-

Even though the price has decreased, data showed BTC has not yet hit its bottom.

A deep-dive showed that the coin can reach $64,688 as long as demand increases.

As an analyst with extensive experience in cryptocurrency market analysis, I believe that even though Bitcoin’s price has decreased significantly since the halving event, it has not yet hit its bottom. Based on a deep-dive analysis of the charts and relevant indicators such as the Puell Multiple and Long Term Holder Net Unrealized Profit/Loss (LTH-NUPL), I predict that Bitcoin can still reach $64,688 if demand increases.

Eighty-three days have passed since the Bitcoin [BTC] halving occurred on April 19th, a significant event that typically triggers a rally for the coin. However, thus far, there has been no discernible sign of this traditional post-halving price surge.

In that timeframe, the Bitcoin price was traded at approximately $63,976. This occurred following its record-breaking peak at $73,750 in March. Unsurprisingly, the larger market viewed this occurrence as a significant catalyst to push Bitcoin prices even higher.

Patience is the name of the game

I’ve noticed that around a month after hitting $71,000, Bitcoin took a step back for me as an investor. The correction didn’t take too long to materialize, as it had been 83 days since the halving event. During this period, Bitcoin experienced significant price adjustments, causing my holdings to lose approximately 12.76% of their value.

As a researcher studying Bitcoin’s market trends, I’ve noticed that past Bitcoin price declines following the halving event have typically been followed by recovery periods. However, the current downturn stands out as exceptional due to subpar price action persisting for approximately three months before the halving occurred.

