- USDC trading volume surged to $23 billion in 2024.

- Increased regulatory hurdles increased demand for regulated stablecoins.

As a seasoned crypto investor with a keen interest in market trends and regulatory developments, I’ve witnessed firsthand the surge in demand for regulated stablecoins like USDC. The increased regulatory scrutiny and legal hurdles faced by altcoins have underscored the importance of compliance in this rapidly evolving industry.

As a market analyst, I’ve noticed that the cryptocurrency sector has been undergoing more regulatory oversight and scrutiny recently. Notable altcoins like Ripple [XRP], Uniswap [UNI], and Monero [XMR] have encountered legal challenges in this context.

As a researcher studying the impact of regulatory changes on the cryptocurrency market, I’ve observed an intriguing trend. The stricter regulations implemented in various parts of the world have led to a surge in demand for compliant stablecoins like US Dollar Coin [USDC]. This is because these stablecoins provide a more regulated and reliable alternative to other cryptocurrencies, making them an attractive option for investors seeking to navigate the complex regulatory landscape.

In 2023, I observed USDC’s trading volume at approximately $9 billion. However, by 2024, this figure had significantly increased to an astonishing $23 billion. The primary reason for this exponential growth stems from the heightened demand among major traders for legally recognized stablecoins. As a result, regulated stablecoins like USDC have emerged as a preferred alternative.

As a researcher studying the trends in the digital currency market, I’ve observed an exciting development: USDC’s market share has reached unprecedented heights, approaching 14% according to Kaiko’s recent report.

What’s driving USDC’s surge

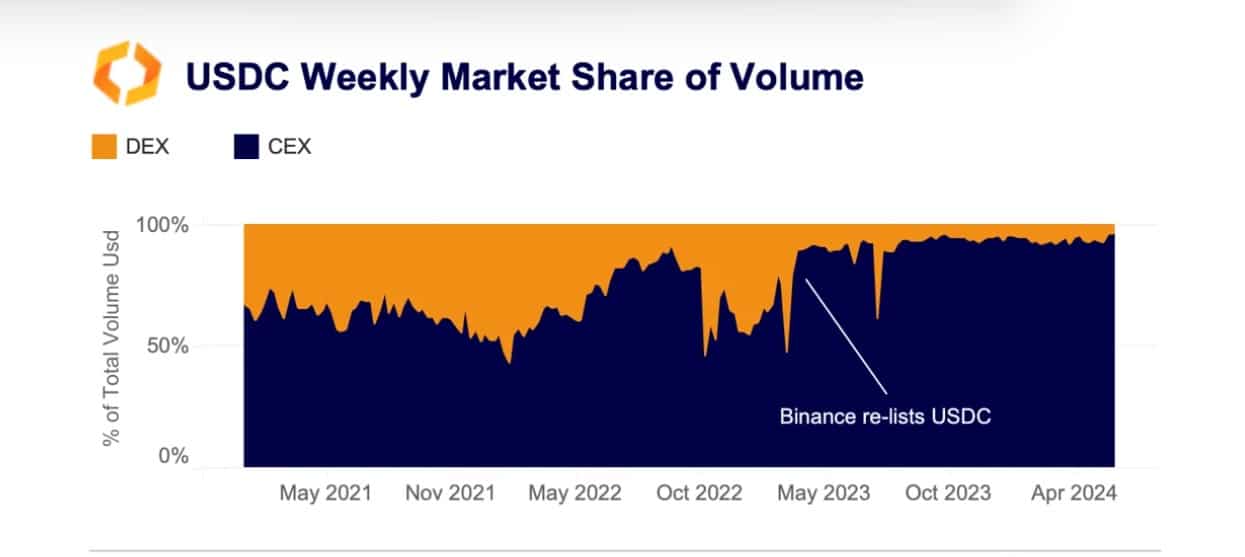

As a crypto investor, I’ve noticed that several elements have significantly influenced USDC’s trading activity and market dominance. Based on data from Kaiko, I believe the expansion of Centralized Exchanges (CEXs) is a major contributor to USDC’s increased trading volume.

As a crypto investor, I’ve noticed an impressive increase in USDC’s market dominance on centralized exchanges (CEXs) since March 2023. The report indicates that USDC’s share rose from a 60% hold to a substantial 90%.

