-

TRON founder Justin Sun purchased 1,614 ETH as the approval of Ethereum ETF nears.

Ethereum’s price action was looking bullish and it may hit the $3,300 level.

As a seasoned crypto investor with a keen interest in Ethereum [ETH], I find Justin Sun’s recent purchase of 1,614 ETH worth $5 million to be an intriguing development. The approval of Ethereum ETFs is indeed a hot topic among investors, and Sun’s massive ETH accumulation is a clear indication that he believes in the potential bullish momentum of Ethereum.

The cryptocurrency market is shifting to a neutral stance following a significant downturn. However, there are signs of recuperation, but the overall investor sentiment towards cryptocurrencies continues to lean towards pessimism.

Many investors have already begun purchasing Ethereum (ETH) in anticipation of the potential approval of spot Ethereum ETFs, rather than waiting for this approval to start their investments.

Justin Sun buys $5 million worth of ETH

As a crypto investor, I came across an intriguing piece of information from the on-chain analytics firm, spotonchain, on July 11th. They announced on X (previously Twitter) that TRON founder Justin Sun had bought approximately 1,614 ETH, which equated to a significant investment of around $5 million.

The average buying price of this massive ETH was somewhere around $3,097.

In addition to his latest ETH acquisition, he has recently transferred a substantial $45 million worth of USDT to Binance, implying a potential forthcoming ETH purchase.

Beginning in February 2024, Sun has consistently bought Ethereum (ETH). Based on available information, he has obtained approximately 362,751 ETH, which is equivalent to around $1.11 Billion at the current average price of $3,047 per token. This was accomplished through three separate digital wallets.

On the other hand, another whale named Golem appears to have stopped dumping ETH.

Furthermore, Justin Sun and Golem have made a noteworthy investment of approximately 40,000 ETH, equivalent to around $124.6 million according to Lookonchain. This latest move by Sun and Golem may indicate an impending bullish trend in the market.

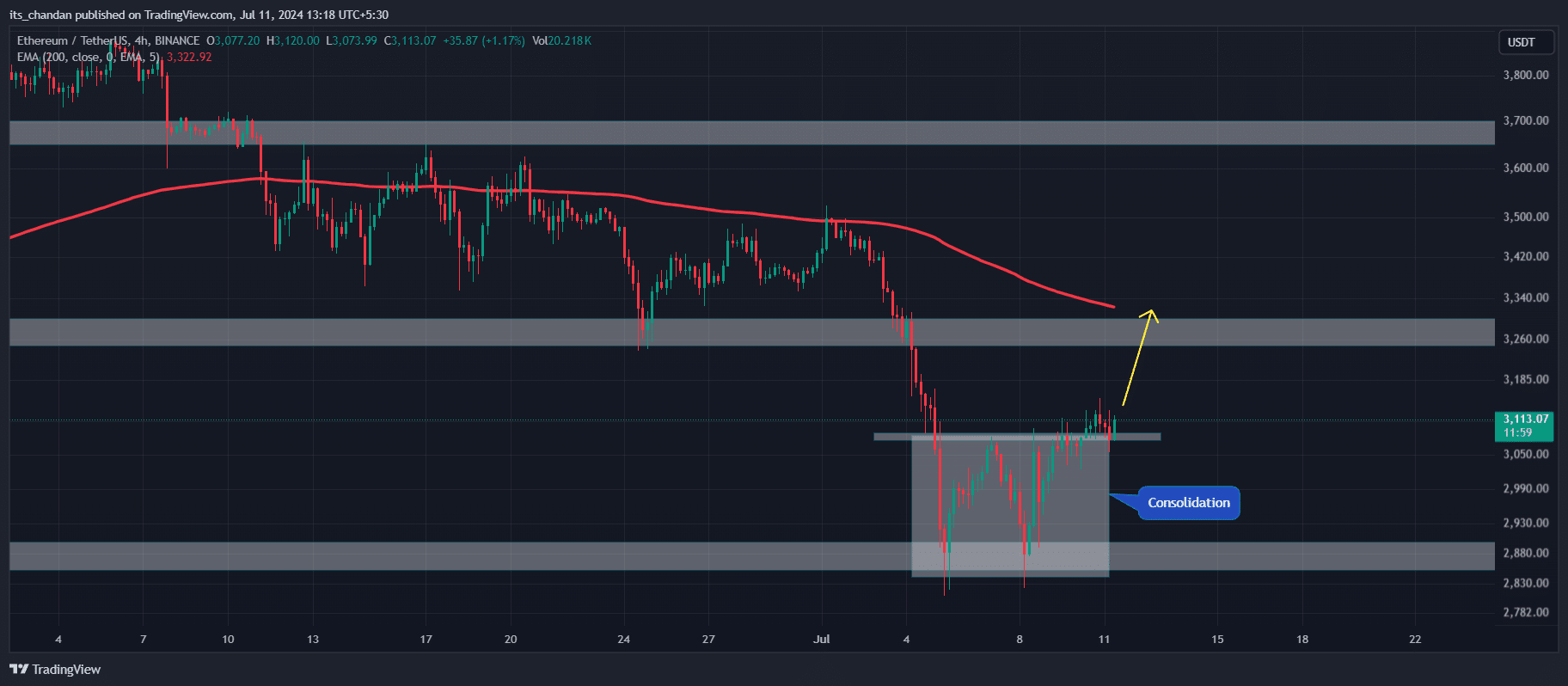

Ethereum technical analysis and key levels

Based on the technical assessment of experts, Ethereum (ETH) appears poised for an uptrend after breaking above its neckline in a 4-hour double bottom chart formation.

