-

BNB’s price plummeted by 10.11%, with notable declines in on-chain activity

Technical analysis revealed that BNB bulls defended the support ably

As an experienced analyst, I’ve closely followed the recent price decline of Binance Coin (BNB) and its related on-chain activity. The sudden 10.11% plummet between 4 and 5 July was unexpected, especially considering the coin’s previous all-time high of $720.67 just a month prior.

Just over a month ago, Binance Coin (BNB) reached its peak price of $720.67. However, its value took a downturn once more. Specifically, there was a 10.11% decrease in price between the 4th and 5th of July.

The coin’s price has been declining since the beginning of the month, taking many holders by surprise with the extent of the correction in such a short timeframe. According to AMBCrypto’s assessment, this downturn can be attributed to significant selling pressure within the market.

User activity low, kicks BNB demand down

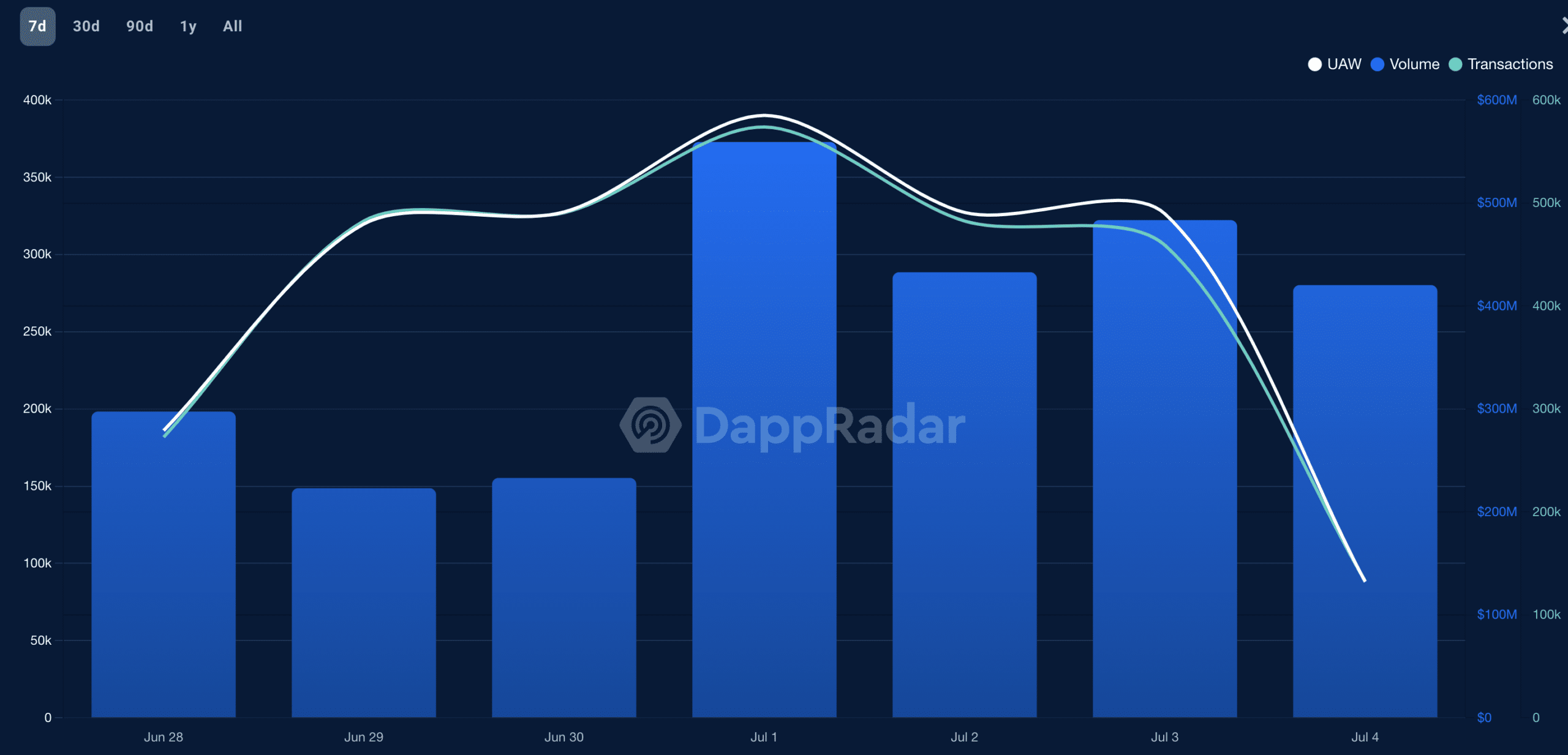

I’ve observed a significant decrease in on-chain activity lately. Upon closer inspection using DappRadar data, I discovered this trend.

