- Bitcoin does not have enough demand in the short term to sustain a rally beyond $60k.

- Traders can prepare for a bearish reversal on Monday but should watch out for volatility.

As a researcher with experience in analyzing cryptocurrency markets, I believe that Bitcoin does not have enough demand in the short term to sustain a rally beyond $60k. The recent price action shows a sharp downward move followed by a bounce, which might establish a short-term range formation. Traders should prepare for a bearish reversal on Monday but be aware of potential volatility.

🚀 Trump Effect: EUR/USD Primed for Wild Swing?

Expert predictions show massive EUR/USD reaction to Trump's latest tariff agenda!

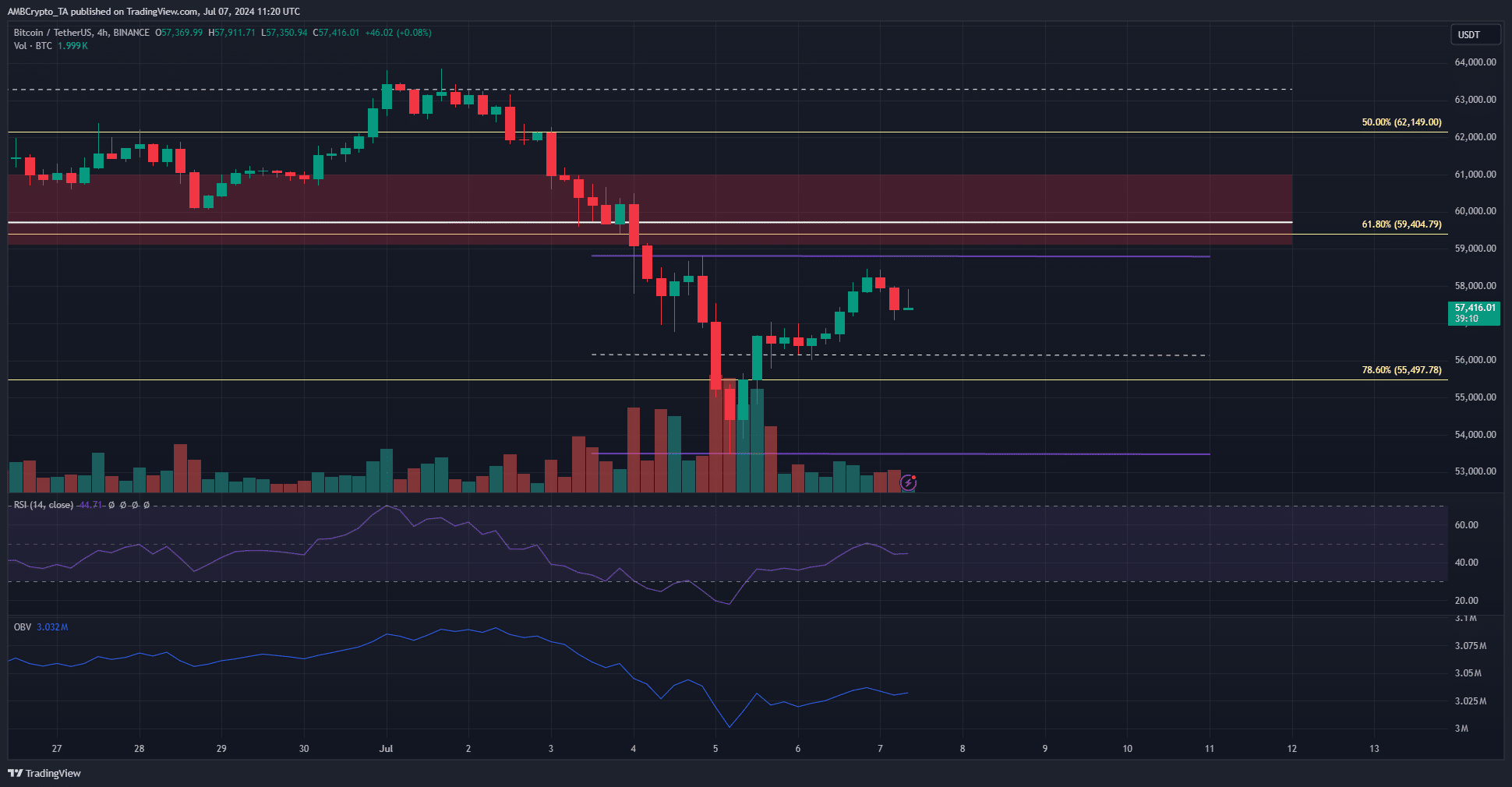

View Urgent ForecastBetween July 1st and 5th, Bitcoin [BTC] experienced a significant drop of approximately 16.2%. This decline reached its lowest point at $53,500. However, within the next day and a half, BTC rebounded by nearly 9.33%, offering some relief to investors. The sudden price decrease may lead to the formation of a short-term trading range.

