-

The XRP volume saw a slight increase in the past 24 hours.

Of late, there has been a battle between sellers and buyers.

As a long-term crypto investor with some experience in the market, I’ve seen my fair share of bull and bear markets. The recent trend for XRP has been particularly challenging, and the past few days have been no exception.

As a researcher observing the cryptocurrency market, I’ve noticed a significant change in the attitude towards Ripple [XRP] this week. The rocky beginning has prompted an increasing number of traders to consider taking short positions against XRP.

As a researcher examining XRP‘s market trends, I discovered that one of its essential derivative indicators signaled a surge in bearish sentiments among traders, suggesting this change.

XRP sees a change in mood

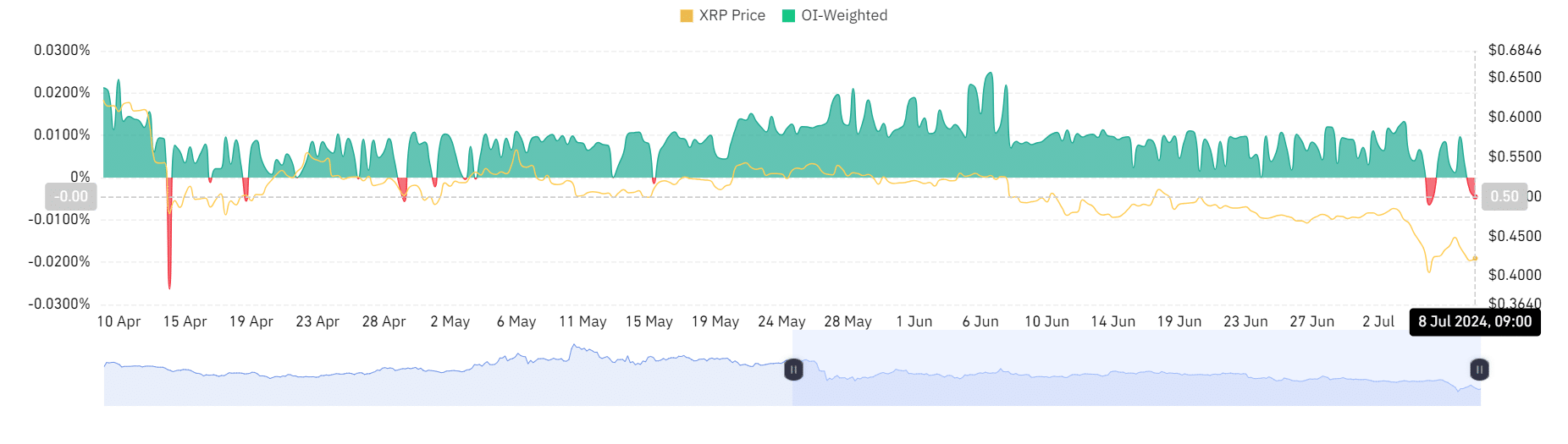

As an analyst, I’d interpret AMBCrypto’s finding regarding Ripple’s funding rate on Coinglass as follows: The market conditions surrounding Ripple have undergone a substantial transformation based on my analysis of the data provided by Coinglass.

On July 7th, the Weighted Funding Rate for XRP hovered around 0.0097%. However, this rate underwent a significant decrease during the day and turned negative, reaching -0.0046% by the end of the trading session.

A change from a favorable to unfavorable Funding Rate signifies a move from buyers’ control to sellers’.

As a market analyst, I would interpret a negative Funding Rate as indicating that short sellers are prepared to incur additional costs to hold onto their XRP short positions. This implies that they anticipate the cryptocurrency’s price to keep falling.

As a crypto investor observing the market trends, I’ve noticed an uptick in the number of short positions on XRP. This means that traders have become pessimistic about XRP’s near-term price performance and are placing bets against its potential recovery. The growing bearish sentiment among traders could potentially impact XRP’s price movement in the coming days.

Is a recovery in progress?

Based on an analysis by AMBCrypto, the daily chart perspective on XRP revealed reasons that have led several traders to adopt a bearish stance towards this cryptocurrency.

As a crypto investor, I observed that XRP started the week on a bearish note, and the trend continued to worsen leading up to a substantial decline. By the close of business on July 7th, the chart indicated a steep drop of approximately 6.65%, resulting in a price around $0.41.

As a financial analyst, I’ve observed that XRP has experienced a rebound at present, with its value hovering around $0.43. This marks a significant gain of more than 3% compared to previous prices.

The price rebound has sparked concerns about the durability of the latest price hike, considering the market’s instability and the increasing tendency towards short selling among traders and investors.

XRP stuck in a bear trend

As a crypto investor, I’ve been closely monitoring XRP‘s performance on the daily timeframe chart, and I must admit that its recent trends have further emphasized its bearish stance. The Relative Strength Index (RSI), a popular indicator in technical analysis, underscores this observation. It’s currently indicating oversold conditions, suggesting that XRP may continue to experience downward pressure in the near term.

At the moment of publication, the Relative Strength Index (RSI) for XRP was under 40. This signifies downward momentum and potentially heavy selling, implying the asset could be experiencing considerable price decreases.

As a data analyst, I’ve observed that the moving averages depicted in the chart, typically signified by yellow and blue lines, were hovering above the current market price at the given point in time.

Realistic or not, here’s XRP market cap in BTC’s terms

As a crypto investor, when I observe a market configuration with this specific setup, I often interpret it as a bearish sign. In simpler terms, the moving averages function as obstacles that can prevent any significant price increase during a downtrend.

The arrangement of these averages above the price line supports the idea that the price decline is robust.

Read More

- Gold Rate Forecast

- Discover Liam Neeson’s Top 3 Action Films That Will Blow Your Mind!

- OM PREDICTION. OM cryptocurrency

- Kanye West Praises Wife Bianca’s Daring Naked Dress Amid Grammys Backlash

- Nintendo Switch 2 Price & Release Date Leaked: Is $449 Too Steep?

- Netflix’s New Harlan Coben Series Features Star-Studded Cast You Won’t Believe!

- Meet the Stars of The Wheel of Time!

- Why Gabriel Macht Says Life Abroad Saved His Relationship With Family

- Where Teen Mom’s Catelynn Stands With Daughter’s Adoptive Parents Revealed

- EUR PKR PREDICTION

2024-07-08 21:11