-

While ETH’s price dropped, whales deposited tokens worth millions of dollars

Few metrics and indicators suggested that ETH was undervalued

As a researcher with experience in analyzing cryptocurrency markets, I find the recent price correction of Ethereum (ETH) intriguing. While ETH’s price dropped significantly due to the overall market downturn, several whales took advantage of the situation by depositing millions of dollars worth of tokens into exchanges.

Last week’s crypto market downturn led to a significant price drop for Ethereum [ETH], the leading altcoin. This price correction left many investors questioning their faith in the token. However, recent developments have brought about a change in trend, as evidenced by the shift of Ethereum’s daily chart from red to green over the past few hours.

Ethereum’s high volatility

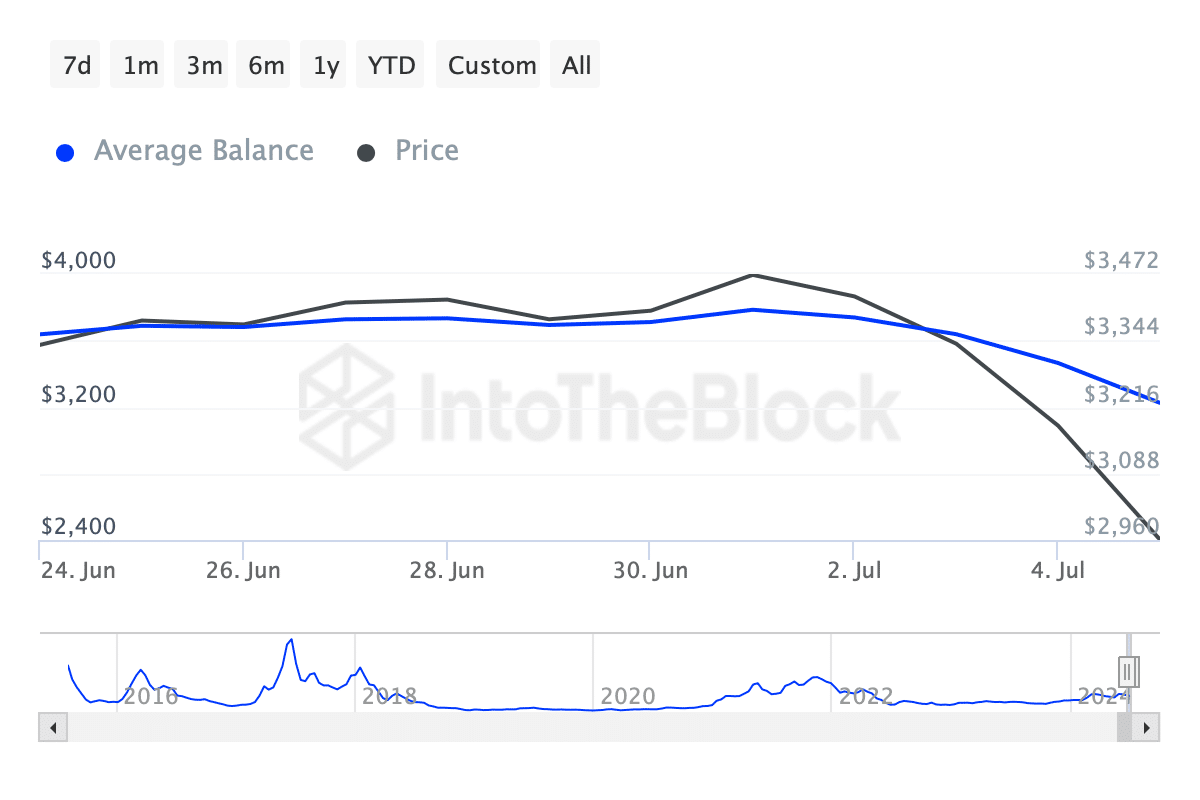

As a crypto investor, I’ve noticed that ETH‘s price took a significant hit over the past week, according to CoinMarketCap’s data. The digital currency experienced a drop of over 12%. Additionally, AMBCrypto’s analysis of IntoTheBlock’s figures revealed that ETH’s average balance had decreased. This decrease in balance is likely linked to the double-digit price decline ETH has recently endured.

As a crypto investor keeping a close eye on market developments, I recently noticed an intriguing update from Lookonchain. They reported that three Ethereum whales transferred 28,558 ETH, equivalent to over $82.2 million, to Binance for sale. However, it’s important to note that right after these sales, Ethereum’s price began to rebound on the charts, indicating a potential trend reversal.

Indeed, the value of that altcoin has increased by approximately 3% just in the past 24 hours. Currently, Ethereum is being exchanged for around $2,967.81 and its market capitalization exceeds $356 billion.

