- The altcoin market cap increased against the Bitcoin market cap fall.

- The launch of the spot Ethereum ETFs could send Bitcoin dominance further down.

As an experienced analyst, I’ve seen the cryptocurrency market undergo numerous fluctuations over the years. The recent development where the altcoin market cap is increasing while Bitcoin’s market cap is falling is a trend that warrants careful attention.

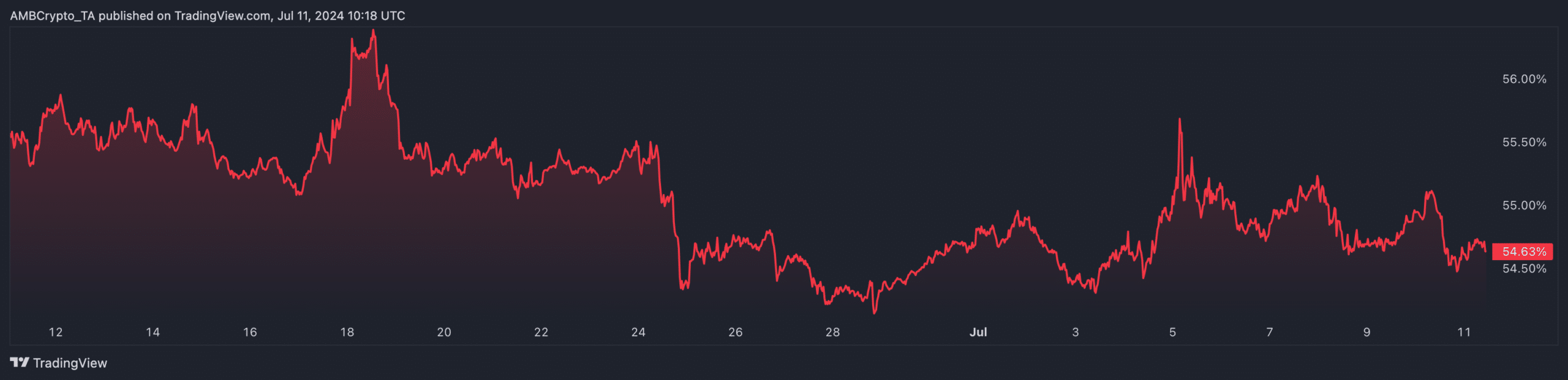

According to AMBCrypto’s examination, the Bitcoin (BTC) dominance in the cryptocurrency market has been on a decline. Specifically, on July 10th, the dominance stood at 55.10%. Yet, as of now, it has dropped to 54.62%.

The degree of control Bitcoin holds over the cryptocurrency market can be gauged through its dominance. This measurement signifies the proportion of the total cryptocurrency market capitalization that Bitcoin represents.

Can BTC dominance continue?

When Bitcoin’s supremacy grows, this signifies that Bitcoin is surpassing the typical altcoin in terms of performance. Conversely, a decrease in Bitcoin’s dominance implies that Bitcoin is weakening and altcoins are gaining strength.

As a crypto investor, I’ve observed that my investments in coins have shown improvement on a Year-To-Date (YTD) basis. However, over the past month and more recently, their performance has been disappointing, even reversing some of the gains I’d made earlier. If this trend persists, there’s a risk that Bitcoin could experience further declines, despite the correction it has already undergone.

At the moment of publication, the price of Bitcoin was $58.257. This marked a 1.37% gain over the previous week. Nevertheless, investors should monitor the TOTAL2 indicator as a potential sign that Bitcoin’s dominance might be weakening.

