- Dogecoin did not see a volume or momentum shift to signal a price reversal yet.

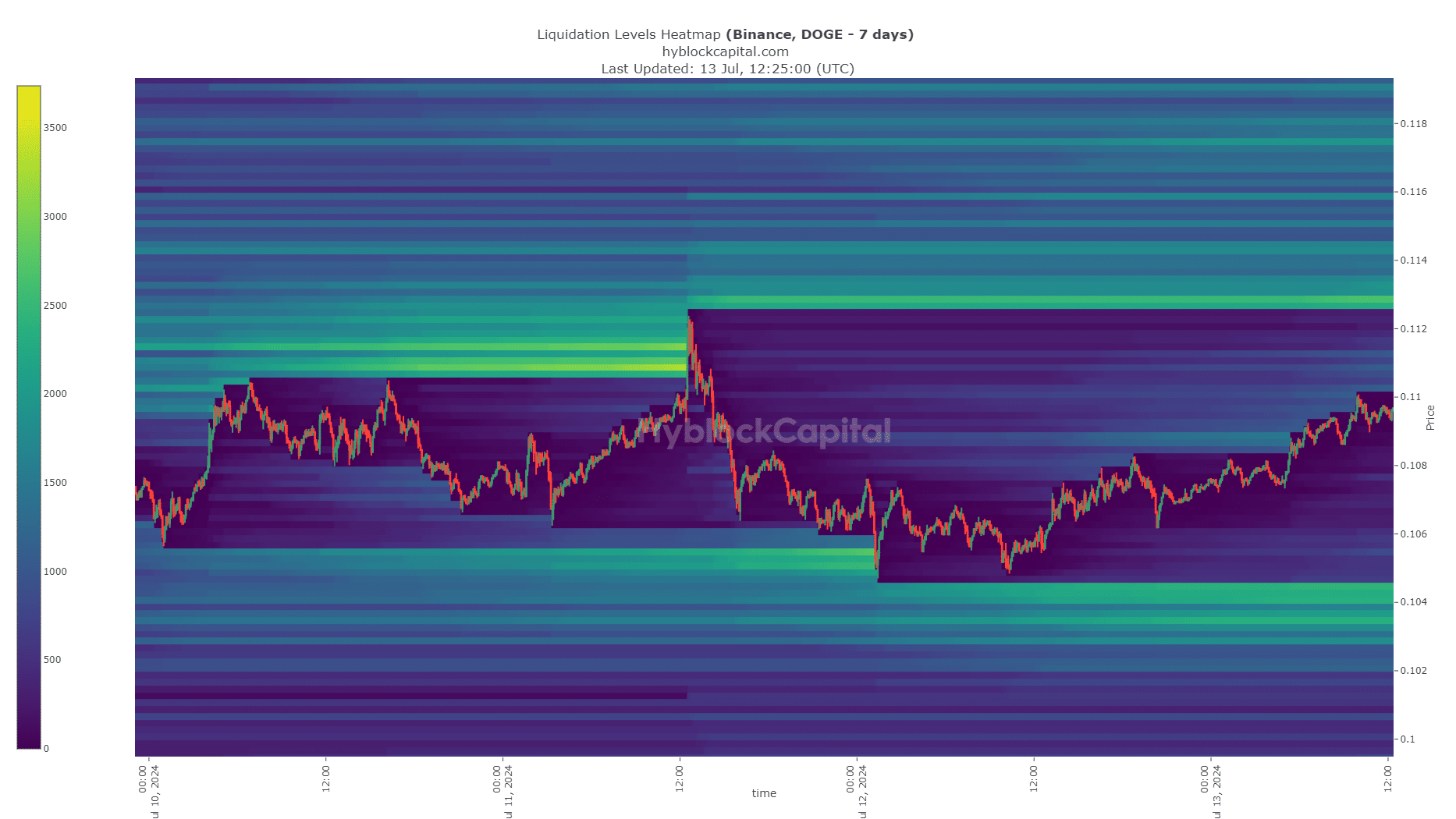

- The liquidation chart indicated a short-term range formation was possible.