As a researcher observing the Ethereum market, I’ve noticed an intriguing development: although the price has been on the upswing, the trading volume has seen a substantial decline by double-digit percentages. This observation raises some questions about Ethereum’s ability to maintain its bullish trend in the long term.

Will ETH’s bull rally last?

Like the trading volume, a few other metrics also looked pretty bearish.

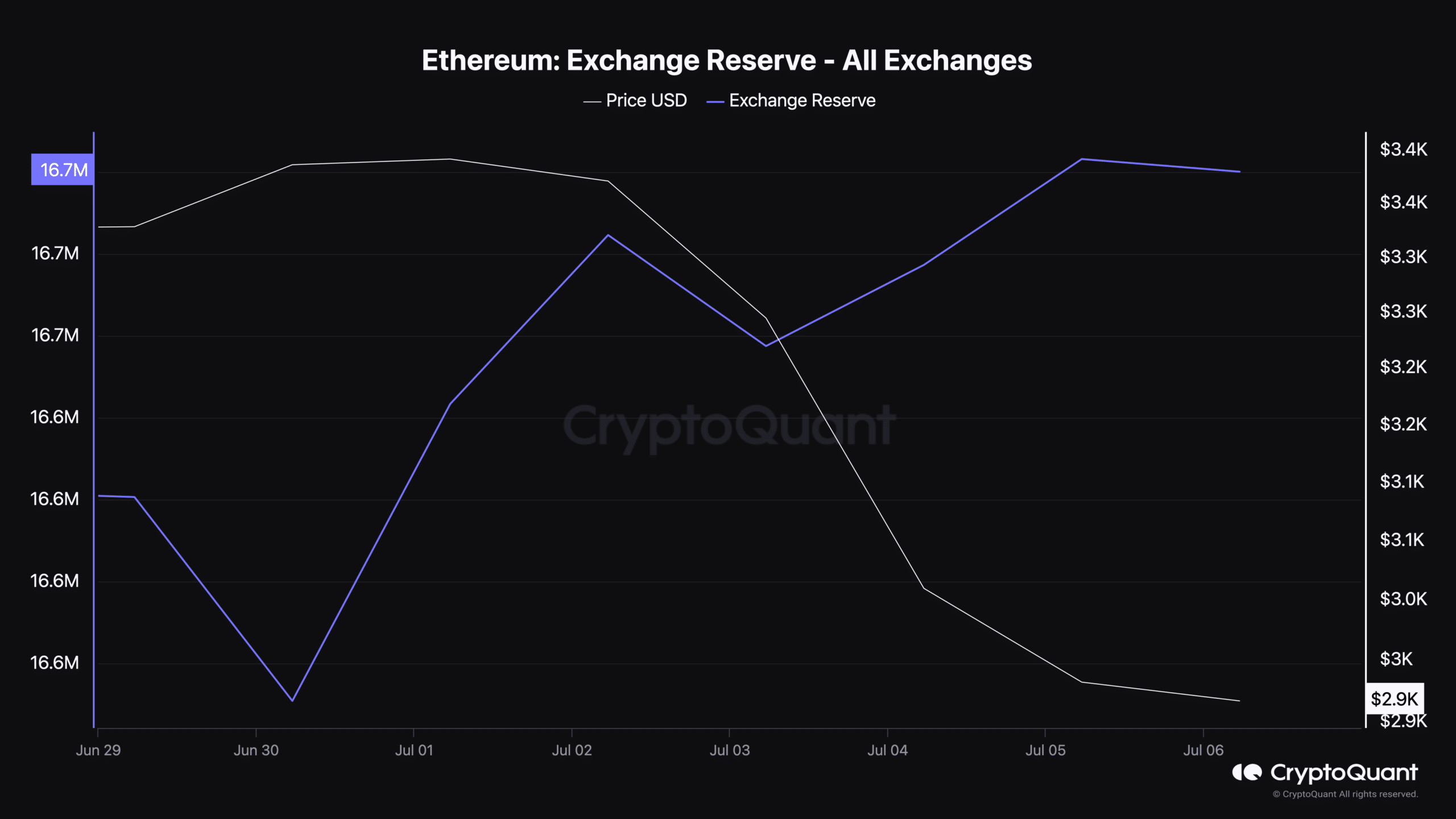

As a researcher studying the cryptocurrency market, I observed that despite ETH experiencing a price increase, there was significant selling pressure on the token. This was apparent from examining the data provided by CryptoQuant, which indicated a surge in ETH’s exchange reserves. Essentially, many investors decided to cash out during this period.

Nonetheless, other metrics supported the possibility of a sustained uptrend as well.