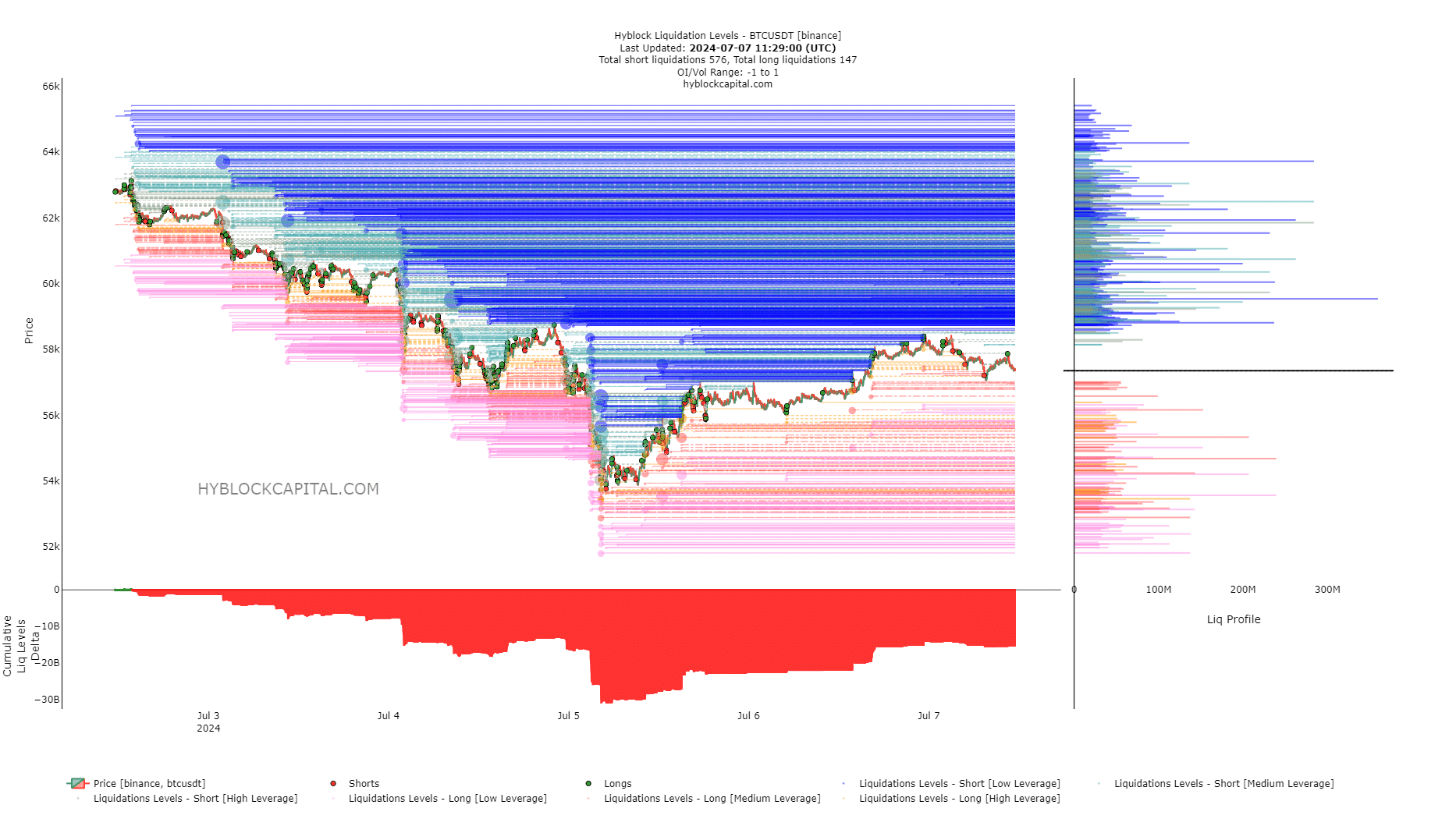

Based on their examination of liquidation charts and market trends, AMBCrypto anticipates potential directions for Bitcoin prices in the upcoming week. While large investors were amassing Bitcoin, the overall mood remained subdued. The increased transfer of Bitcoin to exchanges served as a cause for concern.

Plotting the Bitcoin price path for the next week

On the 4-hour timeframe, it appeared that the price could oscillate between approximately $58,800 and $53,500. The intermediate level at $56,200 acted as a support point on July 5th, helping to prop up prices as they attempted to rebound.

As a researcher studying the financial markets, I’ve observed that the H4 Relative Strength Index (RSI) for Bitcoin stood at 44 and had been rejected at the neutral level of 50. However, based on my analysis of market trends, I believe that the RSI could rise over the next day or two due to the allure of resistance levels.

The OBV, on the other hand, remained in a downtrend, warning bulls not to take the bait offered.

