- Bitcoin’s free fall below $60k saw fear grip the market

- Memecoin market has fallen out of favor lately, but one candidate seemed to pique investor interest

As a seasoned crypto investor with a few battle scars from past market volatility, I’ve learned to keep a cool head during such turbulent times. Bitcoin’s [BTC] free fall below $60k saw fear grip the market, but I’ve been through this before and know that it’s all part of the game.

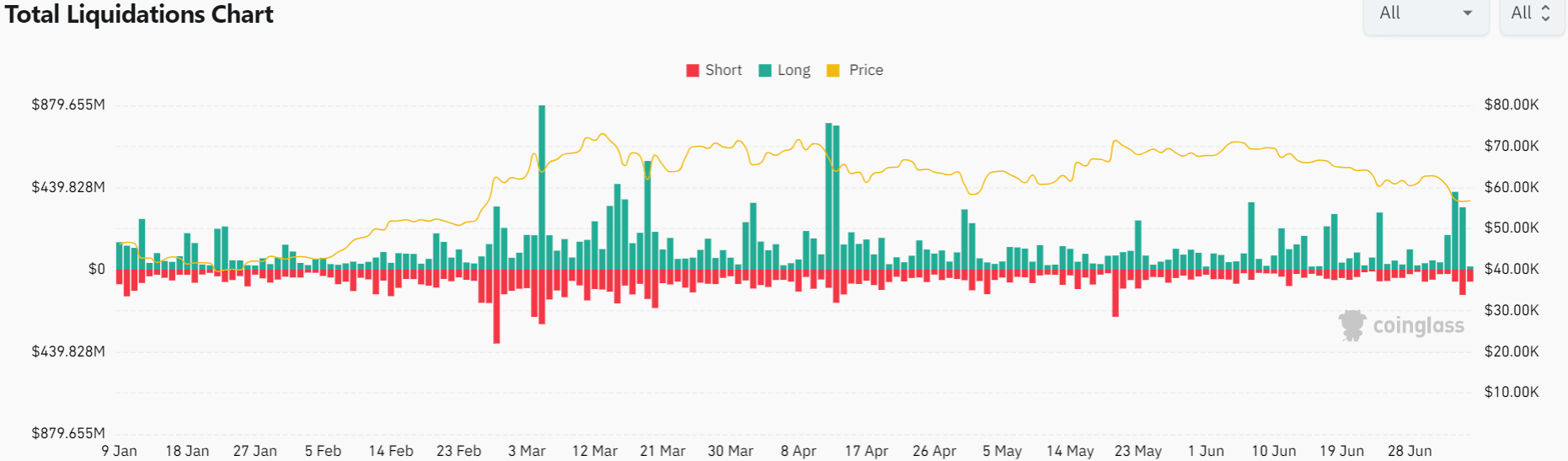

Over the past 36 hours, Bitcoin’s [BTC] price has experienced significant fluctuations. It dropped by nearly 9%, from $58,800 to $55,500. However, following this decline, Bitcoin rebounded and climbed back up to $56,800 at the time of reporting. This volatility resulted in numerous crypto liquidations, with long position holders enduring substantial losses.

The decline in Bitcoin’s price can be attributed to multiple reasons. Among them was the announcement from the German government that they were disposing of their Bitcoins, and the transfer of approximately 2.7 billion dollars’ worth of Bitcoin from Mt. Gox to a new digital wallet.

As a researcher studying cryptocurrency markets, I believe that given the current level of volatility, crypto liquidations may ease up in the coming days. The market requires some time to rebuild its liquidity, after which it will likely absorb more liquidity once again.

The memcoins market didn’t escape the trend either. It experienced significant gains towards the end of May, but has since then shifted to a downturn.

Bloodbath has stalled for now

According to Coinglass’s data, between the 4th and 5th of July, a total of $750.55 million worth of long positions and $198.66 million worth of short positions were forcedly closed due to insufficient account margin in the Futures market.

As an analyst, I would explain it this way: When markets are closed, traders who have open positions introduce market orders in the opposite direction to offset those positions before liquidating them. Consequently, a rapid succession of long liquidations triggered by sudden price decreases can set off a chain reaction, resulting in a cascade of further liquidations.

Significant cryptocurrency liquidations of this kind can bring advantages to the market. By eliminating heavily leveraged investors, it clears the path for price shifts based on actual market conditions, rather than speculative activity.

