-

A bullish double-bottom price action pattern has been spotted on Ethereum in the 4-hour time frame.

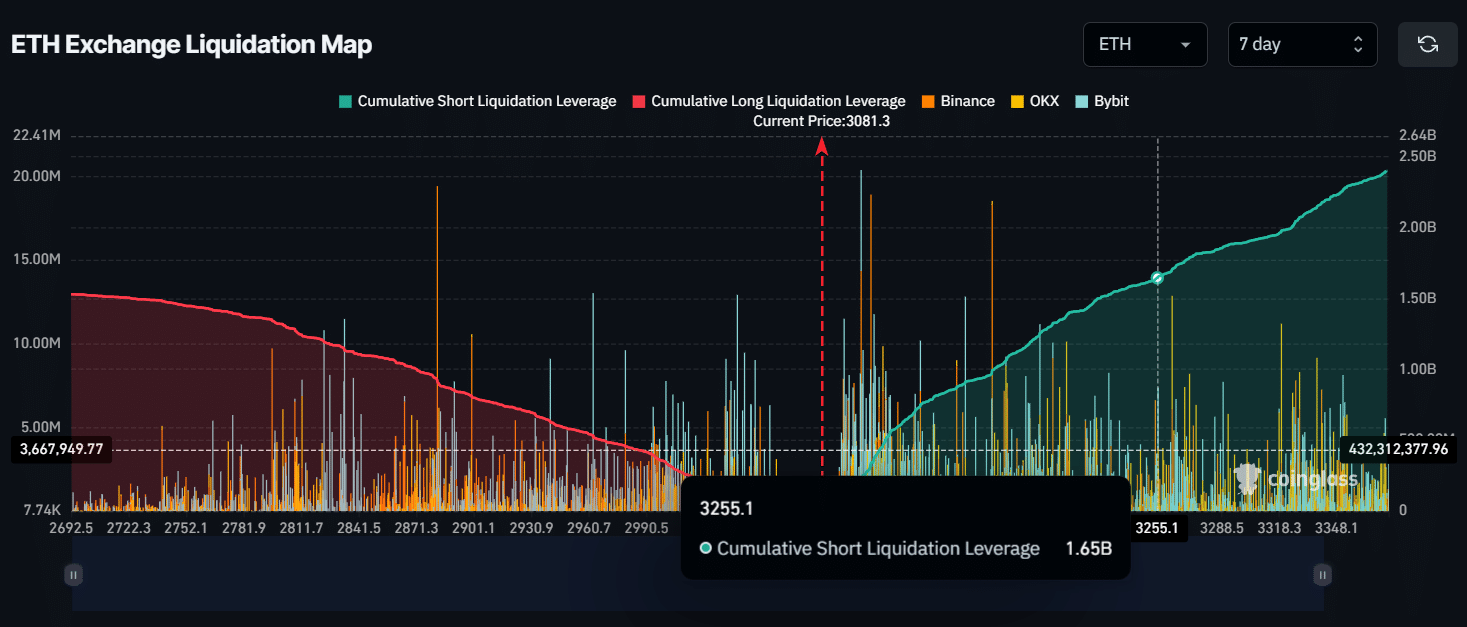

Short sellers are not expecting ETH to reach the $3,250 level, if it does reach this level, $1.65 billion worth of short positions will liquidate.

As a seasoned crypto investor with a keen eye for technical analysis and a solid understanding of market trends, I’m bullish on Ethereum (ETH) based on the recent price action and fundamental developments.

Ethereum, the world’s second-largest cryptocurrency by market capitalization [ETH], has seen a notable price increase of more than 5.5% in response to recent news regarding a potential spot Ethereum ETF approval in the US.

Following the latest ETF development, the crypto market as a whole adopted a greener hue, and investors’ outlook became increasingly optimistic.

