-

Purchase sparked renewed interest in Bitcoin, with a clear support around $57,493

BTC might struggle to hit $60,000 due to reduced network activity

As a seasoned crypto investor with several years of experience under my belt, I’m closely monitoring the recent developments in Bitcoin’s price action. The large purchase of 10,000 BTC by an undisclosed buyer and the surge in spot Bitcoin ETF inflows have renewed my interest in the cryptocurrency. The support around $57,493 is clear, and although hitting $60,000 might be a struggle due to reduced network activity, I remain optimistic about its potential.

As a researcher, I’ve come across intriguing information regarding recent Bitcoin transactions. Specifically, following a price drop to $54,000 on July 9th, an active market participant reportedly acquired a large batch of 10,000 coins, equating to a significant investment of approximately $540 million. This revelation was shared by Ali Martinez, a respected industry analyst at X.

After a brief dip, I observed the price of Bitcoin rebounding and reaching $58,000. This occurrence is characteristic of a “buy the dip” strategy, where investors view price declines as opportunities to acquire assets at reduced costs, in anticipation of further price increases.

As a crypto investor, I’ve noticed that it wasn’t just me purchasing Bitcoin during that timeframe. Surprisingly, spot Bitcoin ETFs experienced significant inflows as well. In fact, they amassed an impressive 3,760 BTC within a mere three-day span.

Based on information from Farside Investors, the act of directly purchasing Bitcoin and heightened involvement with Bitcoin ETFs collectively indicate a growing belief in the cryptocurrency.

Big buys, huge backing

As of the current moment, Bitcoin was priced at $57,384, marking a modest 0.60% decrease in value over the past 24 hours. Nevertheless, AMBCrypto’s examination indicated that the digital currency could potentially approach the $60,000 threshold.

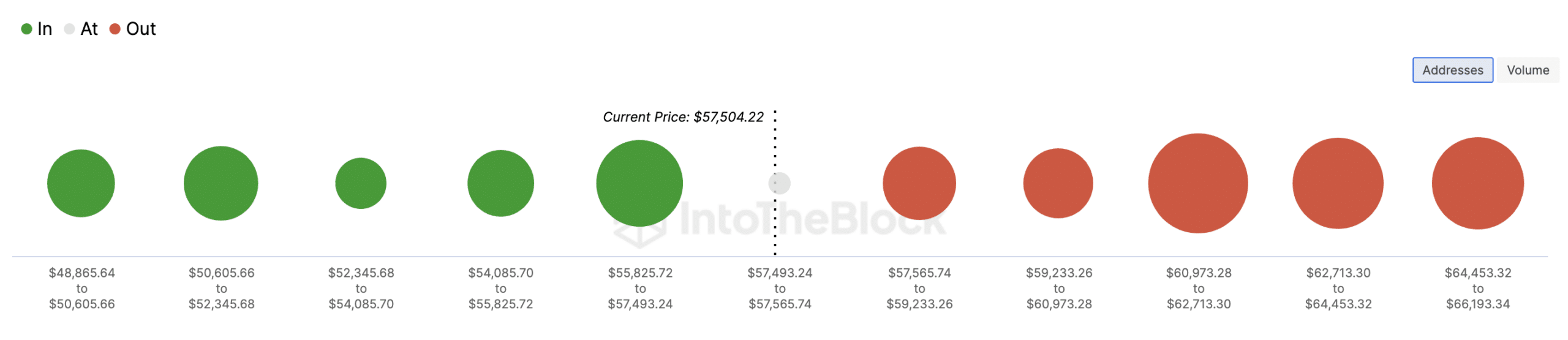

After analyzing the In/Out of Money Around Price (IOMAP) indicator, this was our finding: The IOMAP categorizes addresses depending on whether they were previously profitable or not at a specific price level.

As a researcher studying the behavior of cryptocurrency markets, I can explain that utilizing this metric allows me to determine whether a coin experiences significant backing or opposition at a specific price level. Generally, the more extensive the concentration of wallet addresses within a particular price range, the more robust the support or resistance becomes at that price point.

As a researcher examining data from IntoTheBlock, I’ve discovered that approximately 1.11 million cryptocurrency addresses have acquired around 623,720 Bitcoin. The purchase prices for these Bitcoins fall within the range of $55,825 to $57,493. Remarkably, these addresses currently hold Bitcoin and are in profit.

Contrastingly, approximately 701,630 addresses purchased around 279,210 Bitcoins during the price range of $57,565 to $59,233. Given that a larger number of addresses transacted at lower price points, they have the potential to bolster Bitcoin’s value by serving as a strong support base.

Will buying now yield returns?