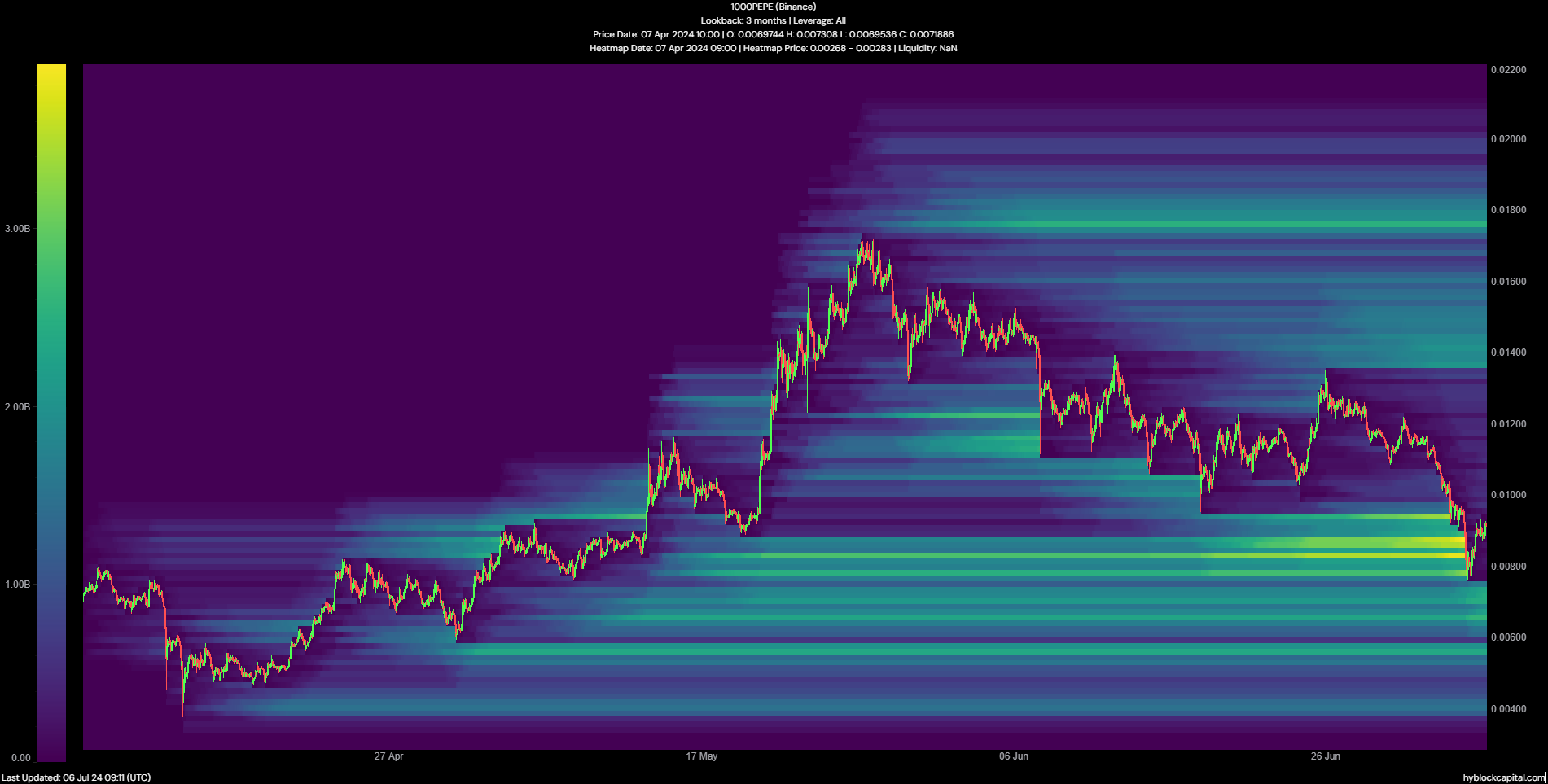

Pepe (PEPE), the coin ranked third largest among memecoins based on market cap, could potentially gain as a result of the current trend in selling.