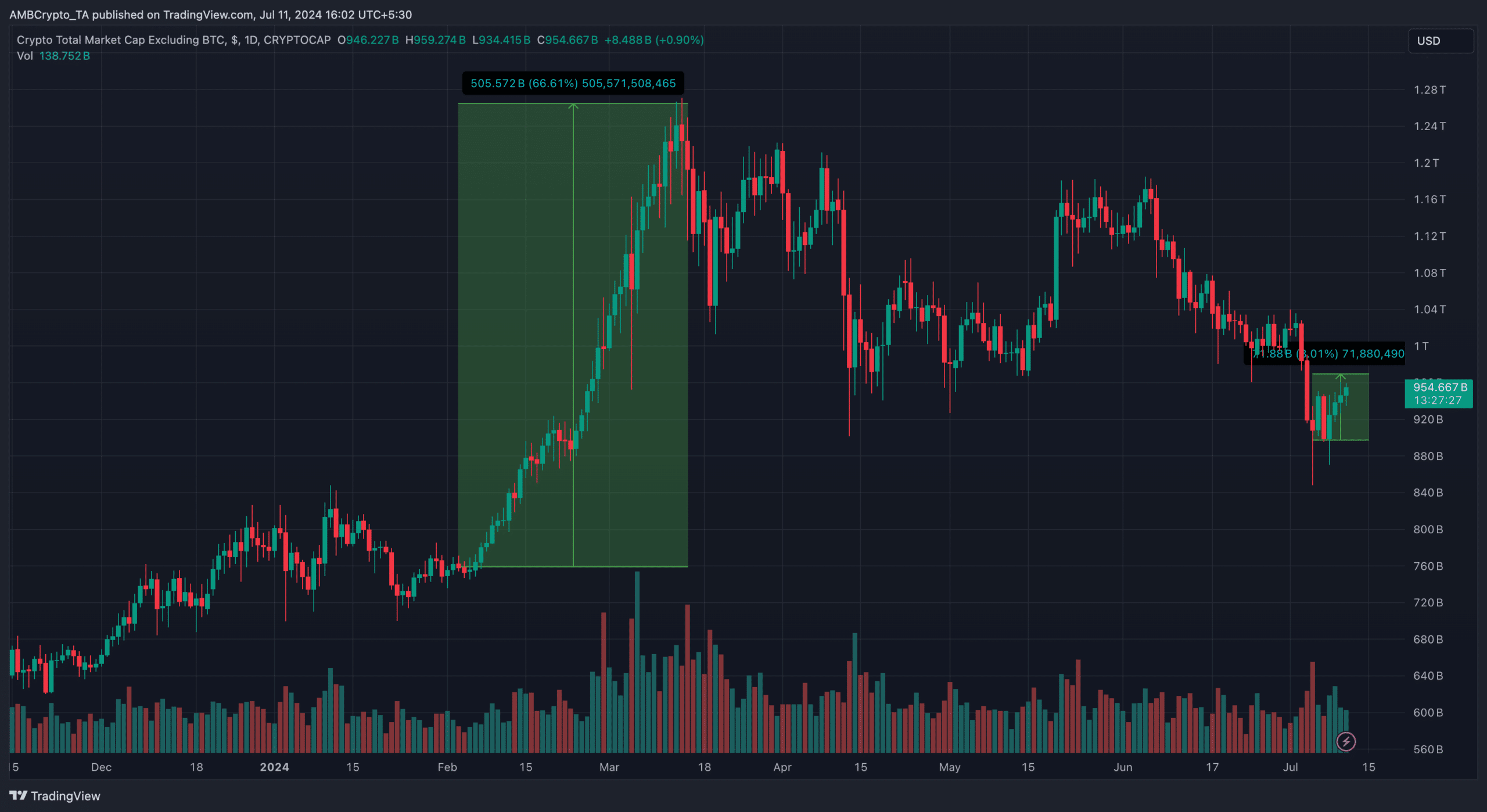

As a crypto investor, I would describe it this way: The TOTal market capitalization of all cryptocurrencies except for Bitcoin is referred to as TOTAL2. When TOTAL2 experiences growth, it signifies that altcoins are outperforming Bitcoin in the market.

But when it decreases, it implies that BTC is leading the market resurgence.

From the 5th of July up until now, the TOTAL2 has experienced a 8.01% increase in value. This suggests that the typical altcoin prices have outperformed Bitcoin’s market share during this period.

Altcoins are prepared to give the king a fight

Previously, the market capitalization experienced a significant surge of 66.61% from February to March, pushing it past the $1.20 trillion threshold. Currently, its value stands at approximately $953.68 billion.

As a crypto investor, I’m keeping a close eye on the current upward trend of the market. If it persists and approaches the $1 trillion market capitalization, we could be inching closer to the highly anticipated altcoin season. In this scenario, Bitcoin’s correction would likely continue its course.

