-

Analysts highlighted a crucial support for XRP, with potential targets at $1.88, $5.85, and $18.22.

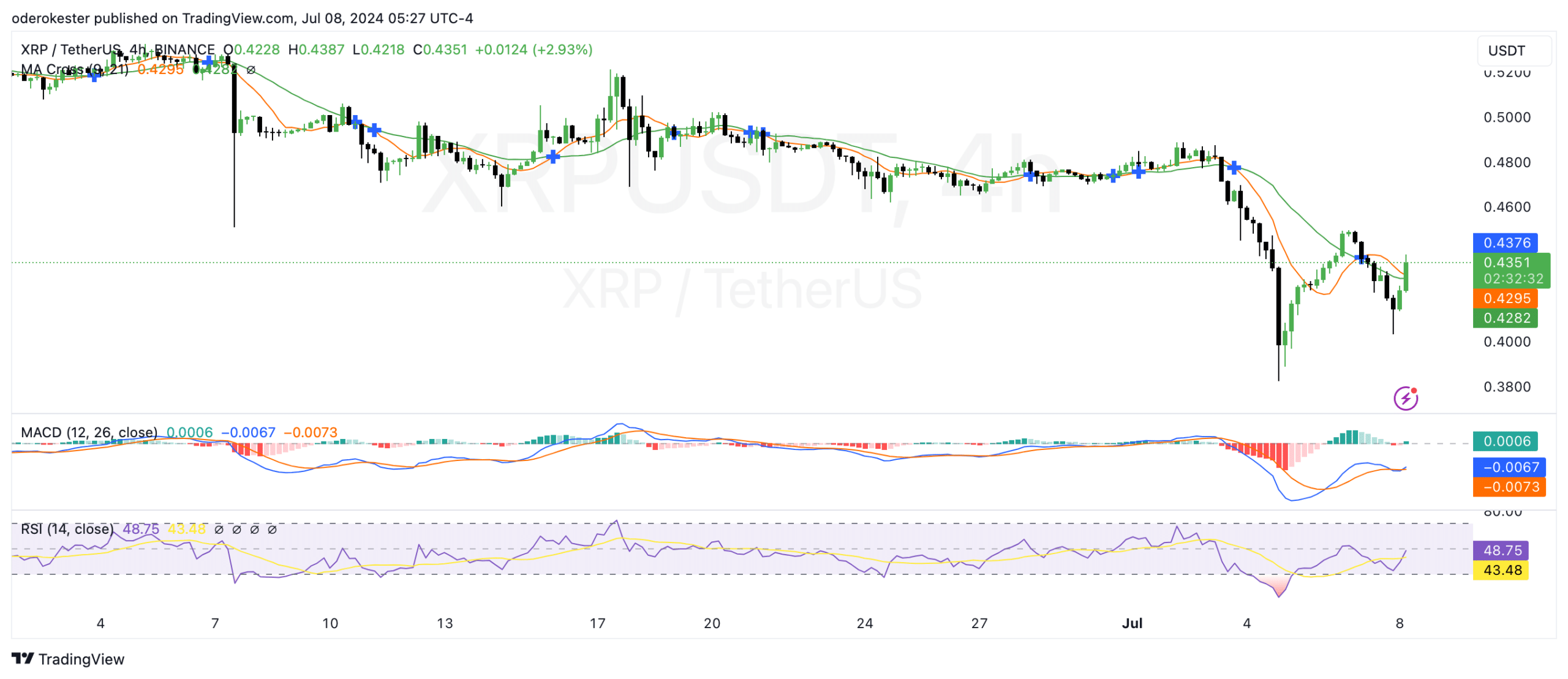

Technical indicators showed mixed signals, with slight bullish momentum building.

As a researcher, I find the current analysis of XRP intriguing, given the mixed signals from both technical indicators and market sentiment. Based on the information provided, it appears that analysts remain bullish about XRP’s potential price movements despite recent negative sentiment. The identification of crucial support levels, oversold conditions, and potential reversal patterns is a positive sign for XRP investors.

In spite of the recent unfavorable opinions towards XRP, analysts continue to be optimistic about its price fluctuations. At present, XRP is priced at $0.432745 per unit, and the daily trading volume amounts to $1,133,080,420.

XRP has decreased by 1.04% in the last 24 hours, bringing the live market cap to $24,113,904,871.

As a dedicated XRP analyst, I’ve closely examined the cryptocurrency’s price action on the weekly chart. Notably, I’ve identified significant technical signals that underscore the relevance of the Fibonacci support level located at $0.3917 in relation to the 5 Elliott Waves theory.

Based on his assessment, it’s crucial to keep this vital threshold in check to prevent any structural modifications. He forecasted potential milestones at $1.88, $5.85, and $18.22 respectively.

The RSI values for the past week suggested that the asset was oversold, potentially signaling a forthcoming change in direction for its price trend.

As a market analyst, I’ve identified a potential significant price movement for XRP based on recent chart patterns. Specifically, a doji candle formation has emerged on the XRP/BTC weekly chart, which historically may indicate a reversal or trend change. While past occurrences don’t guarantee future results, some market observers have suggested that such formations could precede price surges as high as 6,000%. However, it is essential to remember that investing in cryptocurrencies carries inherent risks and uncertainties.

Mixed signals from daily indicators

During this period, the MA Cross between the 9-day and 21-day moving averages indicated a possible transition from bearish to bullish market sentiment. Specifically, the value of the 9-day average was 0.4291, while that of the 21-day average was 0.4281, both marginally lower than the current price level.

Additionally, the MACD (12-day EMA, 26-day EMA based on closing prices) signaled a bullish trend shift, as the MACD line stood at 0.0004 and the signal line was at -0.0070.

