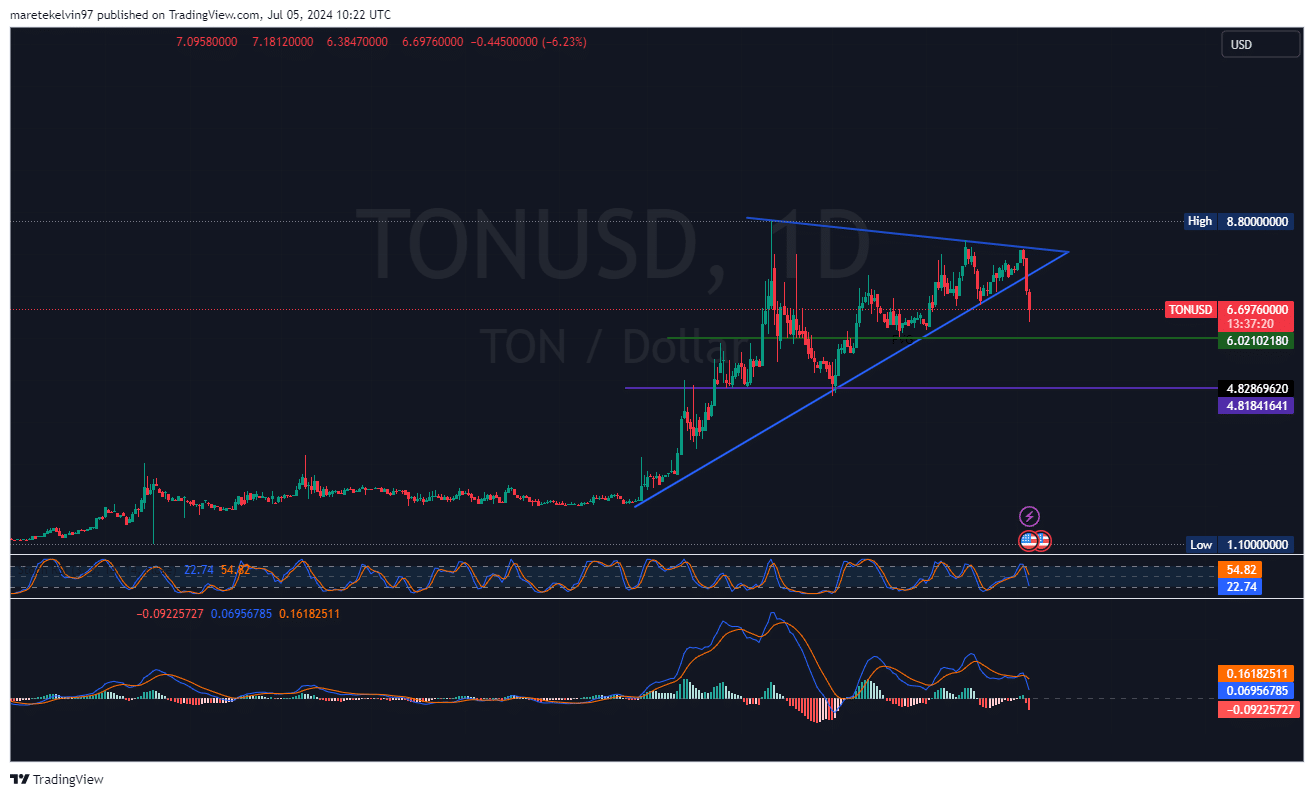

- Toncoin’s price dipped 20% in 48 hours after breaking out of a rising wedge pattern.