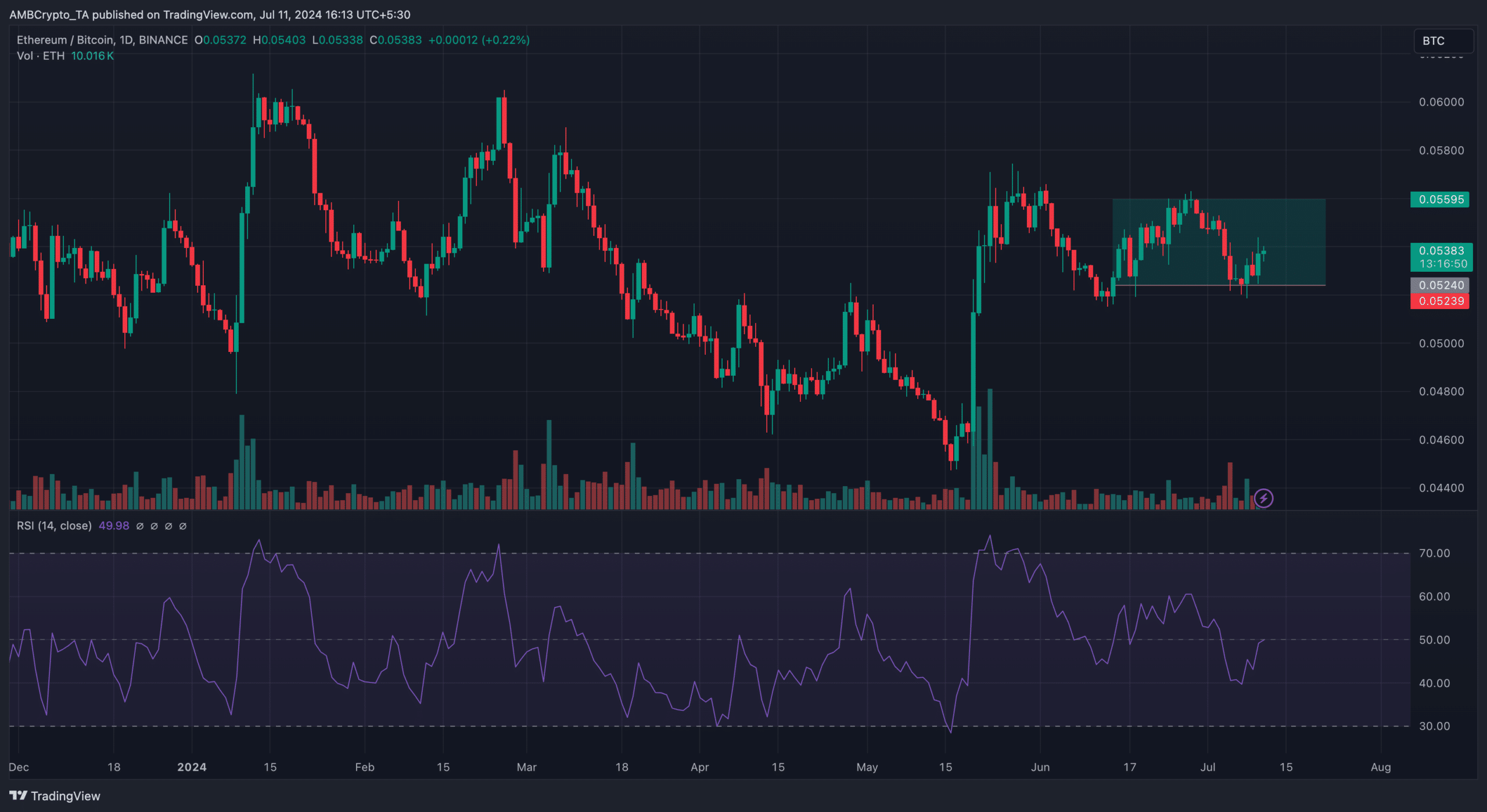

As a crypto investor, I’ve observed that when the price of Ethereum [ETH] outperforms Bitcoin [BTC], it often leads to a surge in the dominance of Ethereum. This historical trend can give altcoins a boost as well.

Turning the tables, this development diminishes Bitcoin’s leading role in the market. Market players eagerly anticipate the rollout of spot Ethereum Exchange-Traded Funds (ETFs) as a potential game-changer.

Additionally, examining the Ethereum-Bitcoin price chart can provide insights into whether Ethereum may surpass Bitcoin’s market dominance in the upcoming weeks.

If the value of Ethereum relative to Bitcoin (ETH/BTC) rises, it signifies that Ethereum is gaining more value compared to Bitcoin in that period. Conversely, a decrease implies the reverse situation. Previously, the value of Ethereum was equivalent to 0.051 Bitcoins.

Realistic or not, here’s BTC’s market cap in ETH terms

As a crypto investor, I’ve noticed that the exchange rate between Ethereum (ETH) and Bitcoin (BTC) has changed since my last check. Currently, it takes 0.053 Bitcoins to acquire one Ethereum. Furthermore, the Relative Strength Index (RSI) indicates that Ethereum is gaining traction and may be a worthwhile investment at this moment.

If sustained, this could drive the ratio to 0.056, and possible send Bitcoin dominance down.

Read More

- Gold Rate Forecast

- PI PREDICTION. PI cryptocurrency

- Rick and Morty Season 8: Release Date SHOCK!

- Discover Ryan Gosling & Emma Stone’s Hidden Movie Trilogy You Never Knew About!

- Masters Toronto 2025: Everything You Need to Know

- We Loved Both of These Classic Sci-Fi Films (But They’re Pretty Much the Same Movie)

- Mission: Impossible 8 Reveals Shocking Truth But Leaves Fans with Unanswered Questions!

- SteelSeries reveals new Arctis Nova 3 Wireless headset series for Xbox, PlayStation, Nintendo Switch, and PC

- Discover the New Psion Subclasses in D&D’s Latest Unearthed Arcana!

- Linkin Park Albums in Order: Full Tracklists and Secrets Revealed

2024-07-12 02:15