-

XRP’s price appreciated by more than 10% in the last 24 hours

Metrics revealed that buying pressure on the token was high

As a seasoned crypto investor with several years of experience under my belt, I’ve learned to pay close attention to price movements and on-chain metrics when considering new investments or assessing the health of existing positions. The recent surge in XRP‘s price, with an appreciation of over 10% in just 24 hours, has piqued my interest.

As a crypto investor, I’ve noticed XRP‘s outstanding progression over the past 24 hours. The value of this token has skyrocketed with double-digit percentage gains. More significantly, this latest price surge enabled XRP to break through a crucial resistance level. This achievement could potentially pave the way for even greater price increases in the near future.

Hence, it’s worth looking at whether metrics supported the case for a sustained bull run.

XRP is pumping

Expert: A well-known crypto analysis firm, World of Charts, recently brought attention to an intriguing occurrence through a tweet. Based on their analysis, a bullish falling wedge formation has emerged in the token’s price graph. Following this peak in March, the token has been confined within this pattern while consolidating.

Over the past week, XRP‘s price experienced a significant increase of around 18%. Within just the previous day, there was a remarkable surge in the token’s value, amounting to over 10%. At present, XRP is being traded at $0.5144 and boasts a market capitalization exceeding $28 billion, positioning it as the seventh largest cryptocurrency by market size.

Due to the recent price developments, XRP has successfully surpassed the previously identified bullish trendline. Should the token revisit this level, there’s a strong possibility that its value could increase by over 50% within the near future.

What do the metrics say?

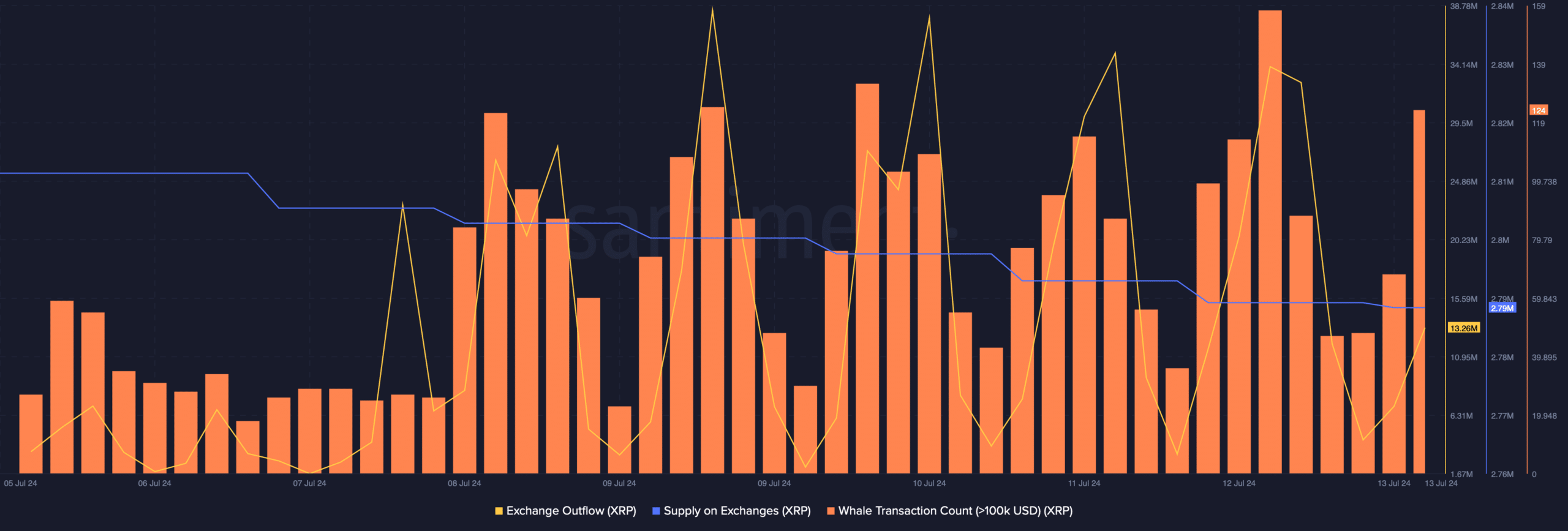

According to AMBCrypto’s interpretation of Santiment’s findings, there has been significant demand for purchasing the token, as indicated by a noticeable increase in buying pressure. Additionally, this trend was further supported by a notable surge in exchange outflows.

As a researcher studying the XRP market, I’ve noticed an intriguing trend: the buying pressure on XRP has been substantial, and this is supported by the decrease in its supply available for trading on exchanges. This indicates that investors are actively accumulating more tokens, further bolstering the demand for XRP. Additionally, there have been signs of increased whale activity – a significant increase in the number of large transactions taking place within the XRP network.

As an analyst examining Coinglass’ data, I discovered that the token’s Open Interest surged in tandem with its rising price. Typically, an increase in this metric indicates a higher likelihood that the current price trend will persist.

As a researcher studying market trends, I’ve observed an intriguing development. The length of investments exceeds the short positions, indicating a larger number of long positions compared to shorts. This imbalance suggests a strong bullish outlook among investors.

Contrary to expectations, Hyblock Capital’s data showed a substantial increase in XRP‘s cumulative liquidation level delta.

As an analyst, I would interpret this significant surge in market activity as a potential warning sign for an impending market peak. Subsequently, a correction in prices could be expected based on historical trends and market behavior.

Realistic or not, here’s XRP’s market cap in BTC’s terms

After examining the token’s liquidation map at AMBCrypto, potential levels of support and resistance were identified. Notably, the token’s liquidation price approached approximately $0.526.

When there’s an increase in the number of companies or entities being liquidated, it typically leads to adjustments in prices. On the other hand, if pessimistic investors gain control over the market, the token’s value could potentially plummet to $0.42.

Read More

2024-07-14 04:08