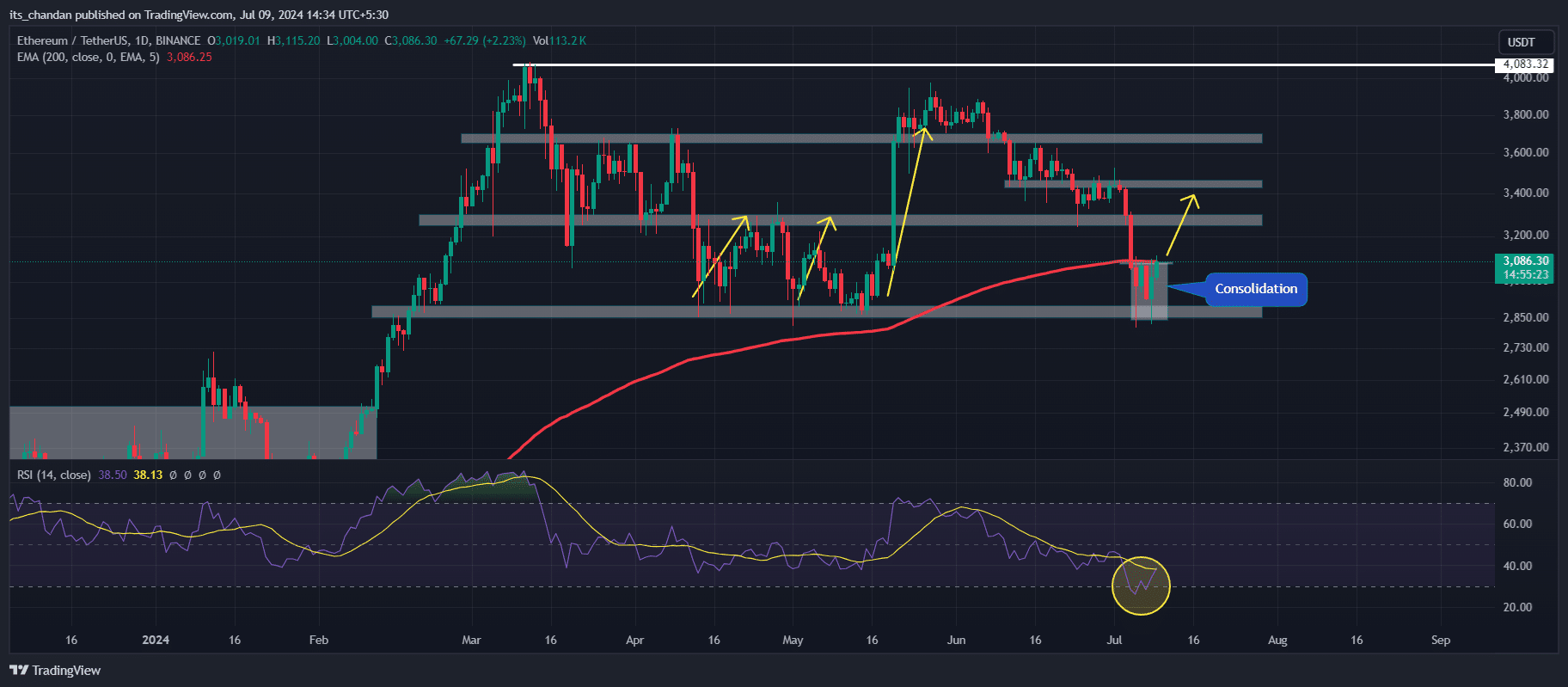

In the past 24 hours, Ethereum’s price has shown significant growth and is now close to touching the 200 Exponential Moving Average (EMA). Furthermore, Ethereum needs only one price candle to surpass this average, signaling a potential bullish trend.

