-

Bitcoin fell lower after a softer June CPI data.

Analysts claimed a bullish reversal was likely for BTC.

As an analyst with a background in macroeconomics and experience in following the cryptocurrency market, I believe that the recent softer June CPI data could indeed boost Bitcoin’s recovery due to the increased odds of Fed rate cuts later in the year. However, this positive outlook could be challenged by ongoing supply pressure from sources like German government sell-offs.

On June 11th, Bitcoin’s price movements closely followed the declines in US stock markets, particularly Big Tech stocks, due to a weaker-than-expected Consumer Price Index report.

BTC failed to reclaim the $60K level and dropped below $58K after the inflation data.

The Consumer Price Index (CPI) for June came in at a lower temperature of 3.0%, contrasting with the previous month’s figure of 3.3%. This implies that the average price for a collection of goods and services, considering their respective importance to consumers, experienced a gentle decrease.

Will a likely September Fed rate cut boost Bitcoin?

A gentler increase in inflation during June may reinforce the current downward trend in prices, heightening the likelihood of Federal Reserve interest rate reductions towards the end of the year. Such an event could bring welcome news to investors in riskier assets, such as cryptocurrencies.

After analyzing the latest Consumer Price Index (CPI) data, I observed that investors shifted their focus from Big Tech stocks and Bitcoin (BTC), opting instead for small-cap US equities. Consequently, these assets experienced a notable decline in value.

It’s intriguing to note that Quinn Thompson, the founder of Lekker Capital – a crypto hedge fund – believes that the outperformance of small-caps could potentially bolster Bitcoin’s comeback. He pointed out,

In simpler terms, the performance of small caps often aligns with the growth of cryptocurrencies. It would be interesting to observe if larger economic trends will outweigh the influence of Bitcoin’s abundant supply.

The chart indicated a strong connection between the growth of small-cap stocks, represented by the iShares Russell 2000 ETF (IWM), and Bitcoin, as both showed increasing trends.

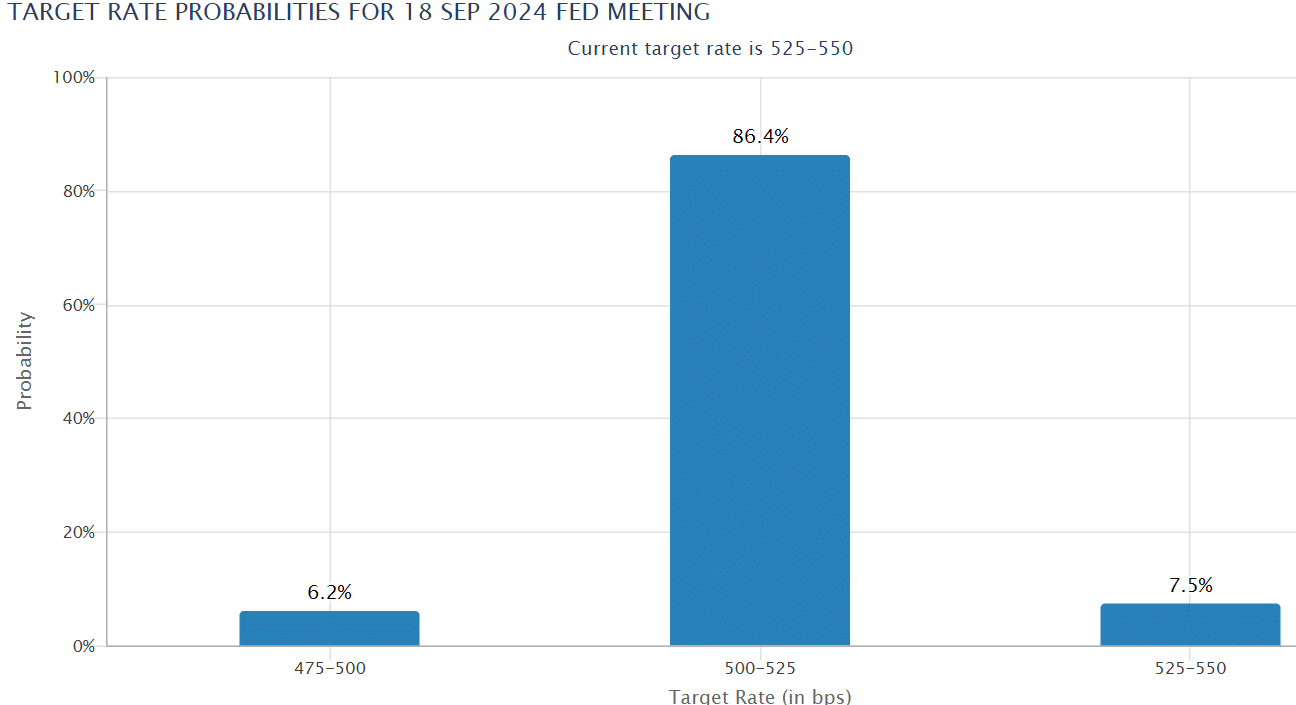

Currently, the probability of the Federal Reserve implementing interest rate reductions in September has risen significantly, reaching over 80%, according to the latest reports. This shift in expectations comes on the heels of a lower-than-anticipated inflation figure for June.

As a crypto investor, I’m optimistic about the developing economic conditions. However, I can’t ignore the potential threat posed by the oversupply of Bitcoin in the market, particularly from the German government sell-offs, which could dampen these prospects as warned by Thompson.

Starting from the 12th of July, Germany owned fewer than 10,000 Bitcoin out of the 50,000 Bitcoin it possessed in mid-June. This decrease could lead to a noticeable reduction in the market pressure caused by German holdings as early as the following week.

So, what’s next for BTC price in the short term?

BTC’s next price target

As a researcher at QCP Capital, I’ve been closely monitoring the cryptocurrency market. Based on my analysis, there are several factors suggesting potential upside for Bitcoin (BTC) in the near future.

Based on the analysis of well-known Bitcoin expert Stockmoney Lizards, there’s a possibility that the price may return to the range of $50,000 to $52,000 prior to reaching the predicted target of $64,000.

Read More

- OM/USD

- Carmen Baldwin: My Parents? Just Folks in Z and Y

- Jellyrolls Exits Disney’s Boardwalk: Another Icon Bites the Dust?

- Solo Leveling Season 3: What You NEED to Know!

- Solo Leveling Season 3: What Fans Are Really Speculating!

- Despite Strong Criticism, Days Gone PS5 Is Climbing Up the PS Store Pre-Order Charts

- Jelly Roll’s 120-Lb. Weight Loss Leads to Unexpected Body Changes

- The Perfect Couple season 2 is in the works at Netflix – but the cast will be different

- Joan Vassos Reveals Shocking Truth Behind Her NYC Apartment Hunt with Chock Chapple!

- Disney’s ‘Snow White’ Bombs at Box Office, Worse Than Expected

2024-07-12 15:03