As a crypto investor, I’ve noticed that ETH‘s funding rate has been trending upward recently. This suggests that long-position traders have been more active and are potentially willing to pay premiums to short-position traders. Additionally, according to CryptoQuant, ETH’s Relative Strength Index (RSI) has dipped into the oversold territory. This could lead to increased buying pressure in the near future, possibly resulting in a price increase on the charts.

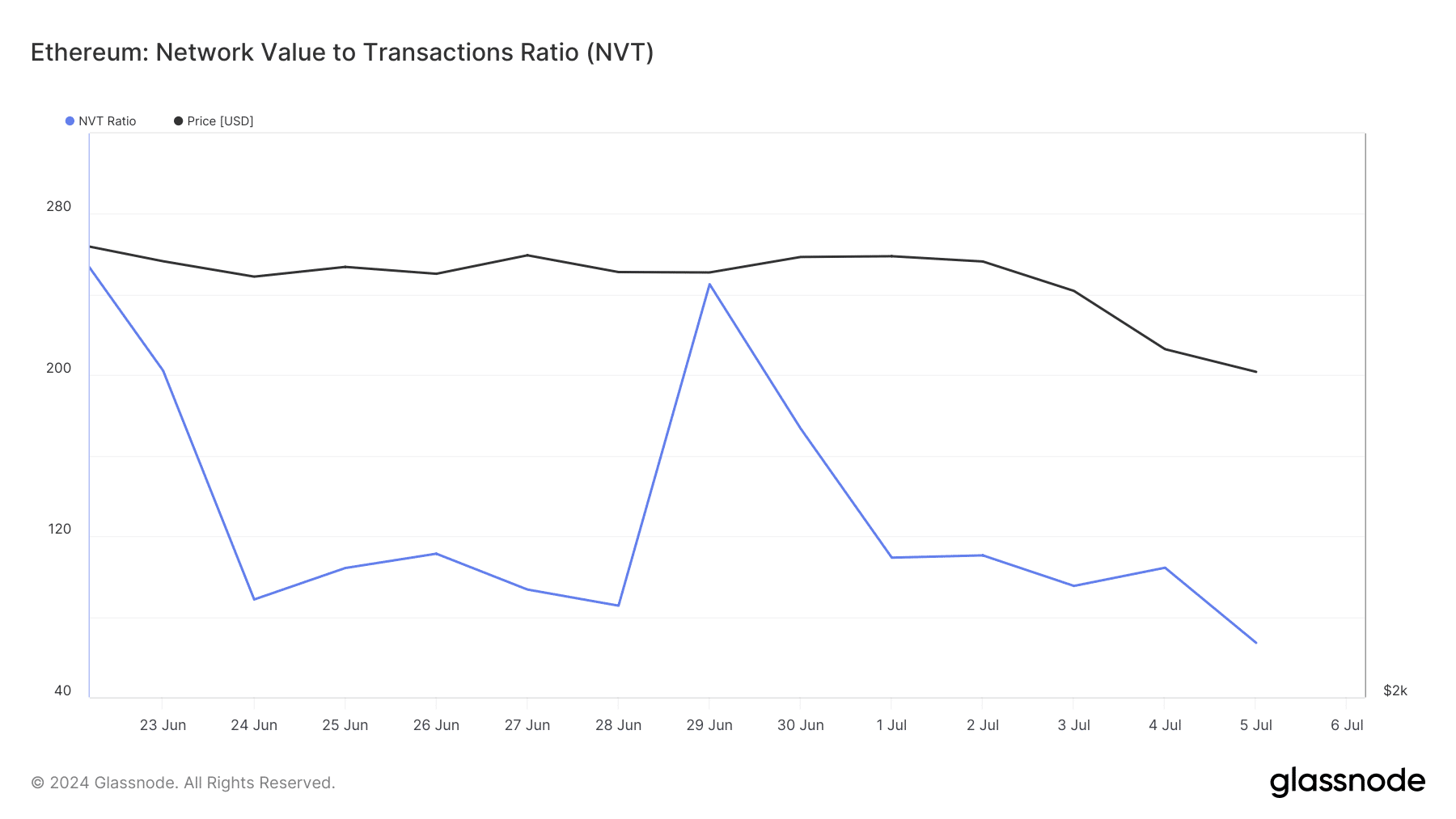

Additionally, the examination conducted by AMBCrypto using Glassnode’s data unveiled a significant decrease in Ethereum’s NVT (Network Value to Transacted Value) ratio. Typically, a decline in this indicator implies that an asset is underpriced, often leading to price surges.

