-

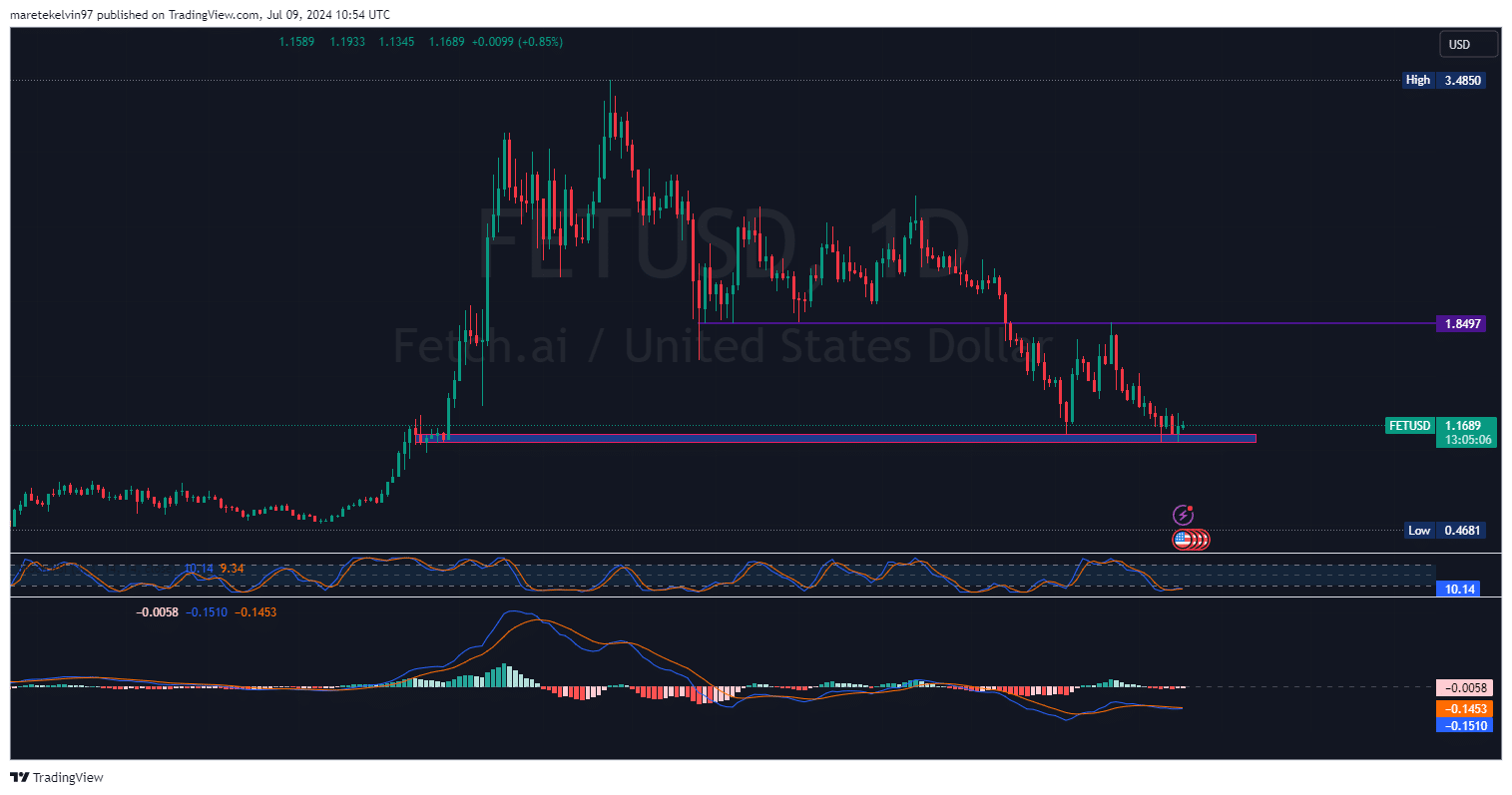

FET’s price has dipped by 40% in the past 14 days to a key support level at $1.0569.

Metrics indicate mixed signals for potential recovery

As a crypto investor with some experience under my belt, I’ve seen my fair share of market fluctuations. The recent 40% dip in FET‘s price within the past 14 days is a reminder of the volatile nature of this asset class. However, it’s important not to panic and instead focus on the potential signs of recovery.

Over the past 14 days, the value of the Fetch.ai [FET] token has dropped by approximately 40%, reaching a current price point of $1.0569. This level serves as a significant support for the token, and if it holds, the token’s near-term trend could potentially improve.

Although the latest trend has seen a decline, it’s worth noting that there could be signs of FET moving into an accrual stage. The value has stabilized close to the $1.0569 mark of support, with reduced selling intensity observable on shorter time scales.

If the current situation unfolds as expected, it may pave the way for a rebound, given that the overall market circumstances continue to be advantageous.

The RSI with stochastic elements indicates that the market may experience a turnaround towards a bullish trend as it currently resides in the oversold region.

Metrics paint a mixed picture for FET

According to data from Santiment, there are some interesting developments for FET.

As a researcher studying the progress of this project, I’ve noticed that there have been notable ups and downs in terms of development activity lately. By monitoring GitHub commits and other relevant actions, we can gain valuable insights into these fluctuations and potentially predict future trends.

Observing multiple surges in Fetch.ai’s development sector might be interpreted as a promising indication, possibly counterbalancing some of the downward trends in its pricing.

As a researcher studying blockchain technology, I’ve observed that periods of heightened network activity are linked to greater price instability. Specifically, active addresses have been found to contribute to increased volatility in cryptocurrency markets.

