- Bonk saw the most price growth in the past 24 hours.

- If the current trend continues, its price might rally to $0.000027.

As an experienced analyst, I’ve been closely monitoring the crypto market, and Bonk (BONK) has caught my attention with its impressive price growth in the past 24 hours. According to data from CoinMarketCap, BONK saw the most significant price increase among all cryptocurrencies, up by 12%, trading at $0.000026 at press time.

As a crypto investor, I’ve noticed an intriguing development in the Solana ecosystem. Specifically, Bonk (BONK), a popular meme coin built on the Solana blockchain, has experienced remarkable growth in the last 24 hours. At the current moment, BONK is trading at $0.000026. Surprisingly enough, its price has surged by an impressive 12% during this period.

Based on information from CoinMarketCap, there was a significant increase in both the price and trading activity for the token. The daily trading volume reached a total of $522 million during the specified timeframe, marking a 67% rise compared to previous periods.

BONK spikes in activity

A significant price increase of over ten percent for BONK led to a surge in derivative market transactions.

As a researcher studying the cryptocurrency market, I’ve observed that the trading volume amounted to $206 million at the current moment, based on my data sources. Surprisingly, I found that this figure represented a significant surge of 77% within the preceding 24-hour timeframe, according to Coinglass.

Likewise, the memecoin’s Open Interest spiked by 24%, according to the data provider.

One way to rephrase this explanation in a conversational and clear manner is: Open Interest represents the current tally of open derivative contracts, like Options and Futures, which have yet to be settled. An uptick in Open Interest implies that an increased number of traders are initiating new positions.

When an asset’s open interest and price rise, this can be interpreted as a bullish sign. This typically indicates the robustness and ongoing nature of an upward trend.

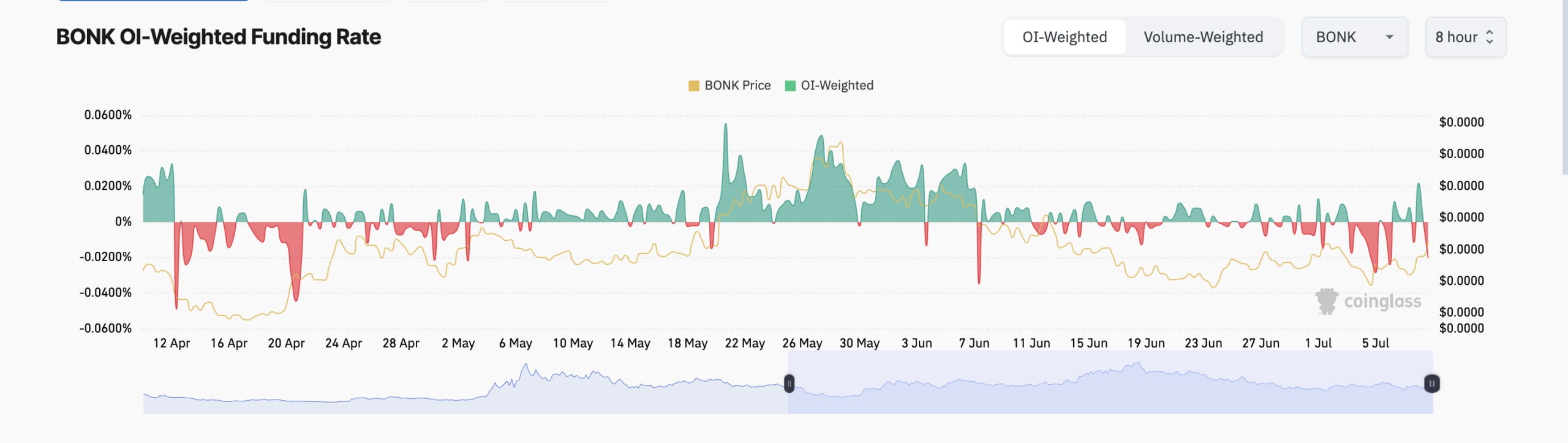

However, BONK’s Futures traders do not seem convinced that the price rally would continue.

At the current moment, the Funding Rate for BONK Futures trading on various cryptocurrency platforms was recording a figure of -0.02%. Consequently, numerous traders opted to take up short positions due to this negative rate.

In the context of perpetual futures contracts, funding rates serve the purpose of adjusting the prices to keep the contract’s value aligned with the current market price (spot price) of the underlying asset.

When an asset’s Funding Rate is running at a loss, it signifies that a larger number of traders are entering the market to sell the asset in anticipation of a price drop, compared to those aiming for a price increase.

Bullish sentiment continues to climb

As BONK‘s Futures traders went short on the asset, there was a growing optimistic sentiment towards the meme coin in its spot market.