State of major memecoins is poor, with one exception

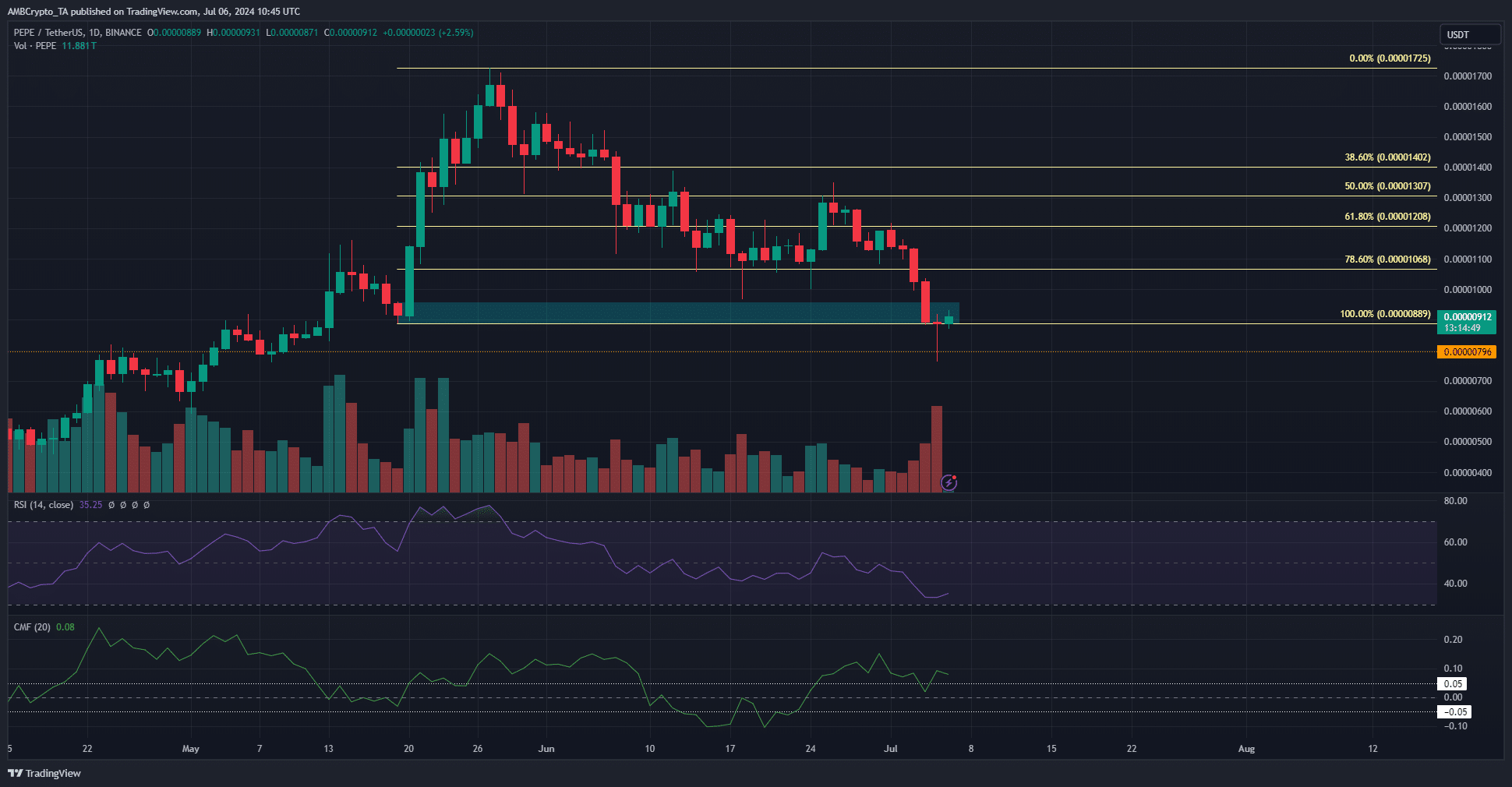

According to AMBCrypto’s analysis, a significant portion of PEPE‘s liquidation levels, which are areas where sell orders can rapidly push down the price, were eliminated from the $0.000077 to $0.0000095 range. This trend has been developing since mid-May. To the upward direction, the $0.000014 area may serve as the next attractive level for PEPE’s price movement.

According to AMBCrypto’s examination, both Dogecoin (DOGE) and Shiba Inu (SHIB) show concentrations of stop-loss orders at lower price points.

As an analyst, I’ve observed that a full recovery for Dogecoin (DOGE) or Shiba Inu (SHIB) may take longer than anticipated and could involve more significant corrections. Despite the bullish flag formation on higher timeframes for Shiba Inu, it seems that Pepe Coin (PEPE) might bounce back first from its recent price declines.

Is your portfolio green? Check the Pepe Profit Calculator

As a PEPE investor, I believe it’s crucial for us to protect the $0.00000796 to $0.0000089 price range. Defending this territory is essential if we want to maintain our bullish outlook in the long term. The recent market turbulence, resulting in significant crypto liquidations, has sparked fear among traders. However, there’s a glimmer of hope that the market could bounce back during July, initiating a price recovery.

Read More

- Gold Rate Forecast

- PI PREDICTION. PI cryptocurrency

- Rick and Morty Season 8: Release Date SHOCK!

- Discover Ryan Gosling & Emma Stone’s Hidden Movie Trilogy You Never Knew About!

- Masters Toronto 2025: Everything You Need to Know

- We Loved Both of These Classic Sci-Fi Films (But They’re Pretty Much the Same Movie)

- Mission: Impossible 8 Reveals Shocking Truth But Leaves Fans with Unanswered Questions!

- SteelSeries reveals new Arctis Nova 3 Wireless headset series for Xbox, PlayStation, Nintendo Switch, and PC

- Discover the New Psion Subclasses in D&D’s Latest Unearthed Arcana!

- Linkin Park Albums in Order: Full Tracklists and Secrets Revealed

2024-07-06 19:03