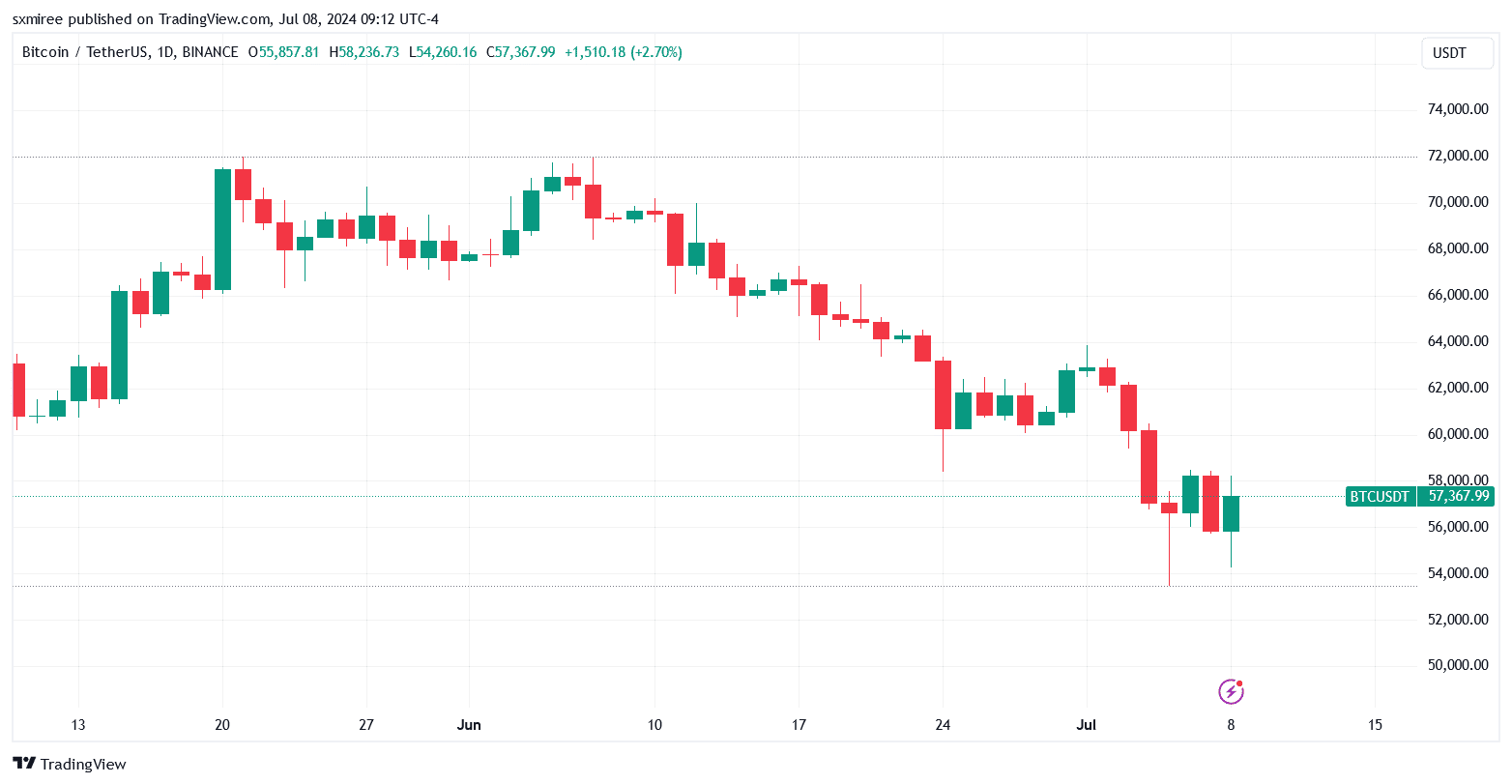

- Bitcoin price recorded its lowest weekly close in four months.

- Markets ushered in more volatility this week with several catalysts lined up, including the U.S. CPI and PPI data release.