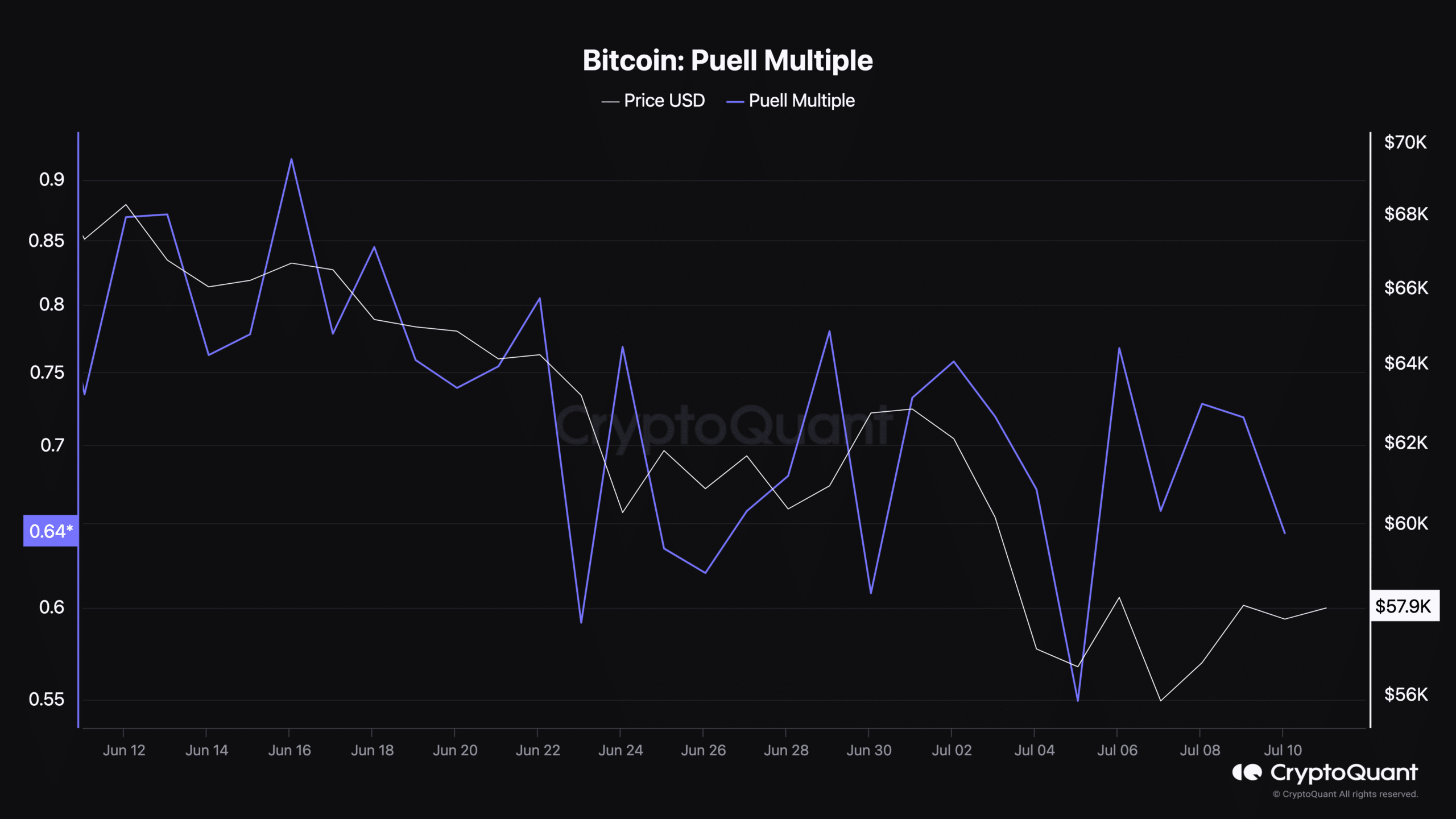

As a cryptocurrency market analyst, I’ve observed that at the current moment, Bitcoin’s price hovers around $57,908 based on available data. However, in my assessment using the Puell Multiple indicator from AMBCrypto, it seems the anticipated bull run may not have commenced just yet.

As a researcher studying the Bitcoin market, I would describe the Puell Multiple as a useful metric that reveals the disparity between the revenue generated by short-term and long-term miners. To calculate this value, I divide the daily newly minted Bitcoin amount by the Bitcoin issuance over a 365-day period.

Normally, when the ratio falls within the range of 1 to 6, it signals that prices are on the expensive side. A ratio greater than 6 may suggest that the price has reached its peak.

If the Puell Multiple is less than 1, it’s a sign that Bitcoin prices are decreasing, with values below 0.40 potentially indicating a price bottom.

Based on data from CryptoQuant, the Puell Multiple for Bitcoin currently stands at 0.64. This figure suggests that the correction in Bitcoin’s price is not yet over. However, if this ratio drops to around 0.40, it may signal that the bottom of the price decline has been reached, and a rebound could follow shortly after.

It’s worth pointing out that Bitcoin may need an additional month before finding its lowest point. Consequently, the bull market could commence around Q3’s end or as early as Q4’s beginning.

HODLers won’t just give up

It’s worth keeping in mind that circumstances can shift rather rapidly. If such a situation arises and the desire for our predicted $75,000 price point by the end of July grows stronger, AMBCrypto’s forecast may indeed materialize.

