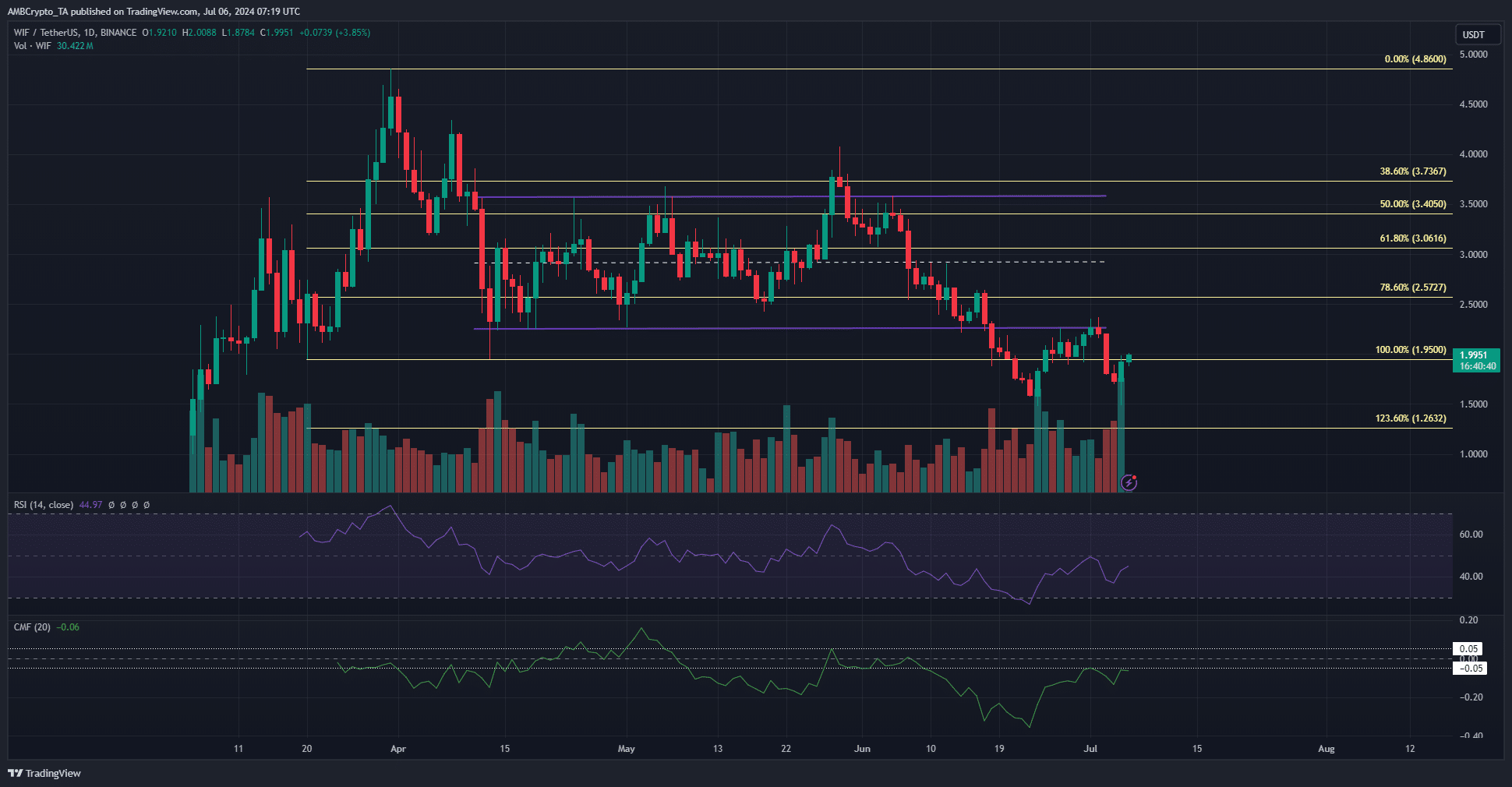

- Market structure and momentum on the daily chart were bearish

- There was evidence of buying pressure over the last ten days

As a seasoned market analyst with extensive experience in cryptocurrency trading, I’ve been closely monitoring the price action of WIF (Dogecoin) over the past week. The bearish trend identified by the technical analysis report earlier in the month proved to be accurate, as the memecoin dropped below the $2-mark and reached a low of $1.57 on July 4th.

Over the last week, there were signs of volatility in dogwifhat’s [WIF‘s] Bitcoin [BTC] price graphs as it dipped below the $60,000 threshold. A recent technical analysis piece by AMBCrypto suggested that WIF was exhibiting a bearish pattern, but a potential rebound to around $2.3 was forecasted.

As a crypto investor, I’ve witnessed an exciting turn of events: The memecoin surpassed $2.37 on Tuesday, 2nd July. However, following this achievement, bears have taken control and driven prices downward. Now, as we head towards the weekend, the question remains: Will the downtrend continue unabated or will the bulls manage to introduce some turbulence and potentially reverse the trend?

Potential for a short-term range formation under the older one

Over the past two weeks, the price has fluctuated between $1.5 and $2.34. Following this, the memecoin dipped below its three-month range, which is marked in purple and lies between $2.26 and $3.58. Currently, the Relative Strength Index (RSI) indicates a bearish trend with a reading of 45.

The CMF hovered slightly beneath the negative 0.05 threshold, signaling that sellers held significant influence. However, buyers weren’t far behind and could potentially reverse this trend.