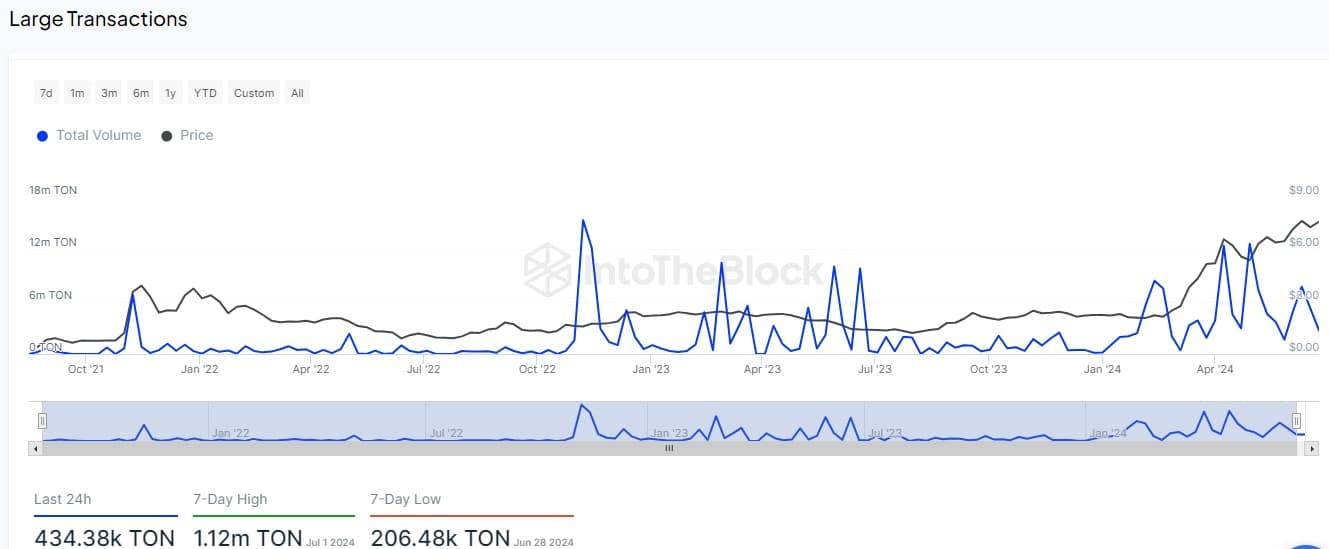

- Large transactions reduced by 52%, suggesting a potential whale retreat.

As an experienced analyst, I believe that Toncoin’s [TON] recent price action has presented some intriguing developments. The sharp 20% dip following the breakout from the rising wedge pattern was unexpected and may have caused concern among holders. However, it is important to note that large transaction activity has decreased by 52%, potentially indicating a withdrawal of whales or institutional players.

As a crypto investor, I’ve been closely monitoring Toncoin [TON] and have noticed its captivating price movement lately. Since the beginning of April, TON has been consolidating in a rising wedge pattern, which has been building anticipation for an imminent breakout.

On the Fourth of July, the anticipated moment arrived in the cryptocurrency market, but contrary to expectations, the price of TON took an unexpected turn. Instead of breaking out above the established wedge pattern, it plunged by a significant 20%.

Large transactions take a dive

Based on AMBCrypto’s findings from IntoTheBlock’s data analysis, there has been a notable decrease of approximately 52% in the occurrence of large transactions within the TON blockchain after a price decline.

The market trend might have caused whales and institutional investors to reconsider their strategies or potentially withdraw from the market.

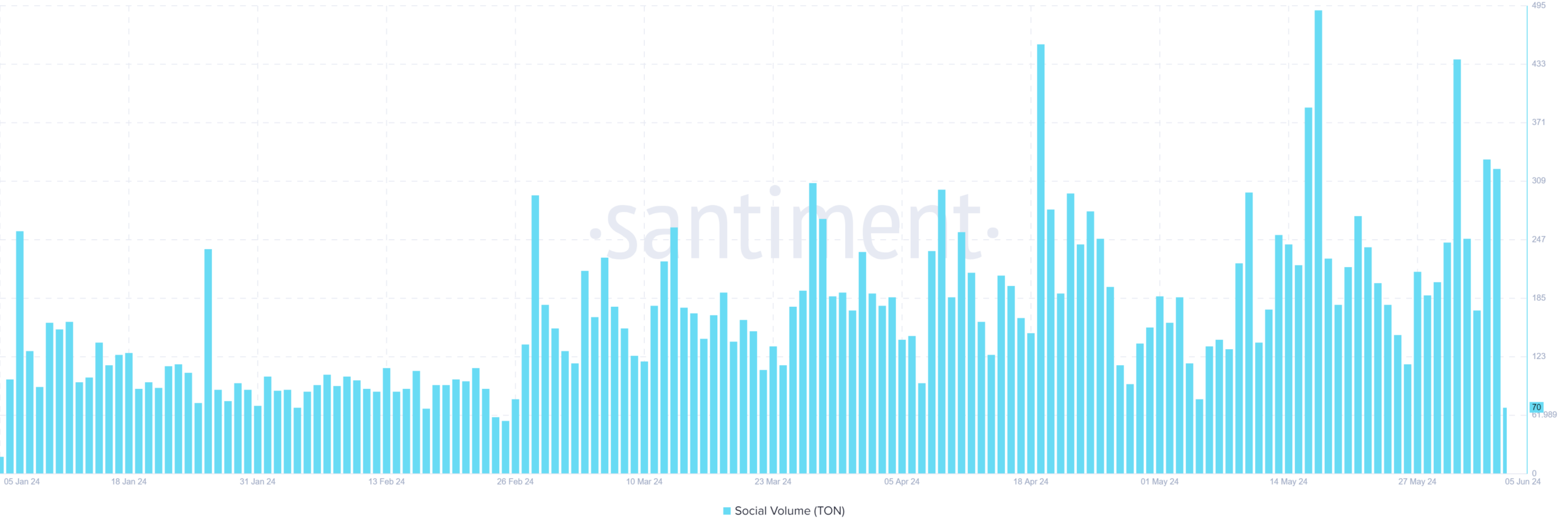

Social volume stays strong

As a researcher examining the data from AMBCrypto’s analysis of TON using Santiment, I noticed several peaks in social volume despite the price instability.

