-

MATIC retested $0.5 as resistance in a bounce that had little trading volume behind it.

A drop toward $0.448 or lower is anticipated over the next week.

As an experienced analyst, I’ve closely monitored Polygon [MATIC]’s price action and market sentiment over the past few months. The latest bounce to $0.5 from the low of $0.448 was a brief relief for investors, but it was not backed by strong trading volume or bullish technical indicators.

As a crypto investor, I’ve noticed that Polygon [MATIC] was following the downward trend of most altcoins in the market just like Bitcoin [BTC]. The price of MATIC broke down below a key support level last week, and the bulls have been struggling to regain control against the persistent bearish pressure.

As a crypto investor, I’ve experienced significant losses with the recent downturn in MATIC‘s price to $0.44. This is the lowest point the cryptocurrency has reached since last June, causing considerable discomfort for those of us holding it.

As a crypto investor, I’ve observed that despite making gains earlier this year, buyers have been unable to hold their ground over the past three months. This inconsistency in the market suggests a deeply rooted bearish sentiment among investors, indicating a longer-term downward trend for cryptocurrencies.

MATIC bulls forced an 18% price bounce over 36 hours

Following a significant decline on July 5th, Matic reached the $0.5 resistance mark. Despite this bounce, trading activity remained low. Over the past few hours, bearish sentiment towards Matic has resurfaced, causing prices to slip further.

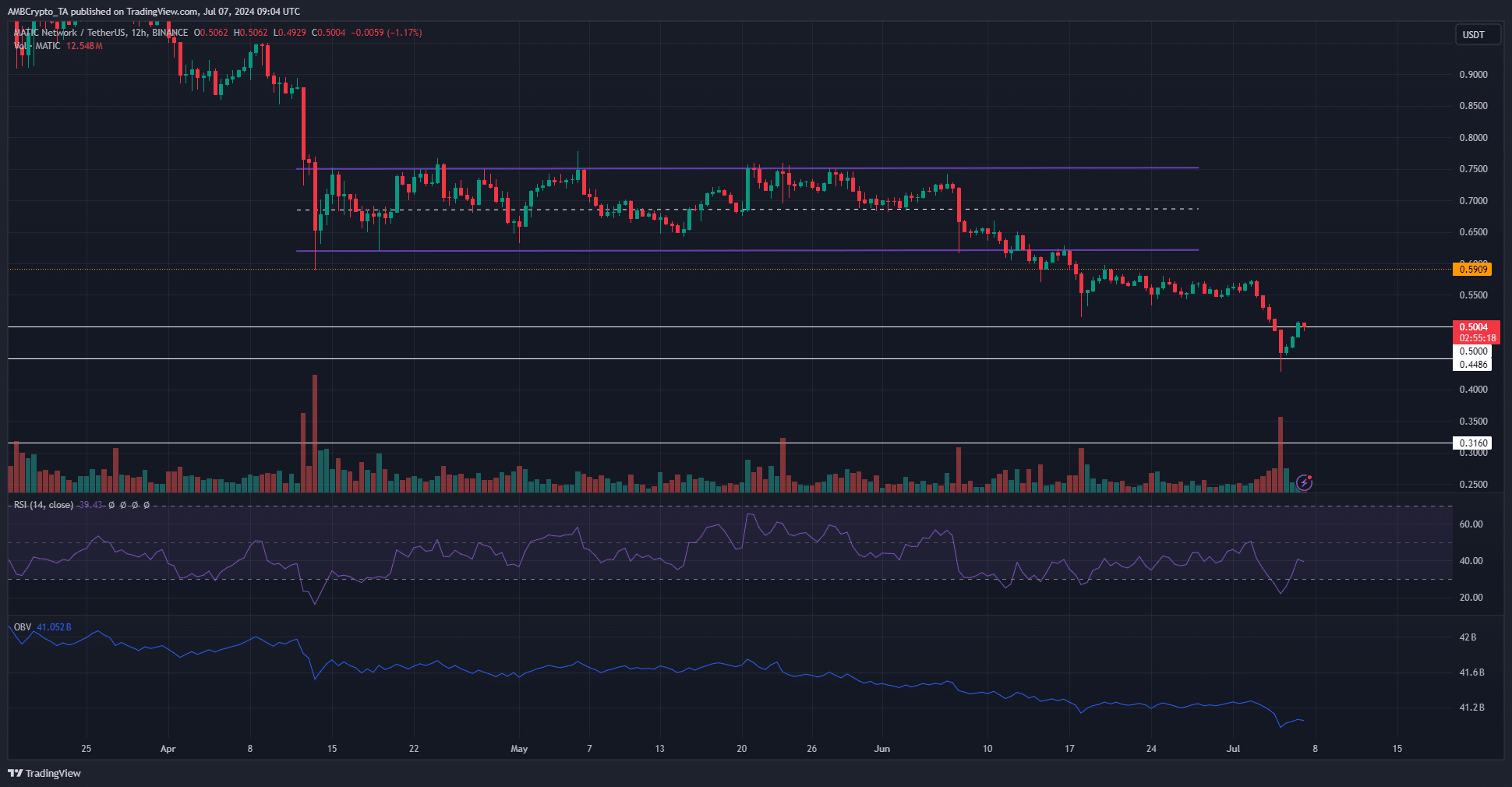

On the 12-hour chart, the Relative Strength Index (RSI) has remained below the neutral threshold of 50 since early June, indicating a persisting downtrend. Notably, this trend has not been reversed. For short sellers focusing on lower timeframes, potential resistance levels are found at $0.543 and $0.518.