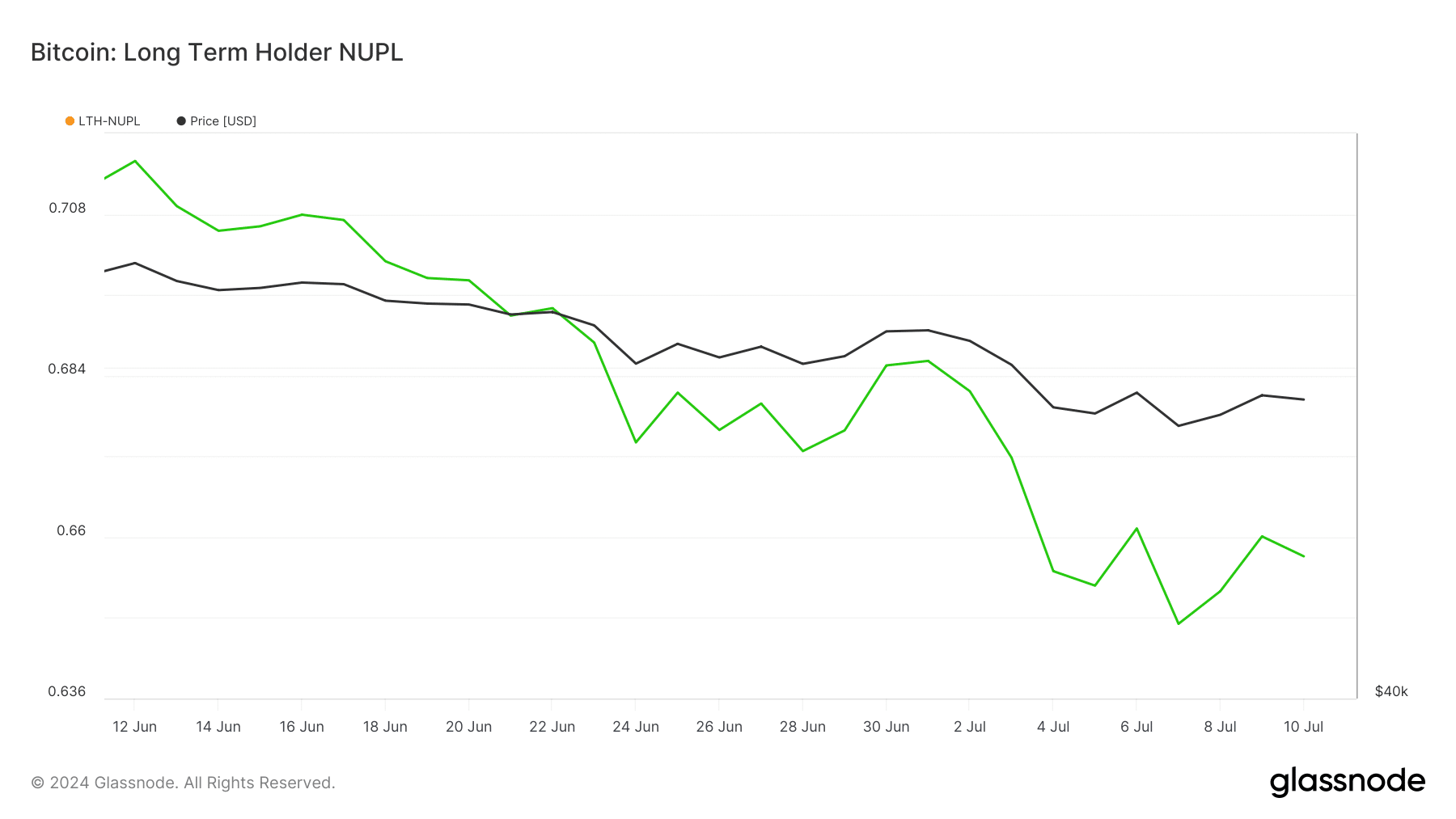

Although the coin’s price hasn’t impressed investors following the halving, long-term holders remain optimistic about its future value based on their analysis of the Long-Term Holder MVRV Ratio (LTH-NUPL).

The term LTH-NUPL refers to Long-Term Holders’ Net Unrealized Profit or Loss, which is an on-chain indicator that examines the actions of Bitcoin owners who have held the cryptocurrency for a minimum of 155 days.

Based on Glassnode’s analysis, the Long-Term Holders Net Unrealized Profit and Loss (LTH-NUPL) indicator signaled optimism towards Bitcoin’s long-term prospects. This bullish sentiment could potentially lead to an uptick in demand for Bitcoin, potentially causing its price to rise further.

As a crypto investor, I’ve noticed that Bitcoin’s price drop of 21.46% between the 6th of June and 7th of July might indicate a potential change in market sentiment. If this downward trend continues and reaches levels of extreme optimism or fear, Bitcoin’s momentum could slow down.

Is a retest of $71,000 possible soon?