DappRadar functions as an analytics hub, offering up-to-the-minute information about on-chain activities. As reported by the platform, there was a decrease of 9.14% in the number of distinct active wallets (UAWs) on BNB Chain over the past week.

In the cryptocurrency world, User Activity Weightings (UAWs) indicate the level of user involvement and transaction volume on a blockchain. An increase in this metric signifies heightened engagement and greater usage of a particular coin.

When the metric drops, it signifies a decrease in the demand for cryptocurrencies within that specific ecosystem. This trend could result in consolidation or even price declines, as was the case with Binance Coin (BNB) not too long ago.

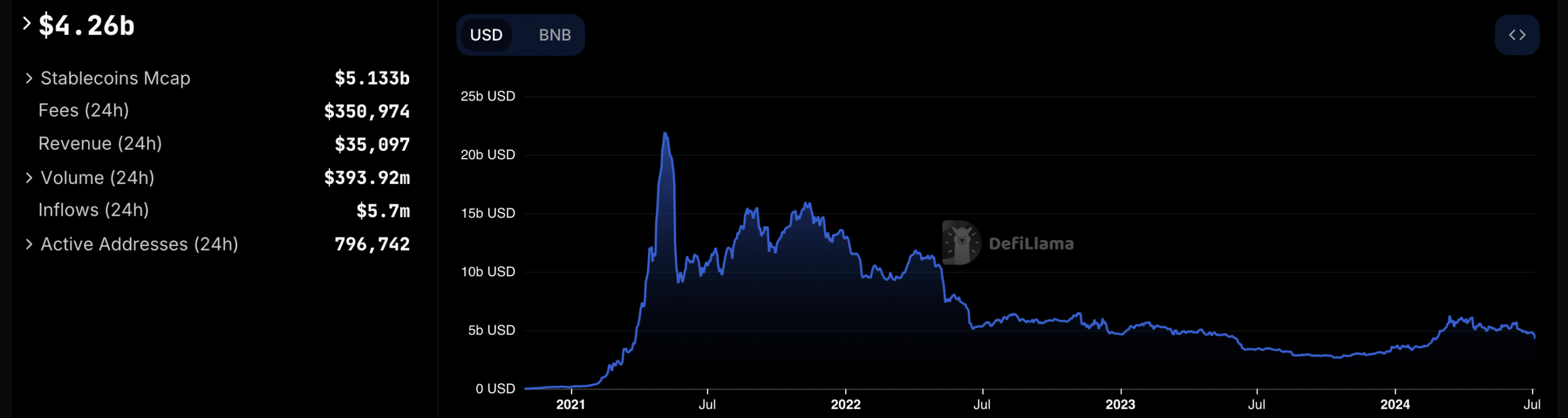

One influential aspect contributing to the coin’s downturn is the Total Value Locked (TVL) within the blockchain network. Essentially, TVL represents the current worth of assets secured on the platform.

When the total value locked (TVL) in a decentralized finance protocol increases, it signifies that market participants are adding more assets to the protocol on the blockchain. However, at present, the value, which was over $5 billion thirty days prior, has dipped below the set threshold.

In addition to the decrease in the value of BNB, this trend indicated that the levels of token trading and staking were significantly lower than they had been before.