As a researcher with experience in analyzing cryptocurrency markets, I have been closely monitoring Dogecoin’s [DOGE] price action. Based on my analysis of the available data, I believe that Dogecoin has not yet shown any significant volume or momentum shifts to signal a price reversal.

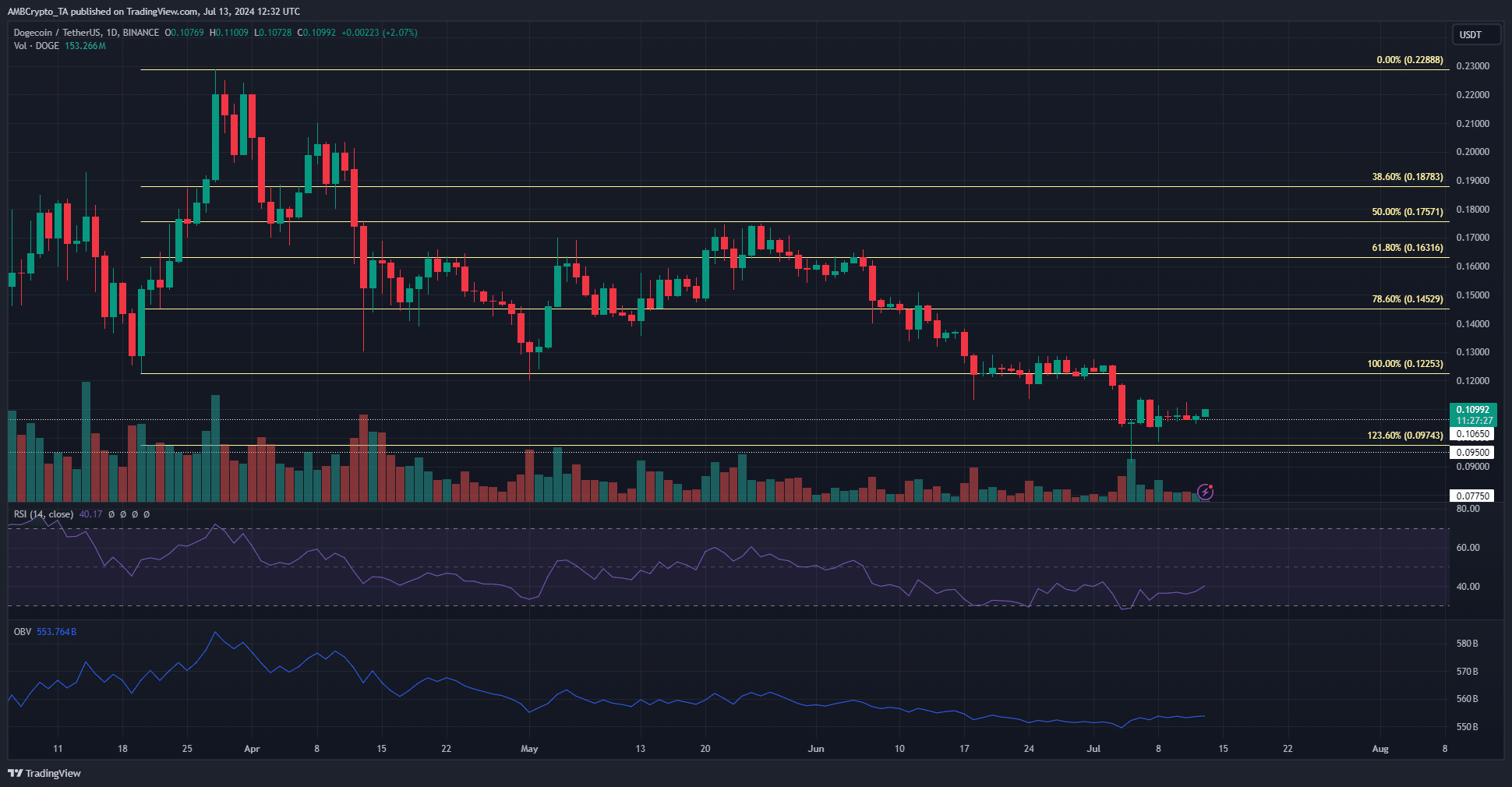

Dogecoin’s price dipped below the $0.123-$0.128 support range, a level bulls have vigilantly guarded since March. The bearish trend on the daily chart was further reinforced by tepid buying interest, suggesting that demand was insufficient for an immediate turnaround.