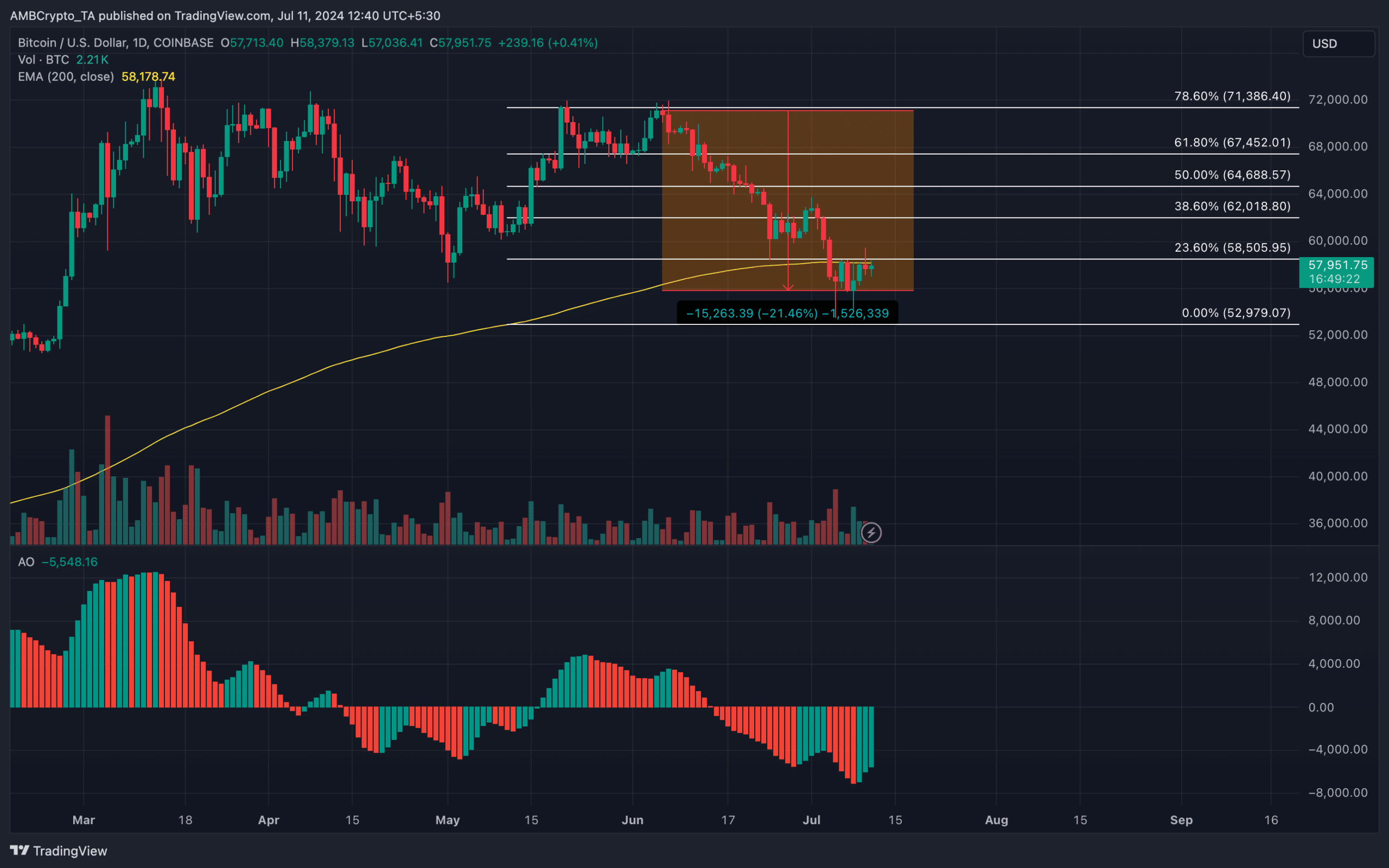

As an analyst, I’ve noticed that the price is currently hovering around the $58,000 mark but has yet to surpass the yellow line representing the 200-day Exponential Moving Average (EMA) on the chart. The EMA serves as a valuable tool for determining the trend direction over a specified timeframe.

As a researcher studying market trends, I’ve observed that when the price of an asset surpasses a particular resistance level, it’s often a sign of a bullish trend. Conversely, if the price falls below a significant support level, it may indicate a bearish trend. However, my analysis of Bitcoin has shown that its price behavior can deviate from this general rule. When Bitcoin’s price was close to flipping a resistance or support zone, it didn’t always follow the usual bullish or bearish pattern. Instead, I found that Bitcoin’s price movements in these instances were more unpredictable and required closer monitoring.

If the Awesome Oscillator (AO) displays clear indications of a rising trend alongside such an event, Bitcoin could potentially reenter its bull market.

Specifically, this could drive Bitcoin to retest its halving and possible trade around $64,688.

In an optimistic scenario, the price could surge up to $71,386, paving the way for a robust upward trend and pushing it closer to hitting the $80,000 mark.

Is your portfolio green? Check the Bitcoin Profit Calculator

As a crypto investor, I’ve noticed some commentary from analysts regarding Bitcoin’s price movement. One of these voices belonged to someone using the pseudonym Rekt Capital. In his assessment, Rekt Capital suggested that we might need to be patient before the next bull run kicks in since he believes the market may still require some time to prepare for the upward trend.

“Bitcoin is not ready to break the downtrend just yet”

Read More

- Gold Rate Forecast

- PI PREDICTION. PI cryptocurrency

- SteelSeries reveals new Arctis Nova 3 Wireless headset series for Xbox, PlayStation, Nintendo Switch, and PC

- Masters Toronto 2025: Everything You Need to Know

- WCT PREDICTION. WCT cryptocurrency

- Guide: 18 PS5, PS4 Games You Should Buy in PS Store’s Extended Play Sale

- LPT PREDICTION. LPT cryptocurrency

- Elden Ring Nightreign Recluse guide and abilities explained

- Solo Leveling Arise Tawata Kanae Guide

- Despite Bitcoin’s $64K surprise, some major concerns persist

2024-07-11 22:16