As a seasoned crypto investor, I’ve witnessed my fair share of market volatility and price swings. The latest dip in Bitcoin’s price, recording its lowest weekly close in four months, has left me feeling a mix of frustration and caution. The market ushered in more volatility this week with several catalysts lined up, including the U.S. CPI and PPI data release.

Last week, Bitcoin [BTC] spearheaded a significant slump among altcoins, with its value dropping heavily due to increased selling pressure. This selling pressure was driven by two main factors: the ongoing Mt. Gox bankruptcy repayments, and the sale of Bitcoin by Germany.

On the 6th of July, the leading cryptocurrency interrupted its sliding trend, surging up to a peak of $58,472 from a recent trough of $53,717 recorded on the 5th. However, it eventually continued its losing streak on the 7th.

The ongoing selling of Bitcoins by entities in Germany caused a halt in its upward trend on the 8th of July.

Bitcoin technical analysis

Double top formation and moving averages

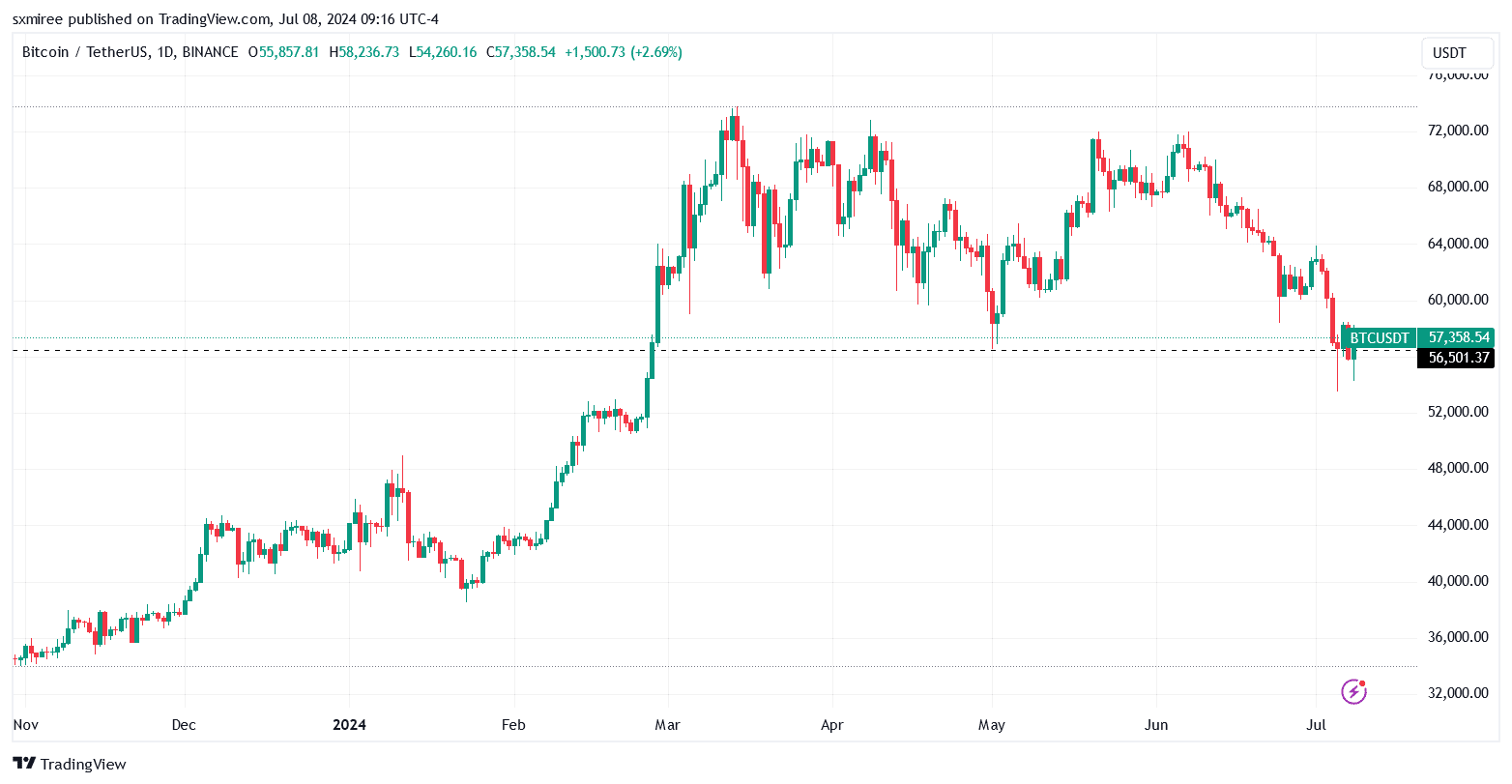

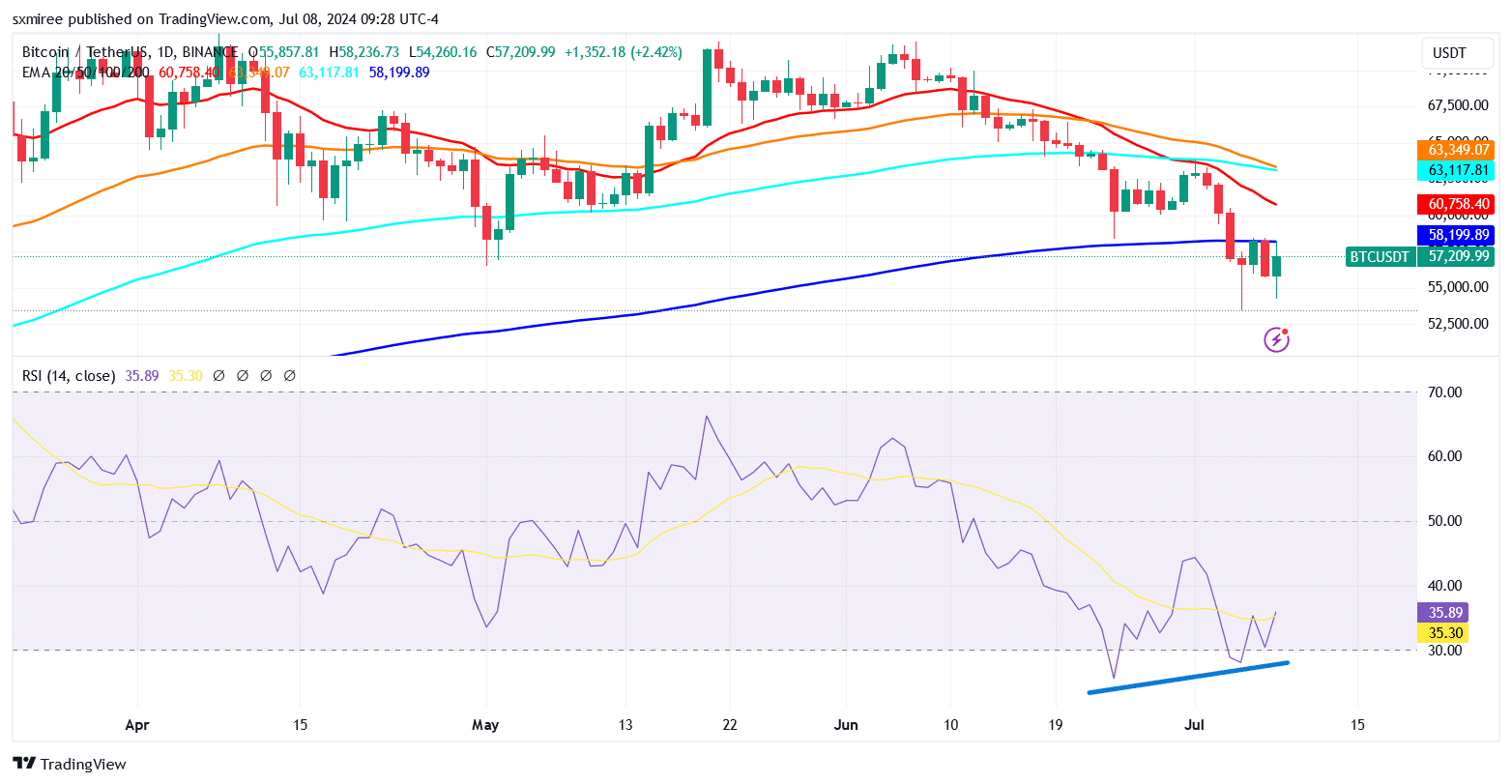

Bitcoin’s extended declines have brought into focus a double-top setup on the daily chart.