The OBV has persistently declined, underlining the robust selling pressure that has been present since April. Based on current market trends and price movements, it’s possible that the price may dip towards $0.44 and $0.393 in the near future.

The funding rate has recovered but speculators are wary

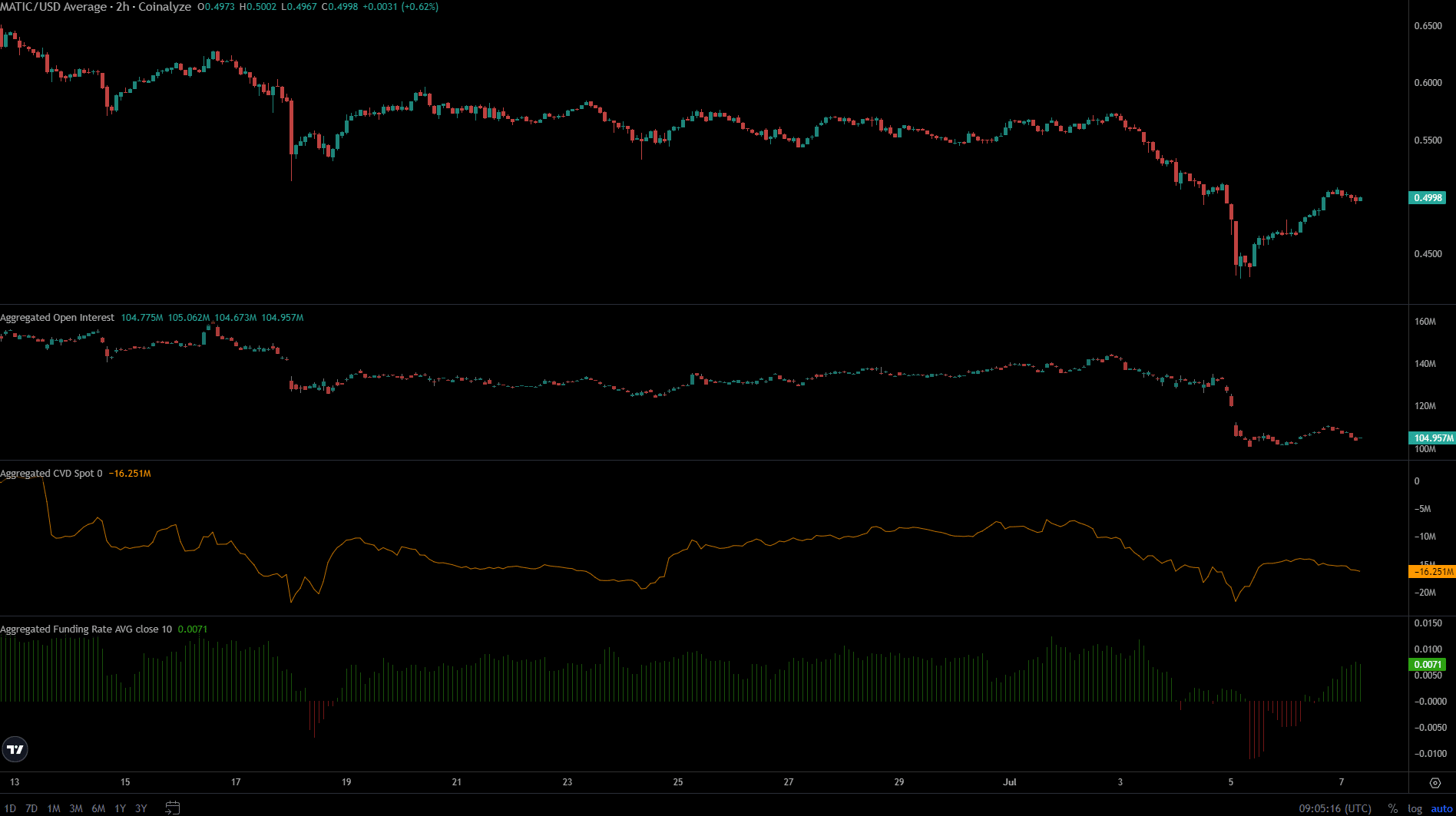

Starting on July 5th and continuing through July 6th, the funding rate took a turn for the worse, dipping into negative numbers. This indicated that short sellers held the upper hand during this period. However, since then, the funding rate has rebounded slightly above zero, yet it hasn’t shown any signs of bullishness.

Is your portfolio green? Check the MATIC Profit Calculator

As a crypto investor, I’ve noticed that open interest in MATIC has decreased during the last few hours. This decrease suggests that speculators have chosen to hold back from purchasing MATIC as it encountered resistance at $0.5. Instead, they seem content with remaining on the sidelines.

In July, the downward trend for CVD on the market became more pronounced following a period of increased buying activity towards the end of June. However, despite this brief respite, the selling force remains dominant, indicating further potential decreases in price.

Read More

- Gold Rate Forecast

- PI PREDICTION. PI cryptocurrency

- Rick and Morty Season 8: Release Date SHOCK!

- Masters Toronto 2025: Everything You Need to Know

- We Loved Both of These Classic Sci-Fi Films (But They’re Pretty Much the Same Movie)

- Mission: Impossible 8 Reveals Shocking Truth But Leaves Fans with Unanswered Questions!

- SteelSeries reveals new Arctis Nova 3 Wireless headset series for Xbox, PlayStation, Nintendo Switch, and PC

- Eddie Murphy Reveals the Role That Defines His Hollywood Career

- LPT PREDICTION. LPT cryptocurrency

- Elden Ring Nightreign Recluse guide and abilities explained

2024-07-08 02:15