-

MATIC has been removed from Grayscale’s GSCPxE Fund

Decision could be a product of the altcoin’s month-long downtrend on the charts

As a researcher with experience in cryptocurrency markets, I believe that Grayscale’s decision to remove MATIC from its GSCPxE fund could be attributed to the altcoin’s month-long downtrend on the charts. The selling of MATIC and subsequent purchase of other existing fund components was likely done to adhere to prevailing market trends and ensure flexibility for each asset based on their weights.

Grayscale Investments has unveiled modifications to the constituents of its funds following the completion of Q2 in 2024. As the largest crypto asset manager globally, Grayscale oversees several products such as GSCPxE, OTCOX: GDLC, and OTCQB: DEFG. After assessing the portfolio performance in the second quarter, they have made adjustments to the weightings of each fund component. The news was shared by CSIMarket via their official platform.

As a crypto investor, I’m excited to hear that Grayscale Investments is responding to the growing demand for diversification in the digital asset space. In Q2 2024, they’ve announced plans to rebalance their crypto funds, which could potentially lead to shifts in the weightings of various cryptocurrencies held within those funds. Stay tuned for updates on how this might impact investments in $GBTC and other Grayscale offerings.

Based on the recent announcement, GDLC tokens kept their value constant. The assets including Bitcoin, Ethereum, Solana, Ripple, and Avalanche held proportions of 70.46%, 23.51%, 3.86%, 1.54%, and 0.63% respectively.

MATIC removed from Grayscale GSCPxE

According to the data from CoinDesk’s Smart Contract Platform Index (Select ex ETH), some modifications were implemented in the GSCPxE. These changes involved offloading Polygon (MATIC) and subsequently using the proceeds to buy existing fund constituents based on their respective weights.

In response, MATIC was taken out of the GSCPxE Portfolio to align with current market tendencies. Each asset’s adjustment maintained adaptability according to their respective weights.

Impact of adjustment on MATIC’s price

As of now, MATIC was priced at $0.4778 following a 8.5% increase within the last 24 hours. Correspondingly, its market capitalization surged, reaching a value of $4 billion on the graphs.

Contrarily, the trading volume for this altcoin decreased by a substantial 39.74%, amounting to only $292 million in the past 24 hours. Additionally, its weekly price trend has also shown a downward trajectory.

As a researcher, I’ve discovered through my analysis with AMBCrypto that MATIC has experienced a significant bearish trend.

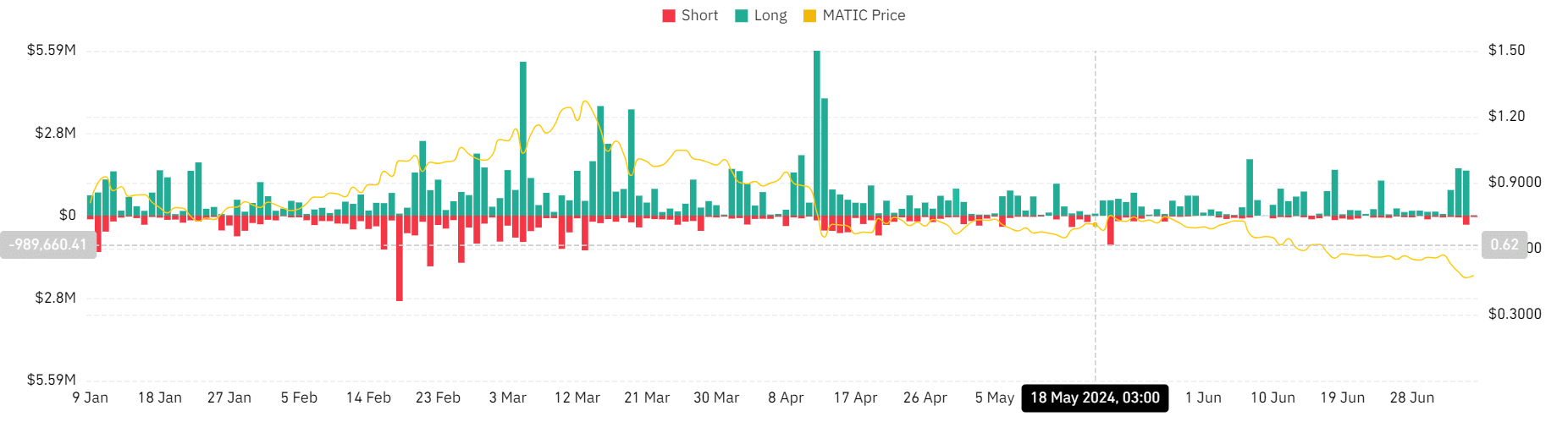

Based on my examination of Coinglass, it appears that MATIC has managed to navigate through significant liquidation thresholds lately. Specifically, the past six days have witnessed a surge in long position liquidations, with amounts totaling $870k, $1.6M, and $1.5M in succession.

When markets experience significant price drops despite investors holding long positions, it signifies that those investors’ anticipations were incorrect, resulting in a surge of selling activity to cut losses.