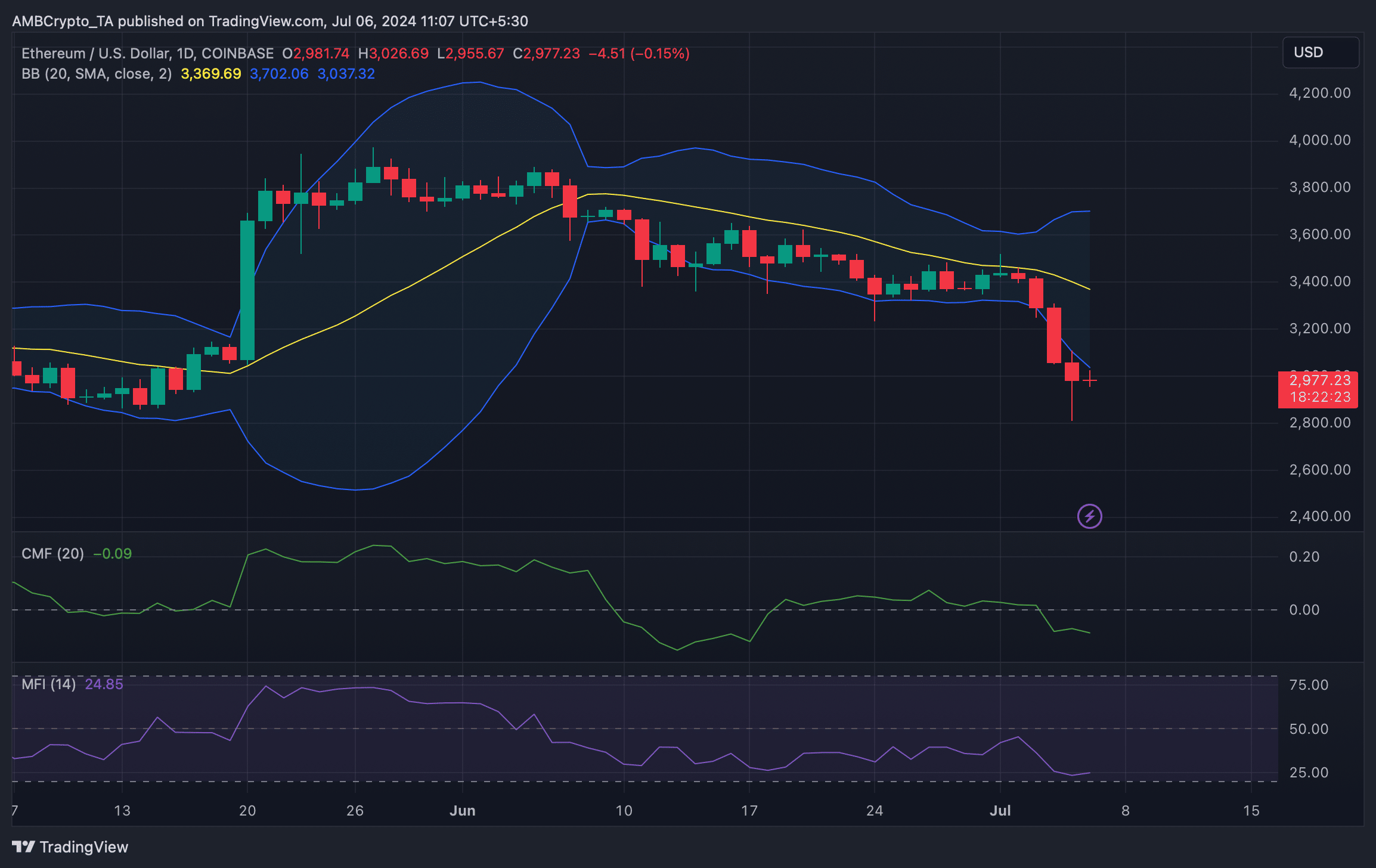

As a crypto investor, I took a closer look at Ethereum’s (ETH) daily chart to gain more insights into its future price movements. Notably, ETH’s price reached the lower boundary of the Bollinger Bands – a strong indicator that a rebound may be imminent.

Read Ethereum’s [ETH] Price Prediction 2024-25

Additionally, its Money Flow Index (MFI) was also about to enter the oversold zone.

However, the Chaikin Money Flow (CMF) looked bearish, as at press time it had a value of -0.09.

Read More

- PI PREDICTION. PI cryptocurrency

- Gold Rate Forecast

- WCT PREDICTION. WCT cryptocurrency

- LPT PREDICTION. LPT cryptocurrency

- Guide: 18 PS5, PS4 Games You Should Buy in PS Store’s Extended Play Sale

- Solo Leveling Arise Tawata Kanae Guide

- Despite Bitcoin’s $64K surprise, some major concerns persist

- Clarkson’s Farm Season 5: What We Know About the Release Date and More!

- Planet Coaster 2 Interview – Water Parks, Coaster Customization, PS5 Pro Enhancements, and More

- Chrishell Stause’s Dig at Ex-Husband Justin Hartley Sparks Backlash

2024-07-06 13:11