Similarly, perpetual futures contracts have significantly contributed to the surge in trading activity. According to Kaiko, the volume of Bitcoin [BTC] perpetuals denominated in USDC increased from 0.3% to 3.6%, while Ethereum [ETH] perpetuals saw a rise from 0.3% to 6.8%.

The rising trend of perpetual settlements indicates a shift in investor attitudes towards more heavily regulated stablecoins.

MiCA: The game changer

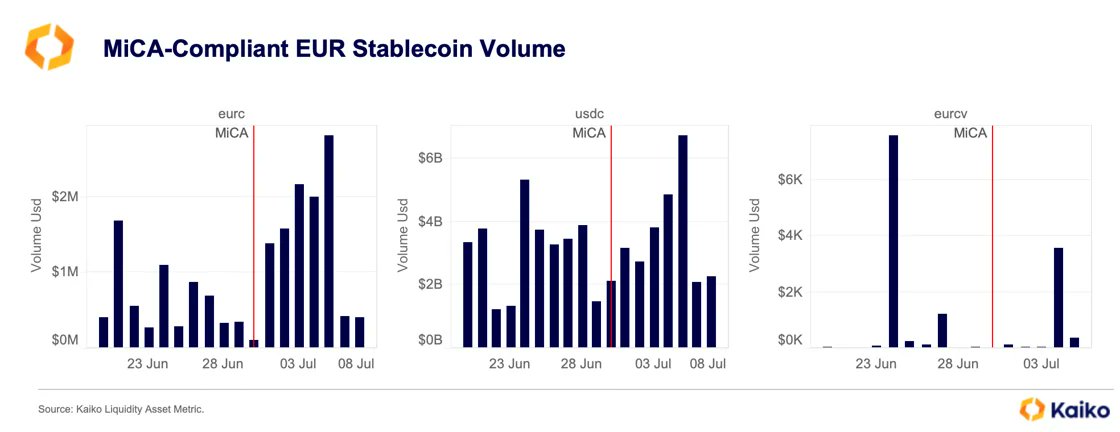

On June 30th, Circle announced that it had fully adhered to the European MiCA (Markets in Crypto-assets) regulation. This significant milestone served as a foundation for other players in Europe’s stablecoin sector.

As a crypto investor, I’ve noticed that after Circle introduced their stablecoin offerings, other firms began to follow in their footsteps. One of these firms is Societe Generale’s Forge, which primarily deals with EURO convertible offerings.

A blueprint for adherence by these companies came forth, mandating steps for other entities, including the sharing of whitepapers, establishment of governance structures, effective reserve management, and observance of prudential guidelines.

Following Circle’s announcement that it had met the MiCA regulations, there was a significant surge in trading activity for EURC and USDC on a daily basis.

Similarly, Société Générale observed an uptick in trading activity. Consequently, the heightened trading volume highlighted the significant influence of MiCA compliance on the rising demand for USDC.

As an analyst, I would put it this way: The current regulatory landscape enables large investors, including institutions, to engage in derivatives trading while adhering to their specific guidelines.

Institutional investors entering the USDC market will significantly boost its popularity and trading activity.

As a crypto investor, I believe that the demand for regulated stablecoins like USDC is on the rise. With users increasingly trusting these assets for their stability and regulatory compliance, I anticipate a significant increase in trading volume for these coins.

Unregulated stablecoins currently hold the majority of the market share, but the outlook is optimistic for regulated stablecoins as prominent cryptocurrency exchanges like Binance (BNB), OKX, Kraken, and Bitstamp progressively limit and remove their unregulated counterparts.

Read More

- PI PREDICTION. PI cryptocurrency

- WCT PREDICTION. WCT cryptocurrency

- Guide: 18 PS5, PS4 Games You Should Buy in PS Store’s Extended Play Sale

- LPT PREDICTION. LPT cryptocurrency

- Gold Rate Forecast

- Shrek Fans Have Mixed Feelings About New Shrek 5 Character Designs (And There’s A Good Reason)

- SOL PREDICTION. SOL cryptocurrency

- FANTASY LIFE i: The Girl Who Steals Time digital pre-orders now available for PS5, PS4, Xbox Series, and PC

- Playmates’ Power Rangers Toyline Teaser Reveals First Lineup of Figures

- Solo Leveling Arise Tawata Kanae Guide

2024-07-11 04:40