- Bitcoin has remained below the $60,000 price range.

- Accumulation has increased after months of distribution.

As a researcher with extensive experience in cryptocurrency markets, I’ve closely observed Bitcoin’s [BTC] recent price behavior and trends. The current market scenario presents some interesting insights.

I’ve noticed that Bitcoin’s price has consistently stayed below the $60,000 threshold for some time now. Interestingly, recent data points suggest that certain entities have been actively amassing Bitcoin during this period of price stability.

Some investors perceived the recent price level as an attractive opportunity for purchase, leading to a build-up of holdings. However, there was a significant reduction in trading volume during the same timeframe.

Bitcoin enters the accumulation phase

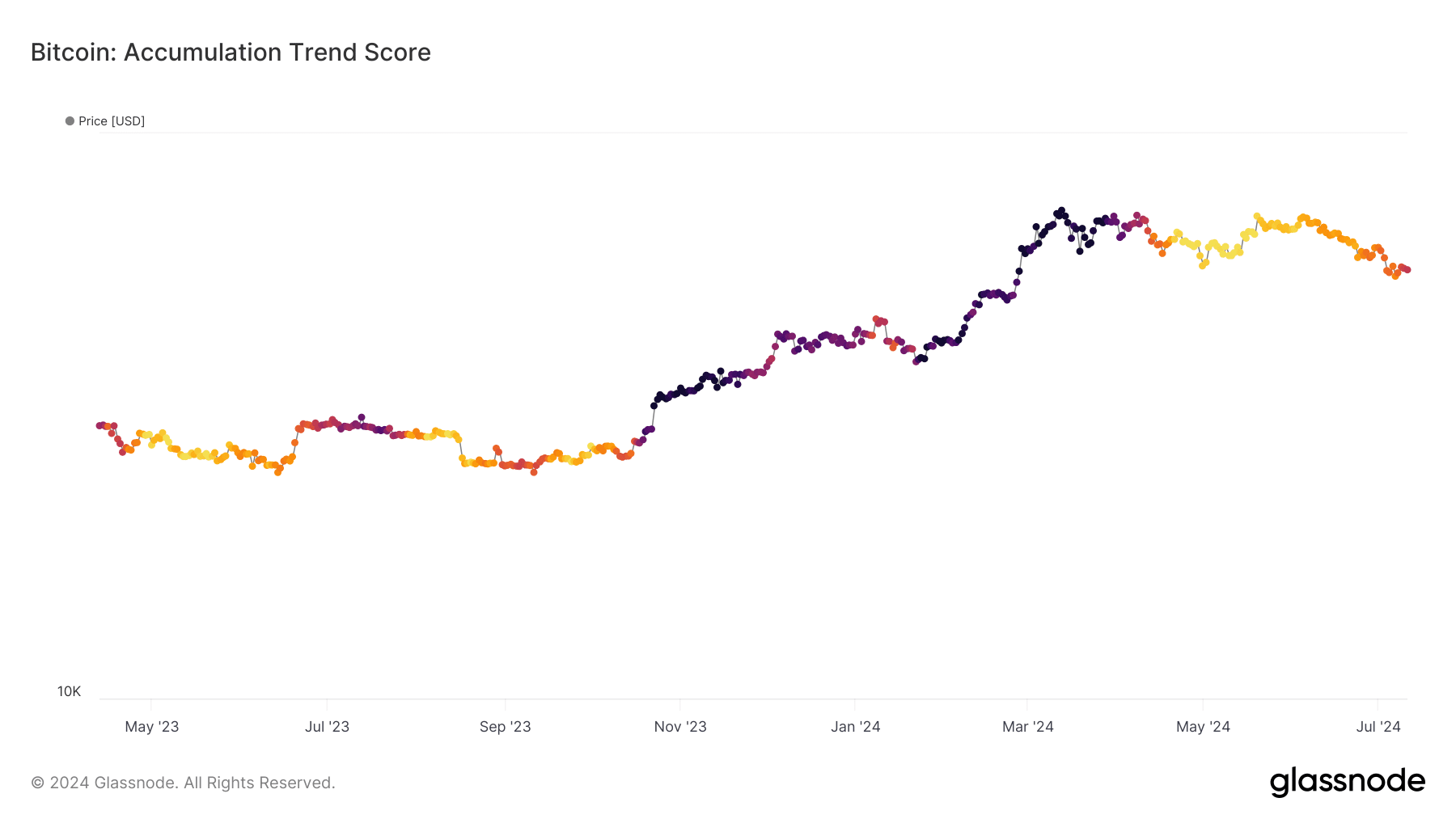

According to AMBCrypto’s interpretation of Bitcoin’s trend analysis by Glassnode, there has been a significant shift in market patterns.

At the current trend reading of 0.4, there’s been a noticeable change indicative of entities starting to amass Bitcoin following a giving-out phase.

As a crypto investor, I’ve noticed an uptick in the trend indicator, which hasn’t quite hit the 1 mark yet, but it’s definitely pointing towards a more assertive buying strategy. In fact, this is the first time since April that the trend score has risen to these levels.

The Accumulation Trend Score provides valuable insights as it takes into account not just the volume of Bitcoin (BTC) transactions conducted by entities, but also their current holdings’ sizes.

When the score is close to 1, it indicates that larger Bitcoin holders are buying a significant amount of Bitcoin, which can be seen as a positive sign. On the other hand, a score close to 0 suggests that these entities may be selling their Bitcoin or choosing not to buy more, which could be viewed as a bearish indication.

As an analyst, I would interpret the rising trend score as a sign of increasing confidence among larger investors.

As a market analyst, I have observed that accumulation phases by large market participants, which involve the purchasing of substantial amounts of assets, can set the stage for broader market recoveries. By reducing the overall supply of securities available in the market, these actions create stronger foundations for price support levels.