The Toncoin community remained actively engaged in conversations about the project and demonstrated strong enthusiasm. Furthermore, a consistent level of social media activity might help mitigate the effects of a potential price decrease and keep the market informed.

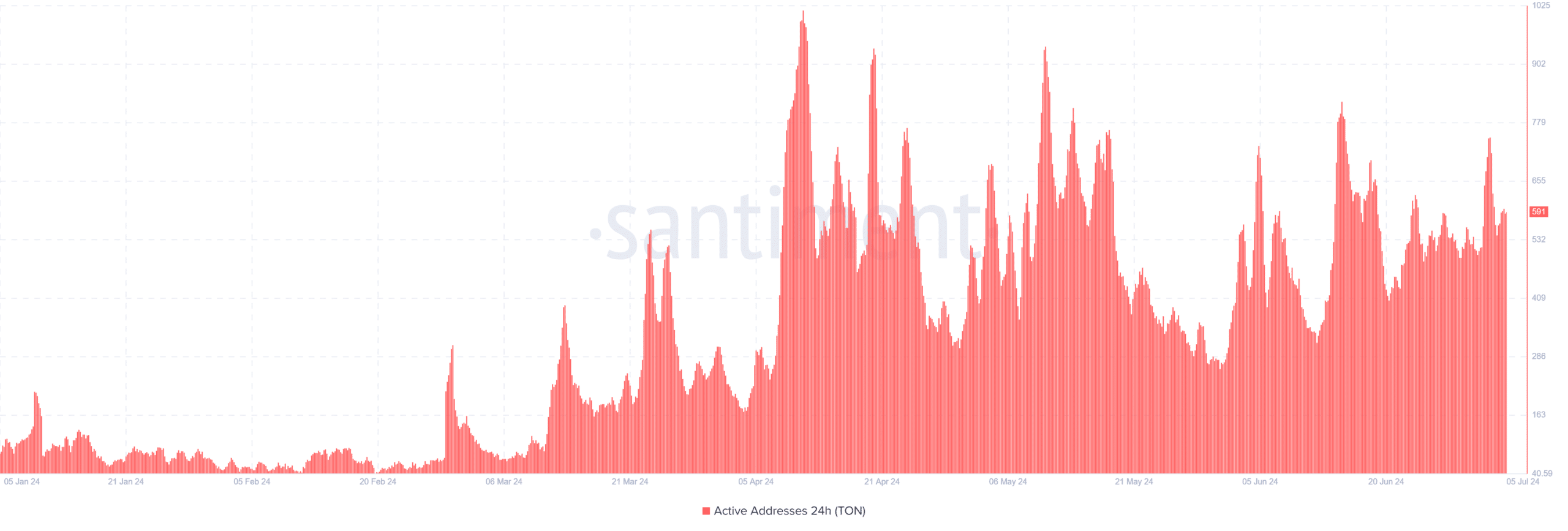

Active users stand firm

It’s intriguing to note that the number of Active Addresses has remained fairly steady, indicating that key backers and innovators have remained unfazed by temporary market price swings.

Such a conviction in the project’s future success might protect TON from additional price drops.

Read Toncoin’s [TON] Price Prediction 2024-25

The sudden price decrease, fewer significant deals, ongoing social engagement, and consistent user behavior hinted at a complex response towards TON‘s future prospects.

If the latest price surge from the ascending triangle doesn’t find sufficient buying support, it may result in additional declines for TON‘s value. On the positive side, the ongoing interaction within the crypto community could serve as a base for TON’s potential price rebound.

Read More

- Gold Rate Forecast

- PI PREDICTION. PI cryptocurrency

- Masters Toronto 2025: Everything You Need to Know

- SteelSeries reveals new Arctis Nova 3 Wireless headset series for Xbox, PlayStation, Nintendo Switch, and PC

- Mission: Impossible 8 Reveals Shocking Truth But Leaves Fans with Unanswered Questions!

- WCT PREDICTION. WCT cryptocurrency

- Guide: 18 PS5, PS4 Games You Should Buy in PS Store’s Extended Play Sale

- LPT PREDICTION. LPT cryptocurrency

- Elden Ring Nightreign Recluse guide and abilities explained

- Solo Leveling Arise Tawata Kanae Guide

2024-07-06 01:11