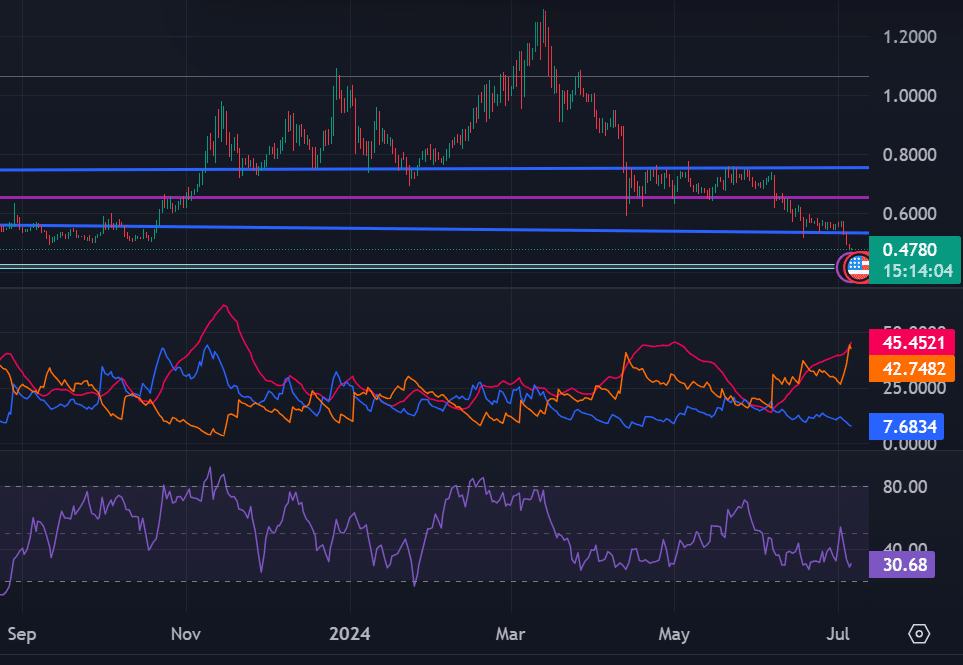

From my perspective as a crypto investor, when I observe a Directional Movement Index (DMI) with a negative index (-42) that sits above the positive index (7.6), it’s a clear bearish sign for me. In simpler terms, this setup implies that selling pressure is dominating demand in the market.

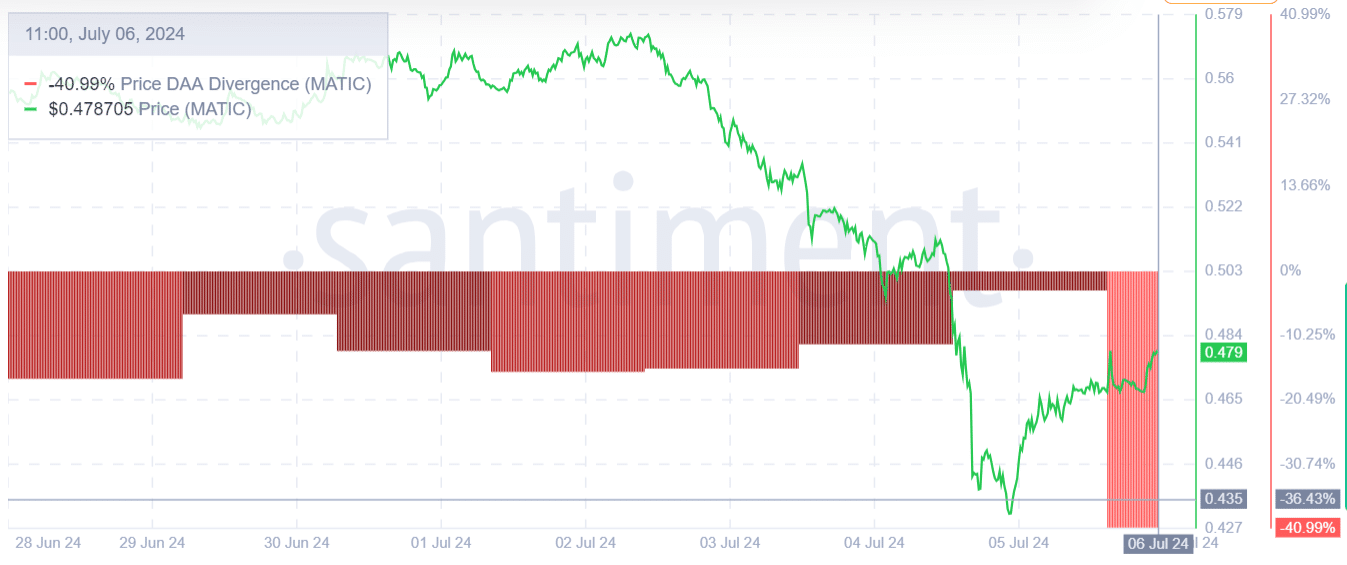

The DAA Divergence showing a figure of -40.99 suggests that the price might be moving in a different direction than the activity level. This discrepancy may signal decreased market engagement, potentially making the current price trend unsustainable unless there’s an increase in user involvement.

Can MATIC recover?

Currently, MATIC appears to be following a downward trend based on its price action. However, a bullish shift may occur if it manages to surpass its 200 moving average. Consequently, should the trend persist, we can anticipate prices dropping to around $0.42.

As a researcher observing the market trends, if the daily gains persist, we can anticipate a shift in the market direction and a subsequent rise towards the next resistance point, approximately at $0.5.

Read More

- PI PREDICTION. PI cryptocurrency

- Gold Rate Forecast

- Rick and Morty Season 8: Release Date SHOCK!

- Discover Ryan Gosling & Emma Stone’s Hidden Movie Trilogy You Never Knew About!

- Linkin Park Albums in Order: Full Tracklists and Secrets Revealed

- Masters Toronto 2025: Everything You Need to Know

- We Loved Both of These Classic Sci-Fi Films (But They’re Pretty Much the Same Movie)

- Mission: Impossible 8 Reveals Shocking Truth But Leaves Fans with Unanswered Questions!

- SteelSeries reveals new Arctis Nova 3 Wireless headset series for Xbox, PlayStation, Nintendo Switch, and PC

- Discover the New Psion Subclasses in D&D’s Latest Unearthed Arcana!

2024-07-07 01:11