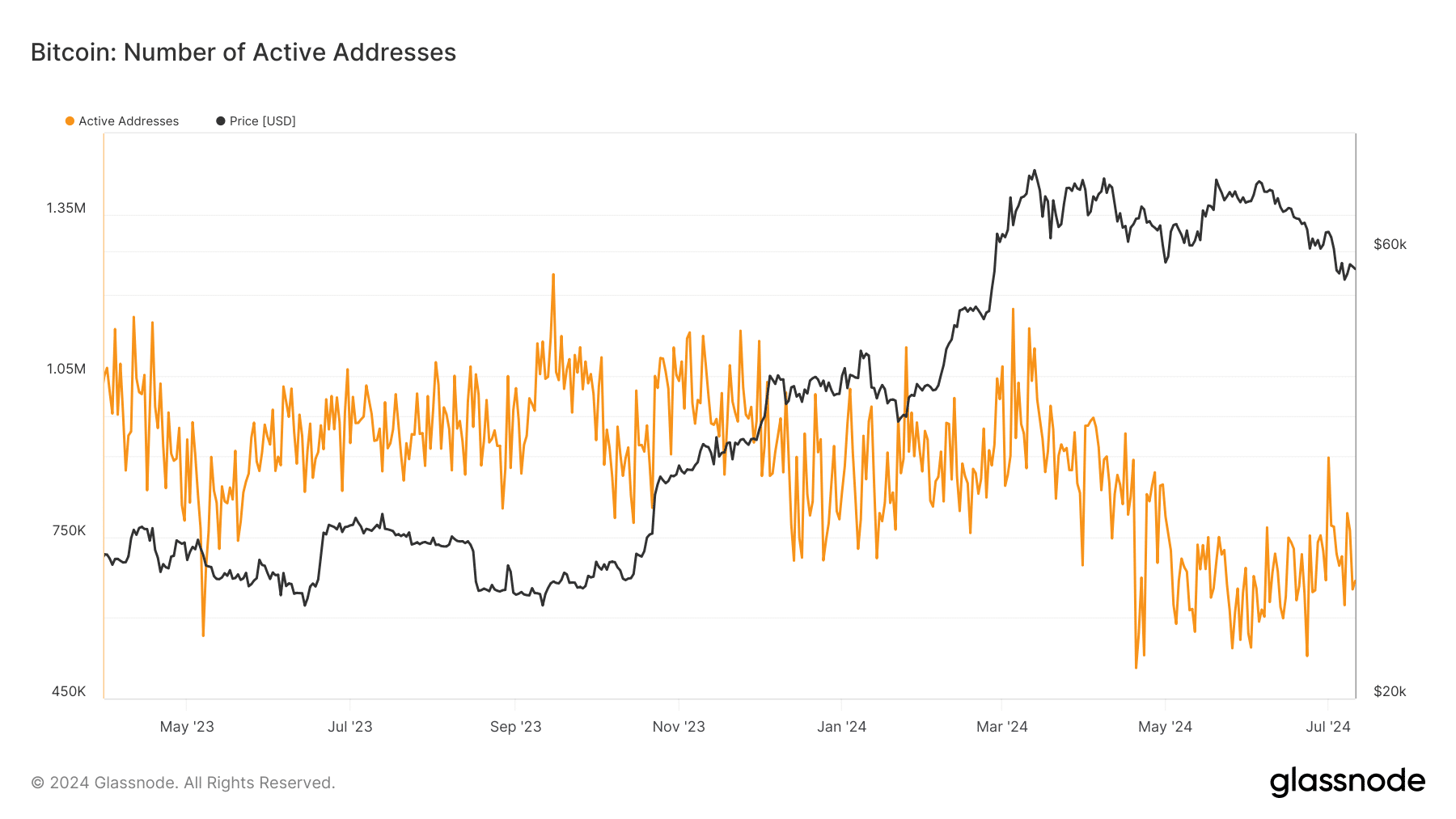

Active Bitcoin addresses fall

Although larger entities have been significantly increasing their holdings of Bitcoin, the count of daily active Bitcoin addresses paints a contrasting picture.

Based on my examination of the active addresses chart on Glassnode, I’ve observed a significant drop in usage lately.

Despite some variation, the count of active cryptocurrency addresses has generally stayed between 600,000 and 669,000. At present, the figure stands at approximately 669,000.

A decrease in the number of active Bitcoin addresses despite an increase in accumulation could indicate several possibilities. One such theory is that larger investors are keeping their Bitcoin for extended periods, thereby reducing the frequency of transactions.

Moreover, this could reflect a more reserved market attitude, with fewer people and organizations participating in trades, potentially holding back to observe clearer cues before buying or selling.

