-

BONK showed bullish pressure was winning in the lower timeframes.

The recent structure break and the consistent buying pressure in recent months could sustain a rally.

As a researcher with experience in analyzing cryptocurrency markets, I’m bullish on BONK based on recent developments. The potential token burn proposal and the resulting buying pressure have forced a strong move higher this week. Although trading volume has begun to dip, the daily structure is turning bullish as evidenced by the flip of the most recent lower high into support.

This week, news about a proposed token burn for BONK, worth approximately 84 billion tokens, caused a significant surge in the cryptocurrency market. Although the proposal hasn’t been approved yet, the bullish investors were exhilarated by the prospect of reduced supply and pushed the price up by around 23%, starting from Monday’s opening.

In simpler terms, although the general feeling towards the asset was favorable, the number of trades being made had started decreasing. This could potentially indicate that the price surge may be coming to an end.

The daily structure is turning bullish

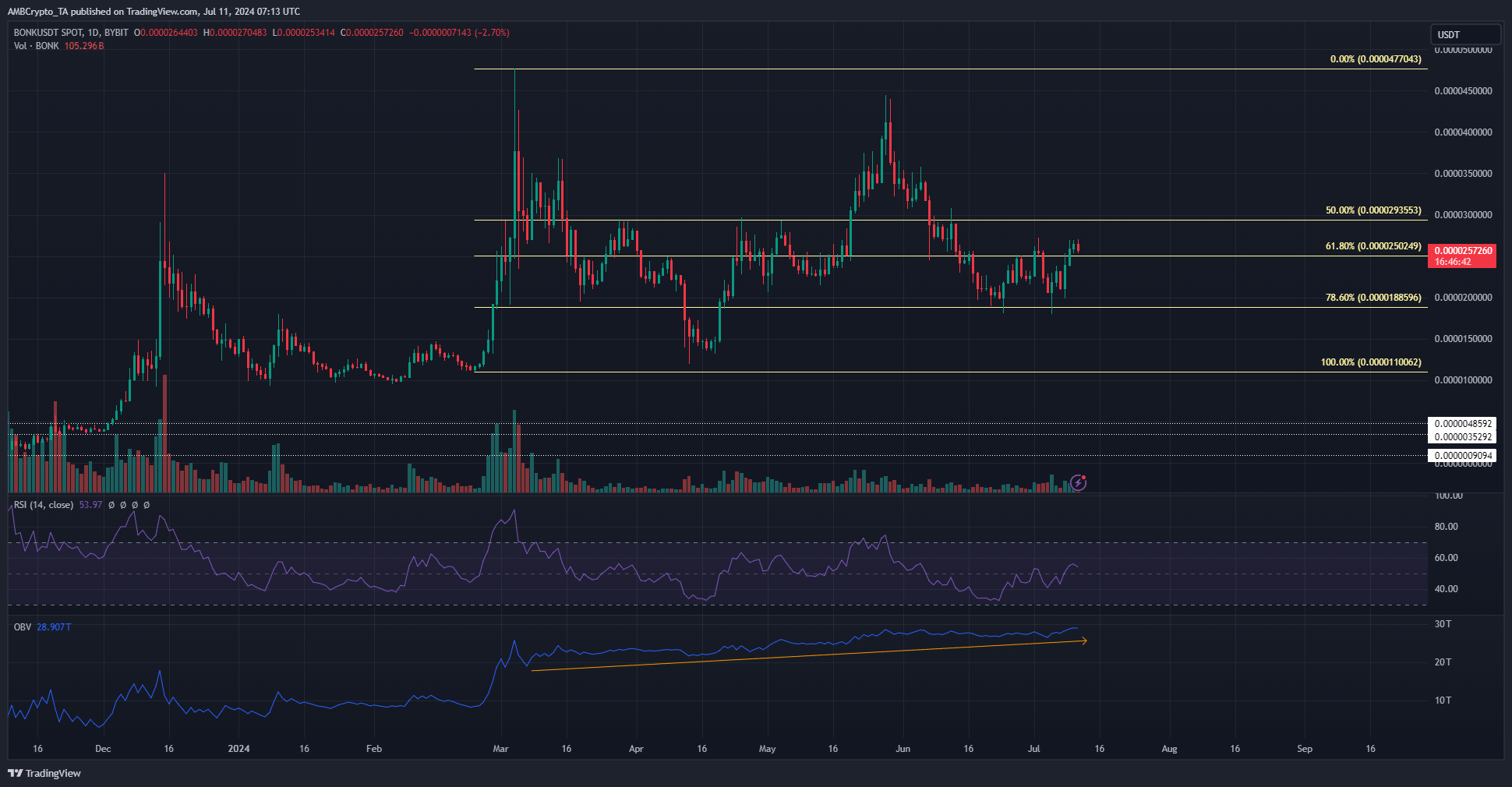

On the one-day price chart, the most recent point where the price reached a lower high was in mid-June at $0.00000256. However, on the 9th of July, the daily trading session ended with the price closing above this level, signaling a bullish reversal.

Over the last six weeks, the 78.6% retracement level has proven to be a robust support for the market. Investors with a bullish outlook will likely endeavor to preserve this level at approximately $0.0000025 and $0.0000023 in the days ahead.

As a seasoned crypto investor, I’ve noticed an intriguing development in the market indicators. The Relative Strength Index (RSI) has recently surpassed the neutral 50 mark, signaling a potential shift toward a bullish trend. Additionally, the On-Balance Volume (OBV) has been steadily climbing since March, which is often an early signal of an impending explosive rally. So, it’s not a matter of if another bull run will occur, but rather when this upward momentum will gain even more steam.