As a researcher studying Ethereum price trends, I’ve noticed an intriguing pattern. Specifically, if the Ethereum 4-hour candlestick closes above the $3,135 mark on July 11, 2024, there’s a strong likelihood that ETH could surge past the $3,300 threshold.

As a crypto investor, I keep a close eye on ETH‘s daily price movements. Recently, I’ve noticed an encouraging sign: ETH has surpassed its 200-day Exponential Moving Average (EMA). When the price is above this key indicator, it usually signals that the asset is in a bullish phase on longer time frames. So, this development could be a promising sign for those holding or considering investing in Ethereum.

Additionally, the Relative Strength Index (RSI), which is a technical indicator, suggests a potential bullish turnaround.

As an analyst, I believe that the bullish sentiment towards Ether will persist once the Securities and Exchange Commission (SEC) approves an Ether Exchange-Traded Fund (ETF). According to Bloomberg ETF expert Eric Balchunas, there is a strong likelihood that the SEC will give its nod to a spot Ether ETF by July 18, 2024.

In a post on X, he stated that,

“The new over/under launch date hasn’t been announced yet due to uncertainties regarding the SEC’s plans. I hope to receive more information soon. Under pressure, I would tentatively suggest a launch date of July 18th.”

In contrast to the optimistic perspective on Ethereum’s future, the open interest in the last 24 hours has decreased by 0.53%, indicating a decline in investor and trader enthusiasm for ETH during this apprehensive market period.

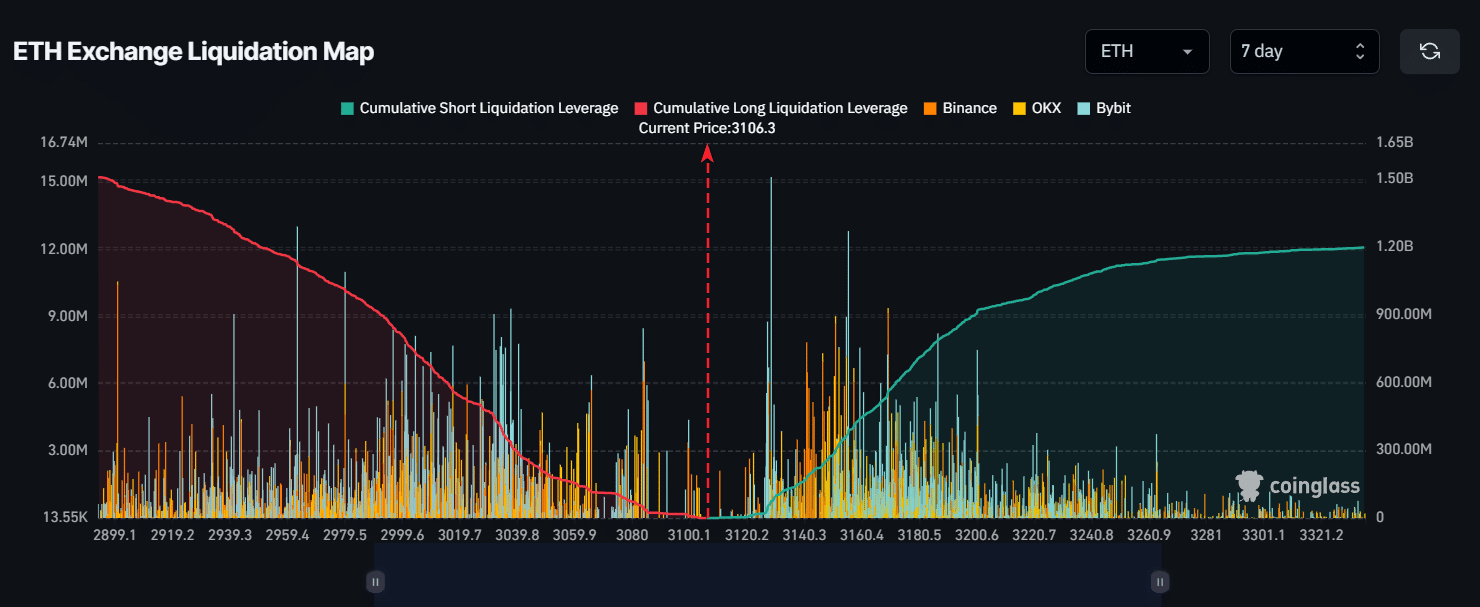

Liquidation and price-performance analysis

Based on recent data from CoinGlass over the past week, it appears that Ethereum’s bulls have resumed their support for the cryptocurrency. Should Ethereum hit a price point of $3,300, an estimated $1.18 billion in short positions would be at risk for liquidation.

Read Ethereum’s [ETH] Price Prediction 2024-2025

As a crypto investor, if Ethereum (ETH) is unable to maintain its current surge and instead drops back to the $2,900 mark, around $1.46 billion in long positions might be at risk for liquidation.

Currently, ETH is approaching $3,115 in value during my writing process, and there has been a modest 0.5% increase in the previous 24-hour period.

Read More

- PI PREDICTION. PI cryptocurrency

- Gold Rate Forecast

- Rick and Morty Season 8: Release Date SHOCK!

- Discover Ryan Gosling & Emma Stone’s Hidden Movie Trilogy You Never Knew About!

- Masters Toronto 2025: Everything You Need to Know

- We Loved Both of These Classic Sci-Fi Films (But They’re Pretty Much the Same Movie)

- Mission: Impossible 8 Reveals Shocking Truth But Leaves Fans with Unanswered Questions!

- SteelSeries reveals new Arctis Nova 3 Wireless headset series for Xbox, PlayStation, Nintendo Switch, and PC

- Discover the New Psion Subclasses in D&D’s Latest Unearthed Arcana!

- Linkin Park Albums in Order: Full Tracklists and Secrets Revealed

2024-07-11 16:08