case for the German administration to cease the Bitcoin sales.

As a crypto investor, I can tell you that holding Bitcoin (BTC) offers me, and potentially governments, a varied portfolio of valuable assets that can serve as a hedge against currency devaluations and inflation. This is because BTC operates independently of traditional government-issued currencies, making it a potential store of value during times of economic instability.

In essence, she urged the government to adopt a Bitcoin strategy.

Instead of focusing on making a sale, consider formulating a thorough Bitcoin plan for your state. This might involve keeping Bitcoin in the treasury, selling Bitcoin-backed bonds, or establishing favorable regulations.

Samson Mow, a well-known commentator in the crypto market, shared the same perspective as Cotar. He considered the actions of governments selling Bitcoins to be the epitome of foolishness.

If selling pressure continues, the price of Bitcoin (BTC) may drop further towards the support levels of $52,900 to $50,000, as indicated by the cyan-marked areas on the weekly chart.

Massive sell-offs following the prolonged pullback and reexamination of Bitcoin at approximately $53,000 have resulted in over $700 million worth of liquidations throughout the crypto market within the last day.

As a crypto investor, I can tell you that during the specified timeframe, bitcoin (BTC) was responsible for approximately $226 million in total liquidations. Among these, long position holders experienced significant losses, amounting to over $180 million.

As a market analyst, I’ve noticed that the recent market event marked the largest liquidation since the FTX crisis in November 2022.

Read More

- Solo Leveling Season 3: What You NEED to Know!

- Oblivion Remastered: The Ultimate Race Guide & Tier List

- Rachel Zegler Claps Back at Critics While Ignoring Snow White Controversies!

- How to Get to Frostcrag Spire in Oblivion Remastered

- Bobby’s Shocking Demise

- Fantastic Four: First Steps Cast’s Surprising Best Roles and Streaming Guides!

- Oshi no Ko Season 3: Release Date, Cast, and What to Expect!

- Captain America: Brave New World’s Shocking Leader Design Change Explained!

- Gold Rate Forecast

- Meta launches ‘most capable openly available LLM to date’ rivalling GPT and Claude

2024-07-05 15:03