However, the histogram remained negative at -0.0074, reflecting lingering bearish sentiment.

The Relative Strength Index (RSI) stood at 46.75, having risen from its recent minimum but staying below the 50 threshold. This suggests a relatively neutral position with a slightly bearish tilt, potentially leaning towards a more bullish outlook in the future.

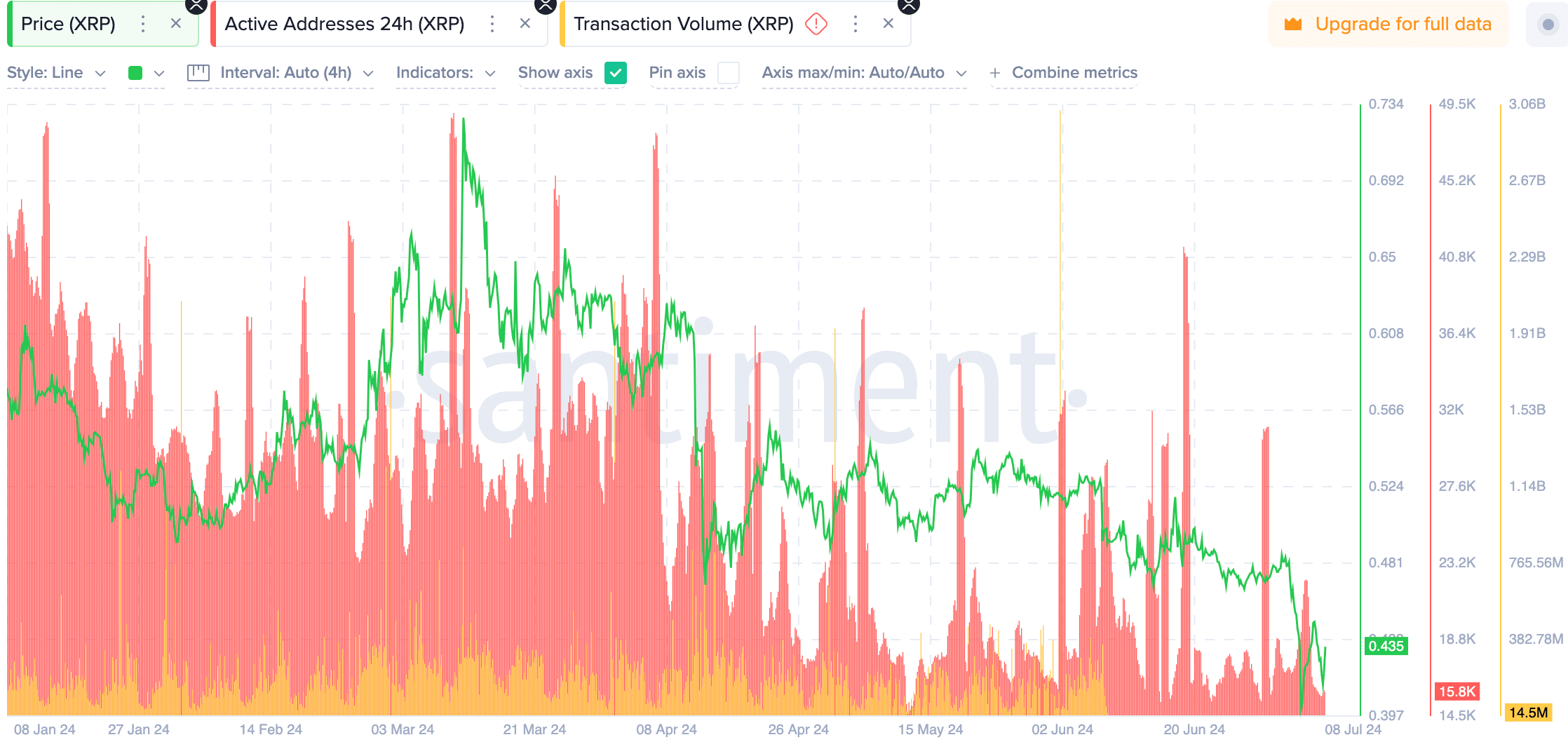

XRP engagement declines significantly

Over the past six months, Santiment’s investigation uncovered significant changes in the number of transactions and active addresses.

During specific periods – late January to mid-February, March, April, and early June – notable increases in trading activity corresponded with significant price changes.

Realistic or not, here’s XRP’s market cap in BTC’s terms

Lately, XRP has seen a noticeable decrease in both trading activity and the number of active wallets, coinciding with a drop in its market value.

Starting from early July, there’s been a noticeable drop in the number of transactions being processed, as well as a decrease in the number of active addresses. This trend may suggest that user interaction has waned and could be a warning signal for investors who are exercising increased caution.

Read More

- PI PREDICTION. PI cryptocurrency

- Gold Rate Forecast

- Rick and Morty Season 8: Release Date SHOCK!

- Discover Ryan Gosling & Emma Stone’s Hidden Movie Trilogy You Never Knew About!

- We Loved Both of These Classic Sci-Fi Films (But They’re Pretty Much the Same Movie)

- Mission: Impossible 8 Reveals Shocking Truth But Leaves Fans with Unanswered Questions!

- SteelSeries reveals new Arctis Nova 3 Wireless headset series for Xbox, PlayStation, Nintendo Switch, and PC

- Discover the New Psion Subclasses in D&D’s Latest Unearthed Arcana!

- Linkin Park Albums in Order: Full Tracklists and Secrets Revealed

- Masters Toronto 2025: Everything You Need to Know

2024-07-09 06:15