- The Federal Reserve recently announced June’s CPI reports.

- However, most crypto assets, led by Bitcoin, did not respond to the recent report.

As an experienced market analyst, I find it intriguing that Bitcoin did not react significantly to the recent Federal Reserve CPI report and the anticipated rate cuts. Based on historical trends, we would expect cryptocurrencies, particularly Bitcoin, to respond positively to such news. However, this time around, the market seems to have already priced in the expectation of rate cuts, leading to a lackluster response.

The latest Consumer Price Index (CPI) update from the Federal Reserve failed to bring about the anticipated increase in Bitcoin’s [BTC] value.

It was quite unexpected that this result emerged, given that experts had predicted the Federal Reserve would implement interest rate reductions towards the end of the year. Historically, such actions have tended to stimulate investments in riskier assets, including cryptocurrencies.

Possible reasons for the non-reaction

Market analysts likely factored in the potential consequences of expected Fed interest rate reductions when determining current market valuations.

Starting from late 2022, the anticipation of interest rate reductions had a profound impact on market mood. Consequently, this trend boosted the price of Bitcoin, pushing it to reach new peaks exceeding $73,000 in the year 2024.

As an analyst, I’ve observed that when interest rates are reduced, the market reaction can be relatively tepid. Furthermore, Bitcoin has been facing significant selling pressure from various directions.

Significantly, after the Bitcoin halving and a resulting decrease in its value, miners have been forced to sell their stashes.

Since the beginning of this month, the German government has been actively disposing of substantial amounts of Bitcoin in the market.

As an analyst, I kept a close eye on the market for any signs of a potential sell-off from Mt.Gox. Despite the fact that these transactions were expected to take place off-exchange due to their substantial size, they remained a significant point of interest for market participants.

These combined factors could be influencing Bitcoin’s lack of reaction to the fed rate cuts.

Read Bitcoin’s [BTC] Price Prediction 2024-25

BTC’s reaction to potential Fed rate cuts

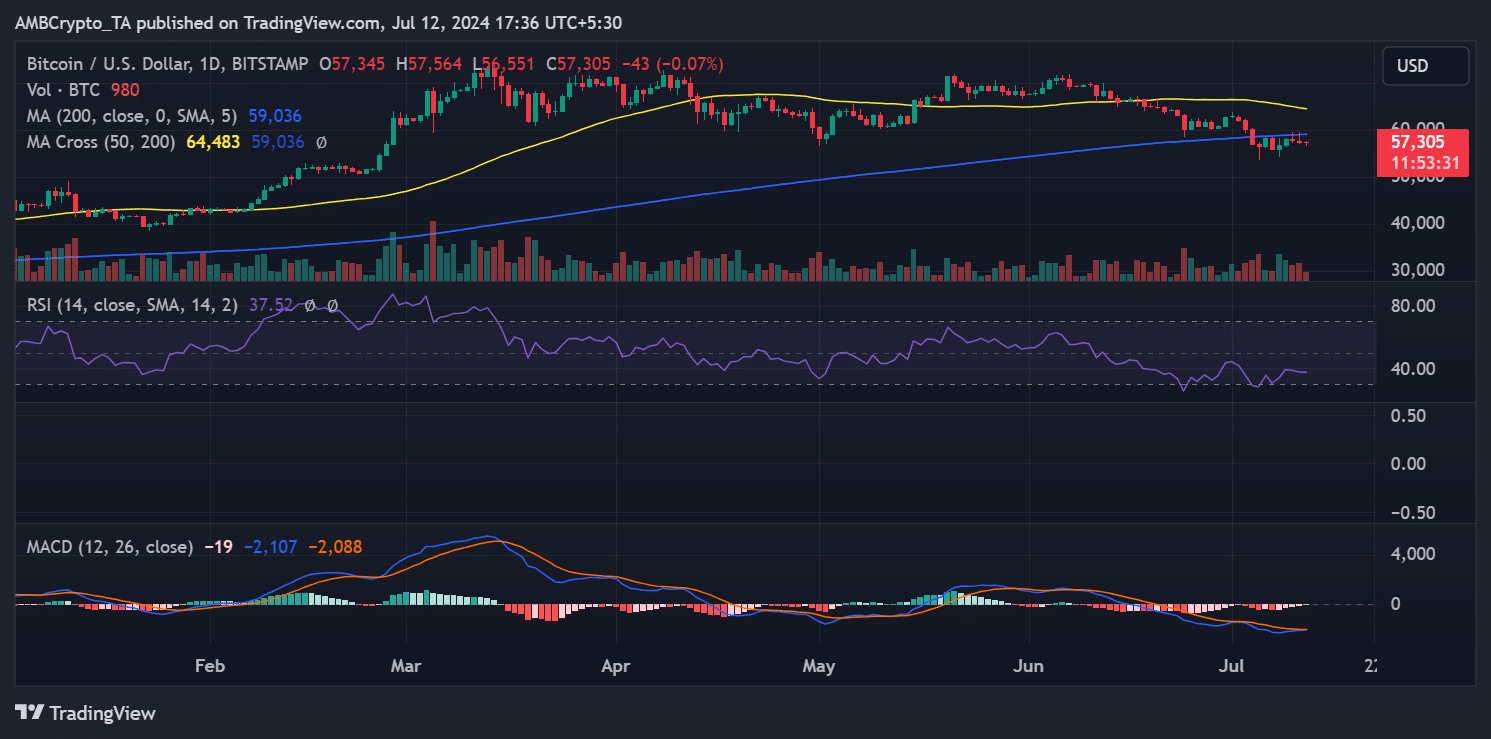

On a daily scale, the Bitcoin price analysis showed a 0.67% decrease as of the 11th of June. The cryptocurrency hovered near $57,348 after the release of the CPI report announcement.

At present, Bitcoin was around $57,304 in value during my latest update, representing a small decrease. The trend appeared to be downward, going against the forecasted optimistic response to the projected Federal Reserve interest rate reductions.

Read More

- We Ranked All of Gilmore Girls Couples: From Worst to Best

- Gaming News: Why Kingdom Come Deliverance II is Winning Hearts – A Reader’s Review

- Jujutsu Kaisen Reveals New Gojo and Geto Image That Will Break Your Heart Before the Movie!

- Why Tina Fey’s Netflix Show The Four Seasons Is a Must-Watch Remake of a Classic Romcom

- How to Get to Frostcrag Spire in Oblivion Remastered

- Assassin’s Creed Shadows is Currently at About 300,000 Pre-Orders – Rumor

- First U.S. Born Pope: Meet Pope Leo XIV Robert Prevost

- Kylie & Timothée’s Red Carpet Debut: You Won’t BELIEVE What Happened After!

- Whale That Sold TRUMP Coins Now Regrets It, Pays Double to Buy Back

- Taylor Swift Denies Involvement as Legal Battle Explodes Between Blake Lively and Justin Baldoni

2024-07-13 07:03