Despite the general decline in interest, there remains substantial investor demand for FET.

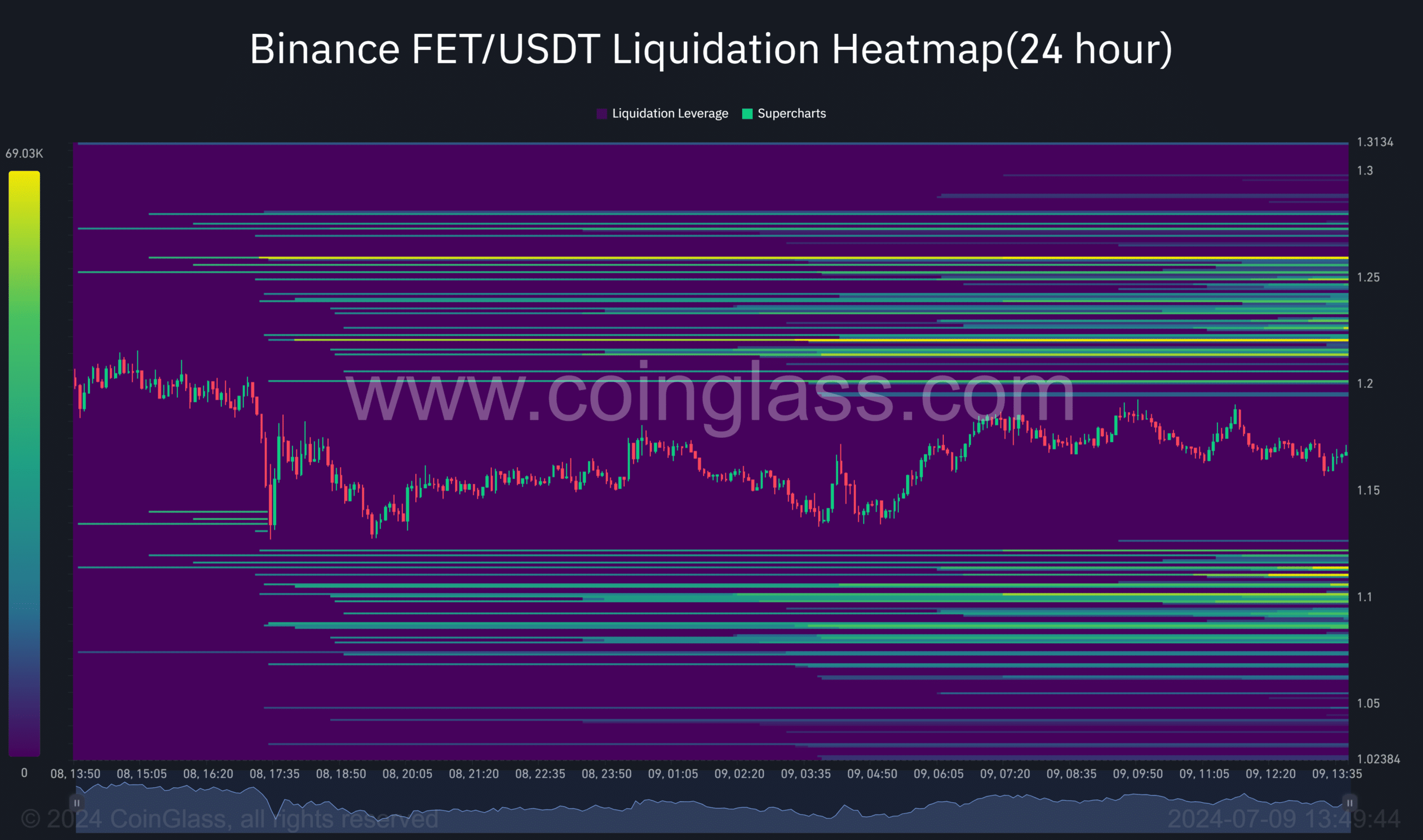

Based on a more in-depth examination of the liquidation heatmap statistics from Coinglass, it appears that the crypto market is currently evenly balanced, exhibiting neither a strong bullish nor bearish trend.

Significant shifts in FET testing support levels might lead to a chain reaction of liquidations, causing prices to fluctuate significantly in both directions. The clustering of these liquidation thresholds near the current price indicates a heightened risk of market instability.

To see a rise in FET prices, it must first gain sufficient buying power to shatter the resistance level and leave behind the consolidation period. On the other hand, if the price falls beneath the present support, there is a risk of more declines.

Read Fetch.ai [FET] Price Prediction 2024-25

As a researcher examining the recent trends of FET, I acknowledge the setbacks it has experienced lately. However, reaching a pivotal support level may signify a shift in fortunes for this asset.

The next few days are expected to significantly influence FET‘s near-term to mid-term prospects, as it remains uncertain whether these developments will lead to a robust rebound or continued downturn.

Read More

- OM/USD

- Carmen Baldwin: My Parents? Just Folks in Z and Y

- Jellyrolls Exits Disney’s Boardwalk: Another Icon Bites the Dust?

- Solo Leveling Season 3: What You NEED to Know!

- Jelly Roll’s 120-Lb. Weight Loss Leads to Unexpected Body Changes

- Despite Strong Criticism, Days Gone PS5 Is Climbing Up the PS Store Pre-Order Charts

- Solo Leveling Season 3: What Fans Are Really Speculating!

- Joan Vassos Reveals Shocking Truth Behind Her NYC Apartment Hunt with Chock Chapple!

- Netflix’s Dungeons & Dragons Series: A Journey into the Forgotten Realms!

- The Perfect Couple season 2 is in the works at Netflix – but the cast will be different

2024-07-10 11:04