As a crypto investor, when I see the price of an asset forming a double top pattern on the chart, it’s a red flag for me. This means that the asset has tried unsuccessfully to break through a significant resistance level twice, and as a result, I believe a bearish reversal is imminent. The asset’s price is likely to decline after these failed attempts.

The price slump ahead of the weekly close confirmed a breakdown out of multi-month consolidation.

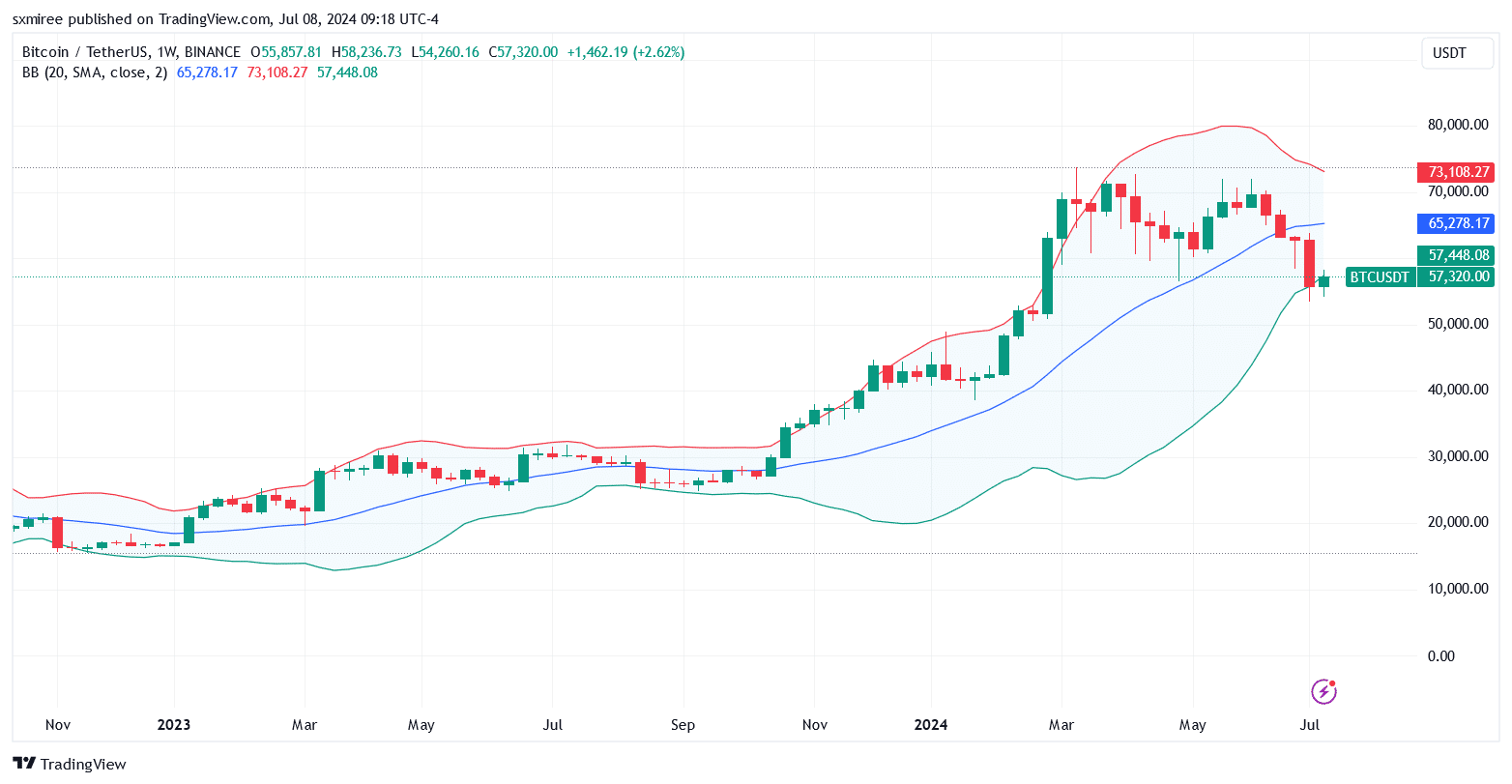

On a weekly basis, Bitcoin finished its trading session below the lower limit of the Bollinger Band indicator, potentially signaling a downward trend and lower future value.

Outside of the price ranges usually signifies robust trends, while a narrowing range implies low market volatility and possible imminent price breaks.