BTC trading below $60,000

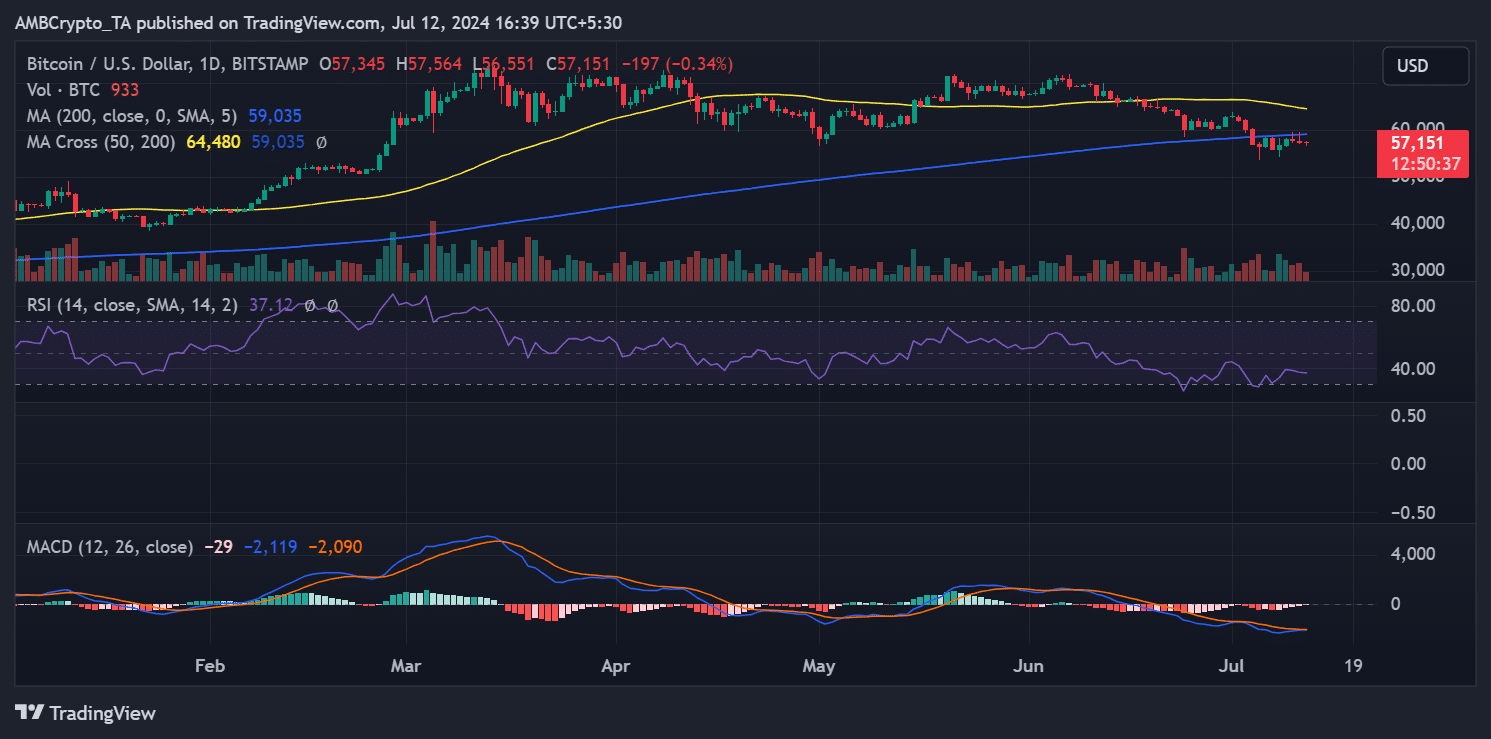

Based on current figures, Bitcoin was priced around $57,151 with a minimal decrease of almost 1% observed over the past day. The price trend on the graph suggested a bearish outlook for Bitcoin.

Read Bitcoin’s [BTC] Price Prediction 2024-25

This was evidenced by its position below the key moving average (yellow and blue lines).

As a researcher studying the cryptocurrency market, I’ve observed that Bitcoin’s current standing in relation to the RSI’s neutral line at present adds credence to my bearish perspective.

Read More

- OM/USD

- Carmen Baldwin: My Parents? Just Folks in Z and Y

- Jellyrolls Exits Disney’s Boardwalk: Another Icon Bites the Dust?

- Solo Leveling Season 3: What You NEED to Know!

- Solo Leveling Season 3: What Fans Are Really Speculating!

- Despite Strong Criticism, Days Gone PS5 Is Climbing Up the PS Store Pre-Order Charts

- Jelly Roll’s 120-Lb. Weight Loss Leads to Unexpected Body Changes

- The Perfect Couple season 2 is in the works at Netflix – but the cast will be different

- Joan Vassos Reveals Shocking Truth Behind Her NYC Apartment Hunt with Chock Chapple!

- Disney’s ‘Snow White’ Bombs at Box Office, Worse Than Expected

2024-07-13 01:11