Altcoin eyes a return to $526

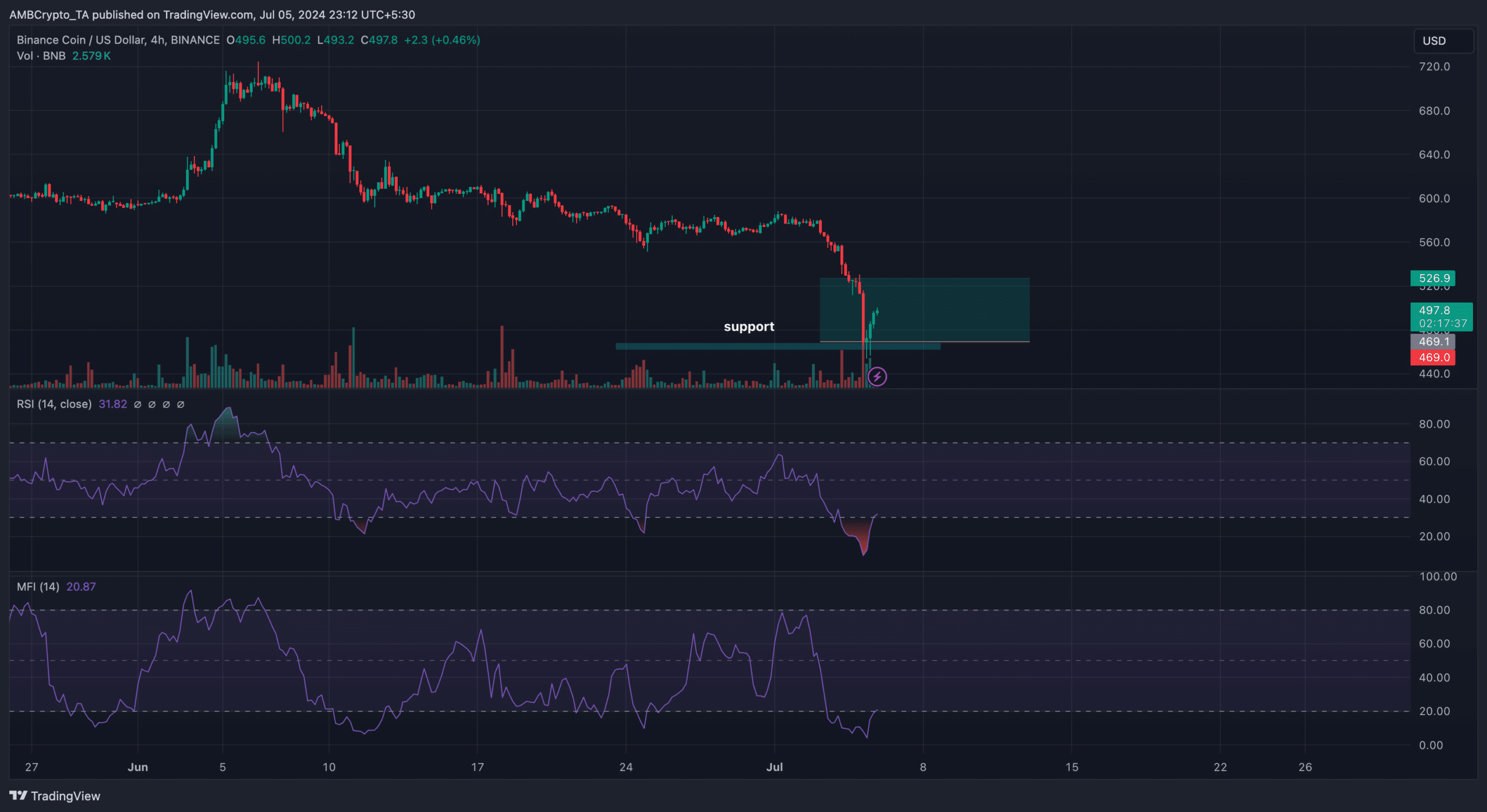

If the current trend persists, the BNB price may decrease further. Based on the 4-hour chart analysis, BNB bulls successfully protected the support level at $469.60. Consequently, the price rebounded from its lows.

At the current price of $479.90, the altcoin was nearly touching the $500 mark during the press time update. It’s important to mention that the Relative Strength Index (RSI) had dipped below the oversold threshold of 30.00 prior to this point.

At the moment of publication, the Relative Strength Index (RSI) for BNB was climbing, implying that the momentum could be shifting away from the bearish trend. If this trend continues, BNB’s price may have a chance to rise and maintain a position above $500.

The Money Flow Index (MFI) exhibited similar tendencies, indicating potential for re-accumulation once $500 was surpassed. Subsequently, BNB may aim for $526.90.

Realistic or not, here’s BNB’s market cap in BTC terms

As an analyst, I must acknowledge the optimistic outlook for BNB‘s price growth. Nevertheless, reaching its record-breaking all-time high may prove elusive in the near term.

Read More

- Best Race Tier List In Elder Scrolls Oblivion

- Elder Scrolls Oblivion: Best Pilgrim Build

- Becky G Shares Game-Changing Tips for Tyla’s Coachella Debut!

- Elder Scrolls Oblivion: Best Sorcerer Build

- Yvette Nicole Brown Confirms She’s Returning For the Community Movie

- Gold Rate Forecast

- Elder Scrolls Oblivion: Best Thief Build

- Justin Baldoni Opens Up About Turmoil Before Blake Lively’s Shocking Legal Claims

- Ludicrous

- Meet Tayme Thapthimthong: The Rising Star of The White Lotus!

2024-07-06 10:15