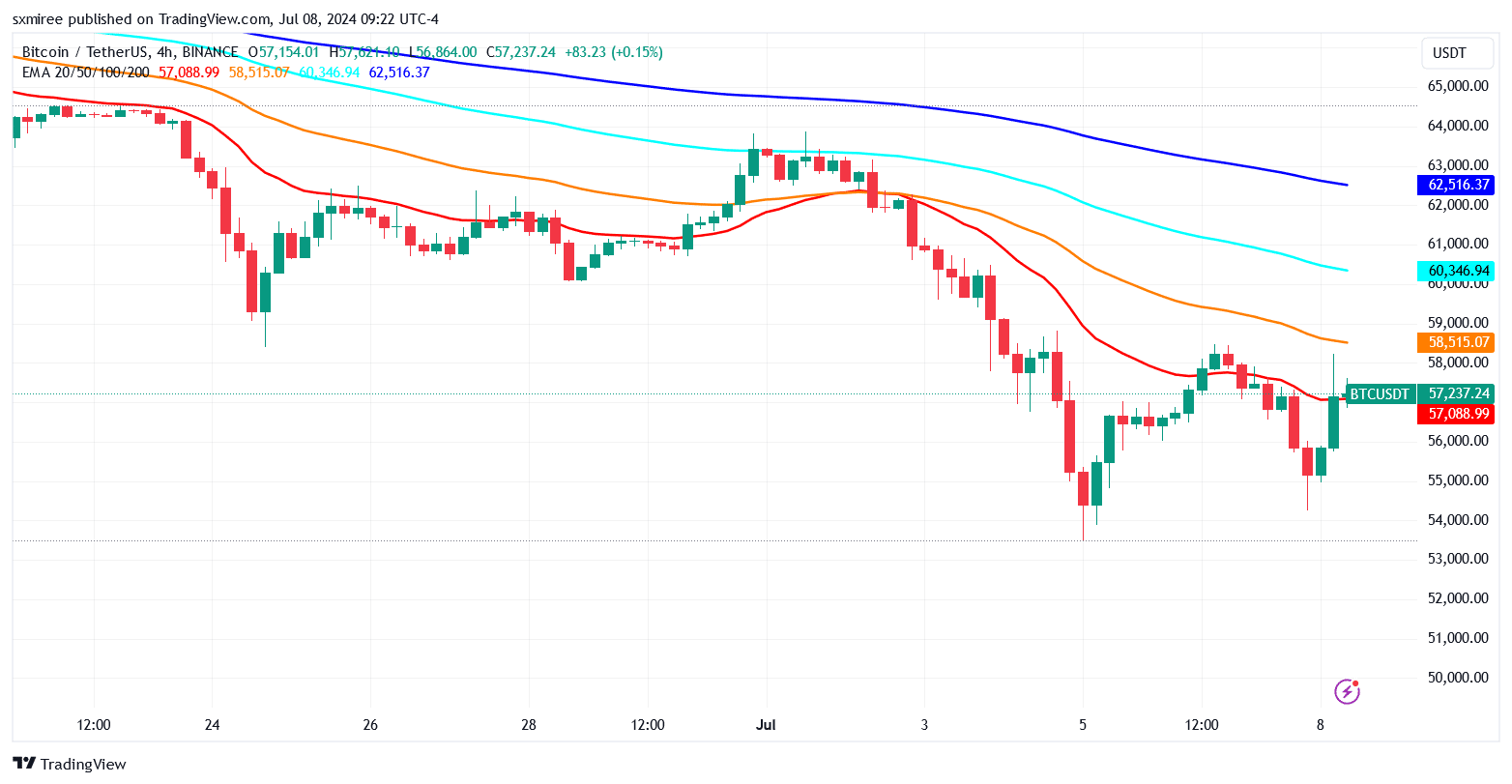

At the moment of reporting, Bitcoin was noticeably selling under its 50-, 100-, and 200-day exponential moving averages (EMAs) on the 4-hour graph, benefiting bearish investors.

In order to correct the current situation, bulls must cause the price to surpass the leveling 20-day Exponential Moving Average (EMA) on the 4-hour price chart.

Positive divergence on the daily RSI

The daily chart of Bitcoin’s Relative Strength Index dipped beneath 30 around the 4th and 5th of July, representing the second occurrence of this indicator entering oversold territory within a three-week span.

As an analyst, I’ve noticed an intriguing development in the daily RSI readings for Bitcoin (BTC). Although the price has been trending downwards, the divergence between the price action and the RSI indicates a potential shift in momentum. Specifically, this bullish divergence suggests that while BTC may continue to decline in price, the rate of decrease could be decelerating based on the RSI readings.

From a historical perspective, I’ve noticed that daily bullish divergences tend to occur more frequently around the formation of bottoms in the market. Currently, the Relative Strength Index (RSI) stands at 36.04 as I write this.

Macro narratives

As a researcher studying the intersection of macroeconomics and cryptocurrency markets, I’m closely monitoring the upcoming releases of key economic indicators in the United States. Specifically, I’m focusing on the Consumer Price Index (CPI) and Producer Price Index (PPI), which are scheduled to print this week. These indices measure inflation at the consumer and producer levels, respectively. The market reactions to these data points could potentially challenge the resolve of crypto traders, as any significant shifts in inflation expectations can influence the value of digital assets.

Experts at Citi Research predict that the Federal Reserve may reduce interest rates by a total of 2 percentage points in each of the next eight consecutive meetings, starting in September 2022 and continuing through July 2025.

The rate cuts extending to summer will lower the benchmark to 3.25%- 3.5% range.

In simpler terms, when interest rates decrease, it becomes less expensive for investors to borrow money. This added liquidity often leads investors to explore riskier assets, such as cryptocurrencies, in search of greater returns.