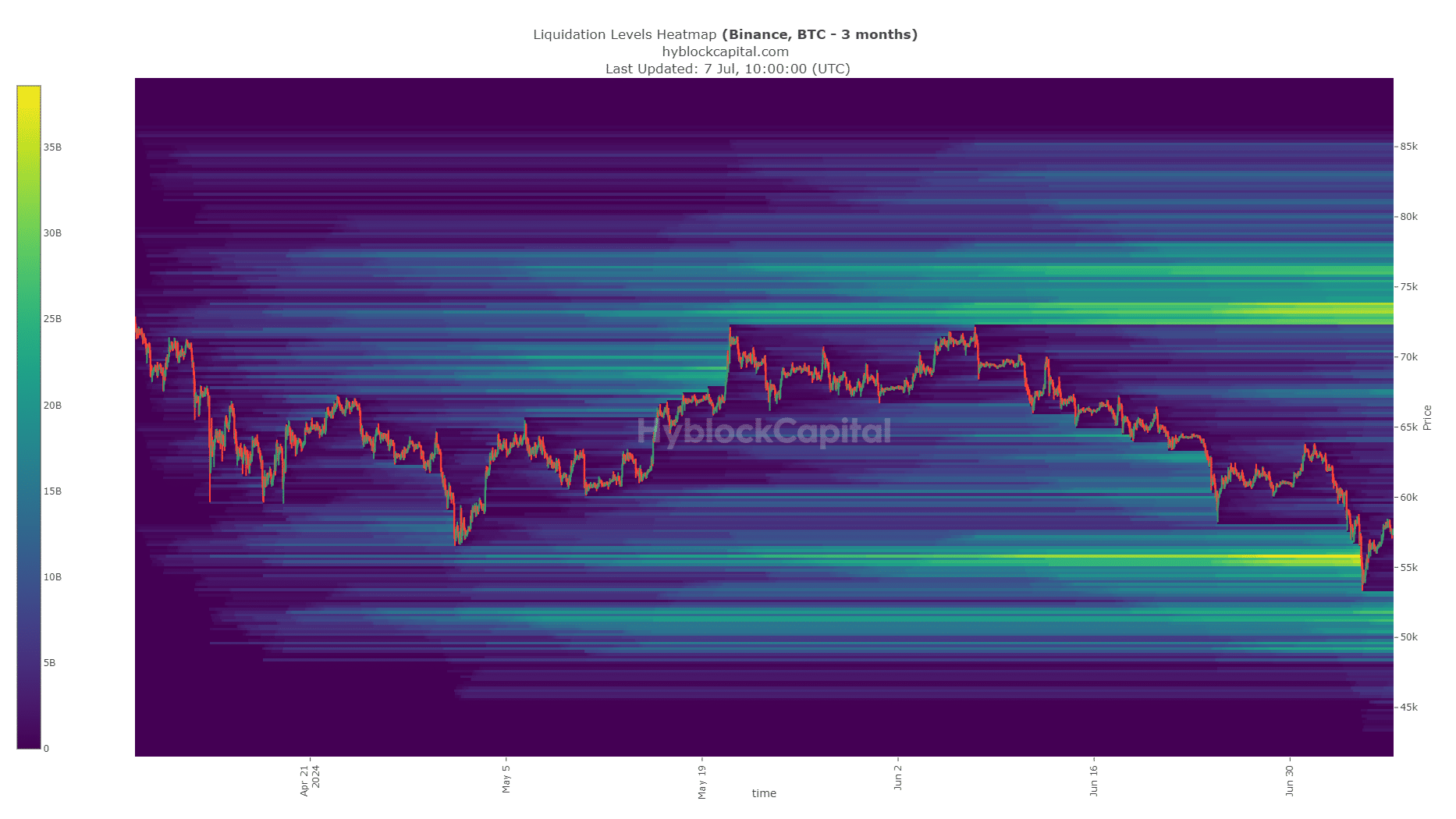

Over the last three months, the heatmap for liquidation events revealed that the $55,500 area held a significant number of these events. This dense cluster of liquidation points was subsequently depleted, and in the upcoming weeks, Bitcoin could potentially surge towards the $73,000 region with its next price movement.

In the near future, a quick turnaround seems improbable. The market’s bulls require some recovery time before making further gains. The previously mentioned price range is projected to persist for approximately a week.