On the daily chart, the bearish trend in pricing remained strong and indicated a potential continuation towards $1.26 with new lows. However, it’s important to note that previous resistance levels at $1.5 and $2.34 could potentially become new support areas and establish a fresh trading range. Unless these levels are surpassed, the market is expected to remain within this range.

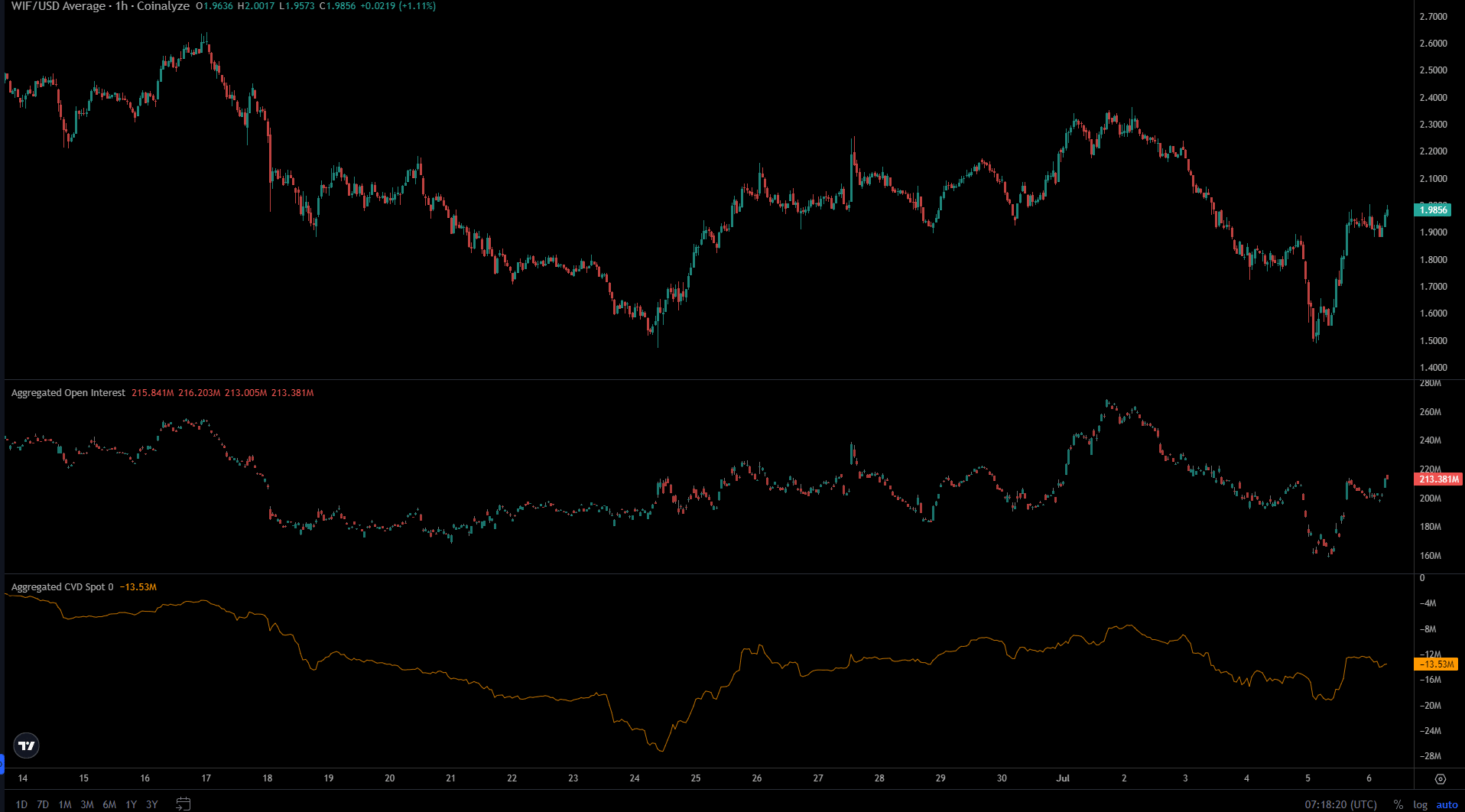

Spark of hope for buyers amidst the price losses

Until the last week of June, the trend for CVD’s performance had been declining. Following this period, there was a significant shift, causing it to head upwards.

Over the past week, the CVD experienced a downturn, yet it was on the mend by the time the press release was issued.

Realistic or not, here’s WIF’s market cap in BTC’s terms

As a researcher studying market trends, I’ve discovered that open interest indicated that buyers weren’t shying away from placing bids even during WIF‘s price surges. This fearlessness could potentially pay off if an uptrend materializes. Nevertheless, based on the current data, neither the bulls nor the bears appear to hold a clear upper hand in the immediate future.

Read More

- Gold Rate Forecast

- PI PREDICTION. PI cryptocurrency

- Rick and Morty Season 8: Release Date SHOCK!

- Discover Ryan Gosling & Emma Stone’s Hidden Movie Trilogy You Never Knew About!

- We Loved Both of These Classic Sci-Fi Films (But They’re Pretty Much the Same Movie)

- Mission: Impossible 8 Reveals Shocking Truth But Leaves Fans with Unanswered Questions!

- SteelSeries reveals new Arctis Nova 3 Wireless headset series for Xbox, PlayStation, Nintendo Switch, and PC

- Discover the New Psion Subclasses in D&D’s Latest Unearthed Arcana!

- Linkin Park Albums in Order: Full Tracklists and Secrets Revealed

- Masters Toronto 2025: Everything You Need to Know

2024-07-06 20:07