-

XRP maintained the $0.4 price range despite the decline.

Interest has fallen in the last 24 hours.

As a long-term crypto investor, I’ve seen my fair share of market ups and downs. And while XRP‘s recent downturn is concerning, I try not to let short-term fluctuations dictate my investment decisions.

As a crypto investor, I’ve noticed that Ripple (XRP) hasn’t been performing well recently, with its price taking a dip and casting doubt on any imminent price recovery.

The financial downturn for XRP has not just influenced its short-term financial perspective, but it has also resulted in reduced enthusiasm from both investors and traders.

Ripple goes through a bend

According to AMBCrypto’s examination, Ripple (XRP) has been exhibiting a troubling pattern in its recent performance, marked by successive drops over the past few days.

Based on the daily chart, the decline in XRP‘s price started around July 3rd. The cryptocurrency saw a decrease of around 3.79%, bringing its value down to roughly $0.46.

On the fifth of July, I observed a significant decrease in XRP‘s value, with the price dropping more than 7% further, leading to approximately $0.43 as the new trading rate. According to the most recent market information, an extra decline of over 3% has occurred, keeping the XRP price around that level.

The examination revealed that XRP‘s Relative Strength Index (RSI) has been consistently indicating a downward trend, with a current reading of approximately 35.

As a researcher studying market trends, I’ve noticed that when the Relative Strength Index (RSI) falls below 40, it usually signifies that an asset is experiencing bearish conditions. This means that selling pressure has been more prevalent than buying pressure in the market. The sustained bearish trend in the RSI serves as additional evidence of negative momentum and could potentially indicate further price declines.

Interest in XRP dwindles

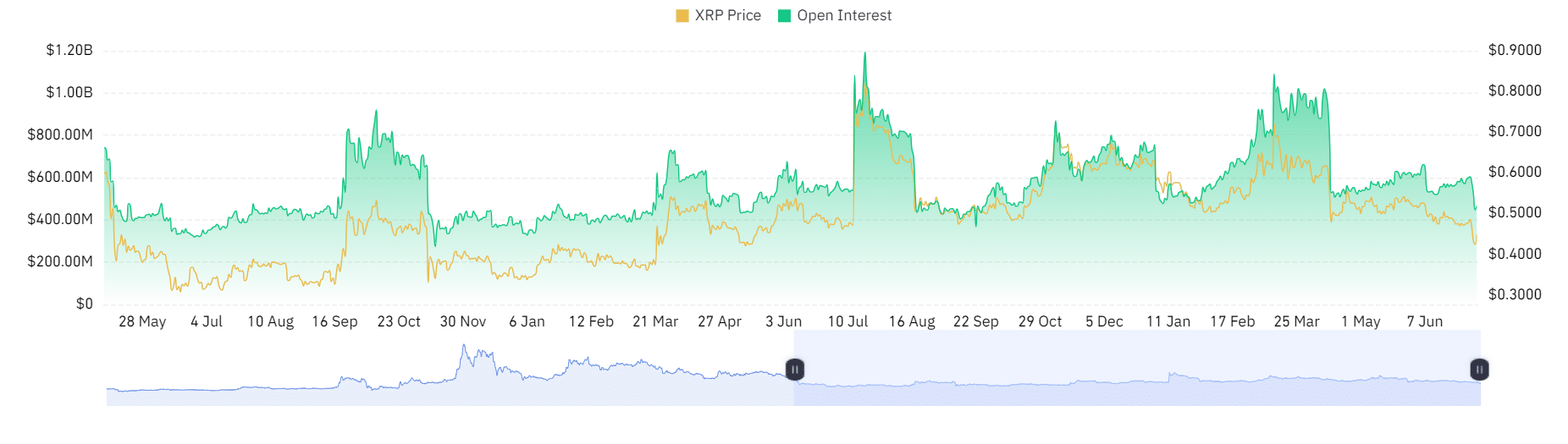

The examination of XRP‘s open interest on Coinglass revealed a noticeable drop in market involvement. Over the past day, its open interest dipped beneath the $500 million threshold, now hovering around $467 million.

The current open interest figure signifies the quantity of unsettled derivative agreements related to XRP. This decline in open interest indicates a decrease in the amount of capital invested in XRP-based derivative contracts.

Trading activity in XRP has decreased, indicating a loss of investor enthusiasm or doubt in keeping positions currently.

Although the number of open positions has decreased, a closer look at the weighted funding rates indicates that buyers continue to hold the upper hand. This suggests that the reduction in market activity may be due to some participants stepping back, while those who are still engaged display a stronger bias towards purchasing rather than selling.

Read Ripple (XRP) Price Prediction 2024-25

With a decrease in open interest, the upper hand of buyers in determining the funding rate could signify ongoing backing for XRP.

The reason for the ongoing investment is that remaining backers anticipate a market recovery or find the present prices enticing enough to continue or initiate new investments.

Read More

- Gold Rate Forecast

- PI PREDICTION. PI cryptocurrency

- Masters Toronto 2025: Everything You Need to Know

- SteelSeries reveals new Arctis Nova 3 Wireless headset series for Xbox, PlayStation, Nintendo Switch, and PC

- Mission: Impossible 8 Reveals Shocking Truth But Leaves Fans with Unanswered Questions!

- WCT PREDICTION. WCT cryptocurrency

- Guide: 18 PS5, PS4 Games You Should Buy in PS Store’s Extended Play Sale

- LPT PREDICTION. LPT cryptocurrency

- Elden Ring Nightreign Recluse guide and abilities explained

- Solo Leveling Arise Tawata Kanae Guide

2024-07-08 05:12