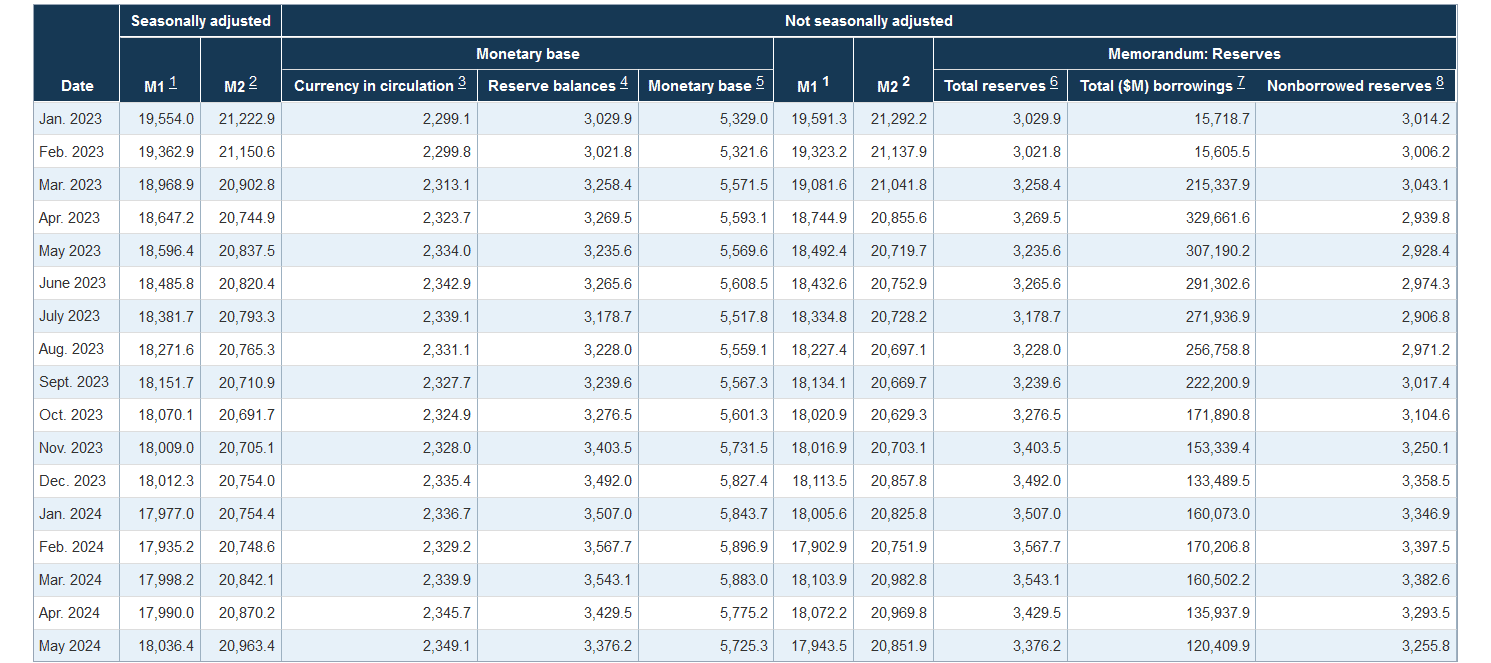

The amount of money in circulation in the United States, representing cash, checking deposits, and savings deposits collectively referred to as M2 money supply, has been expanding significantly.

The latest update on June 25th revealed that the U.S. M2 money stock amounted to $20.96 trillion, marking an increase from $20.87 trillion reported for May 28th (April figure), and $20.84 trillion as of April 23rd (March data).

As a crypto investor, I’ve noticed that the expanding M2 supply is a sign of heightened liquidity in the economy. This trend could result in higher inflation rates, which may lead investors to seek refuge in non-traditional assets such as cryptocurrencies. Consequently, demand for digital currencies might increase, potentially pushing their prices upward.