The RSI reading for each day remained under the 50-mark, which is considered neutral, and the On-Balance Volume (OBV) showed little reaction following its decline. Consequently, these indicators implied that bearish momentum was prevailing, and so far, the bulls had failed to reverse the downward trend.

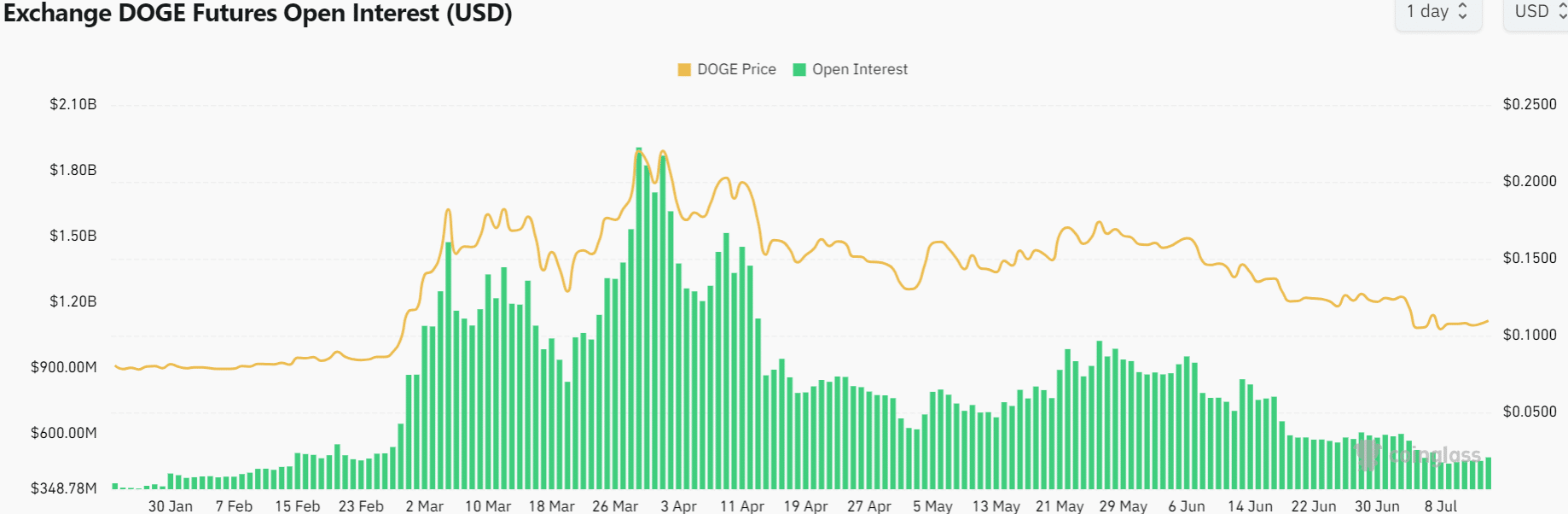

Open Interest falls to pre-rally lows

As a researcher studying the cryptocurrency market trends, I’ve observed an intriguing development regarding Dogecoin (DOGE). In a short span of late February through March, DOGE experienced a significant price surge, resulting in a remarkable 176% increase. At the onset of this rally, Open Interest stood at a substantial $480 million. By the 13th of July, the Open Interest had only slightly dipped to $478 million.

In the last four months, the significant drop in Open Interest for futures trading indicated waning confidence amongst investors. Should the meme coin surmount important resistance thresholds, speculators may rush back into the market.

As a crypto investor observing the market trends, I notice that both the On-Balance Volume (OBV) and Open Interest have been consistently low lately. This observation suggests that buying pressure in both the spot and futures markets is at its lowest point in several months. Unfortunately, based on current on-chain metrics, it seems unlikely that this situation will improve soon.

