-

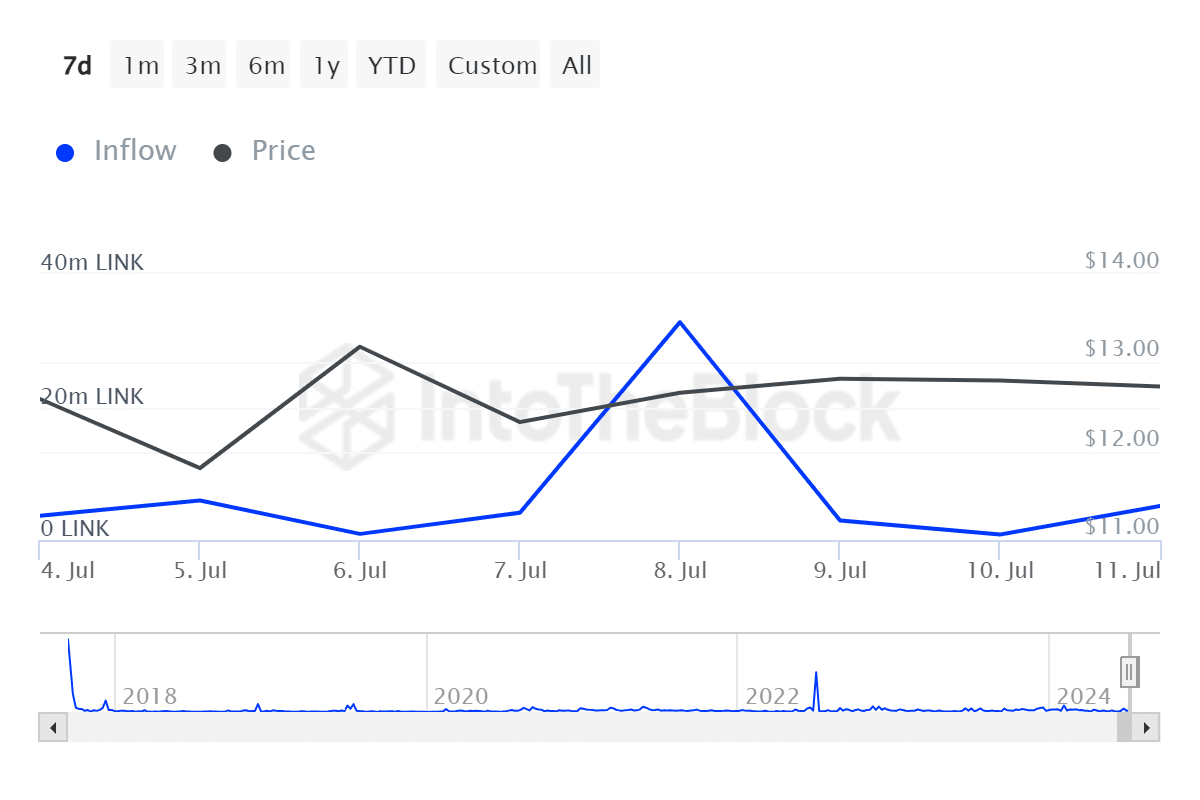

LINK whale activity surged in the past week to 32.76M.

Despite higher holder inflows, market sentiment remained bearish.

As a researcher with extensive experience in cryptocurrency markets, I believe that the recent surge in Chainlink (LINK) price could indeed be driven by increased whale activities. The large inflow of LINK into the market by whales has been significant over the past week, amounting to approximately $76.88 million as per one analyst’s estimate.

Over the past two months, the cryptocurrency market has faced intense selling, leading to significant drops in price. Following Bitcoin‘s [BTC] plunge to a price level not seen for two months, many altcoins suffered substantial losses as a result.

Similar to other cryptocurrencies, Chainlink (LINK) experienced a price decrease of 18.61% over the past month. Yet, during the last week, there have been signs of a potential turnaround. Whales have become more active in this market.

At present, there’s been a significant increase of 11.32% for LINK over the past week. This substantial rise on the weekly graphs has sparked intrigue among traders and analysts, leading them to ponder the potential reasons behind this trend.