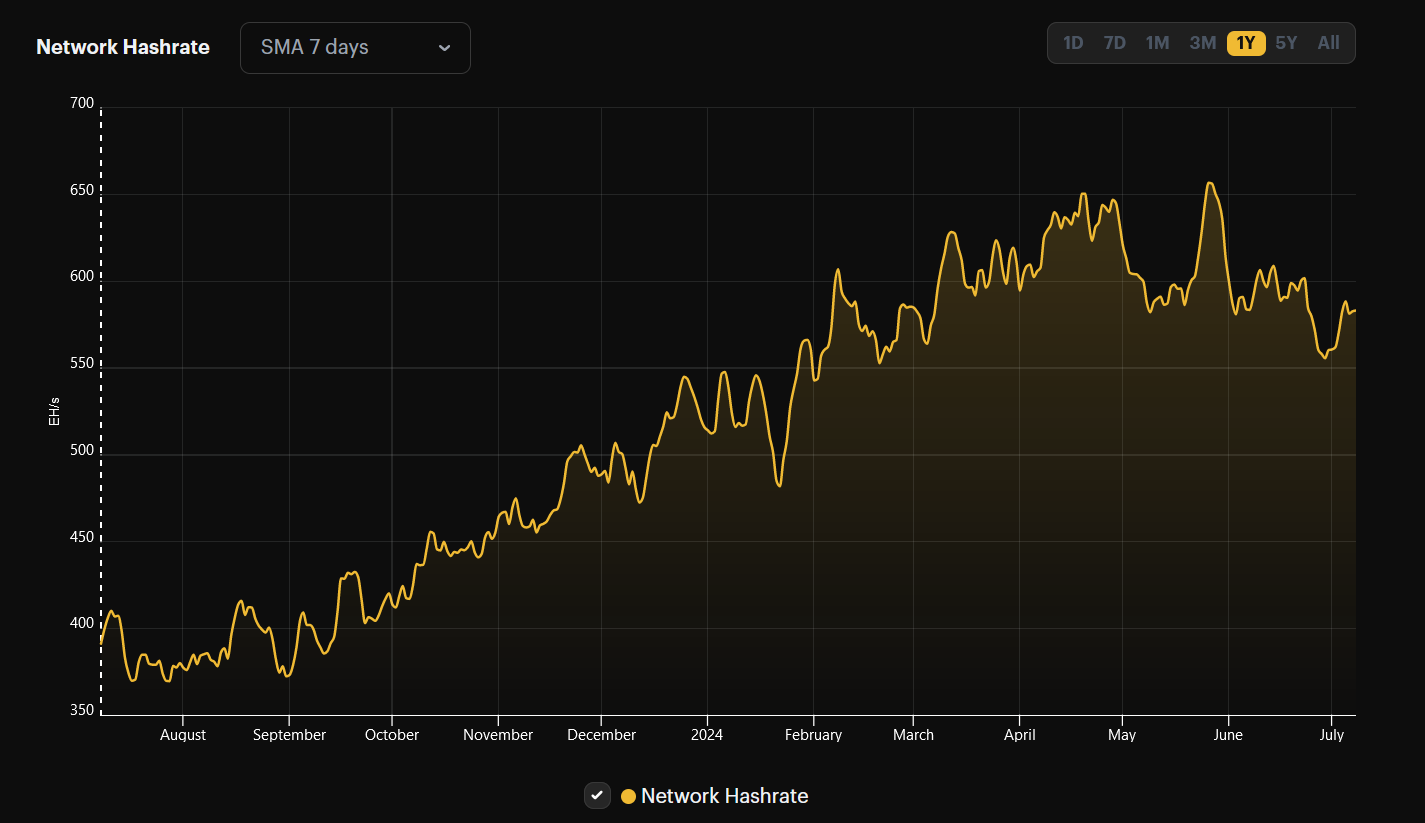

Miner capitulation signals a potential market bottom

As an analyst, I’ve observed that the Bitcoin network hash rate (simple moving average 7-day) experienced a significant decline throughout the month of June. The peak hash rate was reached on May 27th at 656 EH/s, but by June 30th, it had dropped to a four-month low of 556 EH/s.

As a data analyst, I would interpret a lower hash rate as a sign that some miners have stopped their operations due to decreased profits. The hash rate refers to the total computing power employed in mining Bitcoin or processing transactions on its network. When this power decreases, it indicates that some of the machines contributing to this collective effort have been turned off.

Read Bitcoin’s [BTC] Price Prediction 2024-2025

The steady drop in mining hash rate implies that certain miners may be reducing their level of activity.

The sale of mines and cuts in operations by miners have historically indicated that mining prices have reached their lowest point in the cycle and could potentially rebound soon.

Read More

- Gold Rate Forecast

- Discover Liam Neeson’s Top 3 Action Films That Will Blow Your Mind!

- OM PREDICTION. OM cryptocurrency

- Kanye West Praises Wife Bianca’s Daring Naked Dress Amid Grammys Backlash

- Nintendo Switch 2 Price & Release Date Leaked: Is $449 Too Steep?

- Netflix’s New Harlan Coben Series Features Star-Studded Cast You Won’t Believe!

- Meet the Stars of The Wheel of Time!

- Why Gabriel Macht Says Life Abroad Saved His Relationship With Family

- Where Teen Mom’s Catelynn Stands With Daughter’s Adoptive Parents Revealed

- EUR PKR PREDICTION

2024-07-09 13:44