The futures data showed sentiment was positive

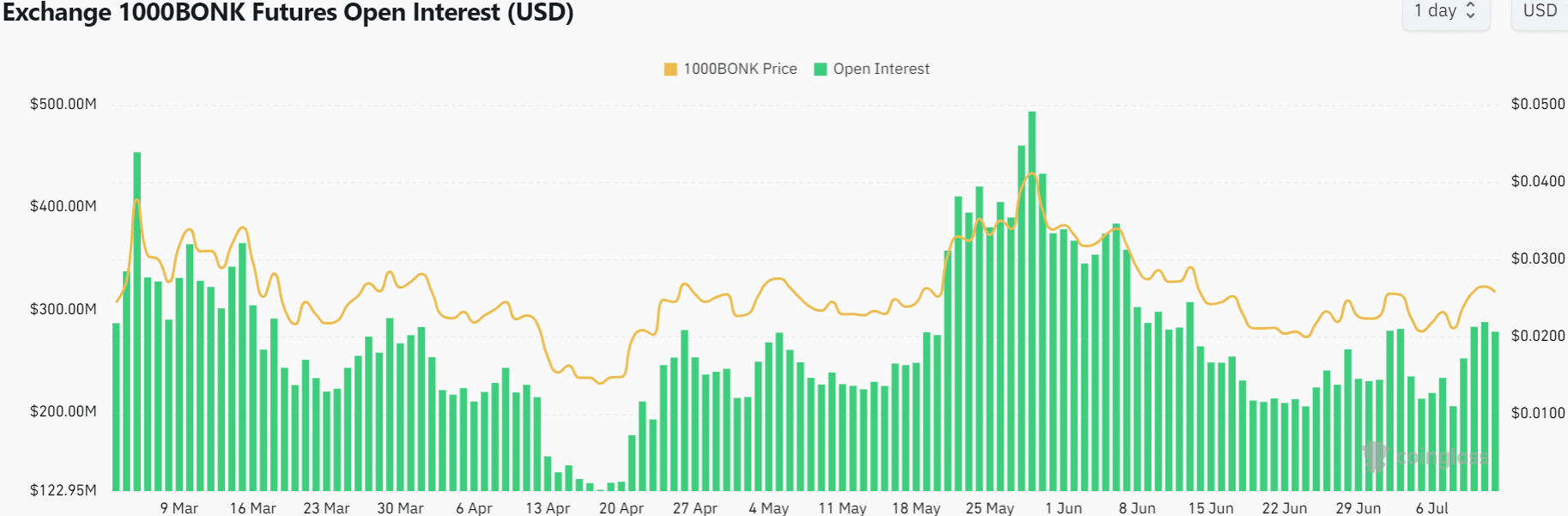

On July 8th, Open Interest amounted to $205 million. By July 10th, it had risen significantly to reach $283.3 million. This surge in Open Interest coincided with a price increase, indicating that speculators were eager to buy the memecoin and hold positions in the market.

Over the past 24 hours, it has begun to diminish, but overall the short-term sentiment was bullish.

Is your portfolio green? Check the BONK Profit Calculator

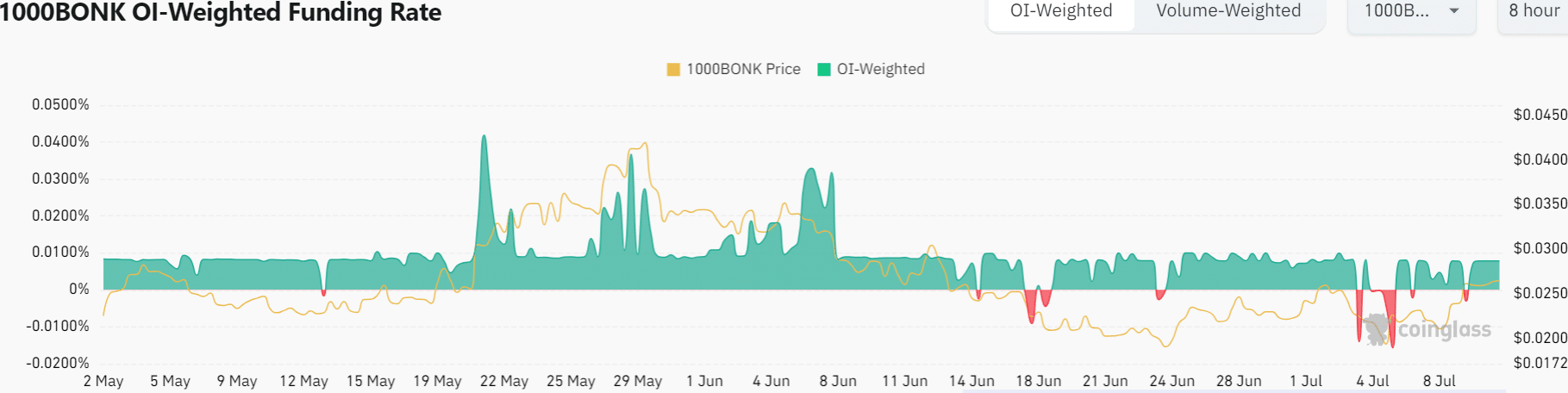

The funding rate regained a positive position following its dip on July 5th and more recently on July 9th.

However, it was not abnormally positive which suggested that the market was not overheated.

Read More

- PI PREDICTION. PI cryptocurrency

- Gold Rate Forecast

- Rick and Morty Season 8: Release Date SHOCK!

- Discover Ryan Gosling & Emma Stone’s Hidden Movie Trilogy You Never Knew About!

- Discover the New Psion Subclasses in D&D’s Latest Unearthed Arcana!

- Linkin Park Albums in Order: Full Tracklists and Secrets Revealed

- Masters Toronto 2025: Everything You Need to Know

- We Loved Both of These Classic Sci-Fi Films (But They’re Pretty Much the Same Movie)

- Mission: Impossible 8 Reveals Shocking Truth But Leaves Fans with Unanswered Questions!

- SteelSeries reveals new Arctis Nova 3 Wireless headset series for Xbox, PlayStation, Nintendo Switch, and PC

2024-07-12 01:11