Outlining the key Bitcoin price levels

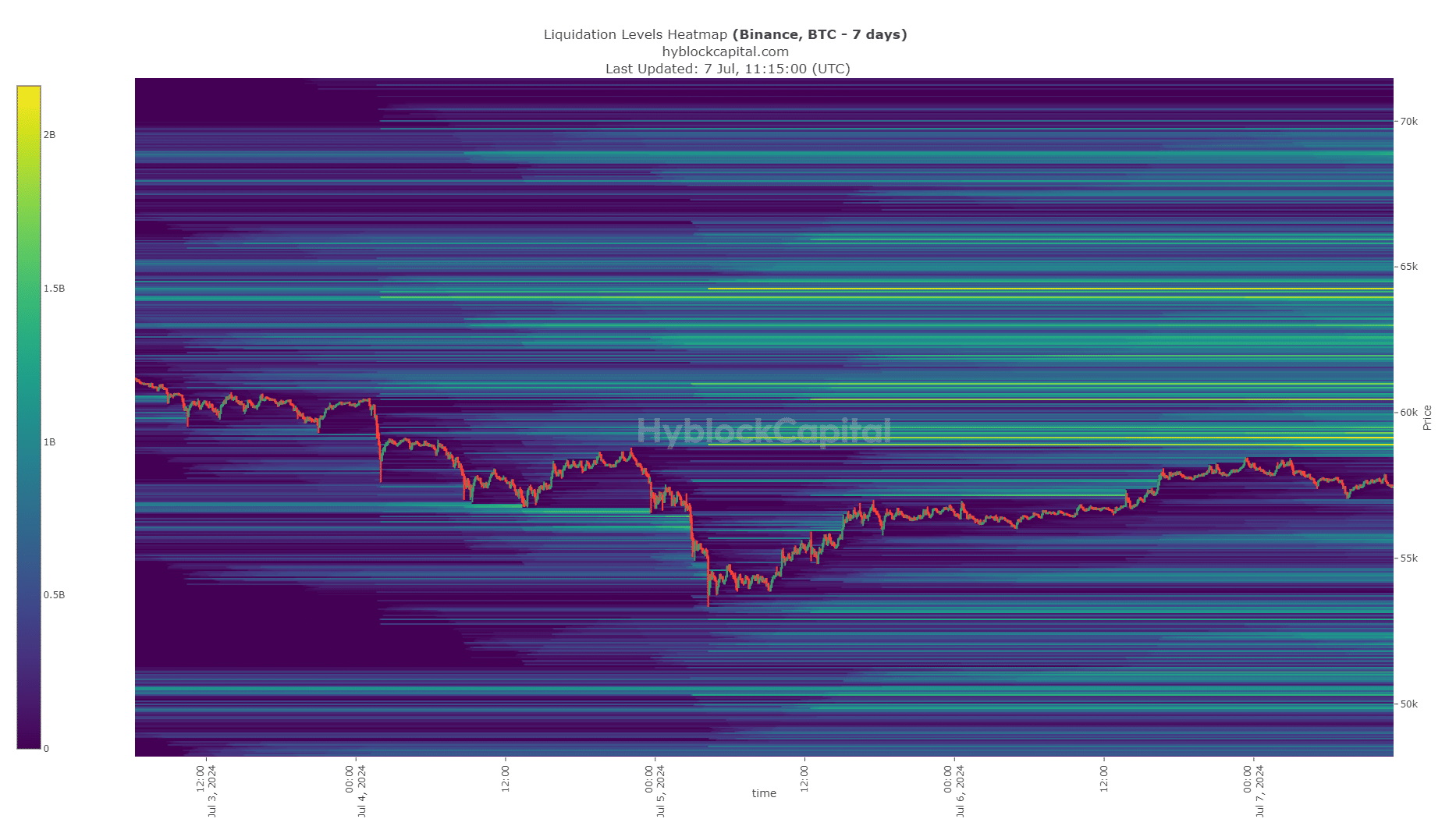

As an analyst, I observed in the 7-day liquidation heatmap that a significant concentration of liquidation levels existed between $59,000 and $59,300. This observation aligned well with the previous highs within the $58,800 range.

The magnetic zone below $60k is likely to draw Bitcoin prices to it.

I recently checked out AMBCrypto’s analysis, and they highlighted the significant negative cumulative liquidation levels. This delta reached its peak on the 5th of July but has since shown a slight improvement.

An uptrend targeting overextended short sellers could potentially begin as early as Monday, the 8th of July.

Read Bitcoin’s [BTC] Price Prediction 2024-25

As a crypto investor, I recognize that Bitcoin’s current mood isn’t particularly bullish, and it may lack the necessary demand for an immediate price surge. However, we should keep a close eye on the possibility of a significant breakout above the $60,000 mark. Even in bearish conditions, unexpected events or market shifts can lead to sudden price movements. Staying informed and prepared is essential in the volatile world of cryptocurrency.

Based on current circumstances, it’s expected that the price will shift from a bearish trend near the $59.2k mark. However, investors should be cautious as volatility may increase around the New York Open at 1 PM UTC on Monday.

Read More

- Discover Liam Neeson’s Top 3 Action Films That Will Blow Your Mind!

- Gold Rate Forecast

- Kanye West Praises Wife Bianca’s Daring Naked Dress Amid Grammys Backlash

- OM PREDICTION. OM cryptocurrency

- Nintendo Switch 2 Price & Release Date Leaked: Is $449 Too Steep?

- Netflix’s New Harlan Coben Series Features Star-Studded Cast You Won’t Believe!

- EUR PKR PREDICTION

- Top 5 Hilarious Modern Comedies Streaming on Prime Video Now!

- Attack on Titan Stars Bryce Papenbrook & Trina Nishimura Reveal Secrets of the Saga’s End

- Beetlejuice 2-Pack Makes a Comeback on Amazon!

2024-07-08 09:11