-

Grayscale’s latest report suggested U.S voters are more likely to buy ETH after ETF approval

While ETH’s value surged on the charts, its network growth fell

As a researcher with a background in cryptocurrencies and finance, I find the latest developments surrounding Ethereum (ETH) particularly intriguing. The Grayscale report suggesting that U.S voters are more likely to buy ETH after ETF approval is an interesting data point to consider.

Over the past few days, the market downturn has caused numerous cryptocurrencies, including Ethereum (ETH), to experience price fluctuations. Currently, Ethereum is finding it difficult to surpass the $3,000 threshold.

Will Ethereum finally see green?

As a crypto investor, I’ve been feeling disheartened by Ethereum’s recent price drops. However, there might be reason to keep the faith based on a recent survey by Grayscale. The findings suggest a promising outlook for Ethereum’s future.

Based on the information provided, approximately one in four American voters might be enticed to invest in Ethereum should the Spot Ethereum ETF become available. This heightened interest aligns with the overall trend towards increased cryptocurrency adoption.

As an analyst, I’ve examined the survey results, and they reveal that approximately half of all voters, specifically 47%, now intend to incorporate cryptocurrencies into their investment portfolios – A noteworthy increase from the 40% reported just six months prior. This substantial surge in public interest could potentially benefit Ethereum in the long term.

As an analyst, I would explain it this way: Just like how the launch of a Bitcoin ETF made it simpler and more secure for new investors to enter the market, the approval of an Ethereum ETF would have a similar effect. Institutions, in particular, might be drawn to invest larger sums of money into Ethereum due to the regulatory oversight that comes with an ETF. Consequently, the increased capital influx could potentially boost Ethereum’s price through heightened demand, as was observed when Bitcoin experienced a significant price surge following its ETF approval.

An Ethereum exchange-traded fund (ETF) endorsed by the U.S. regulatory bodies would signify a significant endorsement, potentially allaying apprehensions among institutions regarding Ethereum’s authenticity.

How is ETH doing?

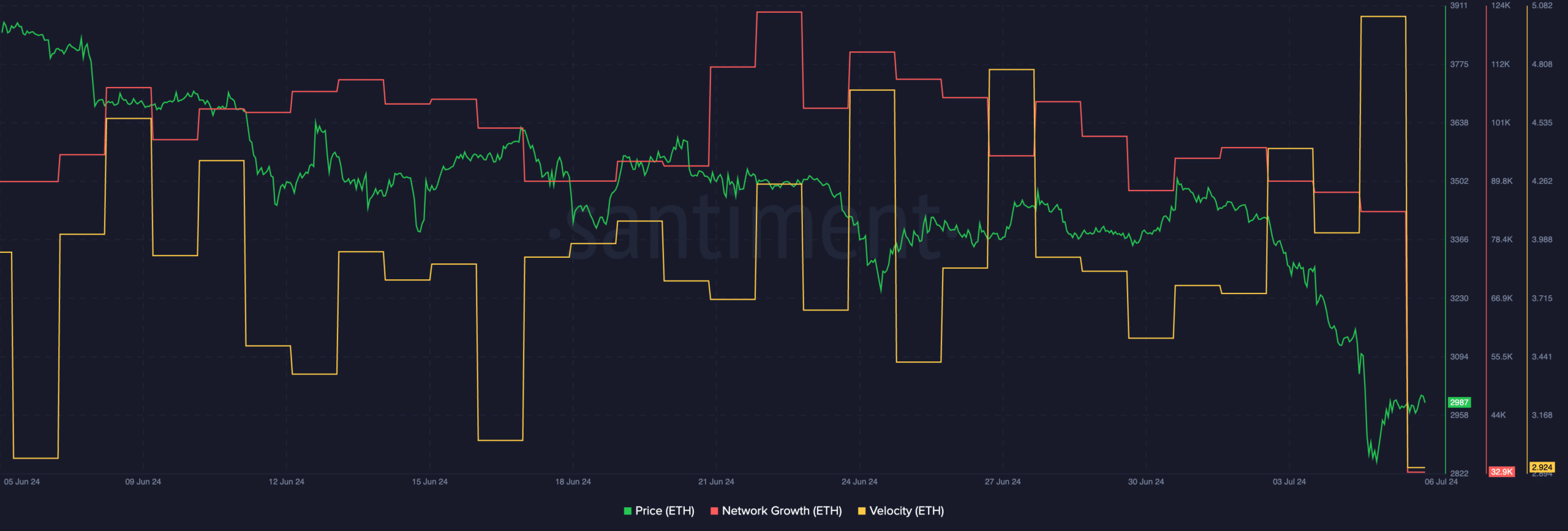

As a crypto investor, I’ve observed that at the current moment, Ethereum (ETH) is being traded at a price of $2,987.46. This represents a 4.19% increase in value over the last 24 hours. However, it’s important to note that the network growth for Ethereum has taken a significant hit during this period. This suggests that even with relatively low prices, many new investors have been hesitant to invest in ETH.

Another interpretation is that the speed at which Ethereum tokens were moving around also decreased, indicating fewer trading transactions.

Read Ethereum’s [ETH] Price Prediction 2024-2025

As an analyst, I would anticipate that the launch of Spot Ethereum ETFs could significantly impact the price of Ethereum moving forward. This development represents a major milestone for the cryptocurrency market and could attract a large influx of institutional investors to the Ethereum ecosystem. The increased liquidity and ease of access to Ethereum through these exchange-traded funds may lead to higher demand, potentially driving up the price. Consequently, it is essential to closely monitor this situation and prepare for potential market shifts.

On the opposite side of the globe, there’s a possibility that Hong Kong could introduce Ethereum staking ETFs within the next 6 months. This news comes from Vivien Wong of Hashkey Capital. Moreover, it seems that local regulators are currently engaging with industry experts regarding this proposed development.

Read More

- PI PREDICTION. PI cryptocurrency

- Gold Rate Forecast

- Rick and Morty Season 8: Release Date SHOCK!

- Discover Ryan Gosling & Emma Stone’s Hidden Movie Trilogy You Never Knew About!

- Linkin Park Albums in Order: Full Tracklists and Secrets Revealed

- Masters Toronto 2025: Everything You Need to Know

- We Loved Both of These Classic Sci-Fi Films (But They’re Pretty Much the Same Movie)

- Mission: Impossible 8 Reveals Shocking Truth But Leaves Fans with Unanswered Questions!

- SteelSeries reveals new Arctis Nova 3 Wireless headset series for Xbox, PlayStation, Nintendo Switch, and PC

- Discover the New Psion Subclasses in D&D’s Latest Unearthed Arcana!

2024-07-06 23:03