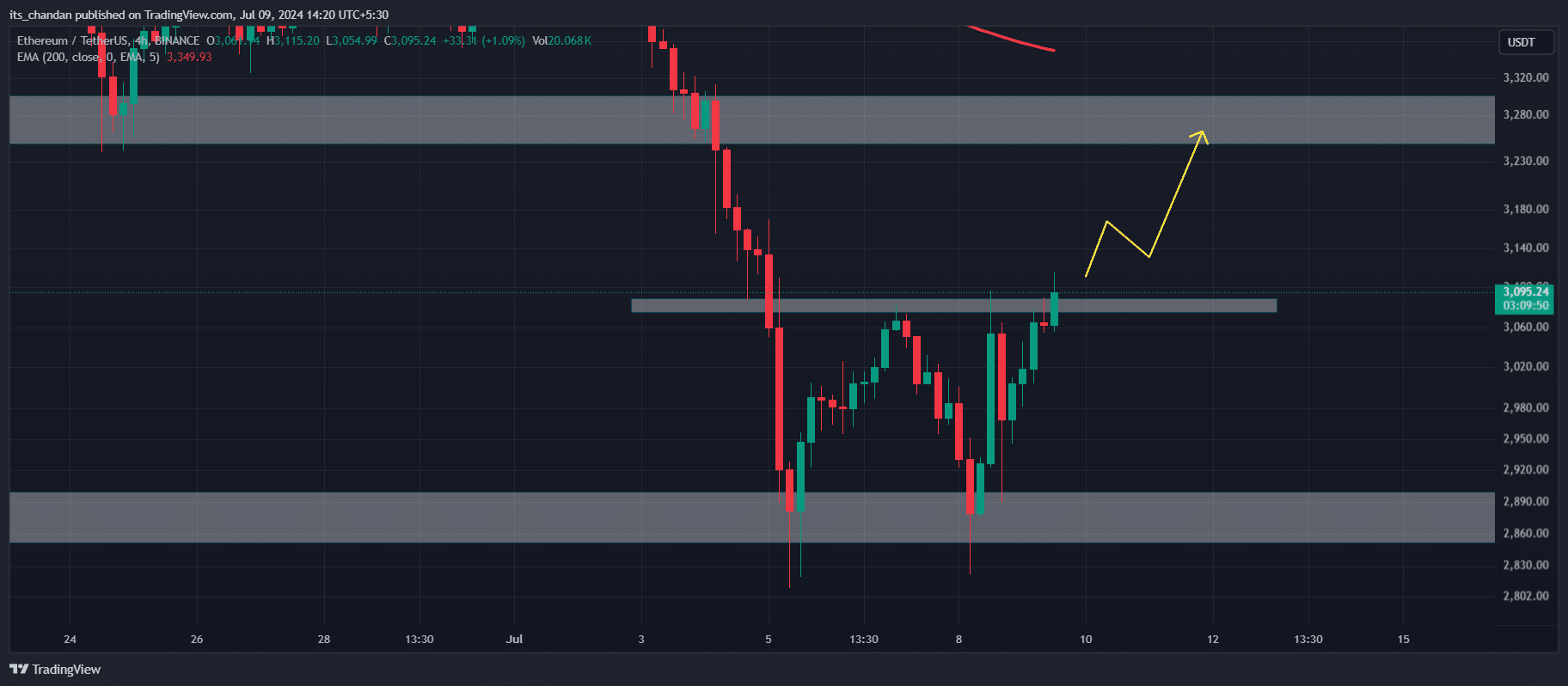

Ethereum bullish double bottom breakout

As a technical analysis expert, I’ve noticed some promising signs for Ethereum (ETH). In the past 4-hour chart, ETH formed a double-bottom price pattern, which is typically a bullish indication. Furthermore, this pattern emerged close to the significant resistance level at $3,085.

If the breakout occurs and the 4-hour chart’s closing price rises above the resistance line (neckline), Ethereum has a strong chance of reaching prices around $3,250 and possibly even $3,300.

Additionally, the Ethereum price chart’s optimistic outlook is further reinforced by the RSI indicator. Currently situated in the oversold region, the RSI suggests an impending rebound.

Although showing signs of a bullish reversal with a double-bottom pattern, Ethereum has been trading between the prices of $2,850 and $3,080 over the past five days, forming a narrow range.

This consolidation is occurring at a crucial level of support. A breach of this zone could trigger substantial price movement, whether upward or downward.

Ether’s strong support level and liquidation area

As a researcher examining Ethereum’s price history since April 2024, I’ve observed that ETH has surpassed the $3,250 mark and the $3,670 mark on more than four occasions. Irrespective of market volatility or external factors, my analysis reveals that Ethereum prices have a tendency to rebound towards these two specific price points based on the daily chart data.

This time traders expect a similar price surge from this level.

After the recent ETF-related developments, there has been a significant increase of over 5.5% in Ethereum’s Open Interest (OI) as per the latest figures from CoinGlass, signaling a resurgence of investor and trader engagement and faith in ETH.

During this period, traders sold off a significant $59.94 million worth of their holdings. Among these were bulls who sold $23.75 million in long positions, while short sellers disposed of a substantial $36.16 million in short positions, according to CoinGlass figures.

Should Ethereum (ETH) reach a price of around $3,250 in the imminent future, approximately $165 billion worth of short positions will be forced to close. Over the past week, short sellers have held the belief that ETH would not surpass this threshold, as suggested by the most recent liquidation figures from CoinGlass.

Read Ethereum’s [ETH] Price Prediction 2024-2025

As of now, Ethereum was approaching the $3,075 mark, and there had been a notable increase of 5.5% within the previous 24-hour period.

Over a prolonged timeframe, Ethereum (ETH) has experienced a decline of almost 10% in terms of value. On the other hand, during the past month, Ethereum has dropped by approximately 16%.

Read More

- OM/USD

- Carmen Baldwin: My Parents? Just Folks in Z and Y

- Solo Leveling Season 3: What You NEED to Know!

- Jellyrolls Exits Disney’s Boardwalk: Another Icon Bites the Dust?

- Disney’s ‘Snow White’ Bombs at Box Office, Worse Than Expected

- Solo Leveling Season 3: What Fans Are Really Speculating!

- Despite Strong Criticism, Days Gone PS5 Is Climbing Up the PS Store Pre-Order Charts

- Jelly Roll’s 120-Lb. Weight Loss Leads to Unexpected Body Changes

- Joan Vassos Reveals Shocking Truth Behind Her NYC Apartment Hunt with Chock Chapple!

- Netflix’s Dungeons & Dragons Series: A Journey into the Forgotten Realms!

2024-07-09 19:04