If the situation holds true, Bitcoin’s price could potentially exceed the $59,233 resistance level. In such a scenario, the coin’s value may spike above $60,000 in the near future.

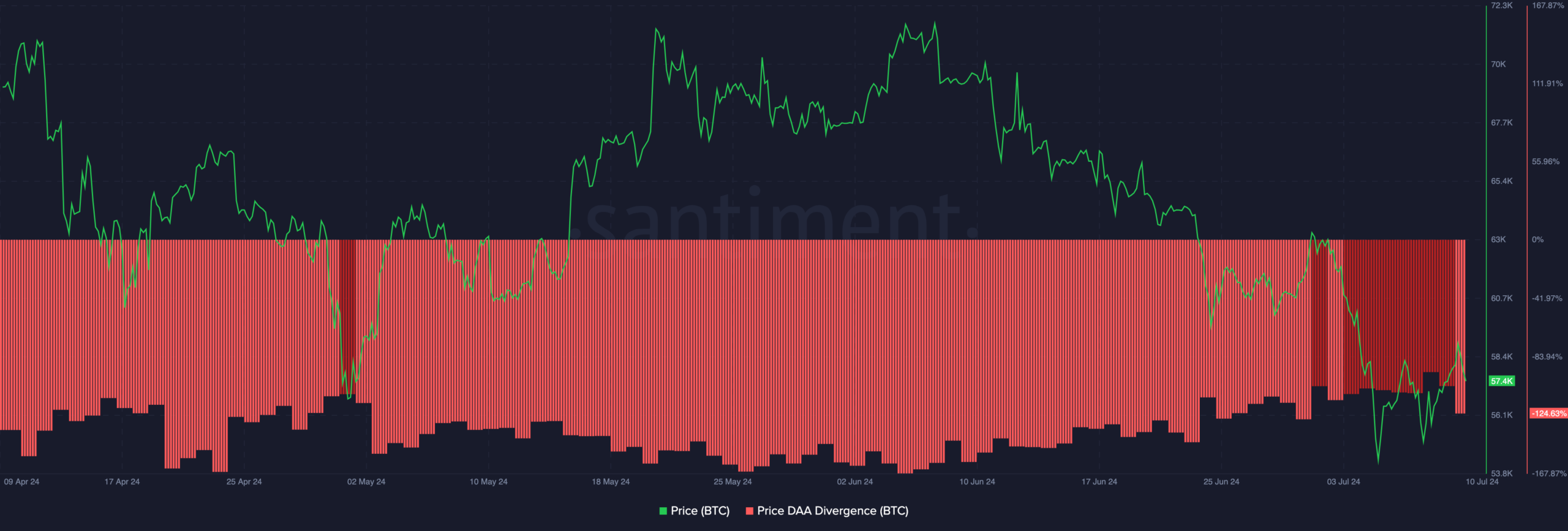

AMBCrypto examined the discrepancy between Bitcoin’s price trends and the number of daily active addresses (DAA). The DAA indicator monitors price movements and the level of engagement, providing buy and sell recommendations based on the differences.

As a crypto investor, I would interpret an increasing price in tandem with a rising DAA (Daily Active Addresses) as a sign of growing value and potential continuity of this trend. Conversely, when the price is declining while network activity is also decreasing, it’s a red flag known as a divergence in negative territory. This suggests that the downturn in Bitcoin’s price may be more significant than the current state of network usage indicates.

Should the current situation persist, it might be difficult for Bitcoin to maintain an upward price trend. On the other hand, if there’s a surge in network activity, Bitcoin could experience a gradual price rise, potentially exceeding $60,000 as it climbs the charts.

Read Bitcoin’s [BTC] Price Prediction 2024-2025

Contrarily, this prediction may be undermined if selling persists. For instance, Germany, a notable distributor of Bitcoin recently, holds approximately $1 billion worth of it. Should it choose to dispose of these coins, Bitcoin could plummet below $58,000 once more.

Read More

- PI PREDICTION. PI cryptocurrency

- WCT PREDICTION. WCT cryptocurrency

- Guide: 18 PS5, PS4 Games You Should Buy in PS Store’s Extended Play Sale

- LPT PREDICTION. LPT cryptocurrency

- Gold Rate Forecast

- FANTASY LIFE i: The Girl Who Steals Time digital pre-orders now available for PS5, PS4, Xbox Series, and PC

- Playmates’ Power Rangers Toyline Teaser Reveals First Lineup of Figures

- Shrek Fans Have Mixed Feelings About New Shrek 5 Character Designs (And There’s A Good Reason)

- SOL PREDICTION. SOL cryptocurrency

- Despite Bitcoin’s $64K surprise, some major concerns persist

2024-07-11 12:08