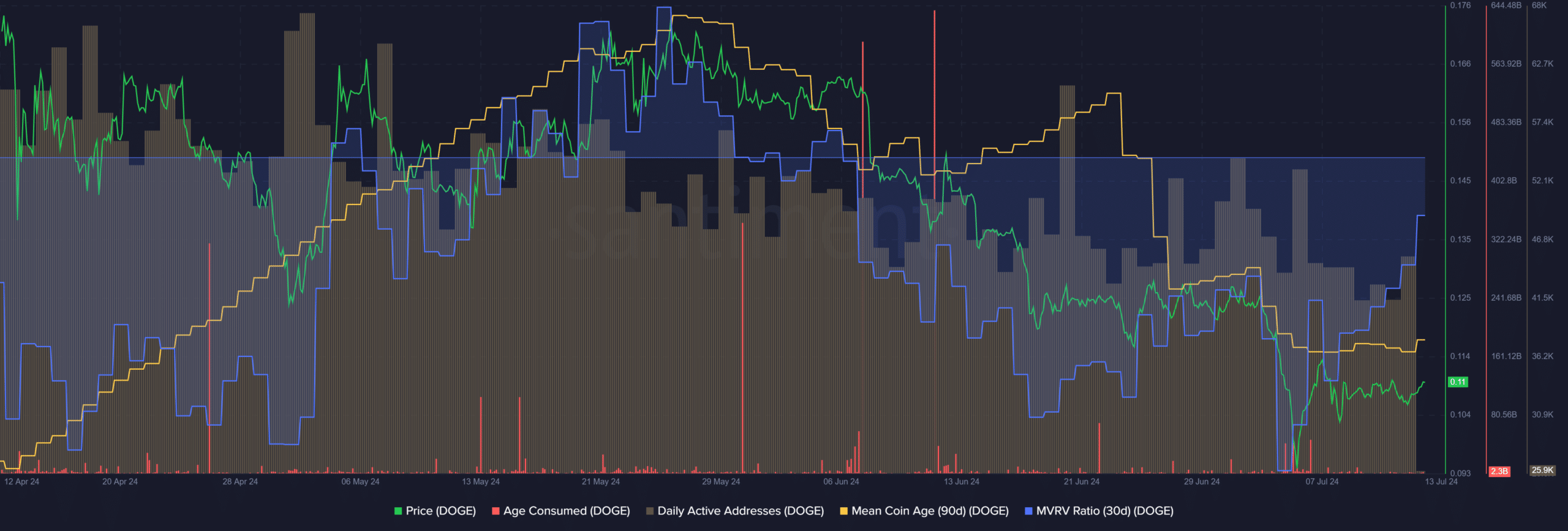

Dogecoin network metrics reflect token distribution

For the past month, the 30-day MVRV ratio, which measures the profitability of coins held by short-term investors, has shown a loss. Simultaneously, the average age of coins in circulation has been decreasing since late May, with only a brief uptick during the first ten days of June.

It wasn’t wise to purchase DOGE based on the undervaluation of the meme coin, as the decreasing average age of coins signaled distribution instead of hoarding. The age-consumed indicator has remained dormant following the recent price decline.

Read Dogecoin’s [DOGE] Price Prediction 2024-25

Based on their analysis, AMBCrypto identified a possible short-term price range of around $0.104 to $0.1128 based on the 7-day look-back period liquidation heatmap.

Beyond $0.113, the $0.13 and $0.135 levels are the next resistances to watch.

Read More

- Gold Rate Forecast

- PI PREDICTION. PI cryptocurrency

- Rick and Morty Season 8: Release Date SHOCK!

- We Loved Both of These Classic Sci-Fi Films (But They’re Pretty Much the Same Movie)

- Discover Ryan Gosling & Emma Stone’s Hidden Movie Trilogy You Never Knew About!

- Discover the New Psion Subclasses in D&D’s Latest Unearthed Arcana!

- SteelSeries reveals new Arctis Nova 3 Wireless headset series for Xbox, PlayStation, Nintendo Switch, and PC

- Masters Toronto 2025: Everything You Need to Know

- Mission: Impossible 8 Reveals Shocking Truth But Leaves Fans with Unanswered Questions!

- Linkin Park Albums in Order: Full Tracklists and Secrets Revealed

2024-07-14 12:07