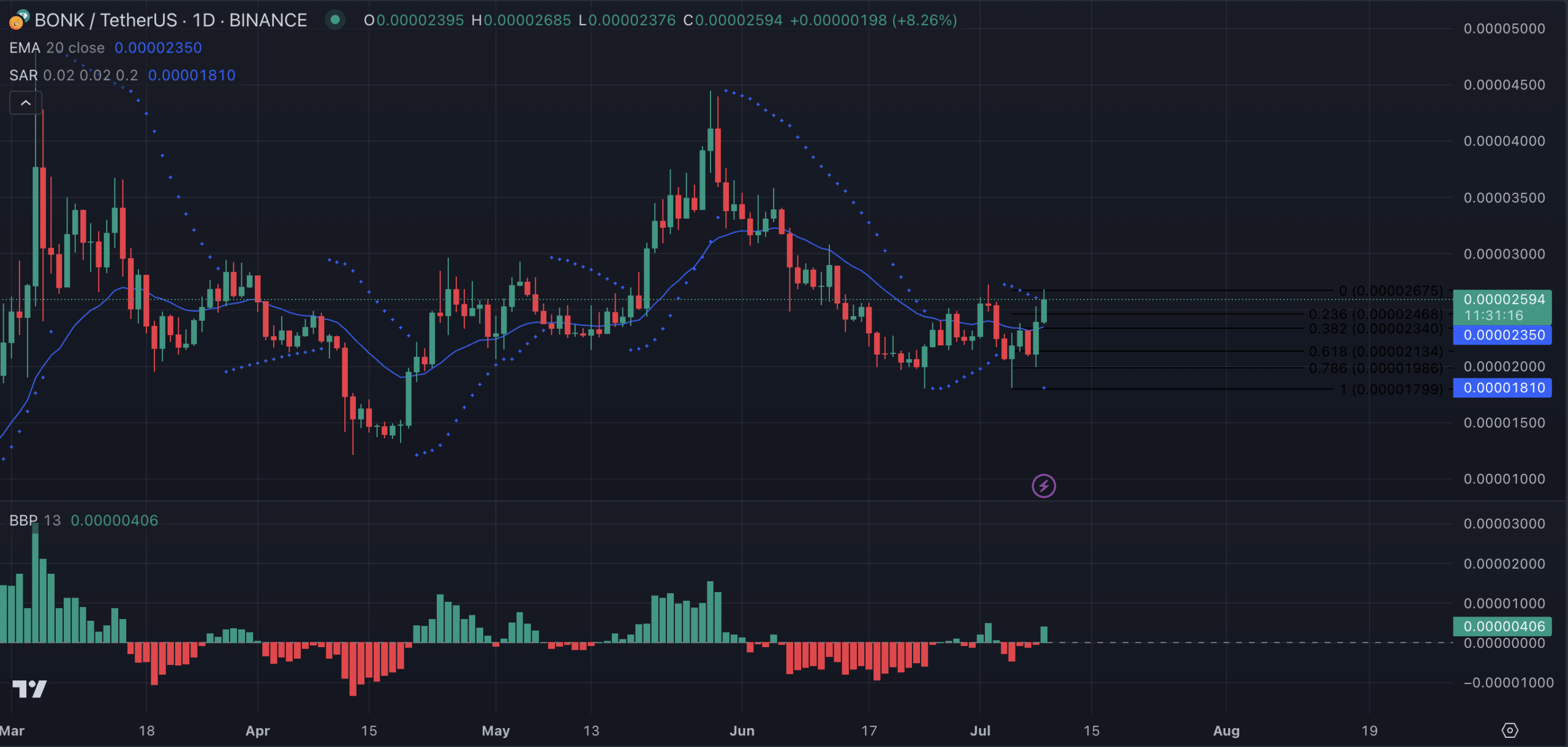

The Parabolic SAR indicator’s dot dipped beneath the token’s price for the first time since the 4th of July.

As a crypto investor, I use this technical analysis tool to help me determine the potential direction of trends and spot reversal points for my assets. When the indicator’s dotted lines are positioned beneath the asset’s current price, it signifies that the market is experiencing an uptrend.

It indicates that the asset’s price is rising, and the uptrend may continue.

Read Bonk’s [BONK] Price Prediction 2024-25

If this trend continues, BONK’s price may rally to $0.000026.

However, if selling pressure gains momentum, its value may drop to $0.000024.

Read More

- OM/USD

- Carmen Baldwin: My Parents? Just Folks in Z and Y

- Jellyrolls Exits Disney’s Boardwalk: Another Icon Bites the Dust?

- Solo Leveling Season 3: What You NEED to Know!

- Disney’s ‘Snow White’ Bombs at Box Office, Worse Than Expected

- Solo Leveling Season 3: What Fans Are Really Speculating!

- Despite Strong Criticism, Days Gone PS5 Is Climbing Up the PS Store Pre-Order Charts

- Jelly Roll’s 120-Lb. Weight Loss Leads to Unexpected Body Changes

- The Perfect Couple season 2 is in the works at Netflix – but the cast will be different

- Netflix’s Dungeons & Dragons Series: A Journey into the Forgotten Realms!

2024-07-10 06:15