What’s driving gains?

Based on the views of several cryptocurrency experts, the heightened actions of large investors, or “whales,” have significantly influenced the prevailing market attitudes. For instance, Ali, a well-known crypto analyst, recently posted on platform X (previously known as Twitter), that:

Over the past week, large investors, or “whales,” in Chainlink (LINK) have purchased around 6.2 million dollars worth of tokens, amounting to a grand total of roughly 76.88 million dollars.

Based on the insights of industry experts, the behavior of whales in the market is causing a shift in trends, potentially leading to price increases due to heightened purchasing activity.

As an analyst, I’ve examined the data from AMBCrypto’s report on IntoTheBlock, and I can tell you that there has been a significant increase in large inflows over the past week. Specifically, the figure reached a peak of 32.76 million units.

Whales’ recent surge in purchasing whale tokens has influenced market perceptions, potentially signaling that LINK may have reached its lowest point for the season. As of now, these large investors are actively buying up tokens, anticipating a price rise.

Such opinion was shared by Michael Van De Poppe on X, who noted,

Based on historical data, $LINK tends to reach its lowest point around June each year. It’s plausible that this trend will continue in 2024, meaning a potential low lies ahead, following which the price may begin to rise.

The affordability of the altcoin’s prices was a significant factor in attracting buyers, thereby fueling the demand. Conversely, increased demand for the altcoin often resulted in price hikes due to the surge in buying activity.

What LINK price charts suggest

At present, according to AMBCrypto’s assessment, the price trend for LINK has been persistently downward, contrary to the recent frenzy of large-scale purchases by whales.

The Directional Movement Index (DMI) of link signaled a robust downward trend, as the positive index stood at 10.07, significantly lower than the negative index’s value of 45. This indicates that recent price declines have overshadowed gains, with increased selling pressure leading the market direction.

In the past week, the On Balance Volume has dropped from $311 million to $301 million. This implies that the trading volume during rising periods wasn’t as robust as it previously was, suggesting that buying pressure has weakened while selling pressure prevails.

Additionally, the Aroon up trendline at 28.57% was positioned beneath the Aroon down trendline at 50%. This implies that the bearish trend has persisted.

Lastly, according to AMBCrypto’s interpretation of Santiment’s figures, the price divergence in terms of Daily Average Accumulation (DAA) stood at a negative 66.35%. This finding signified that prices were hitting new highs daily, while DAA was registering lows.

Despite the latest price hike, there was a decrease in the number of daily transactions taking place, indicating a pessimistic outlook among market participants.

Realistic or not, here’s LINK’s market cap in BTC’s terms

Can LINK whales drive prices up?

The daily RSI for LINK, sitting at 39 which is its lowest point since May, indicates that the cryptocurrency has been subjected to continuous selling. Yet, should the influx of large investors, or “whales,” persist, there’s a possibility of seeing a shift in trend.

If recent whale activities lead to increased buying pressure and our daily charts manage to close above $12.625, then we can expect the prices to bounce back and potentially reach $13.585. In contrast, should these activities fail to generate significant demand, prices might dip down to around $12.114 and further to $11.322.

Read More

- Jujutsu Kaisen Reveals New Gojo and Geto Image That Will Break Your Heart Before the Movie!

- Gaming News: Why Kingdom Come Deliverance II is Winning Hearts – A Reader’s Review

- Hut 8 ‘self-mining plans’ make it competitive post-halving: Benchmark

- The Elder Scrolls IV: Oblivion Remastered – How to Complete Canvas the Castle Quest

- Shundos in Pokemon Go Explained (And Why Players Want Them)

- First U.S. Born Pope: Meet Pope Leo XIV Robert Prevost

- We Ranked All of Gilmore Girls Couples: From Worst to Best

- Kylie & Timothée’s Red Carpet Debut: You Won’t BELIEVE What Happened After!

- S.T.A.L.K.E.R. 2 Major Patch 1.2 offer 1700 improvements

- Quick Guide: Finding Garlic in Oblivion Remastered

2024-07-13 06:16